In column Q, compute the difference between the 3 month nominal interest rates in Japan and the US (Japan minus US). In column R, compute the difference between column Q, and the quarterly forward premium in column I. This is (RJPY RUSD)ln(F/E). What do you learn from these data?

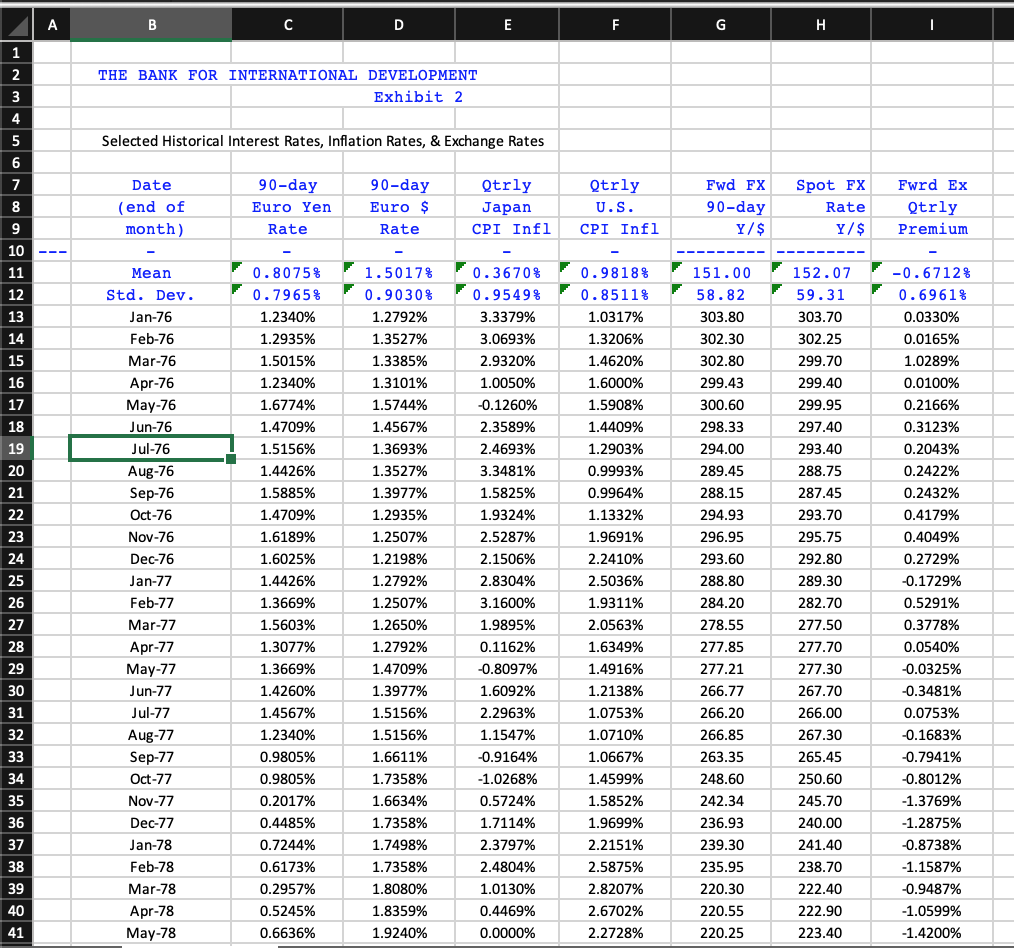

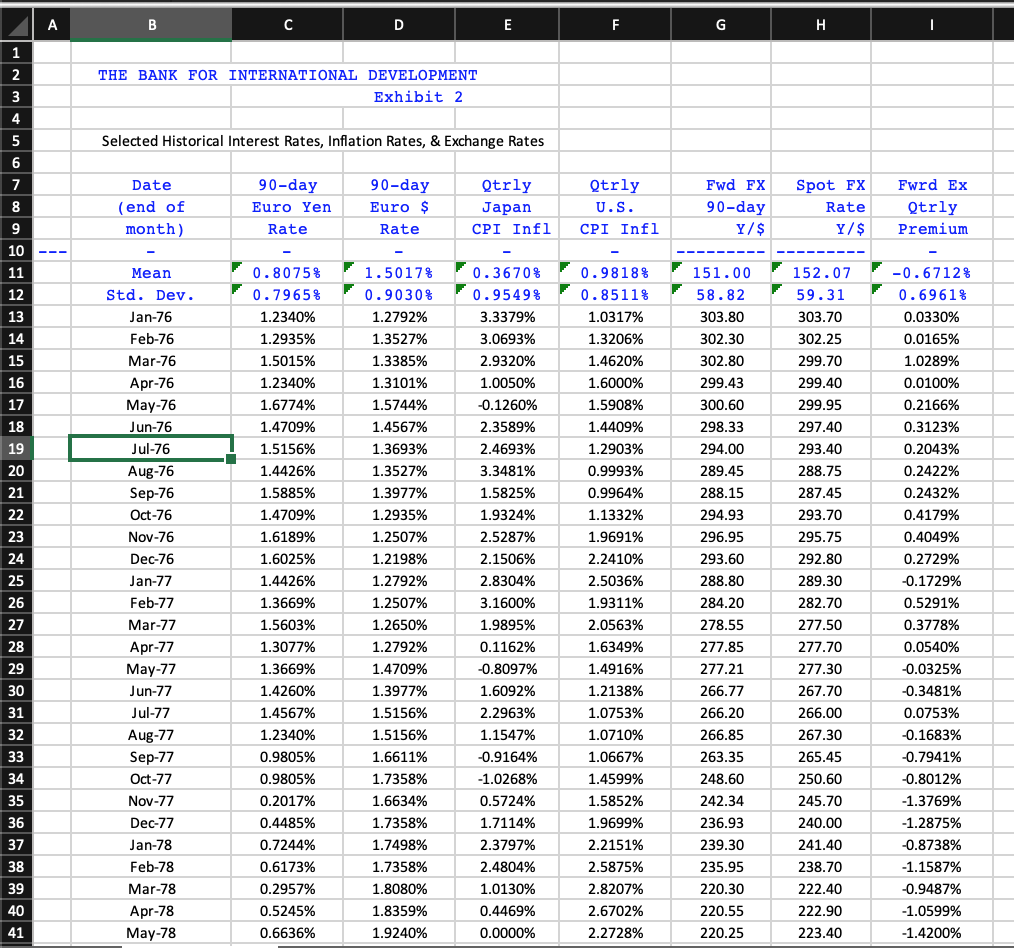

B D E F G H I 1 2 3 THE BANK FOR INTERNATIONAL DEVELOPMENT Exhibit 2 4 5 Selected Historical Interest Rates, Inflation Rates, & Exchange Rates 6 7 8 Date (end of month) 90-day Euro Yen Rate 90-day Euro $ Rate Qtrly Japan CPI Infl Qtrly U.S. CPI Infl Fwd FX 90-day Y/$ Spot FX Rate Y/$ Fwrd Ex Qtrly Premium 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 Mean Std. Dev. Jan-76 Feb-76 Mar-76 Apr-76 May-76 Jun-76 Jul-76 Aug-76 Sep-76 Oct-76 Nov-76 Dec-76 Jan-77 Feb-77 Mar-77 Apr-77 May-77 Jun-77 Jul-77 Aug-77 Sep-77 Oct-77 Nov-77 Dec-77 Jan-78 Feb-78 Mar-78 Apr-78 May-78 0.8075 % 0.7965% 1.2340% 1.2935% 1.5015% 1.2340% 1.6774% 1.4709% 1.5156% 1.4426% 1.5885% 1.4709% 1.6189% 1.6025% 1.4426% 1.3669% 1.5603% 1.3077% 1.3669% 1.4260% 1.4567% 1.2340% 0.9805% 0.9805% 0.2017% 0.4485% 0.7244% 0.6173% 0.2957% 0.5245% 0.6636% 1.5017% 0.9030% 1.2792% 1.3527% 1.3385% 1.3101% 1.5744% 1.4567% 1.3693% 1.3527% 1.3977% 1.2935% 1.2507% 1.2198% 1.2792% 1.2507% 1.2650% 1.2792% 1.4709% 1.3977% 1.5156% 1.5156% 1.6611% 1.7358% 1.6634% 1.7358% 1.7498% 1.7358% 1.8080% 1.8359% 1.9240% 0.36 70% 0.9549% 3.3379% 3.0693% 2.9320% 1.0050% -0.1260% 2.3589% 2.4693% 3.3481% 1.5825% 1.9324% 2.5287% 2.1506% 2.8304% 3.1600% 1.9895% 0.1162% -0.8097% 1.6092% 2.2963% 1.1547% -0.9164% -1.0268% 0.5724% 1.7114% 2.3797% 2.4804% 1.0130% 0.4469% 0.0000% 0.9818% 0.8511% 1.0317% 1.3206% 1.4620% 1.6000% 1.5908% 1.4409% 1.2903% 0.9993% 0.9964% 1.1332% 1.9691% 2.2410% 2.5036% 1.9311% 2.0563% 1.6349% 1.4916% 1.2138% 1.0753% 1.0710% 1.0667% 1.4599% 1.5852% 1.9699% 2.2151% 2.5875% 2.8207% 2.6702% 2.2728% 151.00 58.82 303.80 302.30 302.80 299.43 300.60 298.33 294.00 289.45 288.15 294.93 296.95 293.60 288.80 284.20 278.55 277.85 277.21 266.77 266.20 266.85 263.35 248.60 242.34 236.93 239.30 235.95 220.30 220.55 220.25 152.07 59.31 303.70 302.25 299.70 299.40 299.95 297.40 293.40 288.75 287.45 293.70 295.75 292.80 289.30 282.70 277.50 277.70 277.30 267.70 266.00 267.30 265.45 250.60 245.70 240.00 241.40 238.70 222.40 222.90 223.40 -0.67128 0.69618 0.0330% 0.0165% 1.0289% 0.0100% 0.2166% 0.3123% 0.2043% 0.2422% 0.2432% 0.4179% 0.4049% 0.2729% -0.1729% 0.5291% 0.3778% 0.0540% -0.0325% -0.3481% 0.0753% -0.1683% -0.7941% -0.8012% -1.3769% -1.2875% -0.8738% -1.1587% -0.9487% -1.0599% -1.4200% 41 B D E F G H I 1 2 3 THE BANK FOR INTERNATIONAL DEVELOPMENT Exhibit 2 4 5 Selected Historical Interest Rates, Inflation Rates, & Exchange Rates 6 7 8 Date (end of month) 90-day Euro Yen Rate 90-day Euro $ Rate Qtrly Japan CPI Infl Qtrly U.S. CPI Infl Fwd FX 90-day Y/$ Spot FX Rate Y/$ Fwrd Ex Qtrly Premium 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 Mean Std. Dev. Jan-76 Feb-76 Mar-76 Apr-76 May-76 Jun-76 Jul-76 Aug-76 Sep-76 Oct-76 Nov-76 Dec-76 Jan-77 Feb-77 Mar-77 Apr-77 May-77 Jun-77 Jul-77 Aug-77 Sep-77 Oct-77 Nov-77 Dec-77 Jan-78 Feb-78 Mar-78 Apr-78 May-78 0.8075 % 0.7965% 1.2340% 1.2935% 1.5015% 1.2340% 1.6774% 1.4709% 1.5156% 1.4426% 1.5885% 1.4709% 1.6189% 1.6025% 1.4426% 1.3669% 1.5603% 1.3077% 1.3669% 1.4260% 1.4567% 1.2340% 0.9805% 0.9805% 0.2017% 0.4485% 0.7244% 0.6173% 0.2957% 0.5245% 0.6636% 1.5017% 0.9030% 1.2792% 1.3527% 1.3385% 1.3101% 1.5744% 1.4567% 1.3693% 1.3527% 1.3977% 1.2935% 1.2507% 1.2198% 1.2792% 1.2507% 1.2650% 1.2792% 1.4709% 1.3977% 1.5156% 1.5156% 1.6611% 1.7358% 1.6634% 1.7358% 1.7498% 1.7358% 1.8080% 1.8359% 1.9240% 0.36 70% 0.9549% 3.3379% 3.0693% 2.9320% 1.0050% -0.1260% 2.3589% 2.4693% 3.3481% 1.5825% 1.9324% 2.5287% 2.1506% 2.8304% 3.1600% 1.9895% 0.1162% -0.8097% 1.6092% 2.2963% 1.1547% -0.9164% -1.0268% 0.5724% 1.7114% 2.3797% 2.4804% 1.0130% 0.4469% 0.0000% 0.9818% 0.8511% 1.0317% 1.3206% 1.4620% 1.6000% 1.5908% 1.4409% 1.2903% 0.9993% 0.9964% 1.1332% 1.9691% 2.2410% 2.5036% 1.9311% 2.0563% 1.6349% 1.4916% 1.2138% 1.0753% 1.0710% 1.0667% 1.4599% 1.5852% 1.9699% 2.2151% 2.5875% 2.8207% 2.6702% 2.2728% 151.00 58.82 303.80 302.30 302.80 299.43 300.60 298.33 294.00 289.45 288.15 294.93 296.95 293.60 288.80 284.20 278.55 277.85 277.21 266.77 266.20 266.85 263.35 248.60 242.34 236.93 239.30 235.95 220.30 220.55 220.25 152.07 59.31 303.70 302.25 299.70 299.40 299.95 297.40 293.40 288.75 287.45 293.70 295.75 292.80 289.30 282.70 277.50 277.70 277.30 267.70 266.00 267.30 265.45 250.60 245.70 240.00 241.40 238.70 222.40 222.90 223.40 -0.67128 0.69618 0.0330% 0.0165% 1.0289% 0.0100% 0.2166% 0.3123% 0.2043% 0.2422% 0.2432% 0.4179% 0.4049% 0.2729% -0.1729% 0.5291% 0.3778% 0.0540% -0.0325% -0.3481% 0.0753% -0.1683% -0.7941% -0.8012% -1.3769% -1.2875% -0.8738% -1.1587% -0.9487% -1.0599% -1.4200% 41