Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In April 2021, Company A relocated Employee R from Company A's corporate office to an office in another city. At May 31, 2021, the

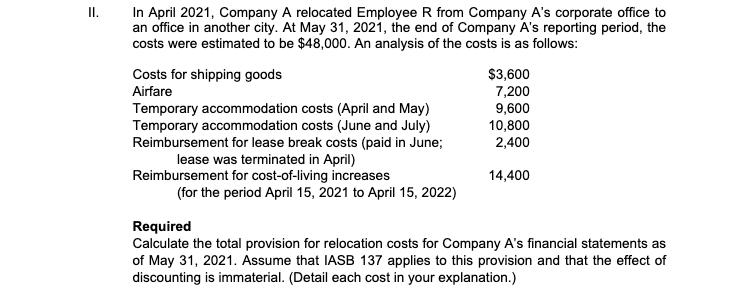

In April 2021, Company A relocated Employee R from Company A's corporate office to an office in another city. At May 31, 2021, the end of Company A's reporting period, the costs were estimated to be $48,000. An analysis of the costs is as follows: I. Costs for shipping goods Airfare Temporary accommodation costs (April and May) Temporary accommodation costs (June and July) Reimbursement for lease break costs (paid in June; $3,600 7,200 9,600 10,800 2,400 lease was terminated in April) Reimbursement for cost-of-living increases 14,400 (for the period April 15, 2021 to April 15, 2022) Required Calculate the total provision for relocation costs for Company A's financial statements as of May 31, 2021. Assume that IASB 137 applies to this provision and that the effect of discounting is immaterial. (Detail each cost in your explanation.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

As per IAS 137 provision shall be recognised when a an entity has a present obligation legal or cons...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started