Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In above question , assume abandonment is not an option if the project is a failure and consider the following. In first question , assume

In above question , assume abandonment is not an option if the project is a failure and consider the following.

In first question , assume abandonment is not an option if the project is a failure. In addition, suppose the cost of the new production facility will decline by $1,900,000 next year. Should the company make the investment today or delay it by one year? If the company delays the project, the project will last for four years. The NPV of the project is the PV today of the NPV in one year

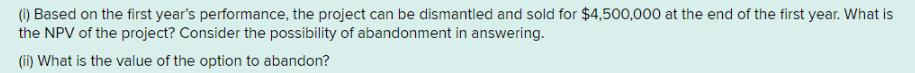

Atlantic Tires is considering an investment in a new production facility. For the next five years, the company expects to achieve an annual cash flow of $3,500,000 if the project is successful and $1,000,000 if the project is a failure. Projects of this nature are successful 60% of the time. The initial investment required is $9,500,000, and the relevant discount rate is 10%. Assume the production facility will be obsolete five years from now. (i) What is the base-case NPV? (ii) Suppose the company has an option to double the scale of the project in one year if the project is a success at the end of the first year. This would imply that if the project is successful, project annual cash flows would be $7,000,000 after expansion. What is the NPV of the project? Consider the possibility of expansion in answering. (iii) What is the value of the option to expand?

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down each part of the question and calculate the NPV Net Present Value in different scenarios i BaseCase NPV In the base case the company invests 9500000 upfront and has a 60 chance of succ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started