Question

Suppose a firm has just reported an EPS of $4.55 (i.e., E_0 = 4.55) and expects to maintain a dividend payout ratio of 48

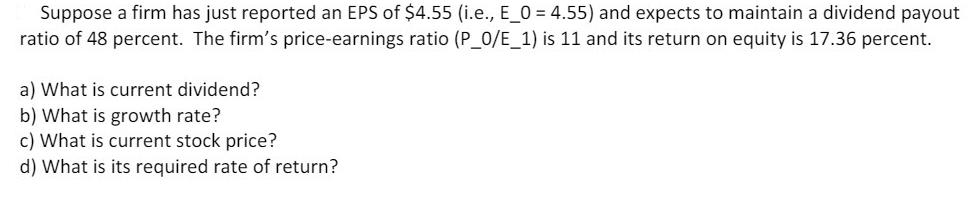

Suppose a firm has just reported an EPS of $4.55 (i.e., E_0 = 4.55) and expects to maintain a dividend payout ratio of 48 percent. The firm's price-earnings ratio (P_0/E_1) is 11 and its return on equity is 17.36 percent. a) What is current dividend? b) What is growth rate? c) What is current stock price? d) What is its required rate of return?

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a To find the current dividend we first need to calculate the earnings available for the dividend We know that the firms EPS is 455 and it plans to maintain a dividend payout ratio of 48 percent There...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Multinational financial management

Authors: Alan c. Shapiro

10th edition

9781118801161, 1118572386, 1118801164, 978-1118572382

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App