Question

In an economy, there are many identically distributed and independent projects with 1 year of the investment horizon, and the (net) rate of return on

In an economy, there are many identically distributed and independent projects with 1 year of the investment horizon, and the (net) rate of return on each project follows a normal distribution, with mean of 6% and standard deviation of 15%. Each project requires an initial investment of $1000. (For questions a)-c), you need to use the Normal Distribution Table in the appendix or you can use Excel or other statistical software.)

a) Suppose a bank is to invest in only one project, what is the probability for the bank to lose more than half of the initial investment, that is, to lose $500? What is the probability for the bank to lose more than 10% of the initial investment, that is, to lose $100?

b) Suppose a bank is to invest in 15 of such projects, what is the mean and standard deviation of the rate of return on this investment? What is the probability for the bank to lose more than 10% of the initial investment, that is, $1500?

c) What is the mean and standard deviation of the rate of return if a bank is to investment in N projects? What happens if N goes to infinity (N+)?

d) Suppose the asset of a bank consists of many such projects (N), and the secondary security this bank offers to its customers is a one-year CD with fixed return 1 + r, what is the maximum interest rate on the one-year deposit a competitive bank can offer? Ignore the operational cost and other costs.

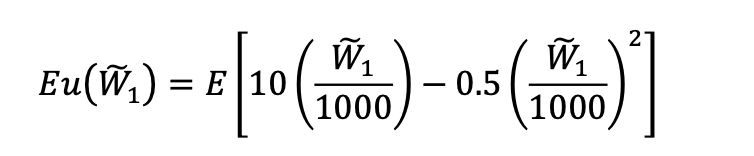

e) If an investor has $1000 and he can either invest in one project or buy the one-year CD with the maximum interest rate offered by the bank. He is risk averse, with expected utility function as,

where W1 is his wealth at the end of year 1, uncertain at the beginning of the year. Suppose he will only consume at the end of year one and will consume whatever he has at that time. Which investment strategy would this investor prefer? Why?

f) From the results you got in a)-e), summarize the special role provided by the bank in this economy? What are the risks associated with the special role provided by the bank?

Eu(W) = 10 2.) [1o() - os (en Eu(W) = 10 2.) [1o() - os (enStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started