Question

In an expansion move, Beam Company paid $2,680,000 for most of the property, plant, and equipment of a small manufacturing firm that was going out

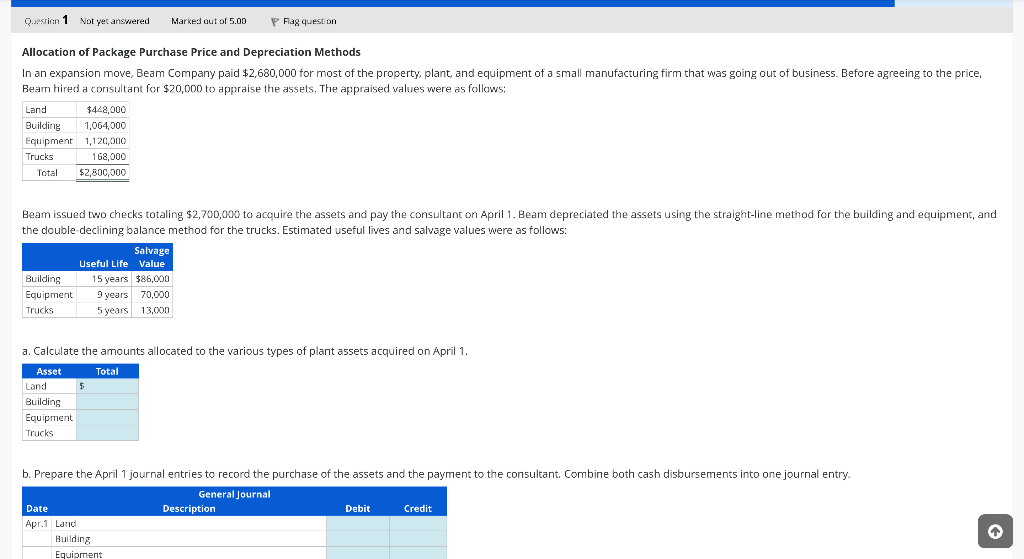

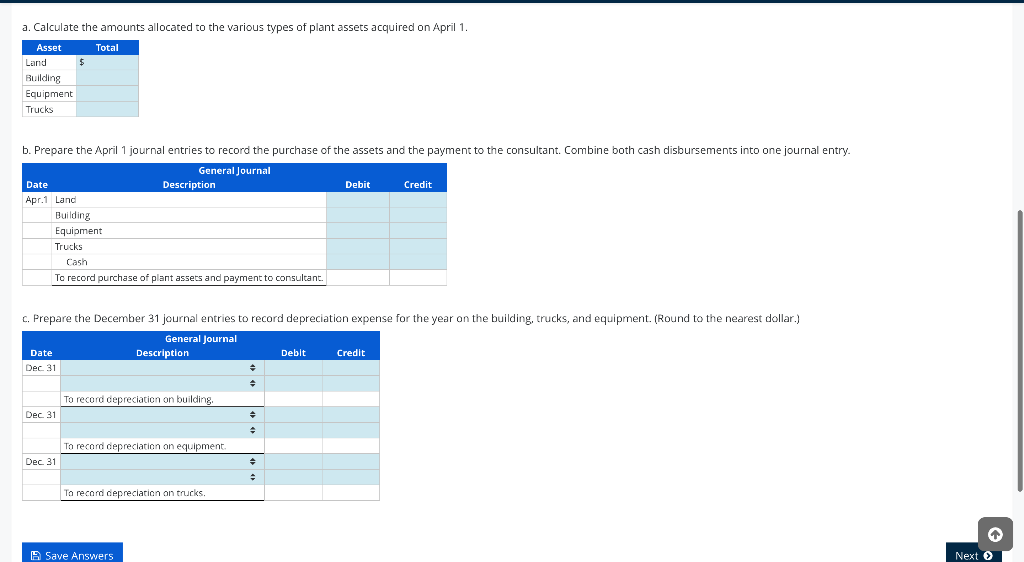

In an expansion move, Beam Company paid $2,680,000 for most of the property, plant, and equipment of a small manufacturing firm that was going out of business. Before agreeing to the price, Beam hired a consultant for $20,000 to appraise the assets. The appraised values were as follows: Land $448,000 Building 1,064,000 Equipment 1,120,000 Trucks 168,000 Total $2,800,000 Beam issued two checks totaling $2,700,000 to acquire the assets and pay the consultant on April 1. Beam depreciated the assets using the straight-line method for the building and equipment, and the double-declining balance method for the trucks. Estimated useful lives and salvage values were as follows: Useful Life Salvage Value Building 15 years $86,000 Equipment 9 years 70,000 Trucks 5 years 13,000

In an expansion move, Beam Company paid $2,680,000 for most of the property, plant, and equipment of a small manufacturing firm that was going out of business. Before agreeing to the price, Beam hired a consultant for $20,000 to appraise the assets. The appraised values were as follows: Land $448,000 Building 1,064,000 Equipment 1,120,000 Trucks 168,000 Total $2,800,000 Beam issued two checks totaling $2,700,000 to acquire the assets and pay the consultant on April 1. Beam depreciated the assets using the straight-line method for the building and equipment, and the double-declining balance method for the trucks. Estimated useful lives and salvage values were as follows: Useful Life Salvage Value Building 15 years $86,000 Equipment 9 years 70,000 Trucks 5 years 13,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started