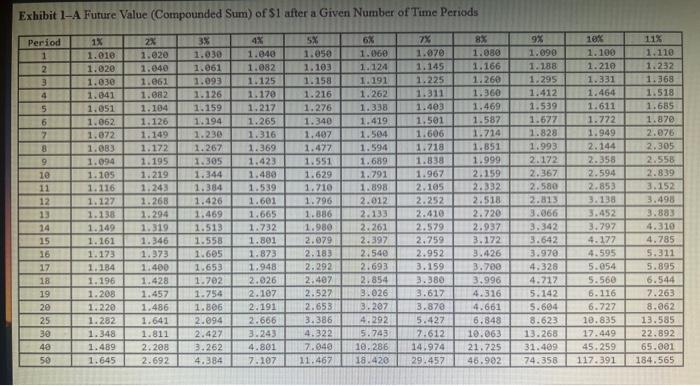

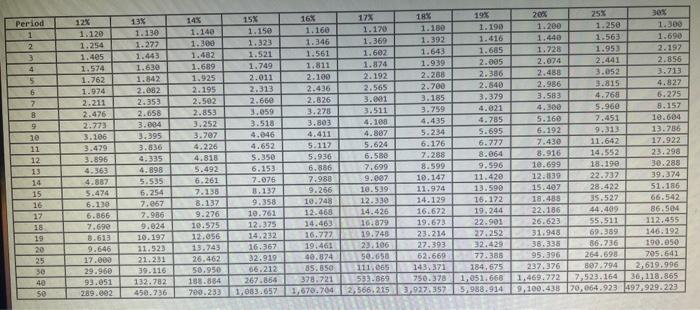

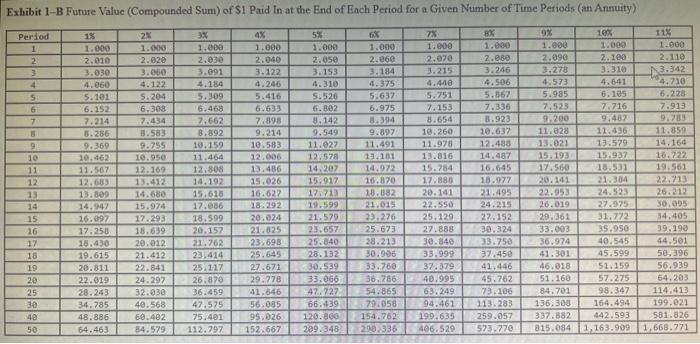

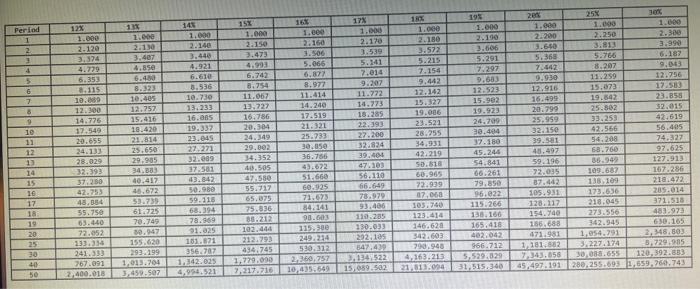

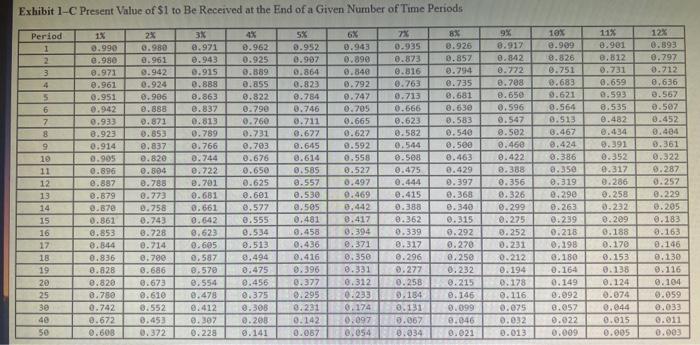

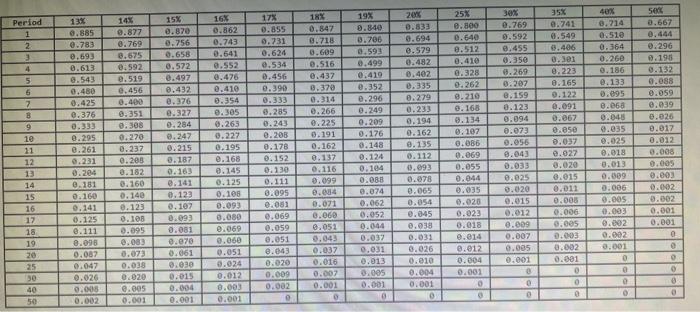

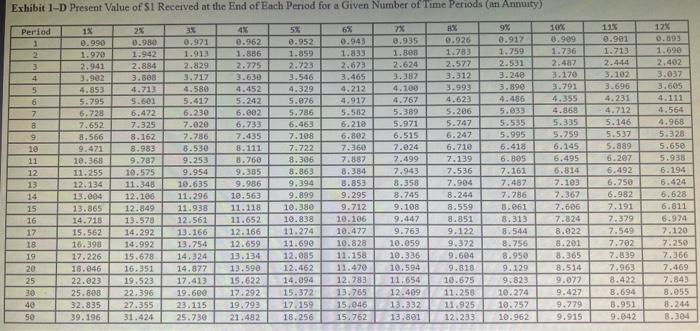

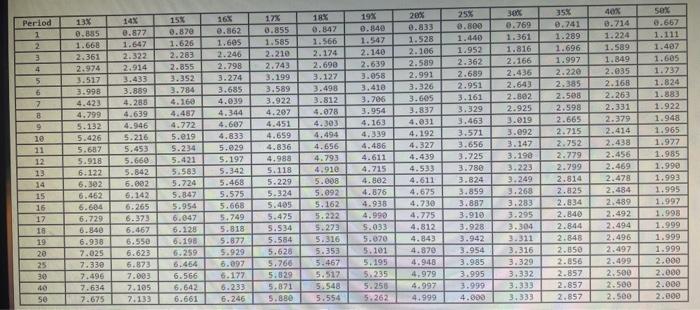

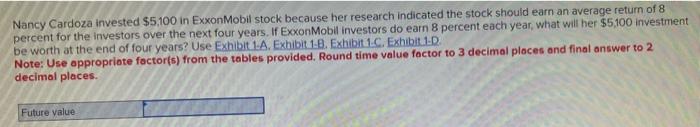

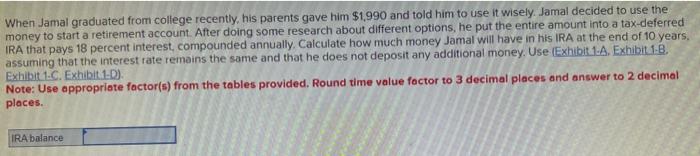

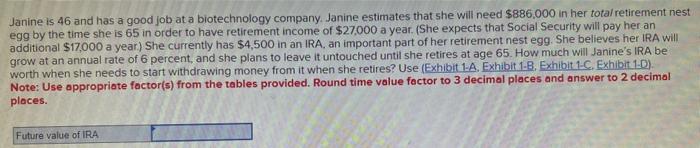

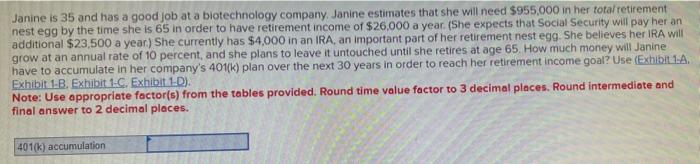

In an attempt to have funds for a down payment, Carmella Carlson plans to save $3,650 a year for the next five years. With an interest rate of 3 percent, what amount will Carmella have available for a down payment after the five years? (Exhibit 1-A. Exhibit 1-B. Exhibit 1 . C. Exhibit 1.D) Note: Use appropriate factor(s) from the tables provided. Round time value foctor to 3 decimal places and final answer to 2 decimal places. \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Period & 13x & 14x & 15x & 16x & 17x & 18x & 19x & 208 & 25x & 30x & 35x & 40x & 568 \\ \hline 1 & 0.885 & 0.877 & 0.870 & 0.862 & 0.855 & 0.847 & 0.849 & 0.833 & 0.800 & 0.769 & 0.741 & 0.714 & 0.667 \\ \hline 2 & 0.783 & 0.769 & 0.756 & 0.743 & 0.731 & 8.718 & 0.706 & 0.694 & 0.640 & 0.592 & 6.549 & 0.510 & 0.444 \\ \hline 3 & 0,693 & 0.675 & 0.658 & 0.641 & 0.624 & 0.609 & 0.593 & 0.579 & 0.512 & 0.455 & 0.406 & 0.364 & 0.296 \\ \hline 4 & 0.613 & 0.592 & 0.572 & 0.552 & 0.534 & 0.516 & 0.499 & 0.482 & 0.410 & 0.350 & 0.101 & 0.260 & 0.195 \\ \hline57 & 0.543 & 0.519 & 0.497 & 0.476 & 0.456 & 0.437 & 0.419 & 0.402 & 0.328 & 0.269 & 0.223 & 0.186 & 0.132 \\ \hline 5 & 0.480 & 0.456 & 0.432 & 0.410 & 0.390 & 0.370 & 0.352 & 0.335 & 0.262 & 0.207 & 0.165 & 0.133 & 0.088 \\ \hline77 & 0.425 & 0.400 & 0.376 & 0.354 & 0.333 & 0.314 & 0.296 & 0.279 & 0.210 & 0.159 & 0.122 & 0.095 & 0.059 \\ \hline B & 0.376 & 0.351 & 0.327 & 0.305 & 0.285 & 0.266 & 0.249 & 0.233 & 0.165 & 0.123 & 0.091 & 0.066 & 0.039 \\ \hline 9 & 0.333 & 0.308 & 0.284 & 0.263 & 0.243 & 0.225 & 0.209 & 0.194 & 0.134 & 0.094 & 0.067 & 0.048 & 0.026 \\ \hline 10 & 0.205 & 0.270 & 0.247 & 0.227 & 0.208 & 0.191 & 0.176 & 0.162 & 0.107 & 0.073 & 0.050 & 9.035 & 0.017 \\ \hline 11 & 0.261 & 0.237 & 0.215 & 0.195 & 0.178 & 0.162 & 0.148 & 0.135 & 0.086 & 0.056 & 0.037 & 0.025 & 0.012 \\ \hline 12 & 0.231 & 0.208 & 0.187 & 0.168 & 0.152 & 0.137 & 0.124 & 0.112 & 0.069 & 0.043 & 0.027 & 0,018 & 0.008 \\ \hline 13 & 0.204 & 0.182 & 0.163 & 0.145 & 0.130 & 0.116 & 0.184 & 0.093 & 0.055 & 0.033 & 0.020 & 0.013 & 0.005 \\ \hline 14 & 0.181 & 0.160 & 0.141 & 0.125 & 0.111 & 0.099 & 0.088 & 0.078 & 0.044 & 0.025 & 0.015 & 0.009 & 0.003 \\ \hline 15 & 0.160 & 0.140 & 0.123 & 0.106 & 0.095 & e.evis & 0.074 & 0.065 & 0.035 & 0.020 & 0.011 & 0.006 & 0.002 \\ \hline 16 & 0.141 & 0.123 & 0.107 & 0.093 & 0.081 & 0.071 & 0.062 & 0.054 & 0.020 & 0.015 & 0.005 & 0.005 & 0.002 \\ \hline 17 & 0.125 & 0.108 & 0.093 & 0.080 & 0.069 & 0.060 & 0.052 & 0.045 & 0.023 & 0.012 & 0.006 & 0.003 & 0.001 \\ \hline 18 & 0.111 & 0.095 & 0.081 & 0.069 & 0.059 & 0.051 & 0.044 & 0.038 & 0.018 & 0.009 & 0.005 & 0.002 & 0.001 \\ \hline 19 & 0.026 & 0.083 & 0.070 & 0.060 & 0.051 & 0.043 & 0.037 & 0.031 & 0.014 & 0.007 & 0.003 & 0.002 & 0 \\ \hline 20 & 0.087 & 0.073 & 0.061 & 0.051 & 6.643 & 0.037 & 0.031 & 0.026 & 0.012 & 0.005 & 0.002 & 0.001 & 8 \\ \hline 25 & 0.047 & 0.038 & 0.039 & 0.024 & 0.020 & 0.016 & 0.013 & 0.010 & 0.004 & 0.001 & 0.001 & 0 & 0 \\ \hline 30 & 0.026 & 0.020 & 0.015 & 0.012 & 0.009 & 0.007 & 0.095 & 0.004 & 0.001 & e & 0 & 8 & 0 \\ \hline 40 & 0.005 & 0.005 & 0.004 & 0.003 & 0.002 & 0.001 & 0.001 & 0.001 & 0 & 0 & 0 & e & 0 \\ \hline5040 & 0.002 & 0,001 & 0.001 & 0.001 & 0 & 0 & 0 & e & 8 & e & 8 & 0 & \\ \hline \end{tabular} Susan has purchased a whole life policy with a death benefit of $420,000. Assuming that she dies in 8 years and the average inflation has been 5 percent, what is the value of the purchasing power of the proceeds? Use (Exhibit 1-A. Exhibit 1:B. Exhibit 1.C. Exhibit 1-D) Note: Use oppropriate factor(s) from the tables provided. Round time value factor to 3 decimal places and final answer to 2 decimal places. Nancy Cardoza invested $5,100 in ExxonMobil stock because her research indicated the stock should earn an average return of 8 percent for the investors over the next four years. If ExxonMobil investors do earn 8 percent each year, what will her $5,100 investment be worth at the end of four years? Use Exhibit 1.A. Exhibit 1-B. Exhibit 1.C. Exhibit 1-D. Note: Use oppropriate foctor(s) from the tables provided. Round time value factor to 3 decimal ploces and final answer to 2 decimal places. Suppose you are 35 and have a $45,000 face amount, 15 -year, limited-payment, participating policy (dividends will be used to build up the cash value of the policy). Your annual premium is $405. The cash value of the policy is expected to be $1,800 in 15 years. Using time value of money and assuming you could invest your money elsewhere for a 8 percent annual yield, calculate the net cost of insurance, Use (Exhibit 1-A, Exhibit 1-B. Exhibit 1-C. Exhibit 1-D) Note: Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Round time value factor to 3 decimal places and final answer to the nearest whole number. Exhibit 1-A Future Value (Compounded Sum) of $1 after a Given Number of Time Periods What would be the net present value of a microwave oven that costs $186 and will save you $76 a year in time and food away from home? Assume an average return on your savings of 4 percent for five years. (Exhibit 1.A. Exhibit 1.B. Exhibit 1-C. Exhibit 1-D) Note: Use appropriate factor(s) from the tables provided. Round time value factor to 3 decimal places and answer to 2 decimal ploces. Janine is 35 and has a good job at a biotechnology company. Janine estimates that she will need $955,000 in her totai retirement nest egg by the time she is 65 in order to have retirement income of $26.000 a year. (She expects that Social Security will pay her an additional \$23,500 a year) She currently has \$4,000 in an IRA, an important part of her retirement nest egg. She believes her IRA will grow at an annual rate of 10 percent, and she plans to leave it untouched until she retires at age 65 . How much money will Janine have to accumulate in her company's 401(k) plan over the next 30 years in order to reach her retirement income goal? Use (Exhibit 1A. Exhibit 1-B, Exhibit 1-C, Exhibit 1-D). Note: Use appropriate factor(s) from the tables provided. Round time value factor to 3 decimal places. Round intermediate and final answer to 2 decimal places. Exhibit 1-C Present Value of \$1 to Be Received at the End of a Given Number of Time Periods \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Period & 18 & 2x & 3x & 4x & 58 & 6x & x & 8x & 9x & 10x & 11x & 12x \\ \hline 1 & 0.990 & 0.980 & 0.971 & 0.962 & 0.952 & 0.943 & 0.935 & 0.926 & 8.917 & 0.999 & 0.901 & 0.893 \\ \hline 2 & 0.980 & 0.961 & 0.943 & 0.925 & 0.907 & 0.896 & 0.873 & 0.857 & 0.842 & 0.826 & 0.812 & 0.797 \\ \hline 3 & 0.971 & 0.942 & 0.915 & 0.889 & 0.864 & 0.849 & 0.816 & 0.794 & 0.772 & 0.751 & 0.731 & 0.712 \\ \hline 4 & 0.961 & 0.924 & 0.888 & 0.855 & 0.823 & 0.792 & 0.763 & 0.735 & 0.788 & 0.683 & 0.659 & 0,636 \\ \hline 5 & 0.951 & 0.906 & e.863 & 0.822 & 0.784 & 0.747 & 0.713 & 0.681 & 0.650 & 0.621 & 0.593 & 0.567 \\ \hline 6 & 0.942 & 0.888 & 0.837 & 0.790 & 0.746 & 0.705 & 0.666 & 0.630 & 0.596 & 0.564 & 0.535 & 0.507 \\ \hline 7 & 0.933 & 0.871 & 0.813 & 0.760 & 0.711 & 0.665 & 0.623 & 0.583 & 0.547 & 0.513 & 0.482 & 0.452 \\ \hline 8 & 0.923 & 0.653 & 0.789 & 0.731 & 0.677 & 0.627 & 0.582 & 0.549 & 0.502 & 0.467 & 0.434 & 0.404 \\ \hline 9 & 0.914 & 0.837 & 0.766 & 0.703 & 0.645 & 0.592 & 0.544 & 0.500 & 0.468 & 0.424 & 0.391 & 0.361 \\ \hline 10 & 0.905 & 0.82 & 0.744 & 0.676 & 0.614 & 0.558 & 0.568 & 0.463 & 0.422 & 0.386 & 0.352 & 0.322 \\ \hline 11 & 0.896 & 0.804 & 0.722 & 0.650 & 0.585 & 0.527 & 0.475 & 0.429 & 0.388 & 0.350 & 0.317 & 0.287 \\ \hline 12 & 0.887 & 0.788 & 0.701 & 0.625 & 0.557 & 0.497 & 0.444 & 0.397 & 0.356 & 0,319 & 0.286 & 0.257 \\ \hline 13 & 0.879 & 0.773 & 0.681 & 0.601 & 0.530 & 0.469 & 0.415 & 0.368 & 0.326 & 0.290 & 0.258 & 0.229 \\ \hline 14 & 0. 870 & 0.758 & 0.661 & 0.577 & 0.505 & 0,442 & 0.388 & 0.340 & 0.299 & 0.263 & 0.232 & 0.205 \\ \hline 15 & 0.861 & 0.743 & 0.642 & 0.555 & 0.481 & 0.417 & 0.362 & 0.315 & 0.275 & 0.239 & 0.209 & 0.183 \\ \hline 16 & 0.853 & 0.728 & 0.623 & 0.534 & 0.456 & 0.394 & 0.339 & 0.292 & 0.252 & 0.218 & 0.188 & 0.163 \\ \hline 17 & 0.844 & 0.714 & 0.695 & 0.513 & 0.436 & 0.371 & 0.317 & 0.270 & 0.231 & 0.198 & 0.170 & 0.146 \\ \hline 18 & 0.836 & 0.700 & 0.587 & 8,494 & 0.416 & 0.350 & 0.296 & 0.250 & 0.212 & 0.180 & 0.153 & 0.130 \\ \hline 19 & 0.028 & 0.686 & 0.570 & 0.475 & 0.396 & 8.331 & 0.277 & 0.232 & 0.194 & 0.164 & 0.138 & 0.116 \\ \hline 20 & 0.820 & 0.673 & 0.554 & 0.456 & 0.377 & 0.312 & 0.258 & 0.215 & 0.178 & 0.149 & 0.124 & 0.104 \\ \hline 25 & 0.780 & 0.610 & 0.478 & 0.375 & 0.295 & 0.233 & 0.184 & 0.146 & 0.116 & 0.092 & 0.074 & 0.059 \\ \hline 30 & 0.742 & 0.552 & 0.412 & 0.306 & 0.231 & 0.174 & 0.131 & 0.099 & 0.075 & 8.057 & 0.044 & 0.033 \\ \hline 40 & 0.672 & 0.453 & 0.307 & 0.268 & 0.142 & 0.097 & 0.067 & 0.046 & 0.032 & 0.022 & 0.015 & 0.011 \\ \hline 50 & 0.608 & 0.372 & 0.228 & 0.141 & 0.067 & 0.054 & 0.034 & 0.021 & 0.013 & 0.009 & 0.005 & 0.003 \\ \hline \end{tabular} When Jamal graduated from college recently, his parents gave him $1,990 and told him to use it wisely. Jamal decided to use the money to start a retirement account After doing some research about different options, he put the entire amount into a tax-deferred IRA that pays 18 percent interest, compounded annually. Calculate how much money Jamal will have in his IRA at the end of 10 years. assuming that the interest rate remains the same and that he does not deposit any additional money. Use (Exhibit 1:A, Exhibit 1.B. Exhibit 1.C. Exhibit1:D). Note: Use appropriate factor(s) from the tables provided. Round time value foctor to 3 decimal places and answer to 2 decimal places. \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Period & 13x & 14X & 158 & 168 & 17x & 18X & 19x & 20% & 25% & 396 & 358 & 40X & sen \\ \hline 1 & 0.835 & 0.877 & 0.879 & 0.862 & 0.855 & 0.847 & 0.840 & 0.833 & 9.800 & 0.769 & 0.741 & 0.714 & 0.667 \\ \hline 2 & 1.668 & 1.647 & 1.626 & 1.605 & 1.585 & 1.566 & 1.547 & 1.528 & 1.440 & 1.361 & 1.289 & 1.224 & 1.111 \\ \hline 3 & 2,361 & 2.322 & 2.283 & 2.246 & 2.210 & 2.174 & 2.140 & 2.106 & 1.952 & 1.816 & 1.696 & 1.589 & 1.487 \\ \hline 4 & 2.974 & 2.914 & 2.855 & 2.798 & 2.743 & 2.690 & 2.639 & 2.589 & 2.362 & 2.166 & 1.997 & 1.849 & 1.605 \\ \hline 5 & 3.517 & 3.433 & 3.352 & 3.274 & 3.199 & 3.127 & 3.058 & 2.991 & 2.689 & 2.436 & 2.220 & 2.635 & 1.737 \\ \hline 6 & 3.998 & 3.889 & 3.784 & 3.685 & 3.589 & 3.498 & 3.410 & 3.326 & 2.951 & 2.643 & 2.385 & 2.168 & 1.824 \\ \hline 7 & 4.423 & 4.288 & 4.160 & 4.039 & 3.922 & 3.812 & 3.706 & 3.605 & 3.161 & 2.802 & 2.588 & 2.263 & 1.883 \\ \hline 8 & 4.799 & 4.639 & 4.487 & 4.344 & 4.207 & 4.078 & 3.954 & 3.837 & 3.329 & 2.925 & 2.598 & 2.331 & 1.922 \\ \hline 9 & 5.132 & 4.946 & 4.772 & 4.697 & 4.451 & 4.303 & 4.163 & 4.031 & 3.463 & 3.019 & 2.665 & 2.379 & 1.948 \\ \hline 10 & 5.426 & 5.216 & 5.019 & 4.833 & 4.659 & 4.494 & 4.339 & 4.192 & 3.571 & 3.092 & 2.715 & 2.414 & 1.965 \\ \hline 11 & 5.687 & 5.453 & 5.234 & 5.029 & 4.836 & 4.656 & 4.486 & 4.327 & 3.656 & 3.147 & 2.752 & 2.438 & 1.977 \\ \hline 12 & 5.918 & 5.660 & 5.421 & 5.197 & 4.983 & 4.793 & 4.611 & 4.439 & 3.725 & 3.198 & 2.779 & 2.456 & 1.985 \\ \hline 13 & 6.122 & 5.842 & 5.583 & 5.342 & 5.118 & 4.910 & 4.715 & 4.533 & 3.780 & 3.223 & 2.799 & 2.469 & 1,990 \\ \hline 14 & 6.302 & 6.002 & 5.724 & 5.468 & 5.229 & 5.008 & 4.802 & 4.611 & 3.824 & 3.249 & 2.814 & 2.478 & 1.993 \\ \hline 15 & 6.462 & 6,142 & 5.847 & 5.575 & 5.324 & 5.092 & 4.676 & 4.675 & 3.859 & 3.268 & 2.825 & 2.484 & 1.995 \\ \hline 16 & 6.604 & 6.265 & 5.954 & 5.668 & 5.405 & 5.162 & 4.9316 & 4.730 & 3.887 & 3.283 & 2.834 & 2.489 & 1.997 \\ \hline 17 & 6.729 & 6.373 & 6.047 & 5,749 & 5.475 & 5.222 & 4.990 & 4,775 & 3.910 & 3.295 & 2.840 & 2.492 & 1.998 \\ \hline 18 & 6.840 & 6.467 & 6.228 & 5.818 & 5.5334 & 5.273 & 5.033 & 4.812 & 3.928 & 3.304 & 2.844 & 2.494 & 1.999 \\ \hline 19 & 6.938 & 6.550 & 6.198 & 5.877 & 5.584 & 5.316 & 5.070 & 4.843 & 3.942 & 3.311 & 2.848 & 2.496 & 1.999 \\ \hline 28 & 7.025 & 6.623 & 6.259 & 5.929 & 5.628 & 5.353 & 5,101 & 4.870 & 3.954 & 3.316 & 2.850 & 2.497 & 1.999 \\ \hline 25 & 7.330 & 6.873 & 6.454 & 5.097 & 5.766 & 5.467 & 5,195 & 4.948 & 3.985 & 3.329 & 2.856 & 2.499 & 2.000 \\ \hline 30 & 2.496 & 7.003 & 6.566 & 6.177 & 5.829 & 5.517 & 5.235 & 4,979 & 3.995 & 3,332 & 2.857 & 2.500 & 2.000 \\ \hline 40 & 7.634 & 7.105 & 6,642 & 6.233 & 5,871 & 5,548 & 5.250 & 4.997 & 3.999 & 3.333 & 2.857 & 2.500 & 2.000 \\ \hline se & 7.675 & 7.133 & 6.661 & 6.246 & 5.880 & 5.554 & 5.262 & 4,999 & 4.000 & 3.333 & 2.857 & 2.500 & 2.000 \\ \hline \end{tabular} Janine is 46 and has a good job at a biotechnology company. Janine estimates that she will need $886,000 in her total retirement nest egg by the time she is 65 in order to have retirement income of $27,000 a year. (She expects that Social Security will pay her an additional \$17,000 a year) She currently has \$4,500 in an IRA, an important part of her retirement nest egg. She believes her IRA will grow at an annual rate of 6 percent, and she plans to leave it untouched until she retires at age 65 . How much will Janine's IRA be worth when she needs to start withdrawing money from it when she retires? Use (Exhibit 1-A. Exhibit 1-B, Exhibit 1-C. Exhibit 1-D). Note: Use oppropriate factor(s) from the tables provided. Round time value factor to 3 decimal places and answer to 2 decimal places. Exhibit 1-D Present Value of S1 Received at the End of Each Period for a Given Number of Trme Periods (an Annuity) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Period & 1x & 2x & 35 & 4x & 5x & 6 & n & Ax & 9x & 100 & 11x & 17x \\ \hline 1 & 0.990 & 0.989 & 0.971 & 0.962 & 0.952 & 0.943 & 0.935 & 0.926 & 0.917 & 0.909 & 0.901 & 0.093 \\ \hline 2 & 1.970 & 1.942 & 1.913 & 1.886 & 1.859 & 1.833 & 1. 8 e6 & 1.763 & 1.759 & 1.736 & 1.713 & 1.690 \\ \hline 3. & 2.941 & 2.884 & 2.829 & 2.775 & 2.723 & 2.673 & 2.624 & 2.577 & 2.531 & 2.4a7 & 2.444 & 2.402 \\ \hline 4 & 3.902 & 3.508 & 3.717 & 3.630 & 3.546 & 3.465 & 3.387 & 3.312 & 3.240 & 3.170 & 3.102 & 3.037 \\ \hline 5 & 4.853 & 4,713 & 4.580 & 4.452 & 4.329 & 4.212 & 4.100 & 3.993 & 3.890 & 3.791 & 3.696 & 3.605 \\ \hline 6 & 5.795 & 5.601 & 5.417 & 5.242 & 5.076 & 4.917 & 4.767 & 4.623 & 4.486 & 4.355 & 4.231 & 4.111 \\ \hline 7 & 6.728 & 6,472 & 6.230 & 6.002 & 5.786 & 5.5112 & 5.369 & 5.206 & 5.033 & 4.868 & 4.712 & 4.564 \\ \hline 8 & 7.652 & 7.325 & 7.020 & 6.733 & 6.463 & 6.210 & 5.971 & 5.247 & 5.535 & 5.335 & 5.146 & 4.968 \\ \hline 9 & 8.566 & 8.162 & 7.786 & 7.435 & 7.198 & 6.892 & 6.515 & 6.247 & 5.995 & 5.759 & 5.537 & 5.328 \\ \hline 10 & 9.471 & 8.983 & 8.530 & 8.111 & 7.722 & 7.360 & 7.024 & 6.710 & 6.418 & 6.145 & 5.889 & 5.650 \\ \hline 11 & 10.368 & 9.787 & 9.253 & 8.760 & 8.306 & 7.887 & 7.499 & 7.139 & 6.805 & 6.495 & 6.207 & 5.938 \\ \hline 12. & 11.255 & 10.575 & 9.954 & 9.385 & 8.863 & 8.384 & 7.943 & 7.536 & 7.161 & 6.814 & 6.492 & 6.194 \\ \hline 13 & 12.134 & 11.348 & 10.635 & 9.986 & 9.394 & 8.853 & 8.358 & 7.904 & 7.487 & 7.103 & 6.750 & 6.424 \\ \hline 14 & 13.064 & 12,106 & 11.296 & 10.563 & 9.899 & 9.295 & 8.745 & 8.244 & 7.786 & 7.367 & 6.982 & 6.628 \\ \hline 15 & 13.865 & 12.849 & 11.938 & 11.118 & 10.380 & 9.712 & 9.108 & 8.559 & 8.861 & 7.696 & 7.191 & 6.811 \\ \hline 16 & 14.718 & 13.570 & 12.561 & 11.652 & 10.838 & 10.106 & 9.447 & 8.851 & 8.313 & 7.824 & 7.379 & 6.974 \\ \hline 17 & 15.562 & 14.292 & 13.166 & 12.166 & 11.274 & 10.477 & 9.763 & 9.122 & 8.544 & 8.022 & 7.549 & 7.120 \\ \hline 18 & 16.398 & 14.992 & 13.754 & 12.659 & 11.690 & 10.828 & 10.059 & 9.372 & 8.756 & 8.201 & 7.702 & 7.250 \\ \hline 19 & 17.226 & 15.678 & 14.324 & 13.134 & 12.055 & 11.158 & 10.336 & 9.684 & 8.950 & 8.365 & 7.839 & 7.366 \\ \hline 20 & 18.046 & 16.351 & 14.877 & 13.590 & 12.462 & 11.470 & 10.594 & 9.818 & 9.129 & 6.514 & 7.963 & 7.469 \\ \hline 25 & 22.023 & 19.523 & 17,413 & 15.622 & 14.094 & 12.783 & 11.654 & 10.675 & 9.823 & 9.077 & 8.422 & 7.843 \\ \hline 30 & 25.828 & 22,396 & 19.600 & 17.292 & 15.372 & 13.765 & 12.409 & 11.258 & 10.274 & 9.427 & 8.694 & 8.055 \\ \hline 40 & 32.835 & 27.355 & 23.115 & 19.793 & 17.159 & 15,046 & 13.332 & 11.925 & 10.757 & 9.779 & 8.951 & 8.244 \\ \hline 50 & 39.196 & 31.424 & 25.730 & 21.482 & 18.256 & 15,762 & 13.891 & 12.2 .33 & 10.962 & 9.915 & 9.642 & 8.364 \\ \hline \end{tabular} Exhibit 1-B Future Value (Compounded Sum) of \$1 Paid In at the End of Each Period for a Given Number of Time Periods (an Annuity) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Period & 18 & 25 & 3x & 4x & 58 & 68 & & 8x & 9x & 10x & 118 \\ \hline 1 & 1.090 & 1.0Ng & 1.000 & 1.000 & 1.000 & 1.000 & 1.000 & 1.000 & 1.000 & 1.009 & 1.000 \\ \hline 2 & 2.010 & 2.020 & 2.030 & 2.040 & 2.050 & 2.060 & 2.070 & 2.980 & 2.090 & 2.100 & 2.110 \\ \hline 3 & 3.030 & 3.050 & 3.091 & 3.122 & 3.153 & 3.184 & 3.215 & 3.246 & 3.278 & 3.310 & 3.342 \\ \hline 4 & 4.060 & 4.122 & 4.184 & 4.246 & 4.310 & 4.375 & 4.440 & 4.506 & 4.573 & 4.641 & 4,710 \\ \hline 5 & 5.101 & 5.204 & 5,309 & 5.416 & 5.526 & 5.637 & 5.751 & 5.867 & 5.985 & 6.105 & 6.228 \\ \hline 6 & 6.252 & 6,308 & 6.468 & 6.633 & 6.802 & 6.975 & 7.153 & 7.336 & 7.523 & 7.716 & 7.913 \\ \hline 7 & 7.214 & 7.434 & 7.662 & 7.898 & 8,142 & 8.304 & 8.654 & 8.923 & 9.200 & 9,407 & 9,709 \\ \hline . & 8.286 & 8.583 & 8.892 & 9.214 & 9.549 & 9.897 & 10.260 & 10.637 & 11.028 & 11,436 & 11.859 \\ \hline 9 & 9.369 & 9.755 & 10.159 & 10.583 & 11.027 & 11,491 & 11.978 & 12.488 & 13.021 & 13.579 & 14,164 \\ \hline 10 & 10.462 & 10.950 & 11.464 & 12.006 & 12.578 & 17,1A1 & 13.816 & 14.487 & 15.193 & 15,937 & 16.722 \\ \hline 11 & 11.567 & 12.169 & 12,808 & 13.486 & 14.207 & 14,972 & 15.784 & 16.645 & 17.560 & 18.531 & 19.561 \\ \hline 12 & 12.683 & 13.412 & 14.192 & 15.026 & 15.917 & 16.870 & 17.880 & 18.977 & 20.141 & 21.304 & 22,713 \\ \hline 13 & 13.609 & 14.680 & 15.618 & 16.627 & 17.713 & 18.1882 & 20.141 & 21.495 & 22.953 & 24.523 & 26.212 \\ \hline 14 & 14,947 & 15.974 & 17.066 & 18.292 & 19.599 & 21.015 & 22.550 & 24,215 & 26.019 & 27.975 & 30.095 \\ \hline 15 & 26.097 & 17.293 & 18.599 & 20.024 & 21.579 & 23.276 & 25,129 & 27.152 & 29.361 & 31.772 & 34,405 \\ \hline 16 & 17.25d & 18,639 & 20,157 & 21.025 & 23.657 & 25.673 & 27.888 & 30.324 & 33.003 & 35.950 : & 39,190 \\ \hline 17 & 16.430 & 20.012 & 21.762 & 23,698 & 25.840 & 28.213 & 30.840 & 33.750 & 36.974 & 40.545 & 44.501 \\ \hline 18 & 19.615 & 21.412 & 23.414 & 25.645 & 28.132 & 30.906 & 33.999 & 37.450 & 41.301 & 45.599 & 50,396 \\ \hline 19 & 20.811 & 22.841 & 25.117 & 27.671 & 30.539 & 33.760 & 37.379 & 41,446 & 46,018 & 52.159 & 56.939 \\ \hline 20 & 22.019 & 24.297 & 26.870 & 29.778 & 33.066 & 36.786 & 40.995 & 45.762 & 51.160 & 57.275 & 64.203 \\ \hline 25 & 28.243 & 32.030 & 36.459 & 41.646 & 47.727 & 54.865 & 63.249 & 73.106 & 84.701 & 98,347 & 114,413 \\ \hline 30 & 34.785 & 40.568 & 47.575 & 56.085 & 66.439 & 79.058 & 94.461 & 113.283 & 136.30d & 164.494 & 199.021 \\ \hline 40 & 48.886 & 60.402 & 75.401 & 95.026 & 120.860 & 154.762 & 199.635 & 259.057 & 337.882 & 442.593 & 581.826 \\ \hline 50. & 64.463 & 84.579 & 112.797 & 152.667 & 299.348 & 200.336 & 406.529 & 573.770 & 015.084 & 1,163.909 & 1,668.771 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Period & 12x & 13x & 148 & 15x & 16x & 17x & & 198 & 206 & 25x & 305 \\ \hline 1 & 1.120 & 1.130 & 1.140 & 1.150 & 1.160 & 1.170 & 1.180 & 1.190 & 1.200 & 1.250 & 1.300 \\ \hline 2 & 1.254 & 1.277 & 1.300 & 1.323 & 1.346 & 1.369 & 1.392 & 1.416 & 1.440 & 1.563 & 1.690 \\ \hline 3 & 1.405 & 1.443 & 1.482 & 1.521 & 1.561 & 1.602 & 1.643 & 1.685 & 1.728 & 1.953 & 2.197 \\ \hline 4 & 1.574 & 1.630 & 1.689 & 1.749 & 1.811 & 1.874 & 1.939 & 2.005 & 2.074 & 2.441 & 2.856 \\ \hline 5. & 1.762 & 1.842 & 1.925 & 2.011 & 2.100 & 2.192 & 2.288 & 2.386 & 2.488 & 3.052 & 3.713 \\ \hline 6 & 1.974 & 2.062 & 2.195 & 2.313 & 2.436 & 2.565 & 2.760 & 2.840 & 2.986 & 3.815 & 4.827 \\ \hline 7 & 2.211 & 2.353 & 2.502 & 2.660 & 2.826 & 3.001 & 3.185 & 3.379 & 3.583 & 4.76 8 & 6.275 \\ \hline 8 & 2.476 & 2.658 & 2.853 & 3.059 & 3.278 & 3.511 & 3.759 & 4.021 & 4.360 & 5.960 & 8.157 \\ \hline 9 & 2.773 & 3.004 & 3.252 & 3.518 & 3.803 & 4.209 & 4.435 & 4.785 & 5.160 & 7.451 & 10.604 \\ \hline 10 & 3.106 & 3.395 & 3.707 & 4.046 & 4.411 & 4.887 & 5.234 & 5.695 & 6.192 & 9.313 & 13.786 \\ \hline 11 & 3.479 & 3.536 & 4.226 & 4.652 & 5.117 & 5.624 & 6.176 & 6.777 & 7.430 & 11.642 & 17.922 \\ \hline 12 & 3.896 & 4.335 & 4.818 & 5.350 & 5.936 & 6.580 & 7.288 & 8.064 & 8.916 & 14,552 & 23.298 \\ \hline 13 & 4.363 & 4.898 & 5.492 & 6.153 & 6.886 & 7.699 & 8.599 & 9.596 & 10.699 & 18.190 & 30.288 \\ \hline 14 & 4.867 & 5.535 & 6.261 & 7.076 & 7.988 & 9.007 & 10.147 & 11.420 & 12. 1839 & 22.737 & 39.374 \\ \hline 15 & 5.474 & 6.254 & 7.138 & 8.137 & 9.266 & 10.539 & 11.974 & 13.590 & 15.407 & 28.422 & 51.186 \\ \hline 16 & 6.130 & 7.067 & 8.137 & 9.358 & 10.748 & 12.330 & 14.129 & 16.172 & 18.485 & 35.527 & 66.542 \\ \hline 17 & 6.866 & 7.986 & 9.276 & 10.761 & 12.468 & 14.426 & 16.672 & 19.244 & 22.186 & 44.409 & 86.504 \\ \hline 18. & 7.690 & 9.024 & 10.575 & 12.375 & 14.463 & 16.879 & 19.673 & 22.901 & 26.623 & 55,511 & 112.455 \\ \hline 19 & 8.613 & 10.197 & 12.056 & 14.232 & 16.772 & 19.748 & 23.214 & 27.252 & 31,948 & 69.389 & 146.192 \\ \hline 20 & 9.646 & 11.523 & 13.743 & 16.367 & 19.461 & 23.106 & 27,393 & 32.429 & 36.335 & 86.736 & 190.050 \\ \hline 25 & 17.000 & 22,231 & 26.462 & 32.919 & 40.874 & 50.650 & 52.669 & 77.388 & 95.396 & 264.698 & 705.641 \\ \hline 30 & 29.960 & 39.116 & 50,950 & 66.212 & 85.650 & 111.065 & 143.371 & 184,675 & 237.376 & 807.794 & 2,619,996 \\ \hline 40 & 93.051 & 132.782 & 188.084 & 267.654 & 378.721 & 539.869 & 750.378 & 1,051,666 & 1,469.772 & 7,523.164 & 36,118.865 \\ \hline 50 & 209.692 & 450.736 & 700.233 & 1,083,657 & 1,670.704 & 2,566.215 & 3,927,357 & 5,958,914 & 9,100,438 & 70,064.923 & 497,929.223 \\ \hline \end{tabular} In an attempt to have funds for a down payment, Carmella Carlson plans to save $3,650 a year for the next five years. With an interest rate of 3 percent, what amount will Carmella have available for a down payment after the five years? (Exhibit 1-A. Exhibit 1-B. Exhibit 1 . C. Exhibit 1.D) Note: Use appropriate factor(s) from the tables provided. Round time value foctor to 3 decimal places and final answer to 2 decimal places. \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Period & 13x & 14x & 15x & 16x & 17x & 18x & 19x & 208 & 25x & 30x & 35x & 40x & 568 \\ \hline 1 & 0.885 & 0.877 & 0.870 & 0.862 & 0.855 & 0.847 & 0.849 & 0.833 & 0.800 & 0.769 & 0.741 & 0.714 & 0.667 \\ \hline 2 & 0.783 & 0.769 & 0.756 & 0.743 & 0.731 & 8.718 & 0.706 & 0.694 & 0.640 & 0.592 & 6.549 & 0.510 & 0.444 \\ \hline 3 & 0,693 & 0.675 & 0.658 & 0.641 & 0.624 & 0.609 & 0.593 & 0.579 & 0.512 & 0.455 & 0.406 & 0.364 & 0.296 \\ \hline 4 & 0.613 & 0.592 & 0.572 & 0.552 & 0.534 & 0.516 & 0.499 & 0.482 & 0.410 & 0.350 & 0.101 & 0.260 & 0.195 \\ \hline57 & 0.543 & 0.519 & 0.497 & 0.476 & 0.456 & 0.437 & 0.419 & 0.402 & 0.328 & 0.269 & 0.223 & 0.186 & 0.132 \\ \hline 5 & 0.480 & 0.456 & 0.432 & 0.410 & 0.390 & 0.370 & 0.352 & 0.335 & 0.262 & 0.207 & 0.165 & 0.133 & 0.088 \\ \hline77 & 0.425 & 0.400 & 0.376 & 0.354 & 0.333 & 0.314 & 0.296 & 0.279 & 0.210 & 0.159 & 0.122 & 0.095 & 0.059 \\ \hline B & 0.376 & 0.351 & 0.327 & 0.305 & 0.285 & 0.266 & 0.249 & 0.233 & 0.165 & 0.123 & 0.091 & 0.066 & 0.039 \\ \hline 9 & 0.333 & 0.308 & 0.284 & 0.263 & 0.243 & 0.225 & 0.209 & 0.194 & 0.134 & 0.094 & 0.067 & 0.048 & 0.026 \\ \hline 10 & 0.205 & 0.270 & 0.247 & 0.227 & 0.208 & 0.191 & 0.176 & 0.162 & 0.107 & 0.073 & 0.050 & 9.035 & 0.017 \\ \hline 11 & 0.261 & 0.237 & 0.215 & 0.195 & 0.178 & 0.162 & 0.148 & 0.135 & 0.086 & 0.056 & 0.037 & 0.025 & 0.012 \\ \hline 12 & 0.231 & 0.208 & 0.187 & 0.168 & 0.152 & 0.137 & 0.124 & 0.112 & 0.069 & 0.043 & 0.027 & 0,018 & 0.008 \\ \hline 13 & 0.204 & 0.182 & 0.163 & 0.145 & 0.130 & 0.116 & 0.184 & 0.093 & 0.055 & 0.033 & 0.020 & 0.013 & 0.005 \\ \hline 14 & 0.181 & 0.160 & 0.141 & 0.125 & 0.111 & 0.099 & 0.088 & 0.078 & 0.044 & 0.025 & 0.015 & 0.009 & 0.003 \\ \hline 15 & 0.160 & 0.140 & 0.123 & 0.106 & 0.095 & e.evis & 0.074 & 0.065 & 0.035 & 0.020 & 0.011 & 0.006 & 0.002 \\ \hline 16 & 0.141 & 0.123 & 0.107 & 0.093 & 0.081 & 0.071 & 0.062 & 0.054 & 0.020 & 0.015 & 0.005 & 0.005 & 0.002 \\ \hline 17 & 0.125 & 0.108 & 0.093 & 0.080 & 0.069 & 0.060 & 0.052 & 0.045 & 0.023 & 0.012 & 0.006 & 0.003 & 0.001 \\ \hline 18 & 0.111 & 0.095 & 0.081 & 0.069 & 0.059 & 0.051 & 0.044 & 0.038 & 0.018 & 0.009 & 0.005 & 0.002 & 0.001 \\ \hline 19 & 0.026 & 0.083 & 0.070 & 0.060 & 0.051 & 0.043 & 0.037 & 0.031 & 0.014 & 0.007 & 0.003 & 0.002 & 0 \\ \hline 20 & 0.087 & 0.073 & 0.061 & 0.051 & 6.643 & 0.037 & 0.031 & 0.026 & 0.012 & 0.005 & 0.002 & 0.001 & 8 \\ \hline 25 & 0.047 & 0.038 & 0.039 & 0.024 & 0.020 & 0.016 & 0.013 & 0.010 & 0.004 & 0.001 & 0.001 & 0 & 0 \\ \hline 30 & 0.026 & 0.020 & 0.015 & 0.012 & 0.009 & 0.007 & 0.095 & 0.004 & 0.001 & e & 0 & 8 & 0 \\ \hline 40 & 0.005 & 0.005 & 0.004 & 0.003 & 0.002 & 0.001 & 0.001 & 0.001 & 0 & 0 & 0 & e & 0 \\ \hline5040 & 0.002 & 0,001 & 0.001 & 0.001 & 0 & 0 & 0 & e & 8 & e & 8 & 0 & \\ \hline \end{tabular} Susan has purchased a whole life policy with a death benefit of $420,000. Assuming that she dies in 8 years and the average inflation has been 5 percent, what is the value of the purchasing power of the proceeds? Use (Exhibit 1-A. Exhibit 1:B. Exhibit 1.C. Exhibit 1-D) Note: Use oppropriate factor(s) from the tables provided. Round time value factor to 3 decimal places and final answer to 2 decimal places. Nancy Cardoza invested $5,100 in ExxonMobil stock because her research indicated the stock should earn an average return of 8 percent for the investors over the next four years. If ExxonMobil investors do earn 8 percent each year, what will her $5,100 investment be worth at the end of four years? Use Exhibit 1.A. Exhibit 1-B. Exhibit 1.C. Exhibit 1-D. Note: Use oppropriate foctor(s) from the tables provided. Round time value factor to 3 decimal ploces and final answer to 2 decimal places. Suppose you are 35 and have a $45,000 face amount, 15 -year, limited-payment, participating policy (dividends will be used to build up the cash value of the policy). Your annual premium is $405. The cash value of the policy is expected to be $1,800 in 15 years. Using time value of money and assuming you could invest your money elsewhere for a 8 percent annual yield, calculate the net cost of insurance, Use (Exhibit 1-A, Exhibit 1-B. Exhibit 1-C. Exhibit 1-D) Note: Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Round time value factor to 3 decimal places and final answer to the nearest whole number. Exhibit 1-A Future Value (Compounded Sum) of $1 after a Given Number of Time Periods What would be the net present value of a microwave oven that costs $186 and will save you $76 a year in time and food away from home? Assume an average return on your savings of 4 percent for five years. (Exhibit 1.A. Exhibit 1.B. Exhibit 1-C. Exhibit 1-D) Note: Use appropriate factor(s) from the tables provided. Round time value factor to 3 decimal places and answer to 2 decimal ploces. Janine is 35 and has a good job at a biotechnology company. Janine estimates that she will need $955,000 in her totai retirement nest egg by the time she is 65 in order to have retirement income of $26.000 a year. (She expects that Social Security will pay her an additional \$23,500 a year) She currently has \$4,000 in an IRA, an important part of her retirement nest egg. She believes her IRA will grow at an annual rate of 10 percent, and she plans to leave it untouched until she retires at age 65 . How much money will Janine have to accumulate in her company's 401(k) plan over the next 30 years in order to reach her retirement income goal? Use (Exhibit 1A. Exhibit 1-B, Exhibit 1-C, Exhibit 1-D). Note: Use appropriate factor(s) from the tables provided. Round time value factor to 3 decimal places. Round intermediate and final answer to 2 decimal places. Exhibit 1-C Present Value of \$1 to Be Received at the End of a Given Number of Time Periods \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Period & 18 & 2x & 3x & 4x & 58 & 6x & x & 8x & 9x & 10x & 11x & 12x \\ \hline 1 & 0.990 & 0.980 & 0.971 & 0.962 & 0.952 & 0.943 & 0.935 & 0.926 & 8.917 & 0.999 & 0.901 & 0.893 \\ \hline 2 & 0.980 & 0.961 & 0.943 & 0.925 & 0.907 & 0.896 & 0.873 & 0.857 & 0.842 & 0.826 & 0.812 & 0.797 \\ \hline 3 & 0.971 & 0.942 & 0.915 & 0.889 & 0.864 & 0.849 & 0.816 & 0.794 & 0.772 & 0.751 & 0.731 & 0.712 \\ \hline 4 & 0.961 & 0.924 & 0.888 & 0.855 & 0.823 & 0.792 & 0.763 & 0.735 & 0.788 & 0.683 & 0.659 & 0,636 \\ \hline 5 & 0.951 & 0.906 & e.863 & 0.822 & 0.784 & 0.747 & 0.713 & 0.681 & 0.650 & 0.621 & 0.593 & 0.567 \\ \hline 6 & 0.942 & 0.888 & 0.837 & 0.790 & 0.746 & 0.705 & 0.666 & 0.630 & 0.596 & 0.564 & 0.535 & 0.507 \\ \hline 7 & 0.933 & 0.871 & 0.813 & 0.760 & 0.711 & 0.665 & 0.623 & 0.583 & 0.547 & 0.513 & 0.482 & 0.452 \\ \hline 8 & 0.923 & 0.653 & 0.789 & 0.731 & 0.677 & 0.627 & 0.582 & 0.549 & 0.502 & 0.467 & 0.434 & 0.404 \\ \hline 9 & 0.914 & 0.837 & 0.766 & 0.703 & 0.645 & 0.592 & 0.544 & 0.500 & 0.468 & 0.424 & 0.391 & 0.361 \\ \hline 10 & 0.905 & 0.82 & 0.744 & 0.676 & 0.614 & 0.558 & 0.568 & 0.463 & 0.422 & 0.386 & 0.352 & 0.322 \\ \hline 11 & 0.896 & 0.804 & 0.722 & 0.650 & 0.585 & 0.527 & 0.475 & 0.429 & 0.388 & 0.350 & 0.317 & 0.287 \\ \hline 12 & 0.887 & 0.788 & 0.701 & 0.625 & 0.557 & 0.497 & 0.444 & 0.397 & 0.356 & 0,319 & 0.286 & 0.257 \\ \hline 13 & 0.879 & 0.773 & 0.681 & 0.601 & 0.530 & 0.469 & 0.415 & 0.368 & 0.326 & 0.290 & 0.258 & 0.229 \\ \hline 14 & 0. 870 & 0.758 & 0.661 & 0.577 & 0.505 & 0,442 & 0.388 & 0.340 & 0.299 & 0.263 & 0.232 & 0.205 \\ \hline 15 & 0.861 & 0.743 & 0.642 & 0.555 & 0.481 & 0.417 & 0.362 & 0.315 & 0.275 & 0.239 & 0.209 & 0.183 \\ \hline 16 & 0.853 & 0.728 & 0.623 & 0.534 & 0.456 & 0.394 & 0.339 & 0.292 & 0.252 & 0.218 & 0.188 & 0.163 \\ \hline 17 & 0.844 & 0.714 & 0.695 & 0.513 & 0.436 & 0.371 & 0.317 & 0.270 & 0.231 & 0.198 & 0.170 & 0.146 \\ \hline 18 & 0.836 & 0.700 & 0.587 & 8,494 & 0.416 & 0.350 & 0.296 & 0.250 & 0.212 & 0.180 & 0.153 & 0.130 \\ \hline 19 & 0.028 & 0.686 & 0.570 & 0.475 & 0.396 & 8.331 & 0.277 & 0.232 & 0.194 & 0.164 & 0.138 & 0.116 \\ \hline 20 & 0.820 & 0.673 & 0.554 & 0.456 & 0.377 & 0.312 & 0.258 & 0.215 & 0.178 & 0.149 & 0.124 & 0.104 \\ \hline 25 & 0.780 & 0.610 & 0.478 & 0.375 & 0.295 & 0.233 & 0.184 & 0.146 & 0.116 & 0.092 & 0.074 & 0.059 \\ \hline 30 & 0.742 & 0.552 & 0.412 & 0.306 & 0.231 & 0.174 & 0.131 & 0.099 & 0.075 & 8.057 & 0.044 & 0.033 \\ \hline 40 & 0.672 & 0.453 & 0.307 & 0.268 & 0.142 & 0.097 & 0.067 & 0.046 & 0.032 & 0.022 & 0.015 & 0.011 \\ \hline 50 & 0.608 & 0.372 & 0.228 & 0.141 & 0.067 & 0.054 & 0.034 & 0.021 & 0.013 & 0.009 & 0.005 & 0.003 \\ \hline \end{tabular} When Jamal graduated from college recently, his parents gave him $1,990 and told him to use it wisely. Jamal decided to use the money to start a retirement account After doing some research about different options, he put the entire amount into a tax-deferred IRA that pays 18 percent interest, compounded annually. Calculate how much money Jamal will have in his IRA at the end of 10 years. assuming that the interest rate remains the same and that he does not deposit any additional money. Use (Exhibit 1:A, Exhibit 1.B. Exhibit 1.C. Exhibit1:D). Note: Use appropriate factor(s) from the tables provided. Round time value foctor to 3 decimal places and answer to 2 decimal places. \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Period & 13x & 14X & 158 & 168 & 17x & 18X & 19x & 20% & 25% & 396 & 358 & 40X & sen \\ \hline 1 & 0.835 & 0.877 & 0.879 & 0.862 & 0.855 & 0.847 & 0.840 & 0.833 & 9.800 & 0.769 & 0.741 & 0.714 & 0.667 \\ \hline 2 & 1.668 & 1.647 & 1.626 & 1.605 & 1.585 & 1.566 & 1.547 & 1.528 & 1.440 & 1.361 & 1.289 & 1.224 & 1.111 \\ \hline 3 & 2,361 & 2.322 & 2.283 & 2.246 & 2.210 & 2.174 & 2.140 & 2.106 & 1.952 & 1.816 & 1.696 & 1.589 & 1.487 \\ \hline 4 & 2.974 & 2.914 & 2.855 & 2.798 & 2.743 & 2.690 & 2.639 & 2.589 & 2.362 & 2.166 & 1.997 & 1.849 & 1.605 \\ \hline 5 & 3.517 & 3.433 & 3.352 & 3.274 & 3.199 & 3.127 & 3.058 & 2.991 & 2.689 & 2.436 & 2.220 & 2.635 & 1.737 \\ \hline 6 & 3.998 & 3.889 & 3.784 & 3.685 & 3.589 & 3.498 & 3.410 & 3.326 & 2.951 & 2.643 & 2.385 & 2.168 & 1.824 \\ \hline 7 & 4.423 & 4.288 & 4.160 & 4.039 & 3.922 & 3.812 & 3.706 & 3.605 & 3.161 & 2.802 & 2.588 & 2.263 & 1.883 \\ \hline 8 & 4.799 & 4.639 & 4.487 & 4.344 & 4.207 & 4.078 & 3.954 & 3.837 & 3.329 & 2.925 & 2.598 & 2.331 & 1.922 \\ \hline 9 & 5.132 & 4.946 & 4.772 & 4.697 & 4.451 & 4.303 & 4.163 & 4.031 & 3.463 & 3.019 & 2.665 & 2.379 & 1.948 \\ \hline 10 & 5.426 & 5.216 & 5.019 & 4.833 & 4.659 & 4.494 & 4.339 & 4.192 & 3.571 & 3.092 & 2.715 & 2.414 & 1.965 \\ \hline 11 & 5.687 & 5.453 & 5.234 & 5.029 & 4.836 & 4.656 & 4.486 & 4.327 & 3.656 & 3.147 & 2.752 & 2.438 & 1.977 \\ \hline 12 & 5.918 & 5.660 & 5.421 & 5.197 & 4.983 & 4.793 & 4.611 & 4.439 & 3.725 & 3.198 & 2.779 & 2.456 & 1.985 \\ \hline 13 & 6.122 & 5.842 & 5.583 & 5.342 & 5.118 & 4.910 & 4.715 & 4.533 & 3.780 & 3.223 & 2.799 & 2.469 & 1,990 \\ \hline 14 & 6.302 & 6.002 & 5.724 & 5.468 & 5.229 & 5.008 & 4.802 & 4.611 & 3.824 & 3.249 & 2.814 & 2.478 & 1.993 \\ \hline 15 & 6.462 & 6,142 & 5.847 & 5.575 & 5.324 & 5.092 & 4.676 & 4.675 & 3.859 & 3.268 & 2.825 & 2.484 & 1.995 \\ \hline 16 & 6.604 & 6.265 & 5.954 & 5.668 & 5.405 & 5.162 & 4.9316 & 4.730 & 3.887 & 3.283 & 2.834 & 2.489 & 1.997 \\ \hline 17 & 6.729 & 6.373 & 6.047 & 5,749 & 5.475 & 5.222 & 4.990 & 4,775 & 3.910 & 3.295 & 2.840 & 2.492 & 1.998 \\ \hline 18 & 6.840 & 6.467 & 6.228 & 5.818 & 5.5334 & 5.273 & 5.033 & 4.812 & 3.928 & 3.304 & 2.844 & 2.494 & 1.999 \\ \hline 19 & 6.938 & 6.550 & 6.198 & 5.877 & 5.584 & 5.316 & 5.070 & 4.843 & 3.942 & 3.311 & 2.848 & 2.496 & 1.999 \\ \hline 28 & 7.025 & 6.623 & 6.259 & 5.929 & 5.628 & 5.353 & 5,101 & 4.870 & 3.954 & 3.316 & 2.850 & 2.497 & 1.999 \\ \hline 25 & 7.330 & 6.873 & 6.454 & 5.097 & 5.766 & 5.467 & 5,195 & 4.948 & 3.985 & 3.329 & 2.856 & 2.499 & 2.000 \\ \hline 30 & 2.496 & 7.003 & 6.566 & 6.177 & 5.829 & 5.517 & 5.235 & 4,979 & 3.995 & 3,332 & 2.857 & 2.500 & 2.000 \\ \hline 40 & 7.634 & 7.105 & 6,642 & 6.233 & 5,871 & 5,548 & 5.250 & 4.997 & 3.999 & 3.333 & 2.857 & 2.500 & 2.000 \\ \hline se & 7.675 & 7.133 & 6.661 & 6.246 & 5.880 & 5.554 & 5.262 & 4,999 & 4.000 & 3.333 & 2.857 & 2.500 & 2.000 \\ \hline \end{tabular} Janine is 46 and has a good job at a biotechnology company. Janine estimates that she will need $886,000 in her total retirement nest egg by the time she is 65 in order to have retirement income of $27,000 a year. (She expects that Social Security will pay her an additional \$17,000 a year) She currently has \$4,500 in an IRA, an important part of her retirement nest egg. She believes her IRA will grow at an annual rate of 6 percent, and she plans to leave it untouched until she retires at age 65 . How much will Janine's IRA be worth when she needs to start withdrawing money from it when she retires? Use (Exhibit 1-A. Exhibit 1-B, Exhibit 1-C. Exhibit 1-D). Note: Use oppropriate factor(s) from the tables provided. Round time value factor to 3 decimal places and answer to 2 decimal places. Exhibit 1-D Present Value of S1 Received at the End of Each Period for a Given Number of Trme Periods (an Annuity) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Period & 1x & 2x & 35 & 4x & 5x & 6 & n & Ax & 9x & 100 & 11x & 17x \\ \hline 1 & 0.990 & 0.989 & 0.971 & 0.962 & 0.952 & 0.943 & 0.935 & 0.926 & 0.917 & 0.909 & 0.901 & 0.093 \\ \hline 2 & 1.970 & 1.942 & 1.913 & 1.886 & 1.859 & 1.833 & 1. 8 e6 & 1.763 & 1.759 & 1.736 & 1.713 & 1.690 \\ \hline 3. & 2.941 & 2.884 & 2.829 & 2.775 & 2.723 & 2.673 & 2.624 & 2.577 & 2.531 & 2.4a7 & 2.444 & 2.402 \\ \hline 4 & 3.902 & 3.508 & 3.717 & 3.630 & 3.546 & 3.465 & 3.387 & 3.312 & 3.240 & 3.170 & 3.102 & 3.037 \\ \hline 5 & 4.853 & 4,713 & 4.580 & 4.452 & 4.329 & 4.212 & 4.100 & 3.993 & 3.890 & 3.791 & 3.696 & 3.605 \\ \hline 6 & 5.795 & 5.601 & 5.417 & 5.242 & 5.076 & 4.917 & 4.767 & 4.623 & 4.486 & 4.355 & 4.231 & 4.111 \\ \hline 7 & 6.728 & 6,472 & 6.230 & 6.002 & 5.786 & 5.5112 & 5.369 & 5.206 & 5.033 & 4.868 & 4.712 & 4.564 \\ \hline 8 & 7.652 & 7.325 & 7.020 & 6.733 & 6.463 & 6.210 & 5.971 & 5.247 & 5.535 & 5.335 & 5.146 & 4.968 \\ \hline 9 & 8.566 & 8.162 & 7.786 & 7.435 & 7.198 & 6.892 & 6.515 & 6.247 & 5.995 & 5.759 & 5.537 & 5.328 \\ \hline 10 & 9.471 & 8.983 & 8.530 & 8.111 & 7.722 & 7.360 & 7.024 & 6.710 & 6.418 & 6.145 & 5.889 & 5.650 \\ \hline 11 & 10.368 & 9.787 & 9.253 & 8.760 & 8.306 & 7.887 & 7.499 & 7.139 & 6.805 & 6.495 & 6.207 & 5.938 \\ \hline 12. & 11.255 & 10.575 & 9.954 & 9.385 & 8.863 & 8.384 & 7.943 & 7.536 & 7.161 & 6.814 & 6.492 & 6.194 \\ \hline 13 & 12.134 & 11.348 & 10.635 & 9.986 & 9.394 & 8.853 & 8.358 & 7.904 & 7.487 & 7.103 & 6.750 & 6.424 \\ \hline 14 & 13.064 & 12,106 & 11.296 & 10.563 & 9.899 & 9.295 & 8.745 & 8.244 & 7.786 & 7.367 & 6.982 & 6.628 \\ \hline 15 & 13.865 & 12.849 & 11.938 & 11.118 & 10.380 & 9.712 & 9.108 & 8.559 & 8.861 & 7.696 & 7.191 & 6.811 \\ \hline 16 & 14.718 & 13.570 & 12.561 & 11.652 & 10.838 & 10.106 & 9.447 & 8.851 & 8.313 & 7.824 & 7.379 & 6.974 \\ \hline 17 & 15.562 & 14.292 & 13.166 & 12.166 & 11.274 & 10.477 & 9.763 & 9.122 & 8.544 & 8.022 & 7.549 & 7.120 \\ \hline 18 & 16.398 & 14.992 & 13.754 & 12.659 & 11.690 & 10.828 & 10.059 & 9.372 & 8.756 & 8.201 & 7.702 & 7.250 \\ \hline 19 & 17.226 & 15.678 & 14.324 & 13.134 & 12.055 & 11.158 & 10.336 & 9.684 & 8.950 & 8.365 & 7.839 & 7.366 \\ \hline 20 & 18.046 & 16.351 & 14.877 & 13.590 & 12.462 & 11.470 & 10.594 & 9.818 & 9.129 & 6.514 & 7.963 & 7.469 \\ \hline 25 & 22.023 & 19.523 & 17,413 & 15.622 & 14.094 & 12.783 & 11.654 & 10.675 & 9.823 & 9.077 & 8.422 & 7.843 \\ \hline 30 & 25.828 & 22,396 & 19.600 & 17.292 & 15.372 & 13.765 & 12.409 & 11.258 & 10.274 & 9.427 & 8.694 & 8.055 \\ \hline 40 & 32.835 & 27.355 & 23.115 & 19.793 & 17.159 & 15,046 & 13.332 & 11.925 & 10.757 & 9.779 & 8.951 & 8.244 \\ \hline 50 & 39.196 & 31.424 & 25.730 & 21.482 & 18.256 & 15,762 & 13.891 & 12.2 .33 & 10.962 & 9.915 & 9.642 & 8.364 \\ \hline \end{tabular} Exhibit 1-B Future Value (Compounded Sum) of \$1 Paid In at the End of Each Period for a Given Number of Time Periods (an Annuity) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Period & 18 & 25 & 3x & 4x & 58 & 68 & & 8x & 9x & 10x & 118 \\ \hline 1 & 1.090 & 1.0Ng & 1.000 & 1.000 & 1.000 & 1.000 & 1.000 & 1.000 & 1.000 & 1.009 & 1.000 \\ \hline 2 & 2.010 & 2.020 & 2.030 & 2.040 & 2.050 & 2.060 & 2.070 & 2.980 & 2.090 & 2.100 & 2.110 \\ \hline 3 & 3.030 & 3.050 & 3.091 & 3.122 & 3.153 & 3.184 & 3.215 & 3.246 & 3.278 & 3.310 & 3.342 \\ \hline 4 & 4.060 & 4.122 & 4.184 & 4.246 & 4.310 & 4.375 & 4.440 & 4.506 & 4.573 & 4.641 & 4,710 \\ \hline 5 & 5.101 & 5.204 & 5,309 & 5.416 & 5.526 & 5.637 & 5.751 & 5.867 & 5.985 & 6.105 & 6.228 \\ \hline 6 & 6.252 & 6,308 & 6.468 & 6.633 & 6.802 & 6.975 & 7.153 & 7.336 & 7.523 & 7.716 & 7.913 \\ \hline 7 & 7.214 & 7.434 & 7.662 & 7.898 & 8,142 & 8.304 & 8.654 & 8.923 & 9.200 & 9,407 & 9,709 \\ \hline . & 8.286 & 8.583 & 8.892 & 9.214 & 9.549 & 9.897 & 10.260 & 10.637 & 11.028 & 11,436 & 11.859 \\ \hline 9 & 9.369 & 9.755 & 10.159 & 10.583 & 11.027 & 11,491 & 11.978 & 12.488 & 13.021 & 13.579 & 14,164 \\ \hline 10 & 10.462 & 10.950 & 11.464 & 12.006 & 12.578 & 17,1A1 & 13.816 & 14.487 & 15.193 & 15,937 & 16.722 \\ \hline 11 & 11.567 & 12.169 & 12,808 & 13.486 & 14.207 & 14,972 & 15.784 & 16.645 & 17.560 & 18.531 & 19.561 \\ \hline 12 & 12.683 & 13.412 & 14.192 & 15.026 & 15.917 & 16.870 & 17.880 & 18.977 & 20.141 & 21.304 & 22,713 \\ \hline 13 & 13.609 & 14.680 & 15.618 & 16.627 & 17.713 & 18.1882 & 20.141 & 21.495 & 22.953 & 24.523 & 26.212 \\ \hline 14 & 14,947 & 15.974 & 17.066 & 18.292 & 19.599 & 21.015 & 22.550 & 24,215 & 26.019 & 27.975 & 30.095 \\ \hline 15 & 26.097 & 17.293 & 18.599 & 20.024 & 21.579 & 23.276 & 25,129 & 27.152 & 29.361 & 31.772 & 34,405 \\ \hline 16 & 17.25d & 18,639 & 20,157 & 21.025 & 23.657 & 25.673 & 27.888 & 30.324 & 33.003 & 35.950 : & 39,190 \\ \hline 17 & 16.430 & 20.012 & 21.762 & 23,698 & 25.840 & 28.213 & 30.840 & 33.750 & 36.974 & 40.545 & 44.501 \\ \hline 18 & 19.615 & 21.412 & 23.414 & 25.645 & 28.132 & 30.906 & 33.999 & 37.450 & 41.301 & 45.599 & 50,396 \\ \hline 19 & 20.811 & 22.841 & 25.117 & 27.671 & 30.539 & 33.760 & 37.379 & 41,446 & 46,018 & 52.159 & 56.939 \\ \hline 20 & 22.019 & 24.297 & 26.870 & 29.778 & 33.066 & 36.786 & 40.995 & 45.762 & 51.160 & 57.275 & 64.203 \\ \hline 25 & 28.243 & 32.030 & 36.459 & 41.646 & 47.727 & 54.865 & 63.249 & 73.106 & 84.701 & 98,347 & 114,413 \\ \hline 30 & 34.785 & 40.568 & 47.575 & 56.085 & 66.439 & 79.058 & 94.461 & 113.283 & 136.30d & 164.494 & 199.021 \\ \hline 40 & 48.886 & 60.402 & 75.401 & 95.026 & 120.860 & 154.762 & 199.635 & 259.057 & 337.882 & 442.593 & 581.826 \\ \hline 50. & 64.463 & 84.579 & 112.797 & 152.667 & 299.348 & 200.336 & 406.529 & 573.770 & 015.084 & 1,163.909 & 1,668.771 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Period & 12x & 13x & 148 & 15x & 16x & 17x & & 198 & 206 & 25x & 305 \\ \hline 1 & 1.120 & 1.130 & 1.140 & 1.150 & 1.160 & 1.170 & 1.180 & 1.190 & 1.200 & 1.250 & 1.300 \\ \hline 2 & 1.254 & 1.277 & 1.300 & 1.323 & 1.346 & 1.369 & 1.392 & 1.416 & 1.440 & 1.563 & 1.690 \\ \hline 3 & 1.405 & 1.443 & 1.482 & 1.521 & 1.561 & 1.602 & 1.643 & 1.685 & 1.728 & 1.953 & 2.197 \\ \hline 4 & 1.574 & 1.630 & 1.689 & 1.749 & 1.811 & 1.874 & 1.939 & 2.005 & 2.074 & 2.441 & 2.856 \\ \hline 5. & 1.762 & 1.842 & 1.925 & 2.011 & 2.100 & 2.192 & 2.288 & 2.386 & 2.488 & 3.052 & 3.713 \\ \hline 6 & 1.974 & 2.062 & 2.195 & 2.313 & 2.436 & 2.565 & 2.760 & 2.840 & 2.986 & 3.815 & 4.827 \\ \hline 7 & 2.211 & 2.353 & 2.502 & 2.660 & 2.826 & 3.001 & 3.185 & 3.379 & 3.583 & 4.76 8 & 6.275 \\ \hline 8 & 2.476 & 2.658 & 2.853 & 3.059 & 3.278 & 3.511 & 3.759 & 4.021 & 4.360 & 5.960 & 8.157 \\ \hline 9 & 2.773 & 3.004 & 3.252 & 3.518 & 3.803 & 4.209 & 4.435 & 4.785 & 5.160 & 7.451 & 10.604 \\ \hline 10 & 3.106 & 3.395 & 3.707 & 4.046 & 4.411 & 4.887 & 5.234 & 5.695 & 6.192 & 9.313 & 13.786 \\ \hline 11 & 3.479 & 3.536 & 4.226 & 4.652 & 5.117 & 5.624 & 6.176 & 6.777 & 7.430 & 11.642 & 17.922 \\ \hline 12 & 3.896 & 4.335 & 4.818 & 5.350 & 5.936 & 6.580 & 7.288 & 8.064 & 8.916 & 14,552 & 23.298 \\ \hline 13 & 4.363 & 4.898 & 5.492 & 6.153 & 6.886 & 7.699 & 8.599 & 9.596 & 10.699 & 18.190 & 30.288 \\ \hline 14 & 4.867 & 5.535 & 6.261 & 7.076 & 7.988 & 9.007 & 10.147 & 11.420 & 12. 1839 & 22.737 & 39.374 \\ \hline 15 & 5.474 & 6.254 & 7.138 & 8.137 & 9.266 & 10.539 & 11.974 & 13.590 & 15.407 & 28.422 & 51.186 \\ \hline 16 & 6.130 & 7.067 & 8.137 & 9.358 & 10.748 & 12.330 & 14.129 & 16.172 & 18.485 & 35.527 & 66.542 \\ \hline 17 & 6.866 & 7.986 & 9.276 & 10.761 & 12.468 & 14.426 & 16.672 & 19.244 & 22.186 & 44.409 & 86.504 \\ \hline 18. & 7.690 & 9.024 & 10.575 & 12.375 & 14.463 & 16.879 & 19.673 & 22.901 & 26.623 & 55,511 & 112.455 \\ \hline 19 & 8.613 & 10.197 & 12.056 & 14.232 & 16.772 & 19.748 & 23.214 & 27.252 & 31,948 & 69.389 & 146.192 \\ \hline 20 & 9.646 & 11.523 & 13.743 & 16.367 & 19.461 & 23.106 & 27,393 & 32.429 & 36.335 & 86.736 & 190.050 \\ \hline 25 & 17.000 & 22,231 & 26.462 & 32.919 & 40.874 & 50.650 & 52.669 & 77.388 & 95.396 & 264.698 & 705.641 \\ \hline 30 & 29.960 & 39.116 & 50,950 & 66.212 & 85.650 & 111.065 & 143.371 & 184,675 & 237.376 & 807.794 & 2,619,996 \\ \hline 40 & 93.051 & 132.782 & 188.084 & 267.654 & 378.721 & 539.869 & 750.378 & 1,051,666 & 1,469.772 & 7,523.164 & 36,118.865 \\ \hline 50 & 209.692 & 450.736 & 700.233 & 1,083,657 & 1,670.704 & 2,566.215 & 3,927,357 & 5,958,914 & 9,100,438 & 70,064.923 & 497,929.223 \\ \hline \end{tabular}