Question

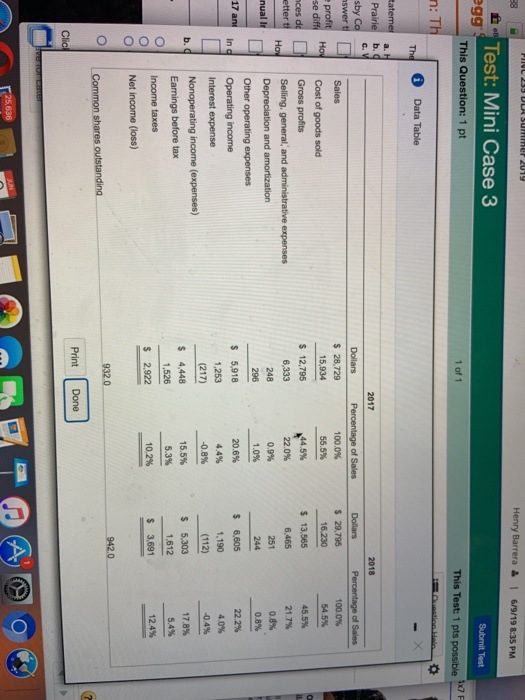

In comparing the percentage changes, all margins improved for Prairie Inc. only both Crosby Co. and Prairie Inc. Crosby Co. only . The increasing margins

In comparing the percentage changes, all margins improved for

Prairie Inc. only

both Crosby Co. and Prairie Inc.

Crosby Co. only

. The increasing margins were attributable to

the same amount of

higher

lower

cost of goods sold and

increases in

decreases in

the same amount of

operating expenses per dollar of sales. (Select from the drop-down menus.)

b. Compare the profit margins between Crosby Co. and Prairie Inc. Which of the following statements is not true?(Select the best choice below.)

A.

A comparison of profit margins between the two companies is not very insightful without looking at the percentage changes in margins.

B.

The operating profit margins are much closer, but are higher for Prairie Inc.

C.

Crosby Co.'s gross profit margins are about 1.5 times those of Prairie Inc., which indicates that Crosby Co.'s cost of goods sold per dollar of sales are much smaller than the case for Prairie Inc.

D.

Prairie Inc. has an advantage since its net profit margin is higher.

c. What differences do you notice in the common-sized balance sheets that might indicate that one of the firms is doing better than the other?(Select all that apply.)

A.

Prairie Inc. has a larger size when it comes to total assets. Furthermore, the relative make-up of the assets is fairly similar.

B.

Based on retained earnings, we see that Crosby Co. has about $86 billion in accumulated profits over the life of the business, while Prairie Inc. has accumulated profits of close to $47 billion.

C.

Crosby Co. has sold over $150 billion in common stock, compared to less than $34 billion by Prairie Inc.

D.

Time Warner relies more heavily on debt financing with a debt ratio of about 56 percent compared to approximately 44 percent for Walt Disney.

E.

Since Crosby Co. produces about $0.39 of sales per dollar of assets compared to Prairie Inc. generating about $0.55 of sales per dollar of assets, Prairie Inc. is clearly using its assets more efficiently than Crosby Co.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started