Answered step by step

Verified Expert Solution

Question

1 Approved Answer

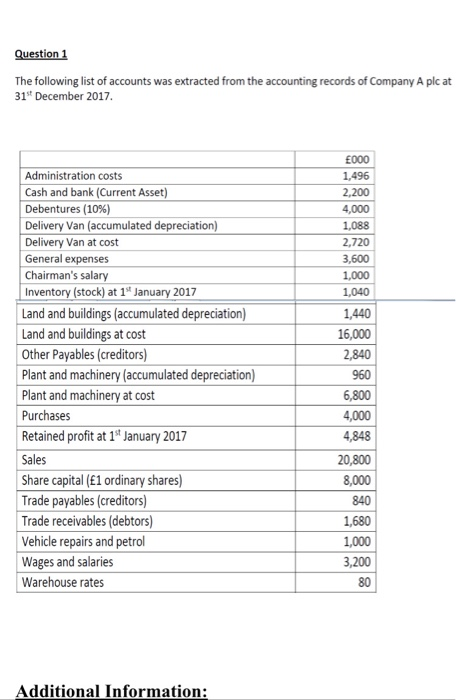

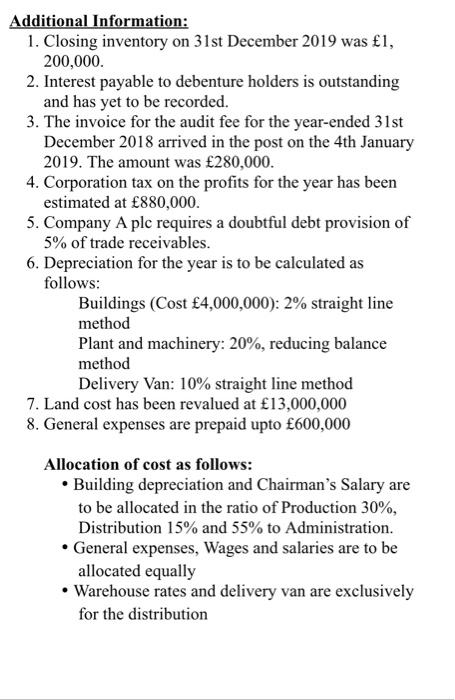

in additional information there are all questions from question 1 till 8 Question 1 The following list of accounts was extracted from the accounting records

in additional information there are all questions from question 1 till 8

Question 1 The following list of accounts was extracted from the accounting records of Company A plc at 31" December 2017 E000 1,496 2,200 4,000 1,088 2.720 3,600 1,000 1,040 Administration costs Cash and bank (Current Asset) Debentures (10%) Delivery Van (accumulated depreciation) Delivery Van at cost General expenses Chairman's salary Inventory (stock) at 1 January 2017 Land and buildings (accumulated depreciation) Land and buildings at cost Other Payables (creditors) Plant and machinery (accumulated depreciation) Plant and machinery at cost Purchases Retained profit at 19 January 2017 Sales Share capital (E1 ordinary shares) Trade payables (creditors) Trade receivables (debtors) Vehicle repairs and petrol Wages and salaries Warehouse rates 1,440 16,000 2,840 960 6,800 4,000 4,848 20,800 8,000 840 1,680 1,000 3,200 Additional Information: Additional Information: 1. Closing inventory on 31st December 2019 was 1, 200,000. 2. Interest payable to debenture holders is outstanding and has yet to be recorded. 3. The invoice for the audit fee for the year-ended 31st December 2018 arrived in the post on the 4th January 2019. The amount was 280,000. 4. Corporation tax on the profits for the year has been estimated at 880,000. 5. Company A plc requires a doubtful debt provision of 5% of trade receivables 6. Depreciation for the year is to be calculated as follows: Buildings (Cost 4,000,000): 2% straight line method Plant and machinery: 20%, reducing balance method Delivery Van: 10% straight line method 7. Land cost has been revalued at 13,000,000 8. General expenses are prepaid upto 600,000 Allocation of cost as follows: Building depreciation and Chairman's Salary are to be allocated in the ratio of Production 30%, Distribution 15% and 55% to Administration. General expenses, Wages and salaries are to be allocated equally Warehouse rates and delivery van are exclusively for the distribution Question 1 The following list of accounts was extracted from the accounting records of Company A plc at 31" December 2017 E000 1,496 2,200 4,000 1,088 2.720 3,600 1,000 1,040 Administration costs Cash and bank (Current Asset) Debentures (10%) Delivery Van (accumulated depreciation) Delivery Van at cost General expenses Chairman's salary Inventory (stock) at 1 January 2017 Land and buildings (accumulated depreciation) Land and buildings at cost Other Payables (creditors) Plant and machinery (accumulated depreciation) Plant and machinery at cost Purchases Retained profit at 19 January 2017 Sales Share capital (E1 ordinary shares) Trade payables (creditors) Trade receivables (debtors) Vehicle repairs and petrol Wages and salaries Warehouse rates 1,440 16,000 2,840 960 6,800 4,000 4,848 20,800 8,000 840 1,680 1,000 3,200 Additional Information: Additional Information: 1. Closing inventory on 31st December 2019 was 1, 200,000. 2. Interest payable to debenture holders is outstanding and has yet to be recorded. 3. The invoice for the audit fee for the year-ended 31st December 2018 arrived in the post on the 4th January 2019. The amount was 280,000. 4. Corporation tax on the profits for the year has been estimated at 880,000. 5. Company A plc requires a doubtful debt provision of 5% of trade receivables 6. Depreciation for the year is to be calculated as follows: Buildings (Cost 4,000,000): 2% straight line method Plant and machinery: 20%, reducing balance method Delivery Van: 10% straight line method 7. Land cost has been revalued at 13,000,000 8. General expenses are prepaid upto 600,000 Allocation of cost as follows: Building depreciation and Chairman's Salary are to be allocated in the ratio of Production 30%, Distribution 15% and 55% to Administration. General expenses, Wages and salaries are to be allocated equally Warehouse rates and delivery van are exclusively for the distribution Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started