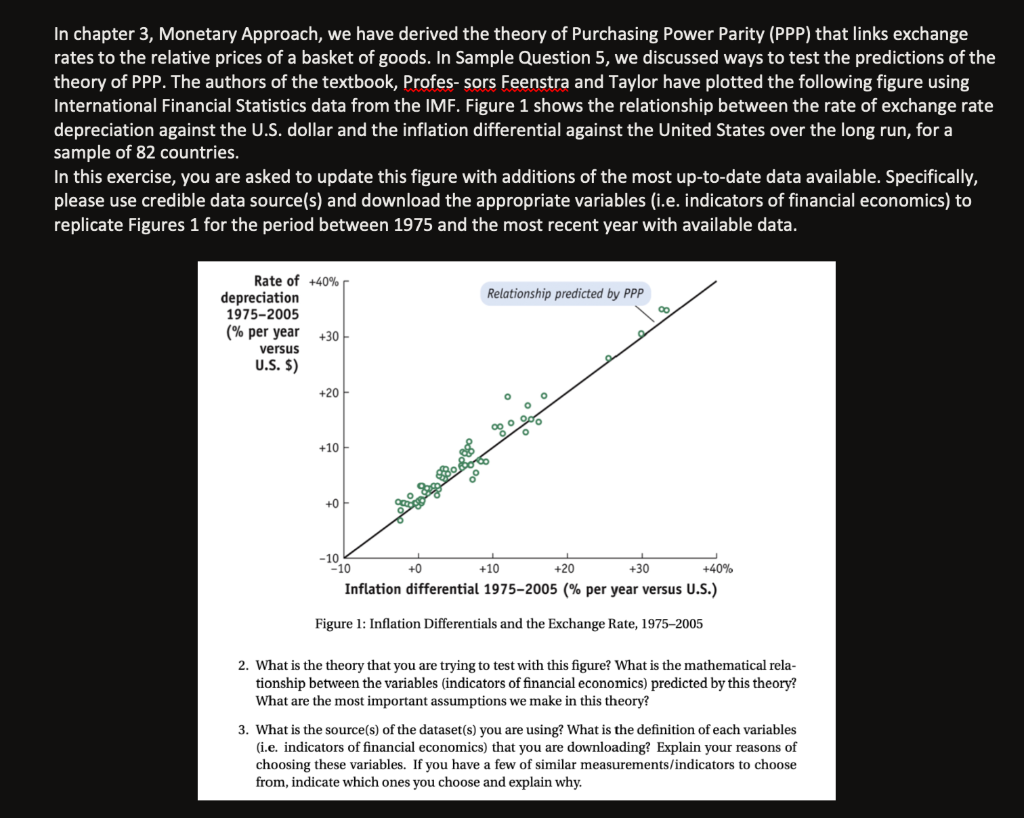

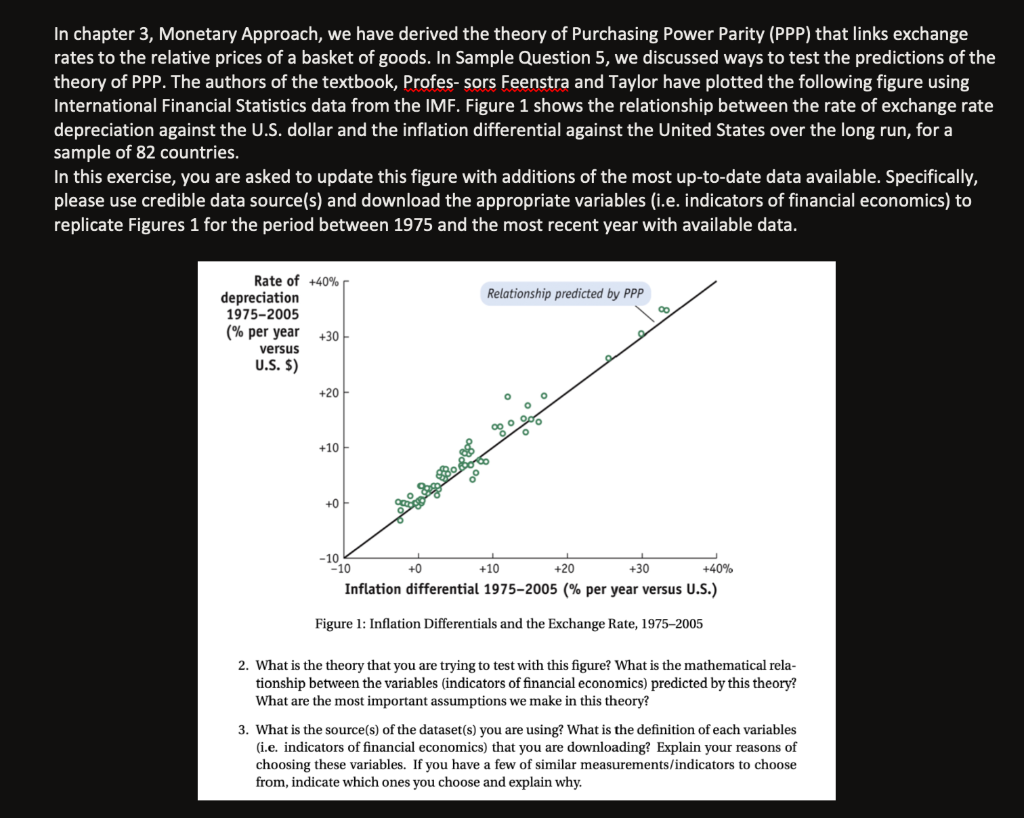

In chapter 3, Monetary Approach, we have derived the theory of Purchasing Power Parity (PPP) that links exchange rates to the relative prices of a basket of goods. In Sample Question 5, we discussed ways to test the predictions of the theory of PPP. The authors of the textbook, Profes-sors Feenstra and Taylor have plotted the following figure using International Financial Statistics data from the IMF. Figure 1 shows the relationship between the rate of exchange rate depreciation against the U.S. dollar and the inflation differential against the United States over the long run, for a sample of 82 countries. In this exercise, you are asked to update this figure with additions of the most up-to-date data available. Specifically, please use credible data source(s) and download the appropriate variables (i.e. indicators of financial economics) to replicate Figures 1 for the period between 1975 and the most recent year with available data. Relationship predicted by PPP QO Rate of +40% depreciation 1975-2005 (% per year +30 versus U.S. S) +20 O +10 +0 1 -10 - 10 +0 +10 +20 +30 +40% Inflation differential 1975-2005 (% per year versus U.S.) Figure 1: Inflation Differentials and the Exchange Rate, 1975-2005 2. What is the theory that you are trying to test with this figure? What is the mathematical rela- tionship between the variables indicators of financial economics) predicted by this theory? What are the most important assumptions we make in this theory? 3. What is the source(s) of the dataset(s) you are using? What is the definition of each variables (i.e. indicators of financial economics) that you are downloading? Explain your reasons of choosing these variables. If you have a few of similar measurements/indicators to choose from, indicate which ones you choose and explain why. In chapter 3, Monetary Approach, we have derived the theory of Purchasing Power Parity (PPP) that links exchange rates to the relative prices of a basket of goods. In Sample Question 5, we discussed ways to test the predictions of the theory of PPP. The authors of the textbook, Profes-sors Feenstra and Taylor have plotted the following figure using International Financial Statistics data from the IMF. Figure 1 shows the relationship between the rate of exchange rate depreciation against the U.S. dollar and the inflation differential against the United States over the long run, for a sample of 82 countries. In this exercise, you are asked to update this figure with additions of the most up-to-date data available. Specifically, please use credible data source(s) and download the appropriate variables (i.e. indicators of financial economics) to replicate Figures 1 for the period between 1975 and the most recent year with available data. Relationship predicted by PPP QO Rate of +40% depreciation 1975-2005 (% per year +30 versus U.S. S) +20 O +10 +0 1 -10 - 10 +0 +10 +20 +30 +40% Inflation differential 1975-2005 (% per year versus U.S.) Figure 1: Inflation Differentials and the Exchange Rate, 1975-2005 2. What is the theory that you are trying to test with this figure? What is the mathematical rela- tionship between the variables indicators of financial economics) predicted by this theory? What are the most important assumptions we make in this theory? 3. What is the source(s) of the dataset(s) you are using? What is the definition of each variables (i.e. indicators of financial economics) that you are downloading? Explain your reasons of choosing these variables. If you have a few of similar measurements/indicators to choose from, indicate which ones you choose and explain why