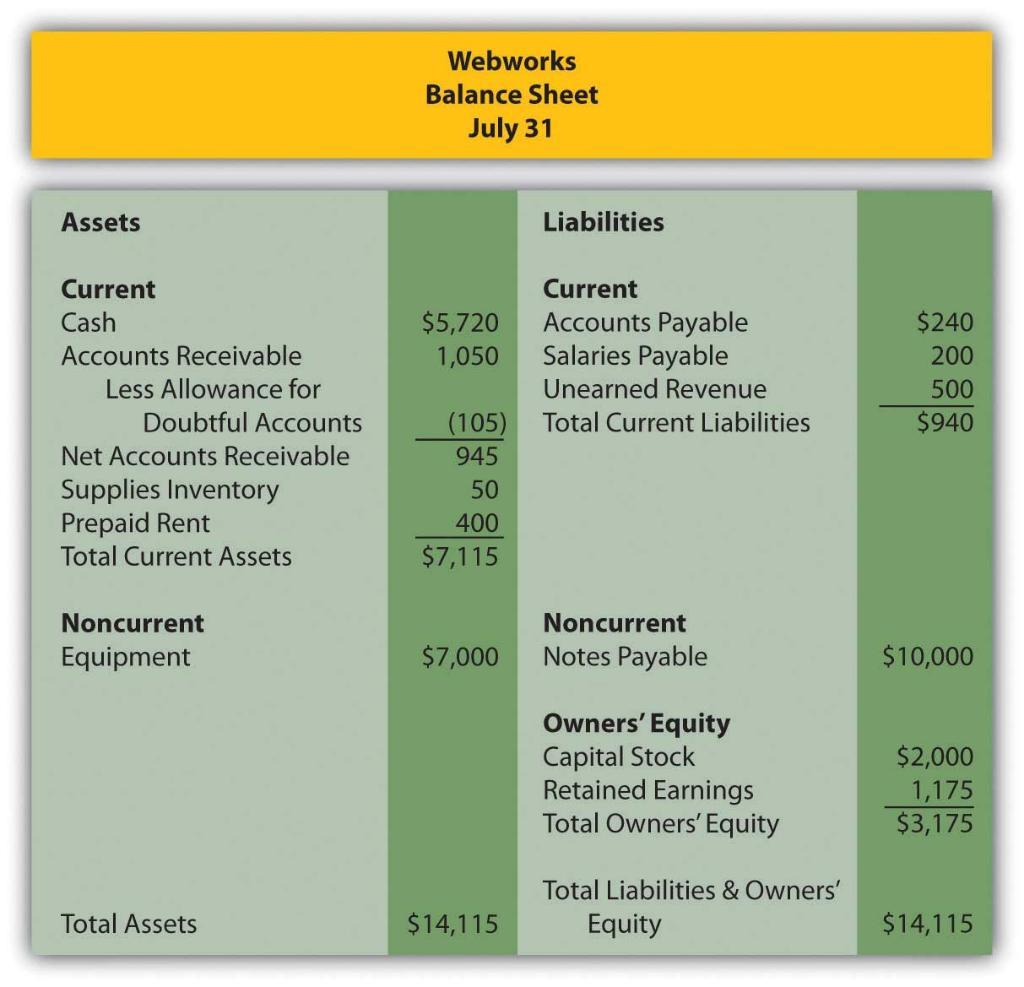

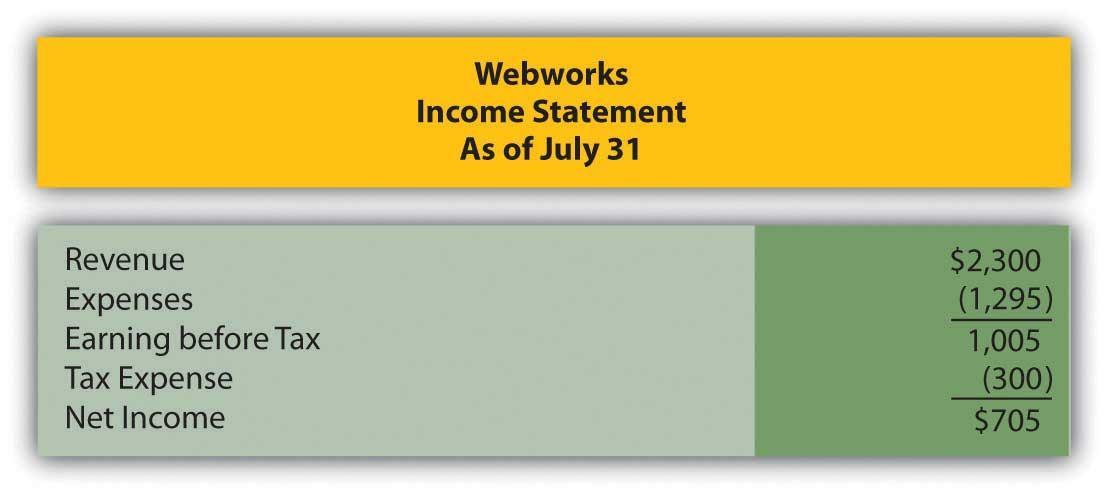

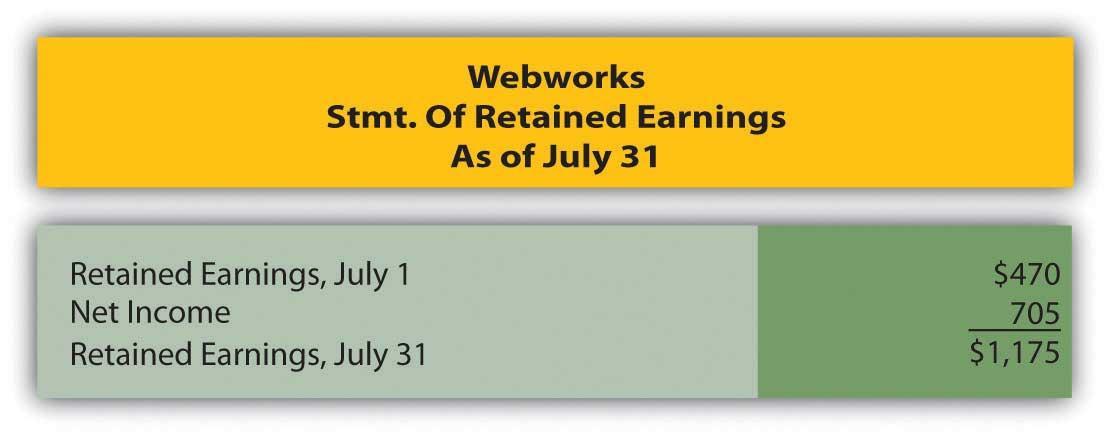

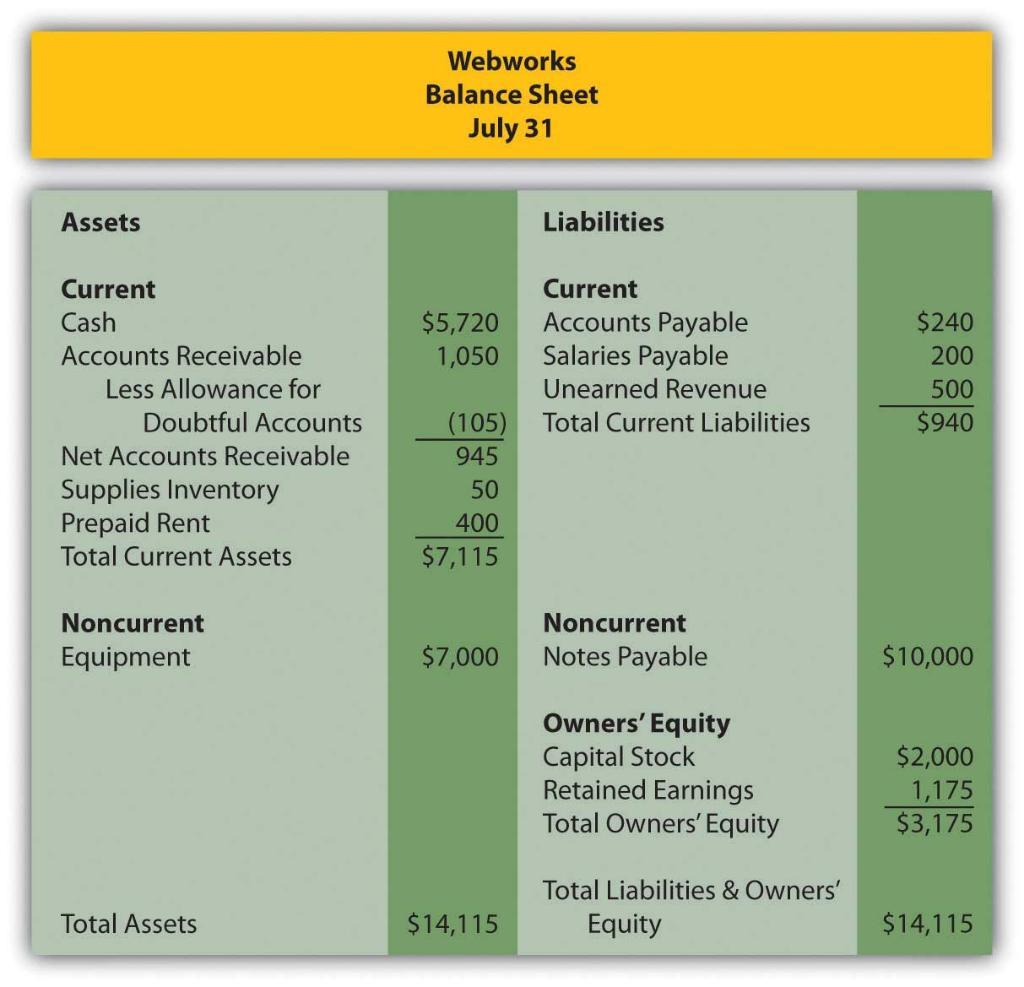

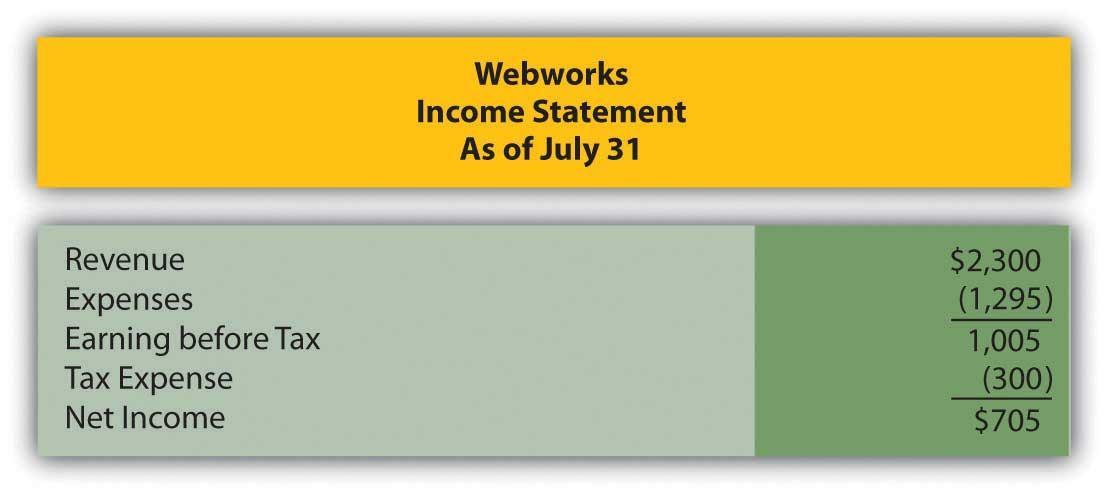

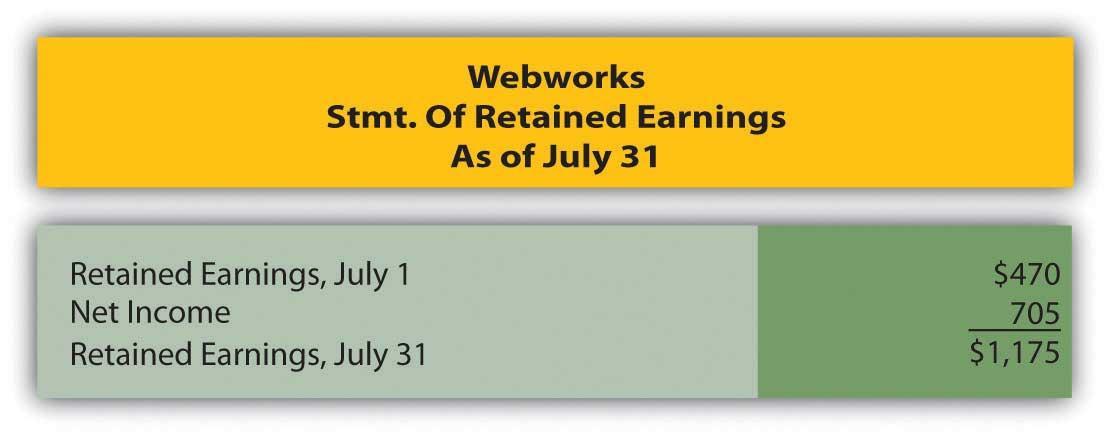

In Chapter 2 In a Set of Financial Statements, What Information Is Conveyed about Receivables?, you prepared Webworks statements for July. They are included here as a starting point for August.

Here are Webworks financial statements as of July 31.

I Just need September part. I bolded the part I need.

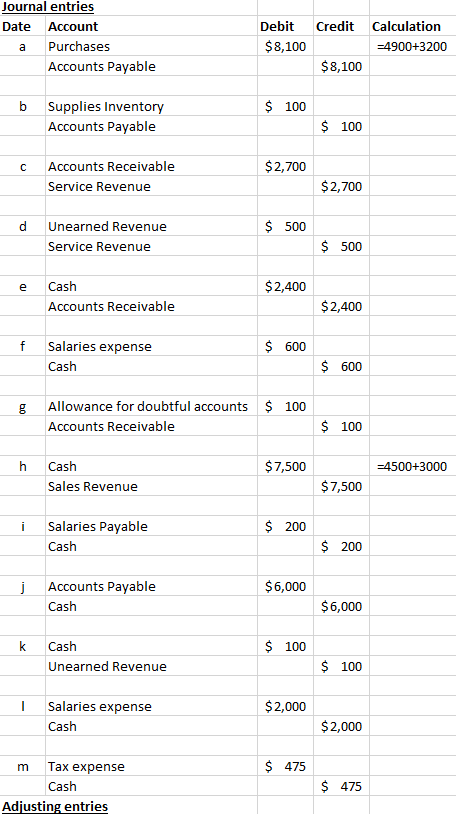

The following events occur during August:

a. Webworks decides to begin selling a limited selection of inventory items related to its business. During August, Webworks purchases specialty keyboards for $4,900 on account and flash drives for $3,200 on account with the hopes of selling them to its Web site customers or others who might be interested. Due to the limited amount of inventory, Webworks will use a periodic system. Record these purchases.

b. Webworks purchases supplies worth $100 on account.

c. Webworks starts and completes six more Web sites and bills clients for $2,700.

d. Recall that in July, Webworks received $500 in advance to design two Web sites. Webworks completes these sites during August.

e. Webworks collects $2,400 in accounts receivable.

f. Webworks pays Nancy $600 for her work during the first three weeks of August.

g. In June, Webworks designed a site for Pauline Smith and billed her. Unfortunately, before she could finish paying the bill, Ms. Smiths business folded. It is unlikely Webworks will collect anything. Record the entry to write off the $100 remaining receivable from Ms. Smith.

h. Webworks sells keyboards for $4,500 and flash drives for $3,000 cash.

i. Webworks pays off its salaries payable from July.

j. Webworks pays off $6,000 of its accounts payable.

k. Webworks receives $100 in advance to work on a Web site for a local dentist. Work will not begin on the Web site until September.

l. Webworks pays Leon salary of $2,000.

m. Webworks pays taxes of $475 in cash.

Required:

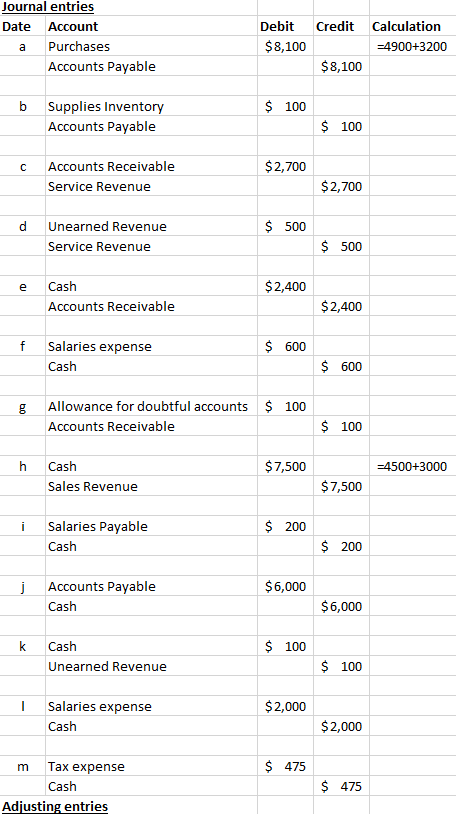

A. Prepare journal entries for the above events.

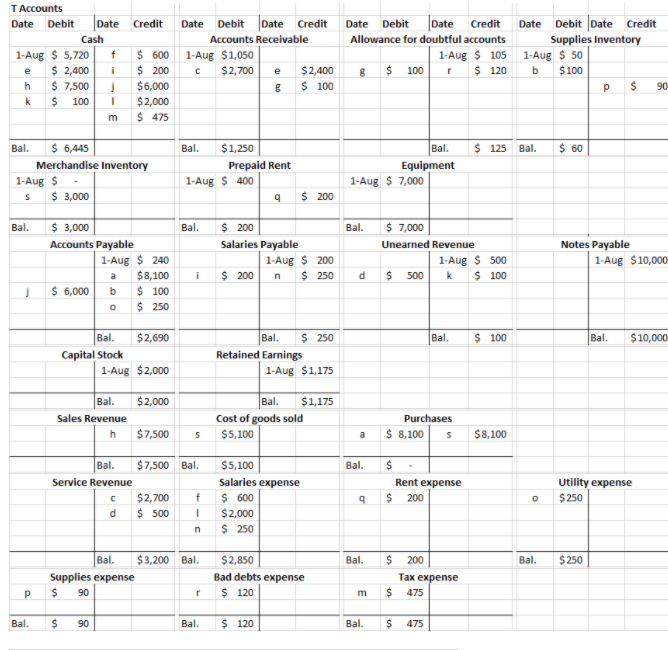

B. Post the journal entries to T-accounts.

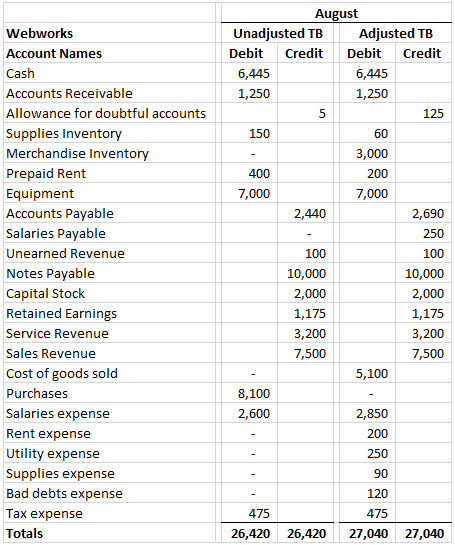

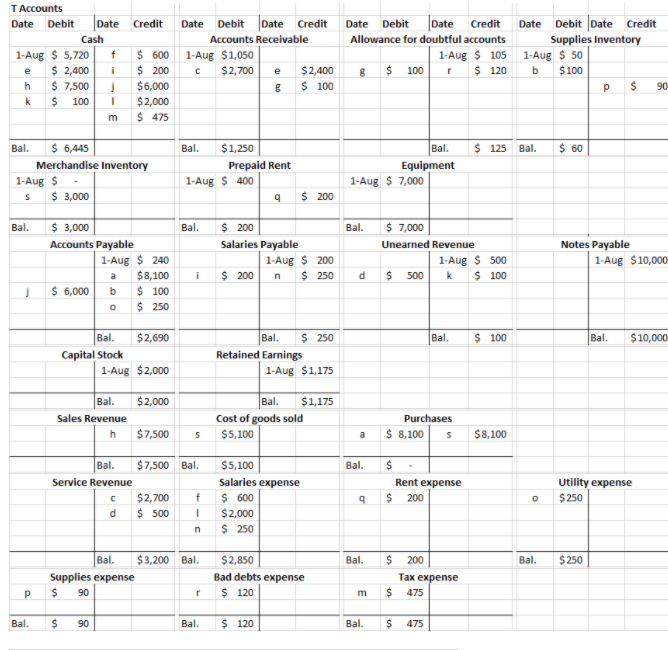

C. Prepare an unadjusted trial balance for Webworks for August.

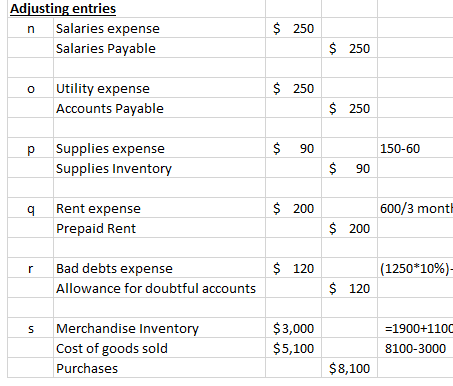

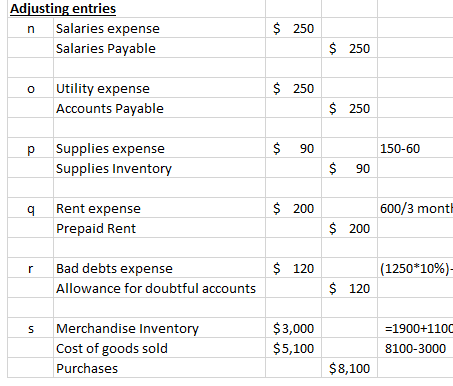

D. Prepare adjusting entries for the following and post them to your T-accounts.

n. Webworks owes Nancy $250 for her work during the last week of August.

o. Leons parents let him know that Webworks owes $250 toward the electricity bill. Webworks will pay them in September.

p. Webworks determines that it has $60 worth of supplies remaining at the end of August.

q. Prepaid rent should be adjusted for Augusts portion.

r. Webworks is continuing to accrue bad debts at 10 percent of accounts receivable.

s. Webworks performs a count of ending inventory and determines that $1,900 in keyboards and $1,100 in flash drives remain. Record cost of goods sold.

E. Prepare an adjusted trial balance.

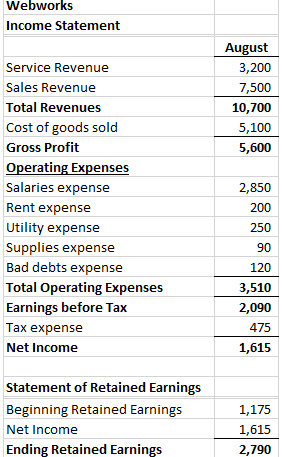

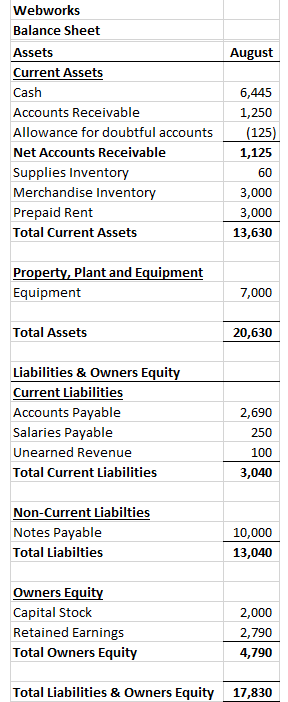

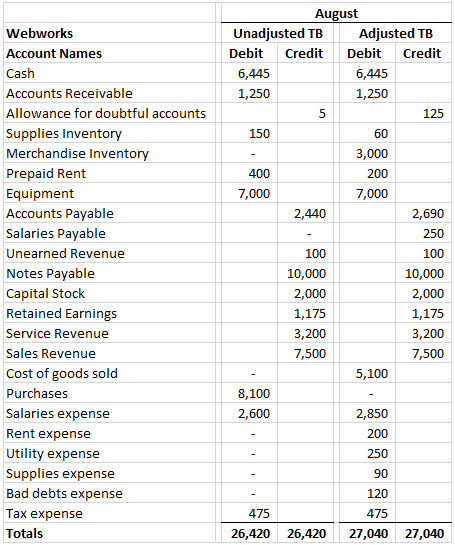

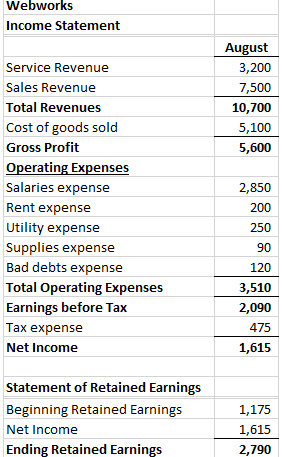

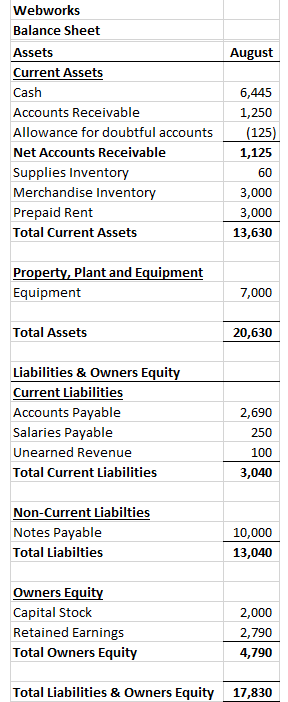

F. Prepare financial statements for August.

Above, you prepared Webworks statements for August.

The following events occur during September:

a. Webworks purchases supplies worth $120 on account.

b. At the beginning of September, Webworks had 19 keyboards costing $100 each and 110 flash drives costing $10 each. Webworks has decided to use perpetual FIFO to cost its inventory.

c. On account, Webworks purchases thirty keyboards for $105 each and fifty flash drives for $11 each.

d. Webworks starts and completes five more Web sites and bills clients for $3,000.

e. Webworks pays Nancy $500 for her work during the first three weeks of September.

f. Webworks sells 40 keyboards for $6,000 and 120 flash drives for $2,400 cash.

g. Webworks collects $2,500 in accounts receivable.

h. Webworks pays off its salaries payable from August.

i. Webworks pays off $5,500 of its accounts payable.

j. Webworks pays off $5,000 of its outstanding note payable.

k. Webworks pays Leon salary of $2,000.

l. Webworks pays taxes of $795 in cash.

Required:

A. Prepare journal entries for the above events.

B. Post the journal entries to T-accounts.

C. Prepare an unadjusted trial balance for Webworks for September.

D. Prepare adjusting entries for the following and post them to your T-accounts.

m. Webworks owes Nancy $300 for her work during the last week of September.

n. Leons parents let him know that Webworks owes $275 toward the electricity bill. Webworks will pay them in October.

o. Webworks determines that it has $70 worth of supplies remaining at the end of September.

p. Prepaid rent should be adjusted for Septembers portion.

q. Webworks is continuing to accrue bad debts so that the allowance for doubtful accounts is 10 percent of accounts receivable.

E. Prepare an adjusted trial balance.

F. Prepare financial statements for September.

Edit: Here are the parts for August that are required

Webworks Balance Sheet July 31 Assets Liabilities $5,720 1,050 Current Cash Accounts Receivable Less Allowance for Doubtful Accounts Net Accounts Receivable Supplies Inventory Prepaid Rent Total Current Assets Current Accounts Payable Salaries Payable Unearned Revenue Total Current Liabilities $240 200 500 $940 (105) 945 50 400 $7,115 Noncurrent Equipment $7,000 Noncurrent Notes Payable $10,000 Owners' Equity Capital Stock Retained Earnings Total Owners' Equity $2,000 1,175 $3,175 Total Liabilities & Owners' Equity Total Assets $14,115 $14,115 Webworks Income Statement As of July 31 Revenue Expenses Earning before Tax Tax Expense Net Income $2,300 (1,295) 1,005 (300) $705 Webworks Stmt. Of Retained Earnings As of July 31 Retained Earnings, July 1 Net Income Retained Earnings, July 31 $470 705 $1,175 Credit Journal entries Date Account Purchases Accounts Payable Debit $ 8,100 Calculation -4900+3200 a $ 8,100 b $ 100 Supplies Inventory Accounts Payable $ 100 $2,700 Accounts Receivable Service Revenue $ 2,700 d $ 500 Unearned Revenue Service Revenue $ 500 e $2,400 Cash Accounts Receivable $ 2,400 f $ 600 Salaries expense Cash $ 600 g Allowance for doubtful accounts $ 100 Accounts Receivable $ 100 h $7,500 -4500+3000 Cash Sales Revenue $ 7,500 i $ 200 Salaries Payable Cash $ 200 j Accounts Payable Cash $6,000 $6,000 k $ 100 Cash Unearned Revenue $ 100 1 Salaries expense Cash $2,000 $2,000 $ 475 m Tax expense Cash Adjusting entries $ 475 Adjusting entries n Salaries expense Salaries Payable $ 250 $ 250 o $ 250 Utility expense Accounts Payable $ 250 $ 90 150-60 Supplies expense Supplies Inventory $ 90 9 $ 200 600/3 month Rent expense Prepaid Rent $ 200 r $ 120 (1250*10%)- Bad debts expense Allowance for doubtful accounts $ 120 S =1900+1100 Merchandise Inventory Cost of goods sold Purchases $3,000 $5,100 8100-3000 $ 8,100 T Accounts Date Debit Date Cash 1-Aug $ 5,720 + $ 2,400 i h $ 7,500 k $ 100 m Credit Date Debit Date Credit Accounts Receivable $ 600 1-Aug $1,050 $ 200 $2,700 $2,400 $6,000 $ 100 $2,000 $ 475 Date Debit Date Credit Allowance for doubtful accounts 1-Aug $ 105 $ 100 $ 120 Date Debit Date Credit Supplies Inventory 1-Aug $ 50 b $ 100 p $ 90 r bo $ 125 Bal. $ 60 Bal. $ 6,445 Merchandise Inventory 1-Aug $ S $ 3,000 Bal. $1,250 Prepaid Rent 1-Aug $ 400 q Bal. Equipment 1-Aug $ 7,000 $ 200 Bal. Bal. Bal. $ 3,000 Accounts Payable 1-Aug $ 240 $8,100 $ 6,000 b $ 100 0 $ 250 $ 200 Salaries Payable 1-Aug $ 200 $ 200 n $ 250 $ 7,000 Unearned Revenue 1-Aug $ 500 $ 500 k $ 100 Notes Payable 1-Aug $10,000 i n d J Bal. $ 100 Bal. $10,000 Bal. $2,690 Capital Stock 1-Aug $2,000 Bal. $ 250 Retained Earnings 1-Aug $1,175 Bal. $2,000 Sales Revenue h Bal. $1,175 Cost of goods sold $5,100 Purchases $ 8,100 S $7,500 S $ 8,100 Bal. Bal. $7,500 Bal. Service Revenue C $2,700 f d $ 500 1 n $5,100 Salaries expense $ 600 $2,000 $ 250 $ Rent expense $ 200 Utility expense $250 a 0 Bal. $ Bal. $250 Bal. $3,200 Bal. Supplies expense $ 90 $2,850 Bad debts expense $ 120 200 Tax expense 475 r E $ Bal. $ 90 Bal. $ 120 Bal. $ 475 Webworks Account Names Cash Accounts Receivable Allowance for doubtful accounts Supplies Inventory Merchandise Inventory Prepaid Rent Equipment Accounts Payable Salaries Payable Unearned Revenue Notes Payable Capital Stock Retained Earnings Service Revenue Sales Revenue Cost of goods sold Purchases Salaries expense Rent expense Utility expense Supplies expense Bad debts expense Tax expense Totals August Unadjusted TB Adjusted TB Debit Credit Debit Credit 6,445 6,445 1,250 1,250 5 125 150 60 3,000 400 200 7,000 7,000 2,440 2,690 250 100 100 10,000 10,000 2,000 2,000 1,175 1,175 3,200 3,200 7,500 7,500 5,100 8,100 2,600 2,850 200 250 90 120 475 475 27,040 27,040 26,420 26,420 Webworks Income Statement August 3,200 7,500 10,700 5,100 5,600 Service Revenue Sales Revenue Total Revenues Cost of goods sold Gross Profit Operating Expenses Salaries expense Rent expense Utility expense Supplies expense Bad debts expense Total Operating Expenses Earnings before Tax Tax expense Net Income 2,850 200 250 90 120 3,510 2,090 475 1,615 Statement of Retained Earnings Beginning Retained Earnings Net Income Ending Retained Earnings 1,175 1,615 2,790 August Webworks Balance Sheet Assets Current Assets Cash Accounts Receivable Allowance for doubtful accounts Net Accounts Receivable Supplies Inventory Merchandise Inventory Prepaid Rent Total Current Assets 6,445 1,250 (125) 1,125 60 3,000 3,000 13,630 Property, plant and Equipment Equipment 7,000 Total Assets 20,630 Liabilities & Owners Equity Current Liabilities Accounts Payable Salaries Payable Unearned Revenue Total Current Liabilities 2,690 250 100 3,040 Non-Current Liabilties Notes Payable Total Liabilties 10,000 13,040 Owners Equity Capital Stock Retained Earnings Total Owners Equity 2,000 2,790 4,790 Total Liabilities & Owners Equity 17,830 Webworks Balance Sheet July 31 Assets Liabilities $5,720 1,050 Current Cash Accounts Receivable Less Allowance for Doubtful Accounts Net Accounts Receivable Supplies Inventory Prepaid Rent Total Current Assets Current Accounts Payable Salaries Payable Unearned Revenue Total Current Liabilities $240 200 500 $940 (105) 945 50 400 $7,115 Noncurrent Equipment $7,000 Noncurrent Notes Payable $10,000 Owners' Equity Capital Stock Retained Earnings Total Owners' Equity $2,000 1,175 $3,175 Total Liabilities & Owners' Equity Total Assets $14,115 $14,115 Webworks Income Statement As of July 31 Revenue Expenses Earning before Tax Tax Expense Net Income $2,300 (1,295) 1,005 (300) $705 Webworks Stmt. Of Retained Earnings As of July 31 Retained Earnings, July 1 Net Income Retained Earnings, July 31 $470 705 $1,175 Credit Journal entries Date Account Purchases Accounts Payable Debit $ 8,100 Calculation -4900+3200 a $ 8,100 b $ 100 Supplies Inventory Accounts Payable $ 100 $2,700 Accounts Receivable Service Revenue $ 2,700 d $ 500 Unearned Revenue Service Revenue $ 500 e $2,400 Cash Accounts Receivable $ 2,400 f $ 600 Salaries expense Cash $ 600 g Allowance for doubtful accounts $ 100 Accounts Receivable $ 100 h $7,500 -4500+3000 Cash Sales Revenue $ 7,500 i $ 200 Salaries Payable Cash $ 200 j Accounts Payable Cash $6,000 $6,000 k $ 100 Cash Unearned Revenue $ 100 1 Salaries expense Cash $2,000 $2,000 $ 475 m Tax expense Cash Adjusting entries $ 475 Adjusting entries n Salaries expense Salaries Payable $ 250 $ 250 o $ 250 Utility expense Accounts Payable $ 250 $ 90 150-60 Supplies expense Supplies Inventory $ 90 9 $ 200 600/3 month Rent expense Prepaid Rent $ 200 r $ 120 (1250*10%)- Bad debts expense Allowance for doubtful accounts $ 120 S =1900+1100 Merchandise Inventory Cost of goods sold Purchases $3,000 $5,100 8100-3000 $ 8,100 T Accounts Date Debit Date Cash 1-Aug $ 5,720 + $ 2,400 i h $ 7,500 k $ 100 m Credit Date Debit Date Credit Accounts Receivable $ 600 1-Aug $1,050 $ 200 $2,700 $2,400 $6,000 $ 100 $2,000 $ 475 Date Debit Date Credit Allowance for doubtful accounts 1-Aug $ 105 $ 100 $ 120 Date Debit Date Credit Supplies Inventory 1-Aug $ 50 b $ 100 p $ 90 r bo $ 125 Bal. $ 60 Bal. $ 6,445 Merchandise Inventory 1-Aug $ S $ 3,000 Bal. $1,250 Prepaid Rent 1-Aug $ 400 q Bal. Equipment 1-Aug $ 7,000 $ 200 Bal. Bal. Bal. $ 3,000 Accounts Payable 1-Aug $ 240 $8,100 $ 6,000 b $ 100 0 $ 250 $ 200 Salaries Payable 1-Aug $ 200 $ 200 n $ 250 $ 7,000 Unearned Revenue 1-Aug $ 500 $ 500 k $ 100 Notes Payable 1-Aug $10,000 i n d J Bal. $ 100 Bal. $10,000 Bal. $2,690 Capital Stock 1-Aug $2,000 Bal. $ 250 Retained Earnings 1-Aug $1,175 Bal. $2,000 Sales Revenue h Bal. $1,175 Cost of goods sold $5,100 Purchases $ 8,100 S $7,500 S $ 8,100 Bal. Bal. $7,500 Bal. Service Revenue C $2,700 f d $ 500 1 n $5,100 Salaries expense $ 600 $2,000 $ 250 $ Rent expense $ 200 Utility expense $250 a 0 Bal. $ Bal. $250 Bal. $3,200 Bal. Supplies expense $ 90 $2,850 Bad debts expense $ 120 200 Tax expense 475 r E $ Bal. $ 90 Bal. $ 120 Bal. $ 475 Webworks Account Names Cash Accounts Receivable Allowance for doubtful accounts Supplies Inventory Merchandise Inventory Prepaid Rent Equipment Accounts Payable Salaries Payable Unearned Revenue Notes Payable Capital Stock Retained Earnings Service Revenue Sales Revenue Cost of goods sold Purchases Salaries expense Rent expense Utility expense Supplies expense Bad debts expense Tax expense Totals August Unadjusted TB Adjusted TB Debit Credit Debit Credit 6,445 6,445 1,250 1,250 5 125 150 60 3,000 400 200 7,000 7,000 2,440 2,690 250 100 100 10,000 10,000 2,000 2,000 1,175 1,175 3,200 3,200 7,500 7,500 5,100 8,100 2,600 2,850 200 250 90 120 475 475 27,040 27,040 26,420 26,420 Webworks Income Statement August 3,200 7,500 10,700 5,100 5,600 Service Revenue Sales Revenue Total Revenues Cost of goods sold Gross Profit Operating Expenses Salaries expense Rent expense Utility expense Supplies expense Bad debts expense Total Operating Expenses Earnings before Tax Tax expense Net Income 2,850 200 250 90 120 3,510 2,090 475 1,615 Statement of Retained Earnings Beginning Retained Earnings Net Income Ending Retained Earnings 1,175 1,615 2,790 August Webworks Balance Sheet Assets Current Assets Cash Accounts Receivable Allowance for doubtful accounts Net Accounts Receivable Supplies Inventory Merchandise Inventory Prepaid Rent Total Current Assets 6,445 1,250 (125) 1,125 60 3,000 3,000 13,630 Property, plant and Equipment Equipment 7,000 Total Assets 20,630 Liabilities & Owners Equity Current Liabilities Accounts Payable Salaries Payable Unearned Revenue Total Current Liabilities 2,690 250 100 3,040 Non-Current Liabilties Notes Payable Total Liabilties 10,000 13,040 Owners Equity Capital Stock Retained Earnings Total Owners Equity 2,000 2,790 4,790 Total Liabilities & Owners Equity 17,830