Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In April 2022, Dan is audited by the IRS for the year 2020 . During the course of the audit, the agent discovers that Dan's

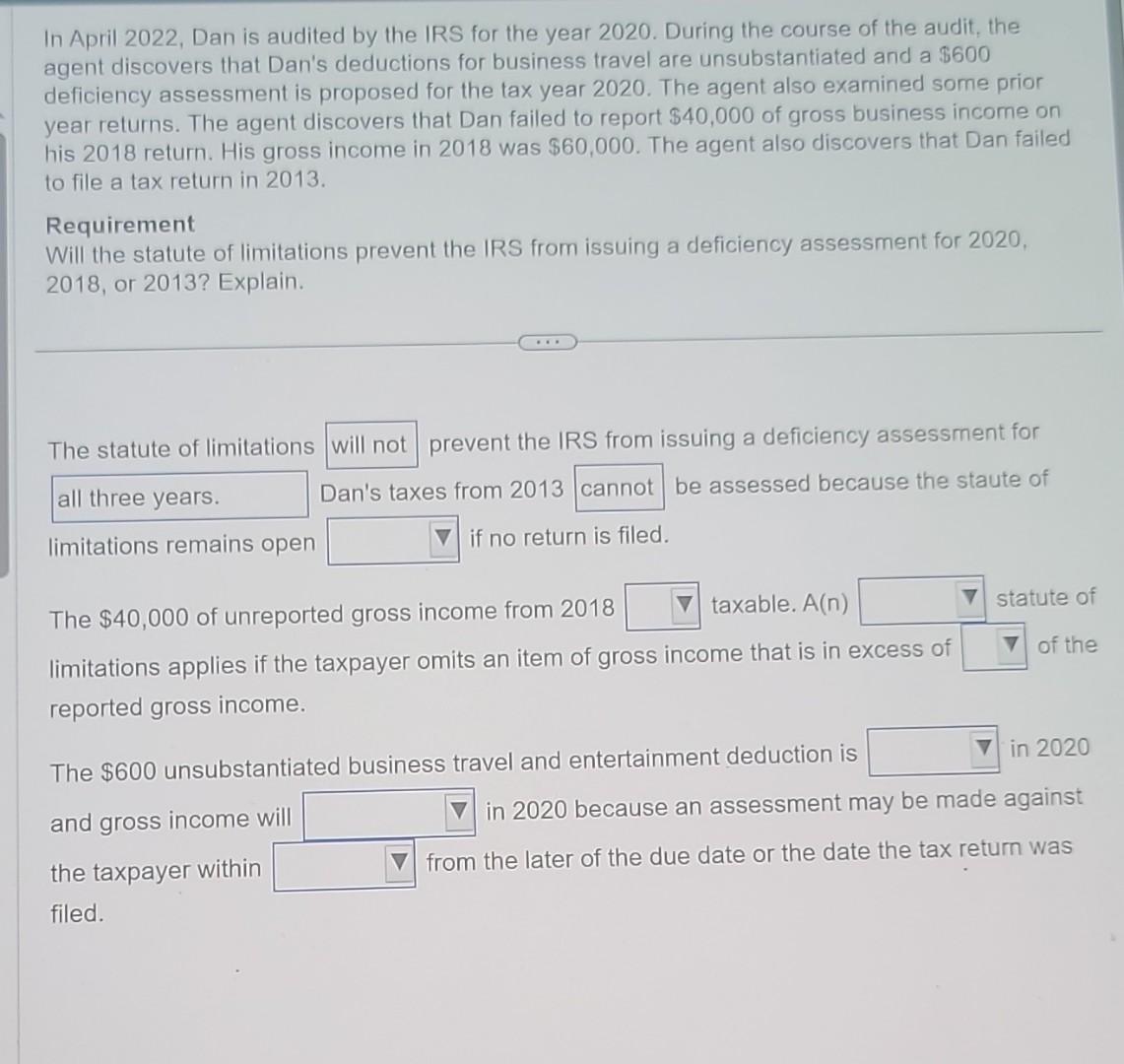

In April 2022, Dan is audited by the IRS for the year 2020 . During the course of the audit, the agent discovers that Dan's deductions for business travel are unsubstantiated and a $600 deficiency assessment is proposed for the tax year 2020. The agent also examined some prior year returns. The agent discovers that Dan failed to report $40,000 of gross business income on his 2018 return. His gross income in 2018 was $60,000. The agent also discovers that Dan failed to file a tax return in 2013. Requirement Will the statute of limitations prevent the IRS from issuing a deficiency assessment for 2020 , 2018 , or 2013 ? Explain. The statute of limitations prevent the IRS from issuing a deficiency assessment for Dan's taxes from 2013 be assessed because the staute of limitations remains open if no return is filed. The $40,000 of unreported gross income from 2018 taxable. A(n) statute of limitations applies if the taxpayer omits an item of gross income that is in excess of of the reported gross income. The $600 unsubstantiated business travel and entertainment deduction is in 2020 and gross income will in 2020 because an assessment may be made against the taxpayer within from the later of the due date or the date the tax return was filed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started