Answered step by step

Verified Expert Solution

Question

1 Approved Answer

No 1. please help its very urgent Morrisey & Brown, Ltd. of Sydney, Australia, is a merchandising firm that is the sole distributor of a

No 1. please help its very urgent

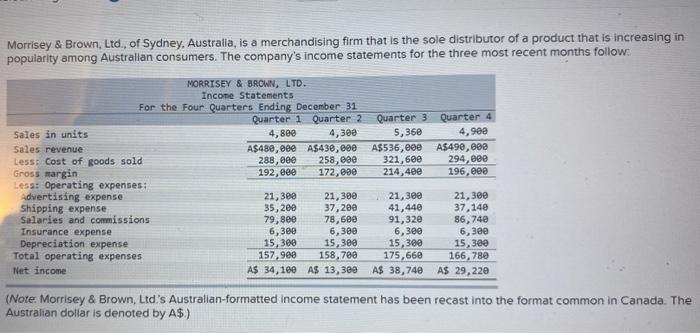

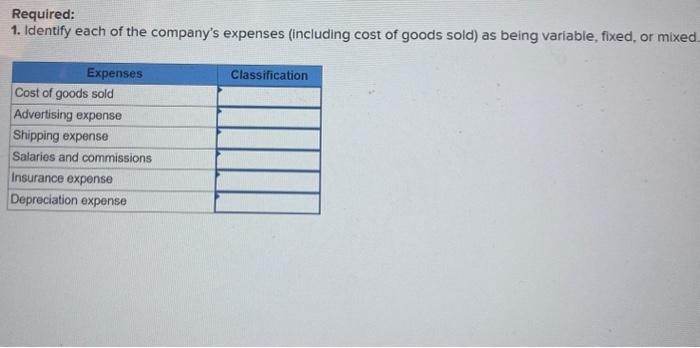

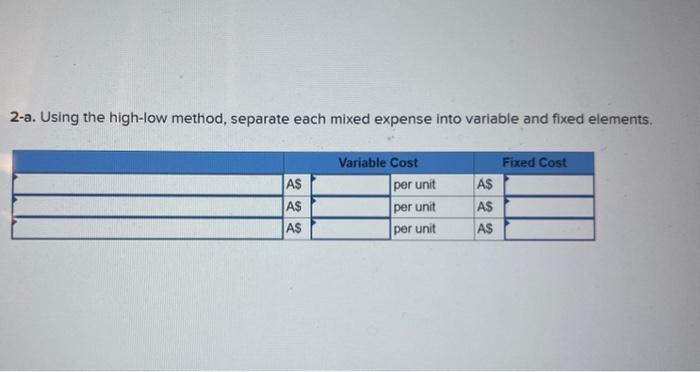

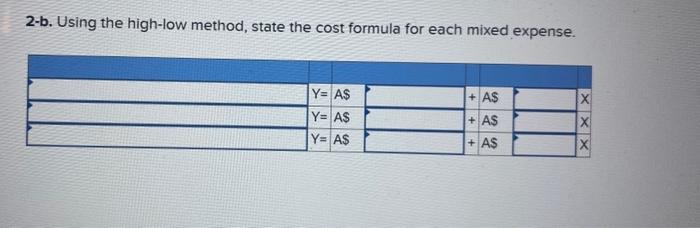

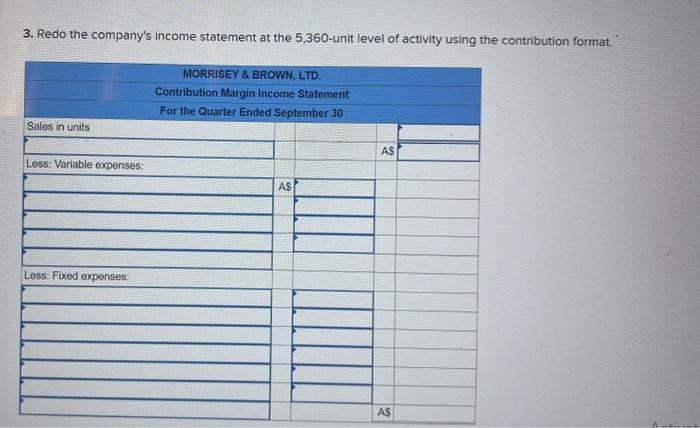

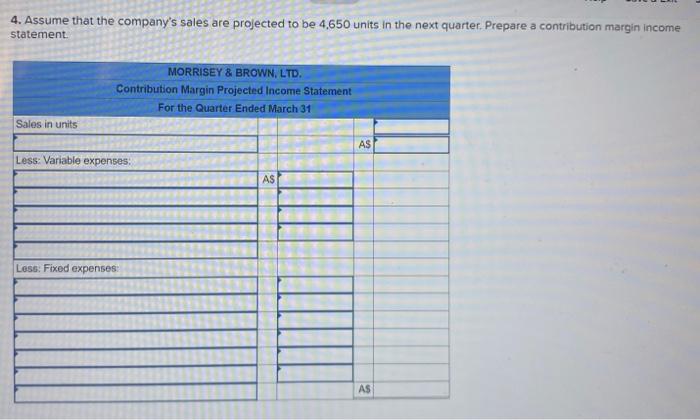

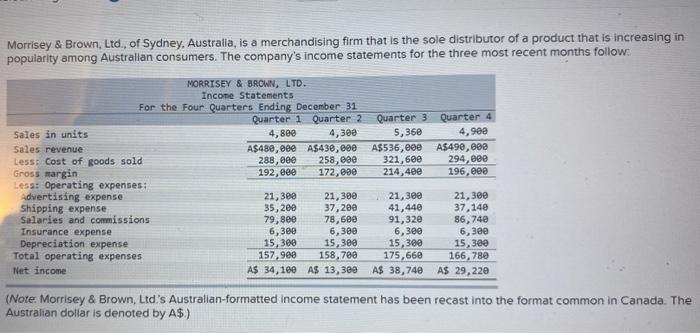

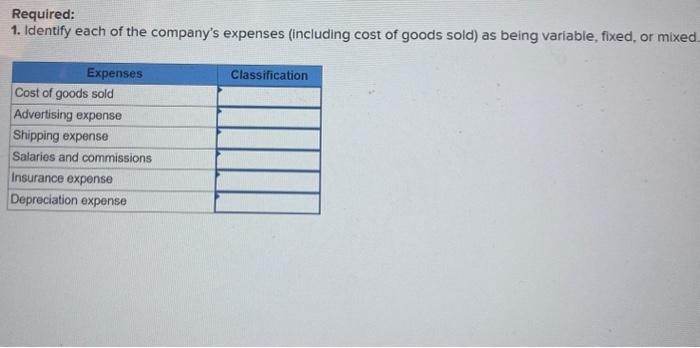

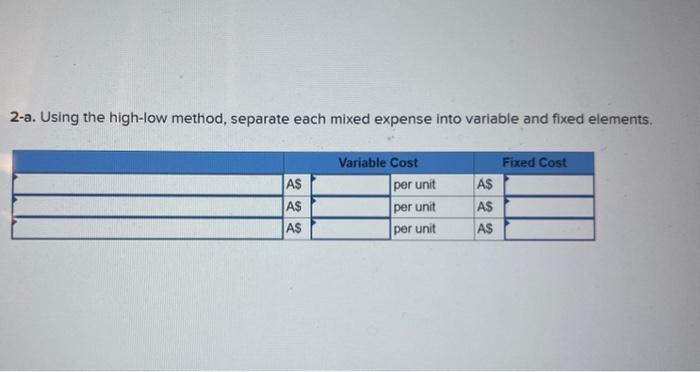

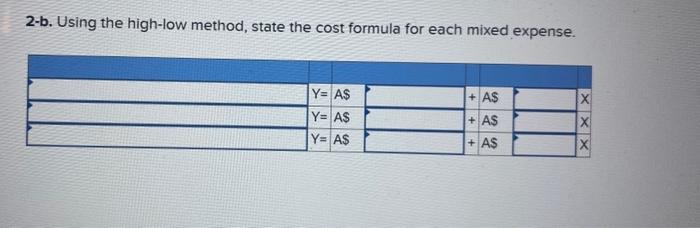

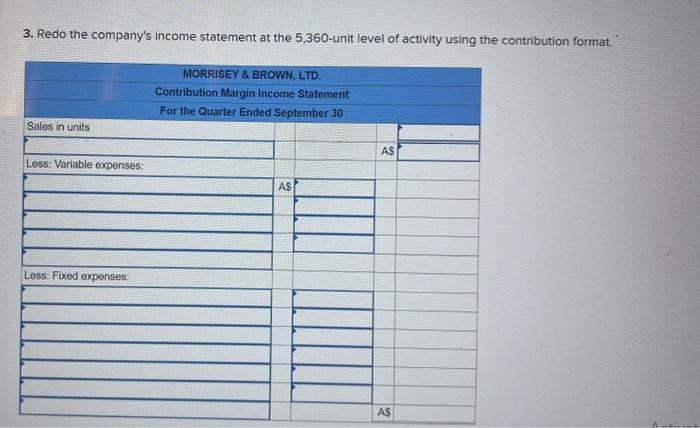

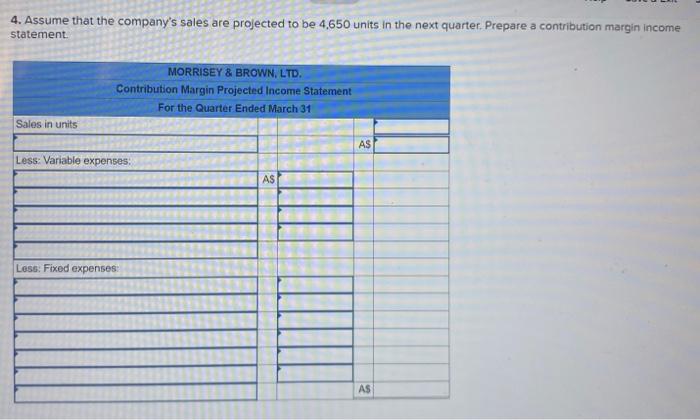

Morrisey \& Brown, Ltd. of Sydney, Australia, is a merchandising firm that is the sole distributor of a product that is increasing in popularity among Australian consumers. The company's income statements for the three most recent months follow: (Note. Morrisey \& Brown, Ltd.'s Australian-formatted income statement has been recast into the format common in Canada. The Australian dollar is denoted by A$.) Required: 1. Identify each of the company's expenses (including cost of goods sold) as being variable, fixed, or mixed 2-a. Using the high-low method, separate each mixed expense into variable and fixed elements. 2-b. Using the high-low method, state the cost formula for each mixed expense. 3. Redo the company's income statement at the 5,360-unit level of activity using the contribution format. 4. Assume that the company's sales are projected to be 4.650 units in the next quarter. Prepare a contribution margin income statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started