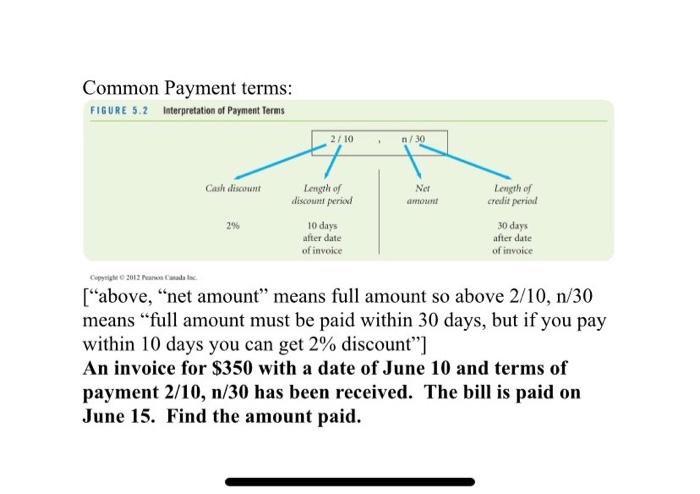

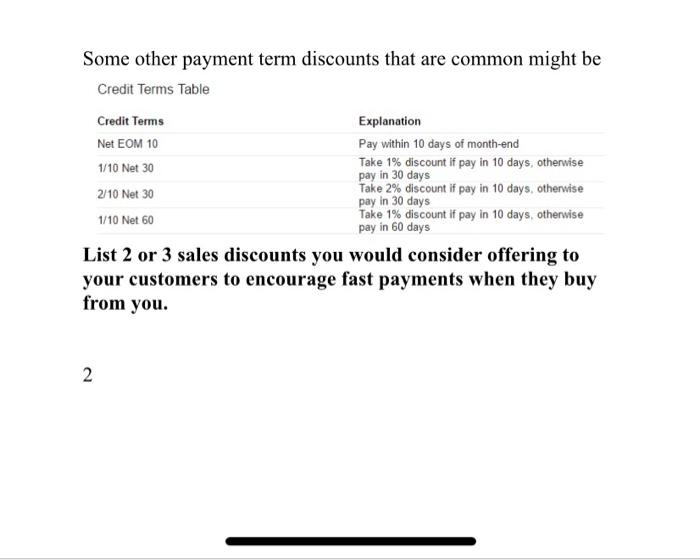

In Class Work: Writing Style SALES CALCULATION CREATIVE EXERCISE Name of your company: Describe what you are selling (I item only): What is the price you will sell at to customer: How will you explain to potential customers WHY they should buy your product? If your total costs to run the company is $5,000 per month, how many do you have to sell each month to cover your costs? Show your calculation! Do you think this is a realistic number to achieve each month? Explain your answer. In case sales go slower than expected, come up with a volume discount offer for customers and describe how it will work in the box below: (for example if you buy 5 items instead of I, you will give customer a 10% discount) Common Payment terms: above, "net amount" means full amount so above 2/10,n30 means "full amount must be paid within 30 days, but if you pay within 10 days you can get 2% discount"] An invoice for $350 with a date of June 10 and terms of payment 2/10, n/30 has been received. The bill is paid on June 15. Find the amount paid. Common Payment terms: FIGURE 5.2 Interpretation of Payment Terms 2/10 n/30 Cash discount Net mu Length of discount period 10 days after date of invoice Length of credit period 30 days after date of invoice 2% Cup 2012 ["above, net amount" means full amount so above 2/10, n/30 means full amount must be paid within 30 days, but if you pay within 10 days you can get 2% discount"] An invoice for $350 with a date of June 10 and terms of payment 2/10, n/30 has been received. The bill is paid on June 15. Find the amount paid. Some other payment term discounts that are common might be Credit Terms Table Credit Terms Explanation Net EOM 10 Pay within 10 days of month-end 1/10 Net 30 Take 1% discount If pay in 10 days, otherwise pay in 30 days 2/10 Net 30 Take 2% discount if pay in 10 days, otherwise pay in 30 days 1/10 Net 60 Take 1% discount if pay in 10 days, otherwise pay in 60 days List 2 or 3 sales discounts you would consider offering to your customers to encourage fast payments when they buy from you. 2 In Class Work: Writing Style SALES CALCULATION CREATIVE EXERCISE Name of your company: Describe what you are selling (I item only): What is the price you will sell at to customer: How will you explain to potential customers WHY they should buy your product? If your total costs to run the company is $5,000 per month, how many do you have to sell each month to cover your costs? Show your calculation! Do you think this is a realistic number to achieve each month? Explain your answer. In case sales go slower than expected, come up with a volume discount offer for customers and describe how it will work in the box below: (for example if you buy 5 items instead of I, you will give customer a 10% discount) Common Payment terms: above, "net amount" means full amount so above 2/10,n30 means "full amount must be paid within 30 days, but if you pay within 10 days you can get 2% discount"] An invoice for $350 with a date of June 10 and terms of payment 2/10, n/30 has been received. The bill is paid on June 15. Find the amount paid. Common Payment terms: FIGURE 5.2 Interpretation of Payment Terms 2/10 n/30 Cash discount Net mu Length of discount period 10 days after date of invoice Length of credit period 30 days after date of invoice 2% Cup 2012 ["above, net amount" means full amount so above 2/10, n/30 means full amount must be paid within 30 days, but if you pay within 10 days you can get 2% discount"] An invoice for $350 with a date of June 10 and terms of payment 2/10, n/30 has been received. The bill is paid on June 15. Find the amount paid. Some other payment term discounts that are common might be Credit Terms Table Credit Terms Explanation Net EOM 10 Pay within 10 days of month-end 1/10 Net 30 Take 1% discount If pay in 10 days, otherwise pay in 30 days 2/10 Net 30 Take 2% discount if pay in 10 days, otherwise pay in 30 days 1/10 Net 60 Take 1% discount if pay in 10 days, otherwise pay in 60 days List 2 or 3 sales discounts you would consider offering to your customers to encourage fast payments when they buy from you. 2