Answered step by step

Verified Expert Solution

Question

1 Approved Answer

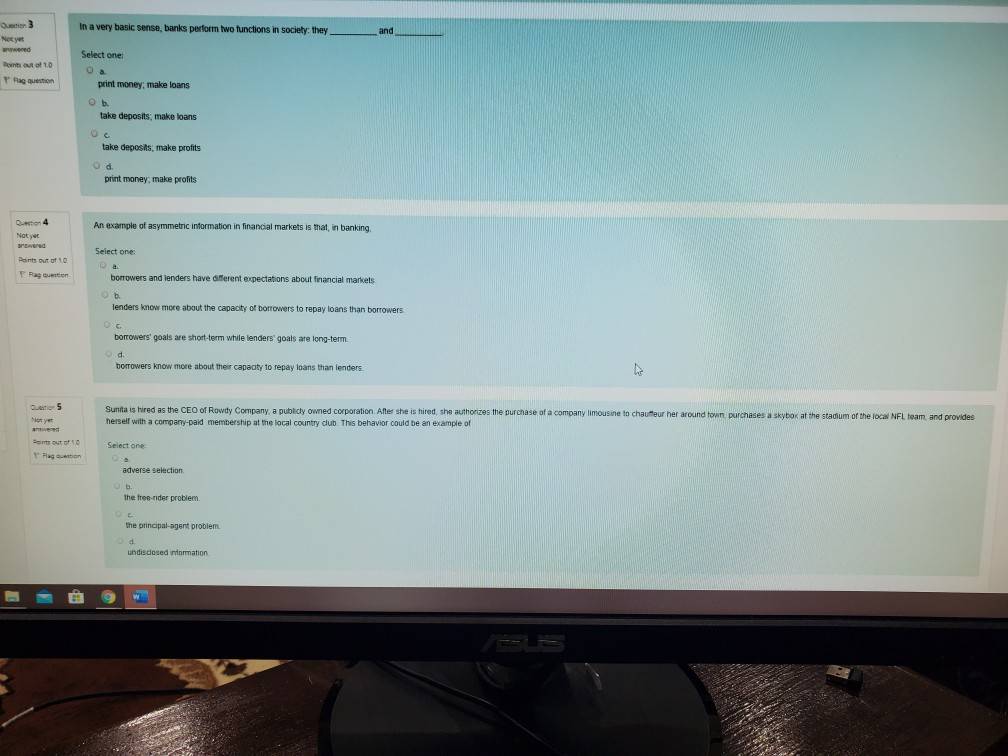

In a very basic sense, banks perform two functions in society: they_ and P Pag question Select one Oa print money, make loans Ob. take

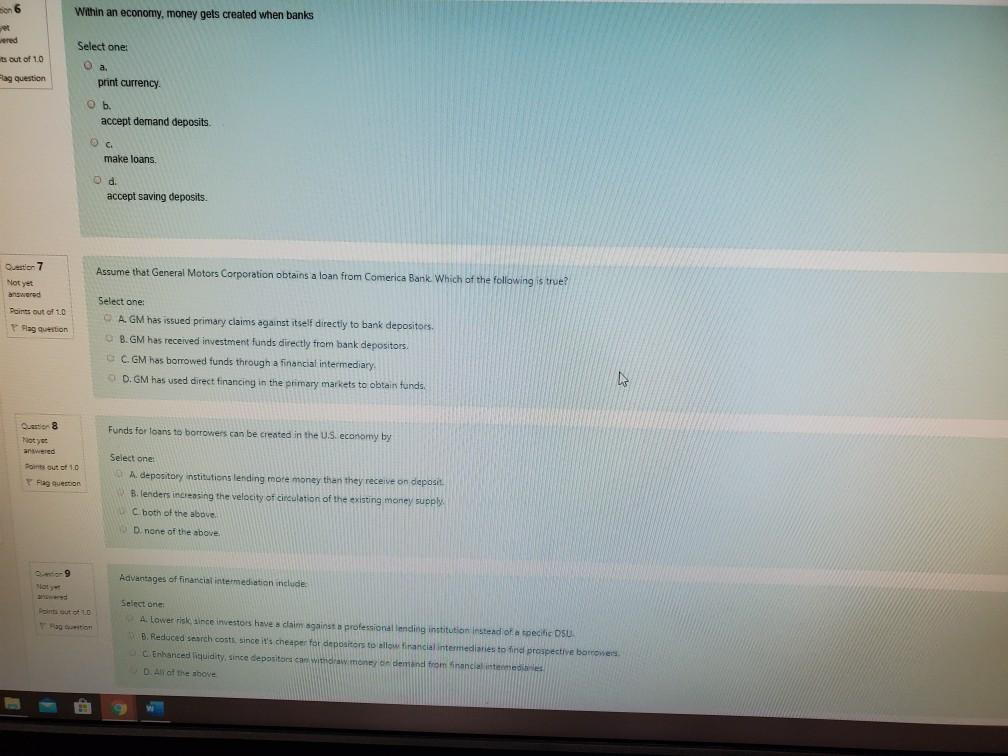

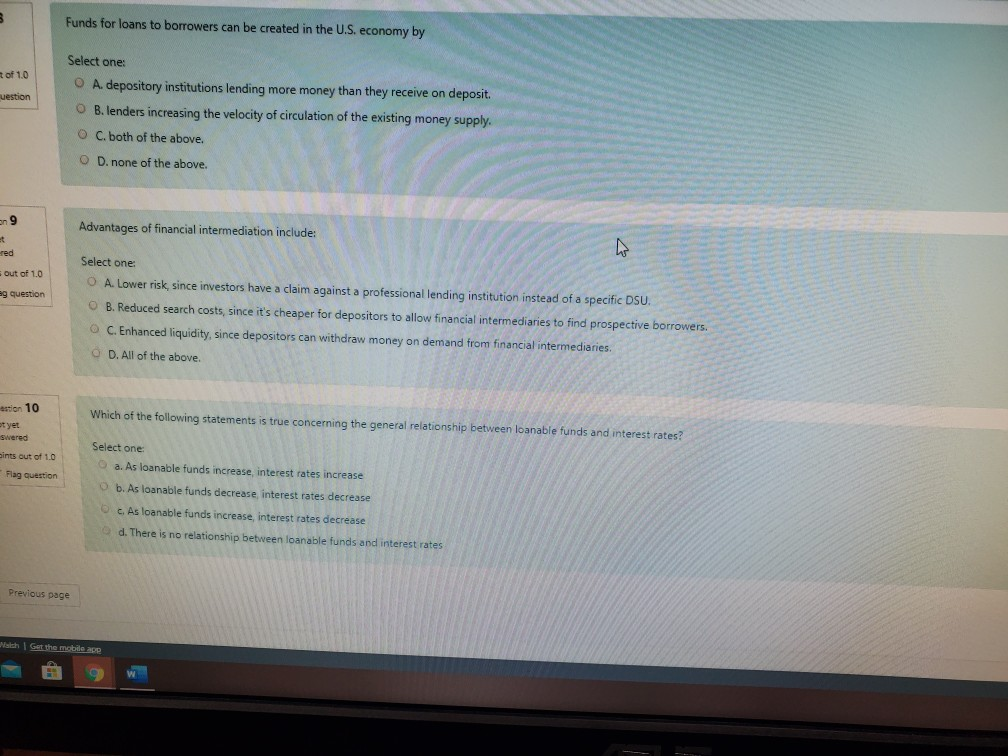

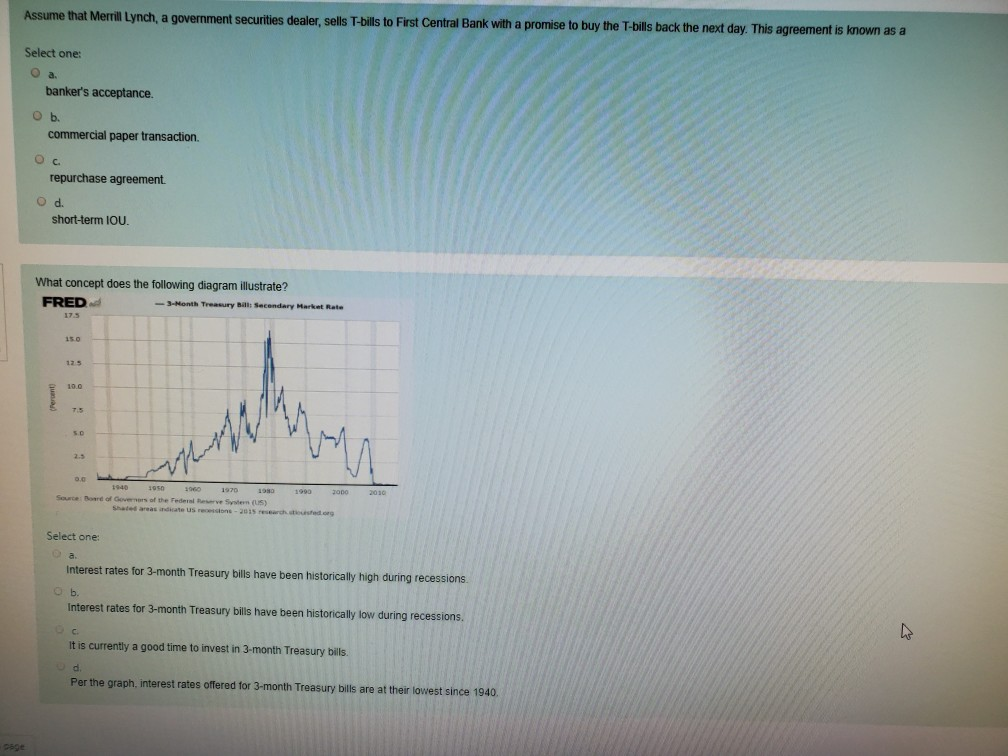

In a very basic sense, banks perform two functions in society: they_ and P Pag question Select one Oa print money, make loans Ob. take deposits make loans take deposits, make profits Od print money, make profits An example of asymmetric information in financial markets is that, in banking Select one Points out 1 borrowers and lenders have different expectations about financial markets lenders know more about the capacity of borrowers to repay loans than borrowers C borrowers' goals are short-term whide lenders' goals are long-term borrowers know more about their capacity to repay loans than lenders 5 Sunita is hired as the CEO of Rowdy Company, a publy owned corporation After she is hired she authorizes the purchase of a company limousine to chauffeur her around town purchases a skybox at the stadium of the local NFL team and provides herself with a company pard membership at the local country club. This behavior could be an example of Domu Select one adverse selection the free-nder problem the principal agent problem undisclosed information on 6 Within an economy, money gets created when banks wered Select one: s out of 1.0 Fag question O a. print currency Ob accept demand deposits. Oo make loans d. accept saving deposits. Question 7 Assume that General Motors Corporation obtains a loan from Comerica Bank. Which of the following is true? Not yet answered Points out of 10 Slag question Select one: A. GM has issued primary claims against itself directly to bank depositors. O B. GM has received investment funds directly from bank depositors. O C. GM has borrowed funds through a financial intermediary. D. GM has used direct financing in the primary markets to obtain funds. Funds for loans to borrowers can be created in the U.S. economy by Questo 8 Not yet answered Points out of 10 Flag question Select one: A. depository Institutions lending more money than they receive on deposit. Blenders increasing the velocity of circulation of the existing money supply C both of the above D. none of the above. 09 Noy wered Advantages of financial intermediation include Points out of 1.0 Bastion Select one: A. Lower risk, Ance investors have a claim against a professional lending institution instead of a sectic OSUL B. Reduced search costs, since it's cheaper for depositors to allow financial intermediaries to find prospective borrowe Enhanced liquidity, since depositors can withdraw money on demand from financial inte D. All of the above Funds for loans to borrowers can be created in the U.S. economy by of 1.0 uestion deposit. Select one: O A. depository institutions lending more money than they receive on deposit O B.lenders increasing the velocity of circulation of the existing money supply. OC. both of the above O D. none of the above. en 9 Advantages of financial intermediation include: red out of 10 e question Select one O A. Lower risk, since investors have a claim against a professional lending institution instead of a specific DSU. B. Reduced search costs, since it's cheaper for depositors to allow financial intermediaries to find prospective borrowers. O C. Enhanced liquidity, since depositors can withdraw money on demand from financial intermediaries. D. All of the above. ution 10 Which of the following statements is true concerning the general relationship between loanable funds and interest rates? swered oints out of 1.0 Flag question Select one a. As loanable funds increase, interest rates increase b. As loanable funds decrease interest rates decrease As loanable funds increase, interest rates decrease d. There is no relationship between loanable funds and interest rates Previous page ch Get the mobile 10 Trade in money markets is dominated by Select one: O a wealthy individuals, investment banks, and commercial banks. Ob. brokers, dealers, investment banks, and commercial banks. . O brokers, dealers, and wealthy individuals d. Fortune 500 corporations, wealthy individuals, and investment banks Assume that Merrill Lynch, a government securities dealer, sells T-bills to First Central Bank with a promise to buy the T-bills back the next day. This agreement is known as a Select one: et of 1.0 Question banker's acceptance. 5 commercial paper transaction repurchase agreement. d. short-term IOU. stion 15 What concept does the following diagram illustrate? FRED mts out of 10 Pag question Assume that Merrill Lynch, a government securities dealer, sells T-bills to First Central Bank with a promise to buy the T-bills back the next day. This agreement is known as a Select one: O a. banker's acceptance. Ob. commercial paper transaction OC. repurchase agreement. O d. short-term IOU. What concept does the following diagram illustrate? FRED -3-Nonth Treasury Bill Secondary Market Rate (Percent 2.5 1940 1950 1960 1970 1980 Source Board of Governors of the Federale ve System (US) Shadedras natus rccos - 2015 research Select one: Interest rates for 3-month Treasury bills have been historically high during recessions b. Interest rates for 3-month Treasury bills have been historically low during recessions. c It is currently a good time to invest in 3-month Treasury bills. d. Per the graph interest rates offered for 3-month Treasury bills are at their lowest since 1940

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started