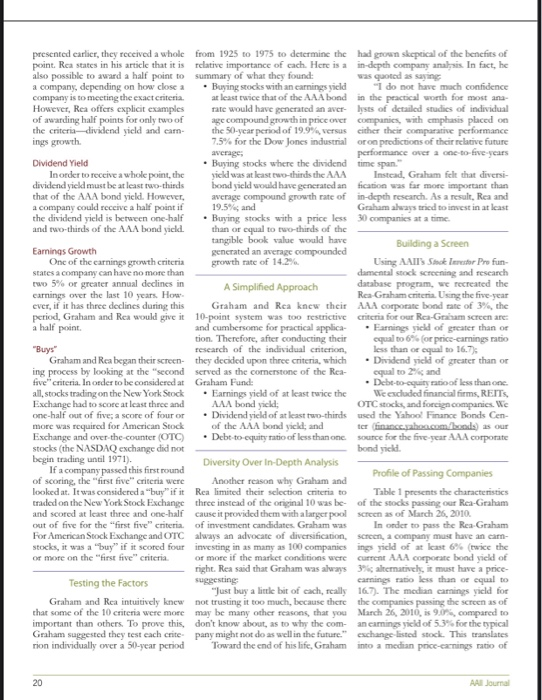

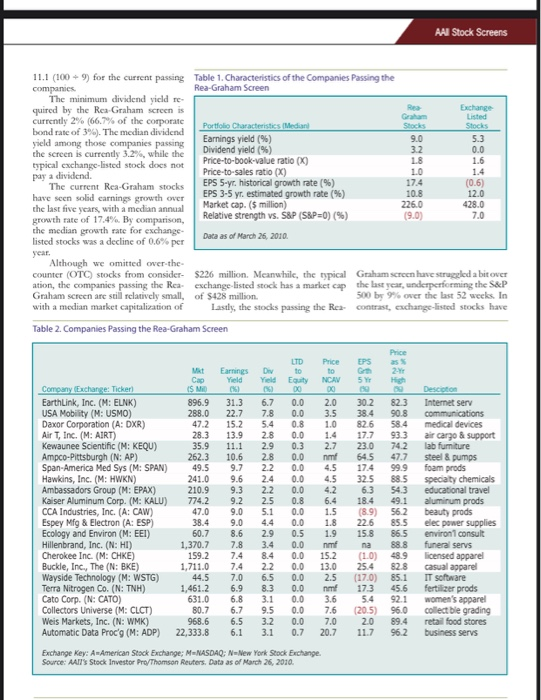

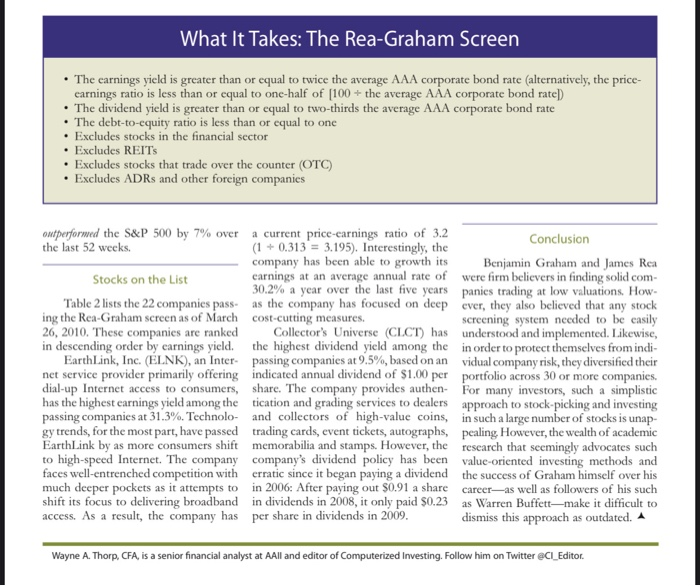

In addition to your spreadsheet, you will need to provide answers to the following questions: 1. Using the 2018 financial statement information for Ford combined with the Valueline survery, score Ford based on the 10 original screening criteria. (Make a spreadsheet) 2. Would Ford make it to the second round? Why or why not? 3. Now assume Ford passes the initial round. Would it be considered a buy after going through the second round? Why or why not? 4. What was the criteria for the Rea-Graham fund? 5. Now look at Ford based on the new reduced criteria. Would Ford be included as a candidate for investment? Why or why not? Graham's "Last Will & Testament" By Wayne A. Thorp, CFA Article Highlights Late in his life, Benjamin Graham worked with James Rea to create a three-criterion system for finding stocks. The system looks for undervalued stocks with good dividends and relatively low debt. We recreated the screen and show you the stocks it found. W hile researching Ben ham. Graham asked him to describe his stock Graham's net current asset val- selection theory, but without using mathemat ue approach to investing for ics. Rea did so using his milk cow analogy Rea likened his method of picking stocks Computerized Investing's Feb. to that of selecting a milk cow. When picking ruary 2010 Online Exclusive a milk cow, you idcally want a cow that gives (available online to Computer- lots of milk (earnings), but also will give more ized Investing subscribers at milk year over year (growth in earnings). Fur thermore, you would like stability in the growth. Also, Rea www.computerizedinvesting.com), I ran across an went on to explain, cheese can be made from the milk, which article written by James Rea shortly after Graham's is the dividend given back to the customer. So, he also would death in The Journal of Portfolio Management. want a lot of cheese from the milk (a high dividend yield). Prior to meeting Graham a few years earlier, Rea had Part of Rea's research was to look for stocks with high been working on a stock selection methodology that looked reward-to-risk ratios. To him, a "high reward" cow was onc for companies with high reward-to-risk ratios. Upon reading that produced a lot of milk, increased its milk output at a an article that Graham had written in Barron's "Renaissance stable rate, and allowed for a lot of cheese to be made. of Value"-Rea discovered that his approach seemed simi The risk in Rea's milk cow analogy was that the cow lar to Graham's. On a lark, Rea forwarded his research to would stop producing milk, meaning you lose your milk Graham. A couple of months later, Graham called Rea and earnings) and cheese (dividend yield). The degree of risk was asked how it was that he was finding vis kinds of stocks and how much you paid for the cow relative to what you could suggested that they meet. That first meeting led to a three- get for the meat on its bones" (the liquidation value). The year working relationship, which culminated in Graham and higher the price paid for the cow relative to its liquidation Rca starting an investment fund that used the "best" stock value," the higher the risk. selection criteria based on their research. To complete his analysis, Rca divided his reward measure This article outlines the 10 criteria Graham and Rea first earnings, growth, stability and dividend) by his risk measure developed and which they tested using a 50-year period), the price paid for a company relative to its liquidation value) and builds a screen with the three criteria that they used for to arrive at a relative measure of "how good a company their Rea-Graham Fund was relative to other companies Ten Criteria Picking Stocks Like Picking a Milk Cow In Rea's article he recounts the first time he met Ben Gra- Over the next several months after their initial meeting All Journal presented earlier, they received a whole from 1925 to 1975 to determine the had grown skeptical of the benefits of point. Rca states in his article that it is relative importance of each Here is a in-depth company is In fact, he also possible to wand a half point to summary of what they found was quoted as saying a company, depending on how cose . Buying stocks with an earnings yield 1 do not have much confidence company is to meeting the exact criteria at least twice that of the AAA bond in the practical worth for mostan However, Rea offers explicit samples rate would have generated ana l yses of detailed studies of individual of warding half points for only two of age compound growth in price over coorpanies with emphasis placed on the criteris dividend yield and can the 50-year period of 19.9% uscither their comparative performance ings growth 7.5% for the Dow Jones industrial or predictions of their relative future performance G e to-five years Dividend Yield Buying stocks where the dividend time span." In order to receive a whole point, the yield was at least two-thirds the AAA Instead, Graham felt that diverse dividend yield must be at least two-thirds bond yield would have generated anfiction was far more important than that of the AAA bond yield. However, average compound growth rate of in-depth research. As a result, Rea and a company could receive a half point if 19.5 and Graham always tried to invest in at least the dividend yield is between onc-half Buying stocks with a price less 30 companies at a time. and two-thirds of the AAA bond yield than or equal to thirds of the tangible book value would have Building a Screen Earnings Growth generated an avere compounded One of the earnings growth criteria growth rate of 14.2%. Using AAITS Stok Tester Pro fun states a company can have no more than damental stock screening and research two 5% or greater annual declines in A Simplified Approach database program, we recreated the carnings over the last 10 years. How Rea Graham criteria. Using the five year ever, if it has three declines during this Graham and Rca knew their AAA corporate bond rate of 3%, the period, Graham and Rea would give it 10-point system was too restrictive criteria for our Rea Guam screen are: a half point and cumbersome for practical applica Farnings yield of greater than or tion. Therefore, after conducting their qual to 6% (or price-carnings ratio "Buys" Tesearch of the individual criterion less than or equal to 16.7) Graham and Rca began their screen they decided upon three criteria, which Dividend yield of greater than or ing process by looking at the second served as the cornerstone of the Rea c qual to 2% and five criteria. In order to be considered at Graham Fund Debt-to-equity of less than one all stocks trading on the New York Stock Earnings yield of at least twice the Weexcluded financial firms, REITS Exchange had to score at least three and AAA bond yield: OTC stocks, and foreign companies. We one-half out of five, a score of four or Dividend yield of at least two-thirds used the Yahoo Finance Bonds Cen- more was required for American Stock of the AAA bond yield, and ter financ e .com boods) as our Exchange and over the counter (OTC) Debt-to-equity ratio of less than one Source for the five year AAA corporate stocks (the NASDAQ exchange did not bond yield begin trading until 1971). Diversity Over In-Depth Analysis If a company passed this first round Profile of Passing Companies of scoring the first five criteria were Another reason why Graham and looked at. It was considered a "buy" if it Rea limited their selection criteria to Table 1 presents the characteristics traded on the New York Stock Exchange three instead of the original 10 was be of the stocks passing our Rea Graham and scored at least three and one-half cause it provided them with a larger pool screen as of March 25, 2010 out of five for the first five criteria of investment candidates. Graham was in ander to pass the Rea Graham For American Stock Exchange and OTC always an advocate of diversification, screen, a company must have an am stocks, it was a "buy" if it scored four investing in as many as 100 companies in yield of at least 6% twice the or more on the first five criteria or more if the market conditions were come AAA bond ik of right. Rea said that Graham was always 39 match it must have a price Testing the factors carning to less than or equal to "Just buy a little bit of cach, really 167 The median carings yield for Graham and Rea intuitively knew not trusting it too much, because there the companies passing the screen as of that some of the 10 criteria were more may be many other reasons that you March 26, 2010, is 90% compared to important than others. To prove this, don't know about, as to why the com a caming yield of 53% for the typical Graham suggested they test cach crite pany might not do as well in the future." exchange sted stock. This translates rion individually over a 50-year period toward the end of his life, Graham into a median price-carning to of M AAl Stock Screens Table 1. Characteristics of the Companies Passing the Rea-Graham Screen Exchange Listed 9.0 0.0 LS 1.6 11.1 (1009) for the current passing companies The minimum dividend yield te quired by the Rea Graham screen is currently 2% (66.7% of the corporate bond rate of 3%). The median dividend yield among those companies passing the screen is currently 3.2%, while the typical exchange-listed stock does not pay a dividend. The current Rea-Graham stocks have seen solid earnings growth over the last five years with a median annual growth rate of 17.4%. By comparison, the median growth rate for exchange- listed stocks was a decline of 0.6% per year Although we omitted over-the- counter (OTC) stocks from consider- ation, the companies passing the Rea Graham screen are still relatively small, with a median market capitalization of Portfolio Characteristics Median Earnings yield (%) Dividend yield (%) Price-to-book-value ratio (X) Price-to-sales ratio (X) EPS 5-yr. historical growth rate (%) EPS 3-5 yr. estimated growth rate (%) Market cap. $ million) Relative strength vs. S&P (S&P=0) (%) 1.0 17.4 10.8 226.0 (9.0) (0.6 12.0 428.0 7.0 Data as of March 26, 2010 $226 million. Meanwhile, the typical Graham screen have struggled a bit over exchange listed stock has a market cap the last year, underperforming the S&P of $428 millon. 500 by 9% Over the last 52 weeks. In Lastly, the stocks passing the Rea contrast, exchange-listed stocks have Table 2. Companies Passing the Rea-Graham Screen Earnings Yield LTD to Equity Diy Yield Price t o NCAV 2YY EPS G 5 Y 6 31. 3 22.7 15.2 13.9 11.1 .7 7.8 5.4 2.8 10.6 28 2.2 Company Exchange: Ticker EarthLink, Inc. (M: ELNK) USA Mobility (M: USMO) Daxor Corporation (A: DXR) Air T, Inc. (M: AIRT) Kewaunee Scientific (M: KEQU) Ampco-Pittsburgh (N: AP) Span-America Med Sys (M: SPAN) Hawkins, Inc. (M: HWKN) Ambassadors Group (M: EPAX) Kaiser Aluminum Corp. (M: KALU) CCA Industries, Inc. (A: CAW) Espey Mfg & Electron (A: ESP) Ecology and Environ (M: EEI) Hillenbrand, Inc. (N: HI) Cherokee Inc. (M: CHKE) Buckle, Inc., The (N: BKE) Wayside Technology (M: WSTG) Terra Nitrogen Co. (N; TINH). Cato Corp. (N: CATO) Collectors Universe (M: CLCT) Weis Markets, Inc. (N: WMK) Automatic Data Proc'. (M: ADP) Cap IS MO 896.9 288.0 47.2 28.3 35.9 262.3 49.5 241.0 210.9 774.2 47.0 38.4 60.7 1.370.7 159.2 1.711. 0 44.5 1.461.2 631.0 80.7 968.6 22,333.8 9.7 9.6 9.3 9.2 9.0 9.0 8.6 2.5 5.1 4.4 2.9 3.4 0.0 0.0 0.8 0.0 0.3 0.0 0.0 0.0 0.0 0.8 0.0 0.0 0.5 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.7 2.0 3.5 1.0 1.4 2.7 m 4.5 4.5 4.2 6.4 1.5 1.8 1.9 mm 15.2 13.0 2.5 nm 3.6 76 7.0 20.7 30.2 38.4 826 17.7 23.0 64.5 17.4 32.5 6.3 18.4 (89) 22.6 15.8 na (1.0) 25.4 (170) 173 54 205) 2.0 11.7 823 908 58.4 93.3 742 47.7 99.9 88.5 543 49.1 56. 2 85.5 86.5 88.8 48.9 828 85.1 45.6 92.1 960 89.4 96.2 Descioton Internet sery communications medical devices air cargo & support tab furniture Steel & pumps foam prods specialty chemicals educational travel aluminum prods beauty prods dlec power supplies environt consult funeral servs licensed apparel casual apparel IT software fertilizer prods women's apparel collect ble grading retail food stores business servs 78 7 7.4 .4 7.0 6.9 6.8 6.7 6.5 6.1 6.5 83 3.1 9.5 3.2 3.1 Exchange Key: An American Stock Exchange; MENASDAQ: New York Stock Exchange Source: AA's Stock Investor Pro Thomson Reuters. Data as of March 26, 2010 What It Takes: The Rea-Graham Screen The earnings yield is greater than or equal to twice the average AAA corporate bond rate (alternatively, the price- carnings ratio is less than or equal to one-half of [100+ the average AAA corporate bond rate) The dividend yield is greater than or equal to two-thirds the average AAA corporate bond rate The debt-to-equity ratio is less than or equal to one Excludes stocks in the financial sector Excludes REITS Excludes stocks that trade over the counter (OTC) Excludes ADRs and other foreign companies ont performed the S&P 500 by 7% over a current price-earnings ratio of 3.2 Conclusion the last 52 weeks. (1 + 0.313 = 3.195). Interestingly, the company has been able to growth its Benjamin Graham and James Rea Stocks on the List carnings at an average annual rate of were firm believers in finding solid com- 30.2% a year over the last five years panies trading at low valuations. How- Table 2 lists the 22 companies pass as the company has focused on deep ever, they also believed that any stock ing the Rea-Graham screen as of March cost-cutting measures. screening system needed to be easily 26, 2010. These companies are ranked Collector's Universe (CLCT) has understood and implemented. Likewise, in descending order by earnings yield. the highest dividend yield among the in order to protect themselves from indi- Earth Link, Inc. (ELNK), an Inter passing companies at 9.5%, based on an vidual company risk, they diversified their net service provider primarily offering indicated annual dividend of $1.00 per portfolio across 30 or more companies. dial-up Internet access to consumers, share. The company provides authen. For many investors, such a simplistic has the highest earnings yield among the tication and grading services to dealers approach to stock-picking and investing passing companies at 31.3%. Technolo- and collectors of high-value coins, in such a large number of stocks is unap- gy trends, for the most part, have passed trading cards, event tickets, autographs, pealing However, the wealth of academic EarthLink by as more consumers shift memorabilia and stamps. However, the research that seemingly advocates such to high-speed Internet. The company company's dividend policy has been value-oriented investing methods and faces well-entrenched competition with erratic since it began paying a dividend the success of Graham himself over his much deeper pockets as it attempts to in 2006: After paying out $0.91 a share career as well as followers of his such shift its focus to delivering broadband in dividends in 2008, it only paid $0.23 as Warren Buffett -make it difficult to access. As a result, the company has per share in dividends in 2009. dismiss this approach as outdated. A Wayne A. Thorp, CFA, is a senior financial analyst at AAll and editor of Computerized Investing. Follow him on Twitter @CI_Editor In addition to your spreadsheet, you will need to provide answers to the following questions: 1. Using the 2018 financial statement information for Ford combined with the Valueline survery, score Ford based on the 10 original screening criteria. (Make a spreadsheet) 2. Would Ford make it to the second round? Why or why not? 3. Now assume Ford passes the initial round. Would it be considered a buy after going through the second round? Why or why not? 4. What was the criteria for the Rea-Graham fund? 5. Now look at Ford based on the new reduced criteria. Would Ford be included as a candidate for investment? Why or why not? Graham's "Last Will & Testament" By Wayne A. Thorp, CFA Article Highlights Late in his life, Benjamin Graham worked with James Rea to create a three-criterion system for finding stocks. The system looks for undervalued stocks with good dividends and relatively low debt. We recreated the screen and show you the stocks it found. W hile researching Ben ham. Graham asked him to describe his stock Graham's net current asset val- selection theory, but without using mathemat ue approach to investing for ics. Rea did so using his milk cow analogy Rea likened his method of picking stocks Computerized Investing's Feb. to that of selecting a milk cow. When picking ruary 2010 Online Exclusive a milk cow, you idcally want a cow that gives (available online to Computer- lots of milk (earnings), but also will give more ized Investing subscribers at milk year over year (growth in earnings). Fur thermore, you would like stability in the growth. Also, Rea www.computerizedinvesting.com), I ran across an went on to explain, cheese can be made from the milk, which article written by James Rea shortly after Graham's is the dividend given back to the customer. So, he also would death in The Journal of Portfolio Management. want a lot of cheese from the milk (a high dividend yield). Prior to meeting Graham a few years earlier, Rea had Part of Rea's research was to look for stocks with high been working on a stock selection methodology that looked reward-to-risk ratios. To him, a "high reward" cow was onc for companies with high reward-to-risk ratios. Upon reading that produced a lot of milk, increased its milk output at a an article that Graham had written in Barron's "Renaissance stable rate, and allowed for a lot of cheese to be made. of Value"-Rea discovered that his approach seemed simi The risk in Rea's milk cow analogy was that the cow lar to Graham's. On a lark, Rea forwarded his research to would stop producing milk, meaning you lose your milk Graham. A couple of months later, Graham called Rea and earnings) and cheese (dividend yield). The degree of risk was asked how it was that he was finding vis kinds of stocks and how much you paid for the cow relative to what you could suggested that they meet. That first meeting led to a three- get for the meat on its bones" (the liquidation value). The year working relationship, which culminated in Graham and higher the price paid for the cow relative to its liquidation Rca starting an investment fund that used the "best" stock value," the higher the risk. selection criteria based on their research. To complete his analysis, Rca divided his reward measure This article outlines the 10 criteria Graham and Rea first earnings, growth, stability and dividend) by his risk measure developed and which they tested using a 50-year period), the price paid for a company relative to its liquidation value) and builds a screen with the three criteria that they used for to arrive at a relative measure of "how good a company their Rea-Graham Fund was relative to other companies Ten Criteria Picking Stocks Like Picking a Milk Cow In Rea's article he recounts the first time he met Ben Gra- Over the next several months after their initial meeting All Journal presented earlier, they received a whole from 1925 to 1975 to determine the had grown skeptical of the benefits of point. Rca states in his article that it is relative importance of each Here is a in-depth company is In fact, he also possible to wand a half point to summary of what they found was quoted as saying a company, depending on how cose . Buying stocks with an earnings yield 1 do not have much confidence company is to meeting the exact criteria at least twice that of the AAA bond in the practical worth for mostan However, Rea offers explicit samples rate would have generated ana l yses of detailed studies of individual of warding half points for only two of age compound growth in price over coorpanies with emphasis placed on the criteris dividend yield and can the 50-year period of 19.9% uscither their comparative performance ings growth 7.5% for the Dow Jones industrial or predictions of their relative future performance G e to-five years Dividend Yield Buying stocks where the dividend time span." In order to receive a whole point, the yield was at least two-thirds the AAA Instead, Graham felt that diverse dividend yield must be at least two-thirds bond yield would have generated anfiction was far more important than that of the AAA bond yield. However, average compound growth rate of in-depth research. As a result, Rea and a company could receive a half point if 19.5 and Graham always tried to invest in at least the dividend yield is between onc-half Buying stocks with a price less 30 companies at a time. and two-thirds of the AAA bond yield than or equal to thirds of the tangible book value would have Building a Screen Earnings Growth generated an avere compounded One of the earnings growth criteria growth rate of 14.2%. Using AAITS Stok Tester Pro fun states a company can have no more than damental stock screening and research two 5% or greater annual declines in A Simplified Approach database program, we recreated the carnings over the last 10 years. How Rea Graham criteria. Using the five year ever, if it has three declines during this Graham and Rca knew their AAA corporate bond rate of 3%, the period, Graham and Rea would give it 10-point system was too restrictive criteria for our Rea Guam screen are: a half point and cumbersome for practical applica Farnings yield of greater than or tion. Therefore, after conducting their qual to 6% (or price-carnings ratio "Buys" Tesearch of the individual criterion less than or equal to 16.7) Graham and Rca began their screen they decided upon three criteria, which Dividend yield of greater than or ing process by looking at the second served as the cornerstone of the Rea c qual to 2% and five criteria. In order to be considered at Graham Fund Debt-to-equity of less than one all stocks trading on the New York Stock Earnings yield of at least twice the Weexcluded financial firms, REITS Exchange had to score at least three and AAA bond yield: OTC stocks, and foreign companies. We one-half out of five, a score of four or Dividend yield of at least two-thirds used the Yahoo Finance Bonds Cen- more was required for American Stock of the AAA bond yield, and ter financ e .com boods) as our Exchange and over the counter (OTC) Debt-to-equity ratio of less than one Source for the five year AAA corporate stocks (the NASDAQ exchange did not bond yield begin trading until 1971). Diversity Over In-Depth Analysis If a company passed this first round Profile of Passing Companies of scoring the first five criteria were Another reason why Graham and looked at. It was considered a "buy" if it Rea limited their selection criteria to Table 1 presents the characteristics traded on the New York Stock Exchange three instead of the original 10 was be of the stocks passing our Rea Graham and scored at least three and one-half cause it provided them with a larger pool screen as of March 25, 2010 out of five for the first five criteria of investment candidates. Graham was in ander to pass the Rea Graham For American Stock Exchange and OTC always an advocate of diversification, screen, a company must have an am stocks, it was a "buy" if it scored four investing in as many as 100 companies in yield of at least 6% twice the or more on the first five criteria or more if the market conditions were come AAA bond ik of right. Rea said that Graham was always 39 match it must have a price Testing the factors carning to less than or equal to "Just buy a little bit of cach, really 167 The median carings yield for Graham and Rea intuitively knew not trusting it too much, because there the companies passing the screen as of that some of the 10 criteria were more may be many other reasons that you March 26, 2010, is 90% compared to important than others. To prove this, don't know about, as to why the com a caming yield of 53% for the typical Graham suggested they test cach crite pany might not do as well in the future." exchange sted stock. This translates rion individually over a 50-year period toward the end of his life, Graham into a median price-carning to of M AAl Stock Screens Table 1. Characteristics of the Companies Passing the Rea-Graham Screen Exchange Listed 9.0 0.0 LS 1.6 11.1 (1009) for the current passing companies The minimum dividend yield te quired by the Rea Graham screen is currently 2% (66.7% of the corporate bond rate of 3%). The median dividend yield among those companies passing the screen is currently 3.2%, while the typical exchange-listed stock does not pay a dividend. The current Rea-Graham stocks have seen solid earnings growth over the last five years with a median annual growth rate of 17.4%. By comparison, the median growth rate for exchange- listed stocks was a decline of 0.6% per year Although we omitted over-the- counter (OTC) stocks from consider- ation, the companies passing the Rea Graham screen are still relatively small, with a median market capitalization of Portfolio Characteristics Median Earnings yield (%) Dividend yield (%) Price-to-book-value ratio (X) Price-to-sales ratio (X) EPS 5-yr. historical growth rate (%) EPS 3-5 yr. estimated growth rate (%) Market cap. $ million) Relative strength vs. S&P (S&P=0) (%) 1.0 17.4 10.8 226.0 (9.0) (0.6 12.0 428.0 7.0 Data as of March 26, 2010 $226 million. Meanwhile, the typical Graham screen have struggled a bit over exchange listed stock has a market cap the last year, underperforming the S&P of $428 millon. 500 by 9% Over the last 52 weeks. In Lastly, the stocks passing the Rea contrast, exchange-listed stocks have Table 2. Companies Passing the Rea-Graham Screen Earnings Yield LTD to Equity Diy Yield Price t o NCAV 2YY EPS G 5 Y 6 31. 3 22.7 15.2 13.9 11.1 .7 7.8 5.4 2.8 10.6 28 2.2 Company Exchange: Ticker EarthLink, Inc. (M: ELNK) USA Mobility (M: USMO) Daxor Corporation (A: DXR) Air T, Inc. (M: AIRT) Kewaunee Scientific (M: KEQU) Ampco-Pittsburgh (N: AP) Span-America Med Sys (M: SPAN) Hawkins, Inc. (M: HWKN) Ambassadors Group (M: EPAX) Kaiser Aluminum Corp. (M: KALU) CCA Industries, Inc. (A: CAW) Espey Mfg & Electron (A: ESP) Ecology and Environ (M: EEI) Hillenbrand, Inc. (N: HI) Cherokee Inc. (M: CHKE) Buckle, Inc., The (N: BKE) Wayside Technology (M: WSTG) Terra Nitrogen Co. (N; TINH). Cato Corp. (N: CATO) Collectors Universe (M: CLCT) Weis Markets, Inc. (N: WMK) Automatic Data Proc'. (M: ADP) Cap IS MO 896.9 288.0 47.2 28.3 35.9 262.3 49.5 241.0 210.9 774.2 47.0 38.4 60.7 1.370.7 159.2 1.711. 0 44.5 1.461.2 631.0 80.7 968.6 22,333.8 9.7 9.6 9.3 9.2 9.0 9.0 8.6 2.5 5.1 4.4 2.9 3.4 0.0 0.0 0.8 0.0 0.3 0.0 0.0 0.0 0.0 0.8 0.0 0.0 0.5 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.7 2.0 3.5 1.0 1.4 2.7 m 4.5 4.5 4.2 6.4 1.5 1.8 1.9 mm 15.2 13.0 2.5 nm 3.6 76 7.0 20.7 30.2 38.4 826 17.7 23.0 64.5 17.4 32.5 6.3 18.4 (89) 22.6 15.8 na (1.0) 25.4 (170) 173 54 205) 2.0 11.7 823 908 58.4 93.3 742 47.7 99.9 88.5 543 49.1 56. 2 85.5 86.5 88.8 48.9 828 85.1 45.6 92.1 960 89.4 96.2 Descioton Internet sery communications medical devices air cargo & support tab furniture Steel & pumps foam prods specialty chemicals educational travel aluminum prods beauty prods dlec power supplies environt consult funeral servs licensed apparel casual apparel IT software fertilizer prods women's apparel collect ble grading retail food stores business servs 78 7 7.4 .4 7.0 6.9 6.8 6.7 6.5 6.1 6.5 83 3.1 9.5 3.2 3.1 Exchange Key: An American Stock Exchange; MENASDAQ: New York Stock Exchange Source: AA's Stock Investor Pro Thomson Reuters. Data as of March 26, 2010 What It Takes: The Rea-Graham Screen The earnings yield is greater than or equal to twice the average AAA corporate bond rate (alternatively, the price- carnings ratio is less than or equal to one-half of [100+ the average AAA corporate bond rate) The dividend yield is greater than or equal to two-thirds the average AAA corporate bond rate The debt-to-equity ratio is less than or equal to one Excludes stocks in the financial sector Excludes REITS Excludes stocks that trade over the counter (OTC) Excludes ADRs and other foreign companies ont performed the S&P 500 by 7% over a current price-earnings ratio of 3.2 Conclusion the last 52 weeks. (1 + 0.313 = 3.195). Interestingly, the company has been able to growth its Benjamin Graham and James Rea Stocks on the List carnings at an average annual rate of were firm believers in finding solid com- 30.2% a year over the last five years panies trading at low valuations. How- Table 2 lists the 22 companies pass as the company has focused on deep ever, they also believed that any stock ing the Rea-Graham screen as of March cost-cutting measures. screening system needed to be easily 26, 2010. These companies are ranked Collector's Universe (CLCT) has understood and implemented. Likewise, in descending order by earnings yield. the highest dividend yield among the in order to protect themselves from indi- Earth Link, Inc. (ELNK), an Inter passing companies at 9.5%, based on an vidual company risk, they diversified their net service provider primarily offering indicated annual dividend of $1.00 per portfolio across 30 or more companies. dial-up Internet access to consumers, share. The company provides authen. For many investors, such a simplistic has the highest earnings yield among the tication and grading services to dealers approach to stock-picking and investing passing companies at 31.3%. Technolo- and collectors of high-value coins, in such a large number of stocks is unap- gy trends, for the most part, have passed trading cards, event tickets, autographs, pealing However, the wealth of academic EarthLink by as more consumers shift memorabilia and stamps. However, the research that seemingly advocates such to high-speed Internet. The company company's dividend policy has been value-oriented investing methods and faces well-entrenched competition with erratic since it began paying a dividend the success of Graham himself over his much deeper pockets as it attempts to in 2006: After paying out $0.91 a share career as well as followers of his such shift its focus to delivering broadband in dividends in 2008, it only paid $0.23 as Warren Buffett -make it difficult to access. As a result, the company has per share in dividends in 2009. dismiss this approach as outdated. A Wayne A. Thorp, CFA, is a senior financial analyst at AAll and editor of Computerized Investing. Follow him on Twitter @CI_Editor