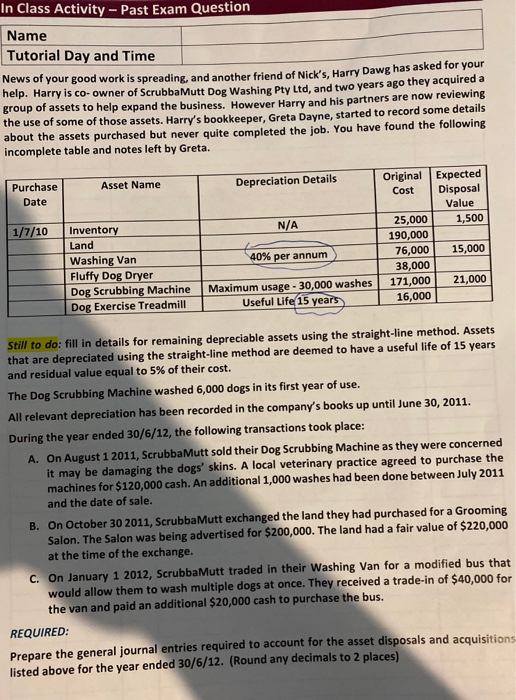

In Class Activity - Past Exam Question Name Tutorial Day and Time News of your good work is spreading, and another friend of Nick's, Harry Dawg has asked for your help. Harry is co-owner of ScrubbaMutt Dog Washing Pty Ltd, and two years ago they acquired a group of assets to help expand the business. However Harry and his partners are now reviewing the use of some of those assets. Harry's bookkeeper, Greta Dayne, started to record some details about the assets purchased but never quite completed the job. You have found the following incomplete table and notes left by Greta. Asset Name Depreciation Details Purchase Date N/A 1/7/10 Original Expected Cost Disposal Value 25,000 1,500 190,000 76,000 15,000 38,000 171,000 21,000 16,000 Inventory Land Washing Van Fluffy Dog Dryer Dog Scrubbing Machine Dog Exercise Treadmill 40% per annum Maximum usage - 30,000 washes Useful Life 15 years Still to do: fill in details for remaining depreciable assets using the straight-line method. Assets that are depreciated using the straight-line method are deemed to have a useful life of 15 years and residual value equal to 5% of their cost. The Dog Scrubbing Machine washed 6,000 dogs in its first year of use. All relevant depreciation has been recorded in the company's books up until June 30, 2011. During the year ended 30/6/12, the following transactions took place: A. On August 1 2011, ScrubbaMutt sold their Dog Scrubbing Machine as they were concerned it may be damaging the dogs' skins. A local veterinary practice agreed to purchase the machines for $120,000 cash. An additional 1,000 washes had been done between July 2011 and the date of sale. B. on October 30 2011, ScrubbaMutt exchanged the land they had purchased for a Grooming Salon. The Salon was being advertised for $200,000. The land had a fair value of $220,000 at the time of the exchange. C. On January 1 2012, ScrubbaMutt traded in their Washing Van for a modified bus that would allow them to wash multiple dogs at once. They received a trade-in of $40,000 for the van and paid an additional $20,000 cash to purchase the bus. REQUIRED: Prepare the general journal entries required to account for the asset disposals and acquisitions listed above for the year ended 30/6/12. (Round any decimals to 2 places) Jessica Yi FA 1 Topic 4 Non-Current Assets Part 2