Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In accounting, what's the issue here? (recognition, measurement, presentation (debt or equity)? and what is the implication and Analysis for the issue? Then, what are

In accounting, what's the issue here? (recognition, measurement, presentation (debt or equity)? and what is the implication and Analysis for the issue? Then, what are the two alternatives here? ( revenue approach?) Lastly, what is the recommendation for the company here?

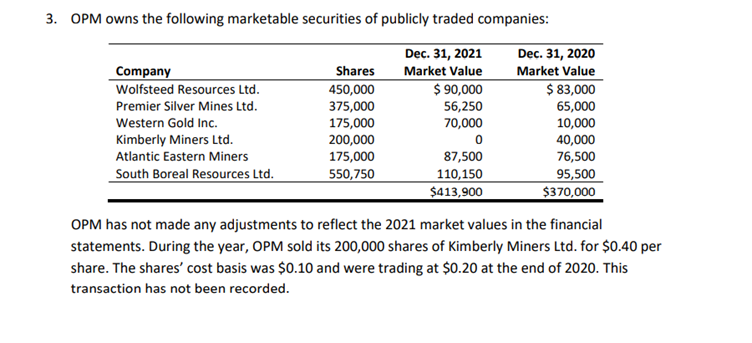

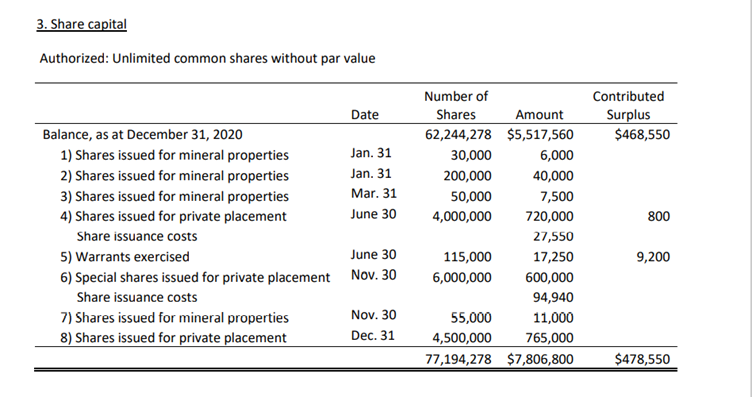

3. OPM owns the following marketable securities of publicly traded companies: Dec. 31, 2021 Dec. 31, 2020 Company Shares Market Value Market Value Wolfsteed Resources Ltd. 450,000 $ 90,000 $ 83,000 Premier Silver Mines Ltd. 375,000 56,250 65,000 Western Gold Inc. 175,000 70,000 10,000 Kimberly Miners Ltd. 200,000 0 40,000 Atlantic Eastern Miners 175,000 87,500 76,500 South Boreal Resources Ltd. 550,750 110,150 95,500 $413,900 $370,000 OPM has not made any adjustments to reflect the 2021 market values in the financial statements. During the year, OPM sold its 200,000 shares of Kimberly Miners Ltd. for $0.40 per share. The shares' cost basis was $0.10 and were trading at $0.20 at the end of 2020. This transaction has not been recorded. 3. Share capital Authorized: Unlimited common shares without par value Contributed Surplus $468,550 800 Date Balance, as at December 31, 2020 1) Shares issued for mineral properties Jan. 31 2) Shares issued for mineral properties Jan. 31 3) Shares issued for mineral properties Mar. 31 4) Shares issued for private placement June 30 Share issuance costs 5) Warrants exercised June 30 6) Special shares issued for private placement Nov. 30 Share issuance costs 7) Shares issued for mineral properties Nov. 30 8) Shares issued for private placement Dec. 31 Number of Shares Amount 62,244,278 $5,517,560 30,000 6,000 200,000 40,000 50,000 7,500 4,000,000 720,000 27,550 115,000 17,250 6,000,000 600,000 94,940 55,000 11,000 4,500,000 765,000 77,194,278 $7,806,800 9,200 $478,550 3. OPM owns the following marketable securities of publicly traded companies: Dec. 31, 2021 Dec. 31, 2020 Company Shares Market Value Market Value Wolfsteed Resources Ltd. 450,000 $ 90,000 $ 83,000 Premier Silver Mines Ltd. 375,000 56,250 65,000 Western Gold Inc. 175,000 70,000 10,000 Kimberly Miners Ltd. 200,000 0 40,000 Atlantic Eastern Miners 175,000 87,500 76,500 South Boreal Resources Ltd. 550,750 110,150 95,500 $413,900 $370,000 OPM has not made any adjustments to reflect the 2021 market values in the financial statements. During the year, OPM sold its 200,000 shares of Kimberly Miners Ltd. for $0.40 per share. The shares' cost basis was $0.10 and were trading at $0.20 at the end of 2020. This transaction has not been recorded. 3. Share capital Authorized: Unlimited common shares without par value Contributed Surplus $468,550 800 Date Balance, as at December 31, 2020 1) Shares issued for mineral properties Jan. 31 2) Shares issued for mineral properties Jan. 31 3) Shares issued for mineral properties Mar. 31 4) Shares issued for private placement June 30 Share issuance costs 5) Warrants exercised June 30 6) Special shares issued for private placement Nov. 30 Share issuance costs 7) Shares issued for mineral properties Nov. 30 8) Shares issued for private placement Dec. 31 Number of Shares Amount 62,244,278 $5,517,560 30,000 6,000 200,000 40,000 50,000 7,500 4,000,000 720,000 27,550 115,000 17,250 6,000,000 600,000 94,940 55,000 11,000 4,500,000 765,000 77,194,278 $7,806,800 9,200 $478,550Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started