Question

In an oil and gas industry full of acquisitions, divestitures and mergers, it is now more important than ever for an oil and gas producer

In an oil and gas industry full of acquisitions, divestitures and mergers, it is now more important than ever for an oil and gas producer to carefully plan its portfolio of assets. Efficiency and profitability must be balanced against overall risk. This paper re-introduces portfolio optimization via the efficient frontier theory and also investigates a worked example of portfolio optimization.

Petroleum companies are constantly faced with difficult investment decisions. Made in isolation, these investments will only maximize the value of the individual asset. In order to balance the risk and exploit project synergies, investment decisions should be made collectively. Portfolio optimization using the efficient frontier analysis is an investment decision making technique that quantifies the selection of multiple investment opportunities such that risk is minimized, and value is maximized - over a complete portfolio.

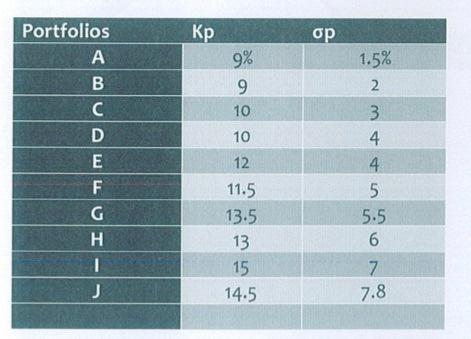

Assume the following risk return possibilities for 10 different portfolios, you are required to

a. Develop an efficient frontier and find the best risk return trade off.

b. Evaluate the optimum portfolio for an investor in terms of indifference curves and the efficient frontier.

c. Do portfolios exist above the efficient frontier? Why or why not.

d. Are betas of individual stocks necessarily stable overtime?

e. Indicate the type of risk associated with individual security. Which is risk is not to be compensated for in the market place under the Capital Asset Pricing Model, Why?

Portfolios A BCDEFGH | J kp 9% 9 10 10 12 11.5 13.5 13 15 14.5 1.5% 2 3 4 4 5 5.5 6 7 7.8

Step by Step Solution

3.39 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

aThe efficient frontier is the set of investment portfolios that provides the lowest risk for a given level of return or the highest return for a given level of risk It is the optimal tradeoff between ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started