Answered step by step

Verified Expert Solution

Question

1 Approved Answer

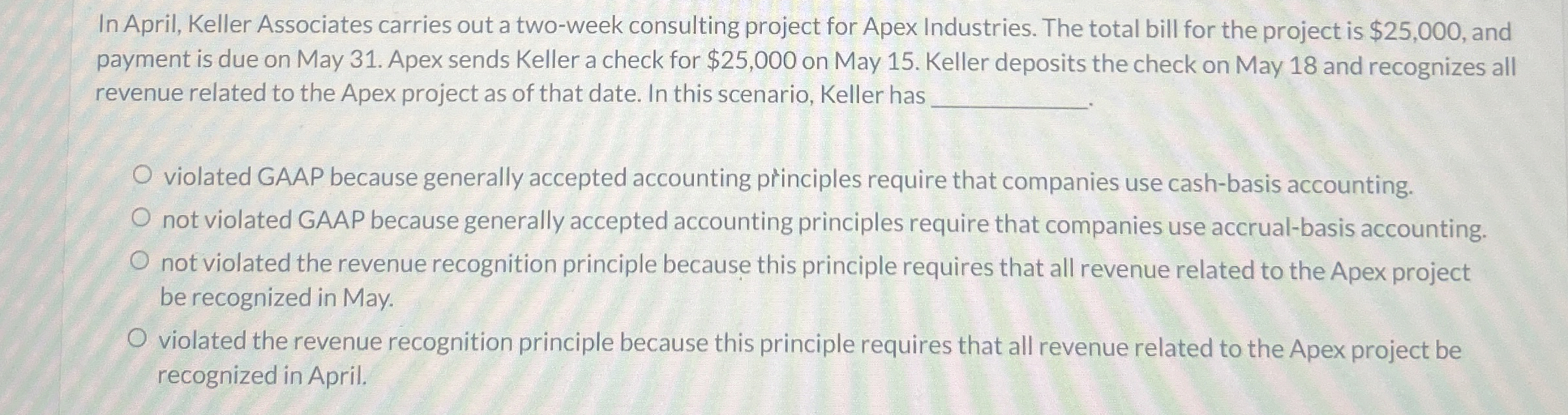

In April, Keller Associates carries out a two - week consulting project for Apex Industries. The total bill for the project is $ 2 5

In April, Keller Associates carries out a twoweek consulting project for Apex Industries. The total bill for the project is $ and

payment is due on May Apex sends Keller a check for $ on May Keller deposits the check on May and recognizes all

revenue related to the Apex project as of that date. In this scenario, Keller has

violated GAAP because generally accepted accounting principles require that companies use cashbasis accounting.

not violated GAAP because generally accepted accounting principles require that companies use accrualbasis accounting.

not violated the revenue recognition principle because this principle requires that all revenue related to the Apex project

be recognized in May.

violated the revenue recognition principle because this principle requires that all revenue related to the Apex project be

recognized in April.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started