Answered step by step

Verified Expert Solution

Question

1 Approved Answer

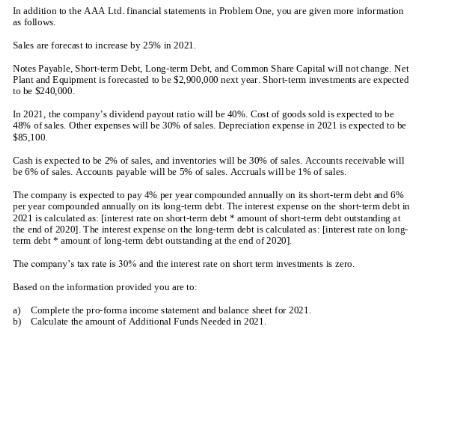

In addition to the AAA Ltd. financial statements in Problem One, you are given more information as follows. Sales are forecast to increase by

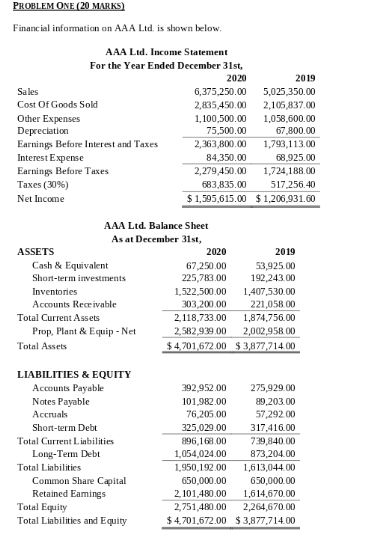

In addition to the AAA Ltd. financial statements in Problem One, you are given more information as follows. Sales are forecast to increase by 25% in 2021 Notes Payable, Short-term Debt, Long-term Debt, and Common Share Capital will not change. Net Plant and Equipment is forecasted to be $2,900,000 next year. Short-term investments are expected to be $240,000. In 2021, the company's dividend payout ratio will be 40%. Cost of goods sold is expected to be 48% of sales. Other expenses will be 30% of sales. Depreciation expense in 2021 is expected to be $85,100. Cash is expected to be 2% of sales, and inventories will be 30% of sales. Accounts receivable will be 6% of sales. Accounts payable will be 5% of sales. Accruals will be 1% of sales. The company is expected to pay 4% per year compounded annually on its short-term debt and 6% per year compounded annually on its long-term debt. The interest expense on the short-term debt in 2021 is calculated as: [interest rate on short-term debt* amount of short-term debt outstanding at the end of 2020]. The interest expense on the long-term debt is calculated as: [interest rate on long- term debt* amount of long-term debt outstanding at the end of 2020] The company's tax rate is 30% and the interest rate on short term investments is zero. Based on the information provided you are to: a) Complete the pro-forma income statement and balance sheet for 2021. b) Calculate the amount of Additional Funds Needed in 2021 PROBLEM ONE (20 MARKS) Financial information on AAA Ltd. is shown below. AAA Ltd. Income Statement For the Year Ended December 31st, 2020 Sales Cost Of Goods Sold Other Expenses Depreciation Earnings Before Interest and Taxes Interest Expense Earnings Before Taxes Taxes (30%) Net Income ASSETS Cash & Equivalent Short-term investments Inventories Accounts Receivable Total Current Assets Prop, Plant & Equip - Net Total Assets AAA Ltd. Balance Sheet As at December 31st, LIABILITIES & EQUITY Accounts Payable Notes Payable Accruals Short-term Debt Total Current Liabilities Long-Term Debt Total Liabilities Common Share Capital Retained Earings Total Equity Total Liabilities and Equity 6,375,250.00 5,025,350.00 2,835,450.00 2,105,837.00 1,100,500.00 1,058,600.00 75,500.00 67,800.00 2,363,800.00 1,793,113.00 84,350.00 68,925.00 2,279,450.00 1,724,188.00 683,835.00 517,256.40 $1,595,615.00 $1,206,931.60 2019 392,952.00 101,982.00 76,205.00 325,029.00 2019 53,925.00 192,243.00 1,407,530.00 221,058.00 2020 67,250.00 225,783.00 1,522,500.00 303,200.00 2,118,733.00 1,874,756.00 2,582,939.00 2,002,958.00 $4,701,672.00 $3,877,714.00 275,929.00 89,203.00 57,292.00 317,416.00 896,168.00 739,840.00 1,054,024.00 873,204.00 1,950,192.00 1,613,044.00 650,000.00 650,000.00 2,101,480.00 1,614,670.00 2,751,480.00 2,264,670.00 $4,701,672.00 $3,877,714.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Proforma Income Statement for 2021 AAA Ltd Income Statement For the Year Ended December 31st 202...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started