Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In answer have a 100 and 1000 where we get them In response to the above scenario, management sells 500, 90-day Eurodollar time deposits futures

In answer have a 100 and 1000 where we get them

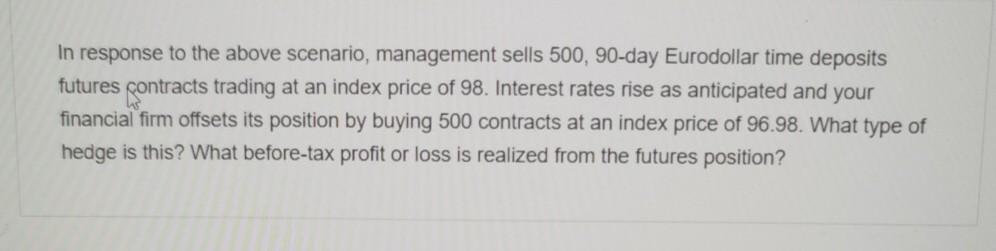

In response to the above scenario, management sells 500, 90-day Eurodollar time deposits futures contracts trading at an index price of 98. Interest rates rise as anticipated and your financial firm offsets its position by buying 500 contracts at an index price of 96.98. What type of hedge is this? What before-tax profit or loss is realized from the futures positionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started