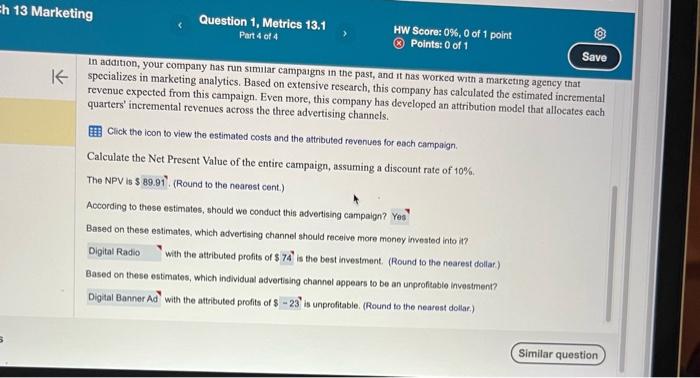

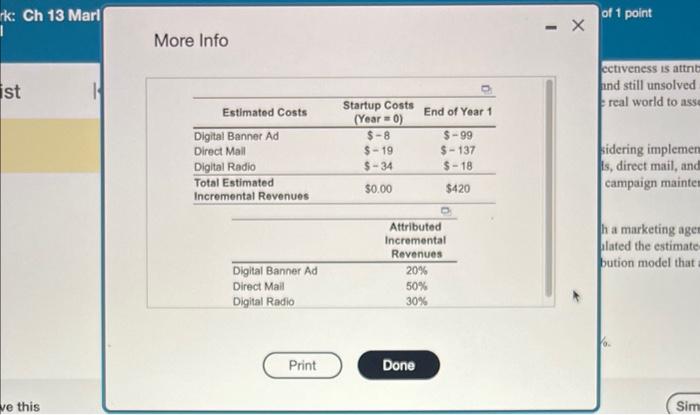

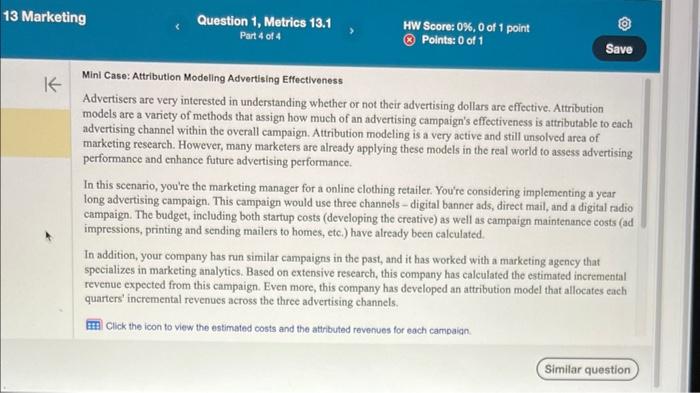

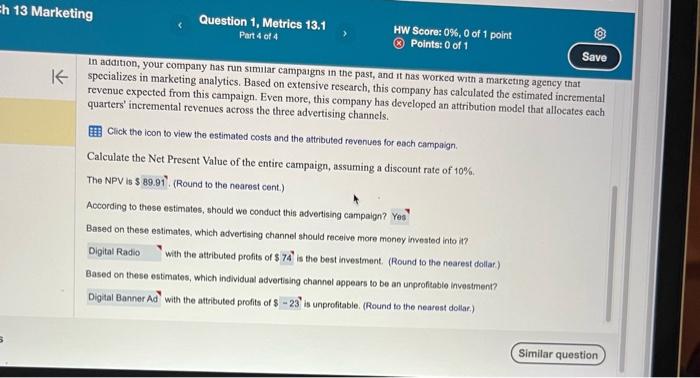

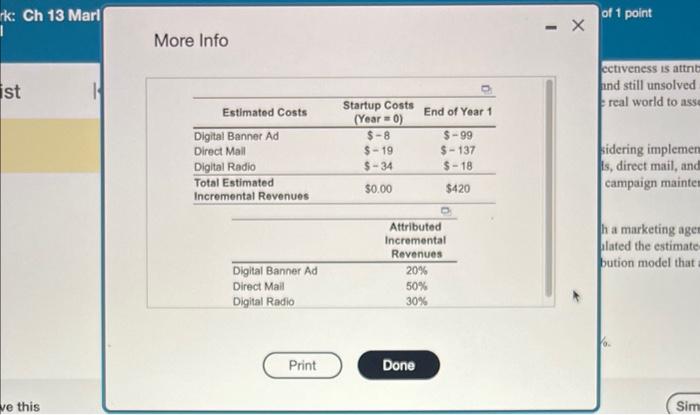

In addition, your company has run simular campatgns in the past, and it has worked with a marketing agency that specializes in marketing analytics. Based on extensive research, this company has calculated the estimated incremental revenue expected from this campaign. Even more, this company has developed an attribution model that allocates each quarters' incremental revenues across the three advertising channels. E: Cirick the icon to view the estimated costs and the attributed revenues for each campaign. Calculate the Net Present Value of the entire campaign, assuming a discount rate of 10%, The NPV is s (Round to the nearest cent.) According to these estimates, should we conduct this advertising campaign? Based on these estimates, which advertising channel should recoive more money imnestod into it? with the attributed profits of $74 is the best investment. (Round to the nearest dollar.) Based on these estimates, which individual advertising channel appears to be an unprofitable investment? with the attributed profits of \& is unprofitable. (Round to the nearest dollar.) More Info Mini Case: Attribution Modeling Advertising Effectiveness Advertisers are very interested in understanding whether or not their advertising dollars are effective. Attribution models are a variety of methods that assign how much of an adyertising campaign's effectiveness is attributable to each advertising channel within the overall campaign. Attribution modeling is a very active and still unsolved area of marketing research. However, many marketers are already applying these models in the real world to assess advertising performance and enhance future advertising performance. In this scenario, you're the marketing manager for a online clothing retafler. You're considering implementing a year long advertising campaign. This campaign would use three channols - digital banner ads, direct mail, and a digital radio campaign. The budget, including both startup costs (developing the creative) as well as campaign maintenance costs (ad) impressions, printing and sending mailers to homes, etc.) have already been calculated. In addition, your company has run similar campaigns in the past, and it has worked with a marketing agency that specializes in marketing analytics. Based on extensive research, this company has calculated the cstimated incremental revenue expected from this campaign. Even more, this company has developed an attribution model that allocates each quarters' incremental revenues across the three advertising channels. Click the icon to view the estimated costs and the attributed revenues for each campaiqn. In addition, your company has run simular campatgns in the past, and it has worked with a marketing agency that specializes in marketing analytics. Based on extensive research, this company has calculated the estimated incremental revenue expected from this campaign. Even more, this company has developed an attribution model that allocates each quarters' incremental revenues across the three advertising channels. E: Cirick the icon to view the estimated costs and the attributed revenues for each campaign. Calculate the Net Present Value of the entire campaign, assuming a discount rate of 10%, The NPV is s (Round to the nearest cent.) According to these estimates, should we conduct this advertising campaign? Based on these estimates, which advertising channel should recoive more money imnestod into it? with the attributed profits of $74 is the best investment. (Round to the nearest dollar.) Based on these estimates, which individual advertising channel appears to be an unprofitable investment? with the attributed profits of \& is unprofitable. (Round to the nearest dollar.) More Info Mini Case: Attribution Modeling Advertising Effectiveness Advertisers are very interested in understanding whether or not their advertising dollars are effective. Attribution models are a variety of methods that assign how much of an adyertising campaign's effectiveness is attributable to each advertising channel within the overall campaign. Attribution modeling is a very active and still unsolved area of marketing research. However, many marketers are already applying these models in the real world to assess advertising performance and enhance future advertising performance. In this scenario, you're the marketing manager for a online clothing retafler. You're considering implementing a year long advertising campaign. This campaign would use three channols - digital banner ads, direct mail, and a digital radio campaign. The budget, including both startup costs (developing the creative) as well as campaign maintenance costs (ad) impressions, printing and sending mailers to homes, etc.) have already been calculated. In addition, your company has run similar campaigns in the past, and it has worked with a marketing agency that specializes in marketing analytics. Based on extensive research, this company has calculated the cstimated incremental revenue expected from this campaign. Even more, this company has developed an attribution model that allocates each quarters' incremental revenues across the three advertising channels. Click the icon to view the estimated costs and the attributed revenues for each campaiqn