Answered step by step

Verified Expert Solution

Question

1 Approved Answer

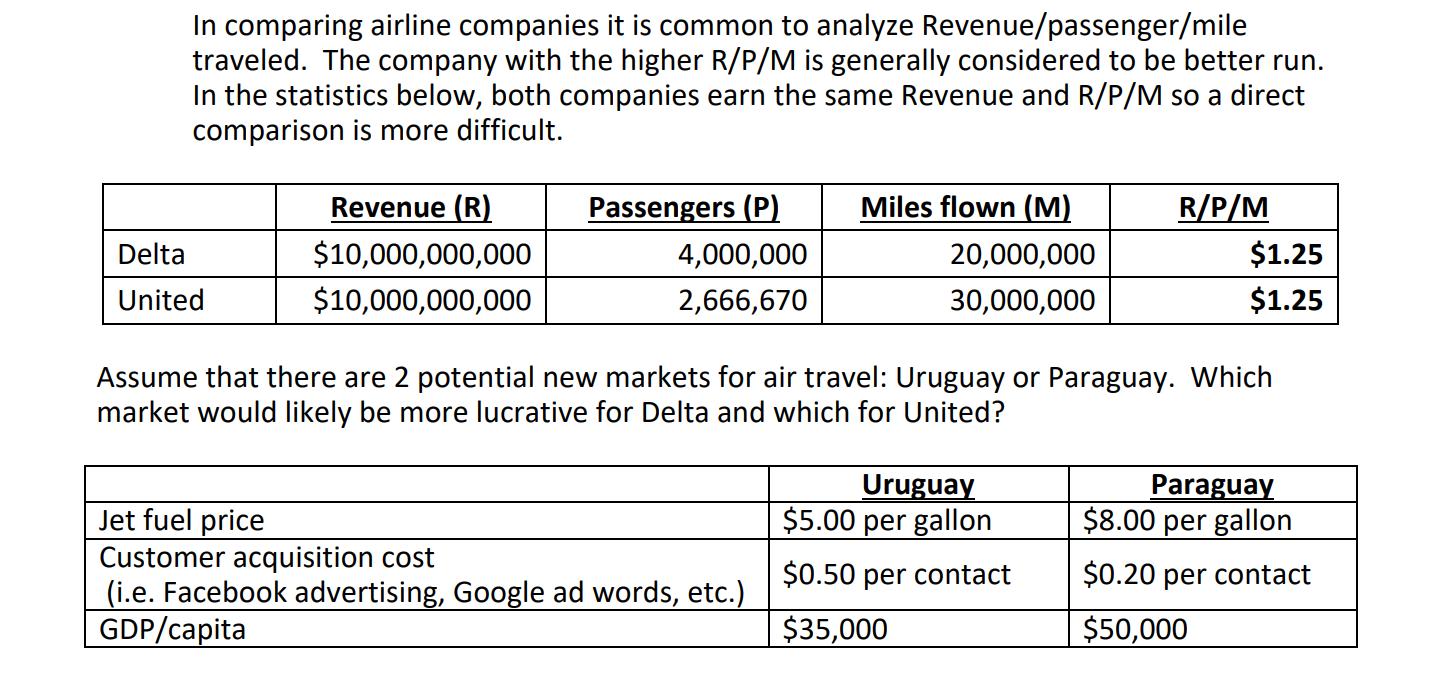

In comparing airline companies it is common to analyze Revenue/passenger/mile traveled. The company with the higher R/P/M is generally considered to be better run.

In comparing airline companies it is common to analyze Revenue/passenger/mile traveled. The company with the higher R/P/M is generally considered to be better run. In the statistics below, both companies earn the same Revenue and R/P/M so a direct comparison is more difficult. Delta United Revenue (R) $10,000,000,000 $10,000,000,000 Passengers (P) 4,000,000 2,666,670 Miles flown (M) Jet fuel price Customer acquisition cost (i.e. Facebook advertising, Google ad words, etc.) GDP/capita 20,000,000 30,000,000 R/P/M Assume that there are 2 potential new markets for air travel: Uruguay or Paraguay. Which market would likely be more lucrative for Delta and which for United? Uruguay $5.00 per gallon $0.50 per contact $35,000 $1.25 $1.25 Paraguay $8.00 per gallon $0.20 per contact $50,000

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Based on the data provided it seems that the market in Uruguay would likely be more lucrative for De...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started