QUESTION 3 Under Basel III, all banks are required to have a Capital Adequacy Ratio. Since Tier 1 Capital is more important, banks are

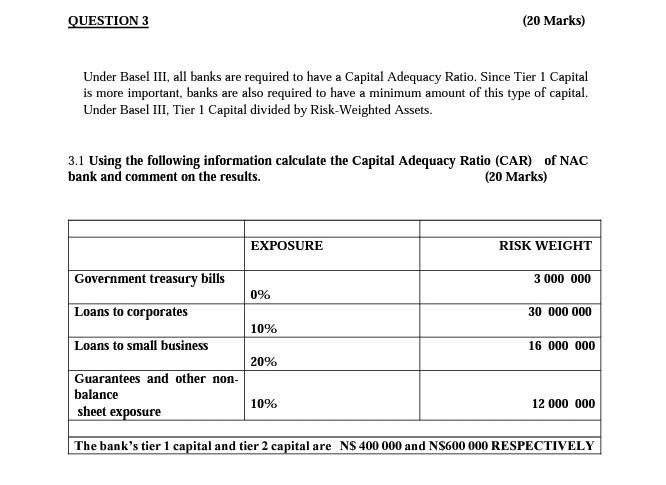

QUESTION 3 Under Basel III, all banks are required to have a Capital Adequacy Ratio. Since Tier 1 Capital is more important, banks are also required to have a minimum amount of this type of capital. Under Basel III, Tier 1 Capital divided by Risk-Weighted Assets. 3.1 Using the following information calculate the Capital Adequacy Ratio (CAR) of NAC bank and comment on the results. (20 Marks) Government treasury bills Loans to corporates Loans to small business EXPOSURE 0% 10% (20 Marks) 20% 10% RISK WEIGHT 3 000 000 30 000 000 16 000 000 Guarantees and other non- balance sheet exposure The bank's tier 1 capital and tier 2 capital are N$ 400 000 and NS600 000 RESPECTIVELY 12 000 000

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

CAR Tier 1 Capital RiskWeighted Assets CAR 400000 3000000 300...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started