Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In December 1998, Mark Vadon, a young consultant, was shopping for an engagement ring and stumbled across a company called Internet Diamonds, run by Seattle

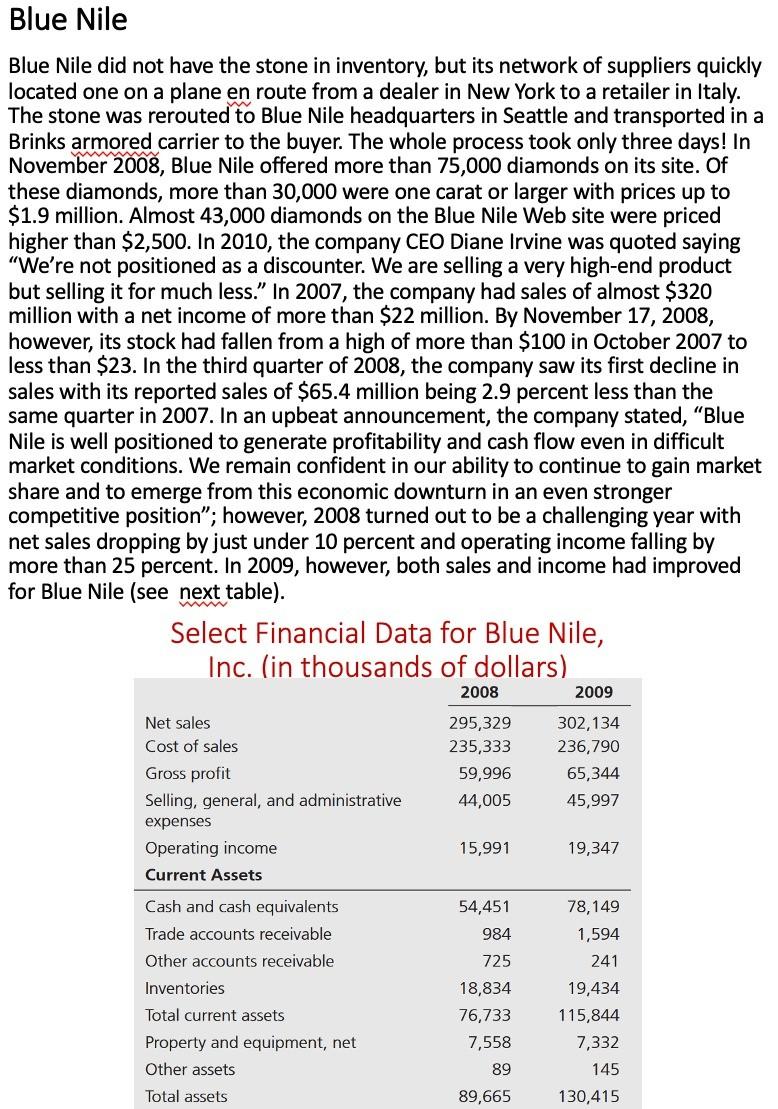

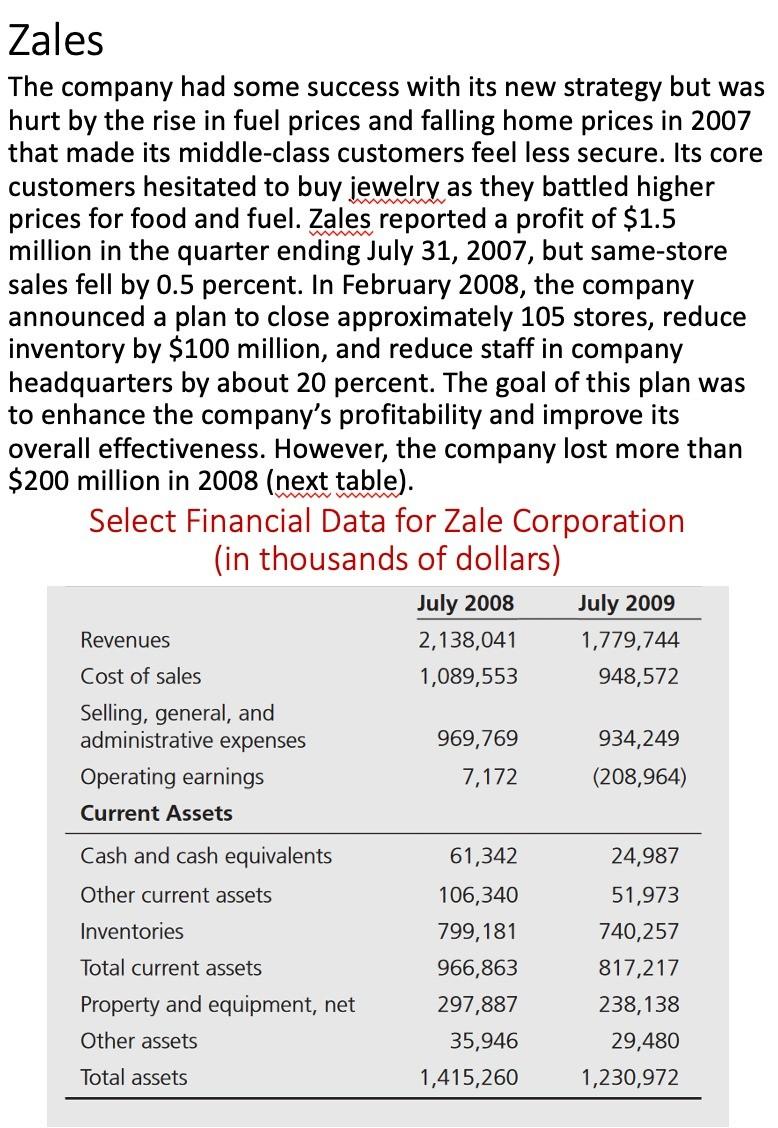

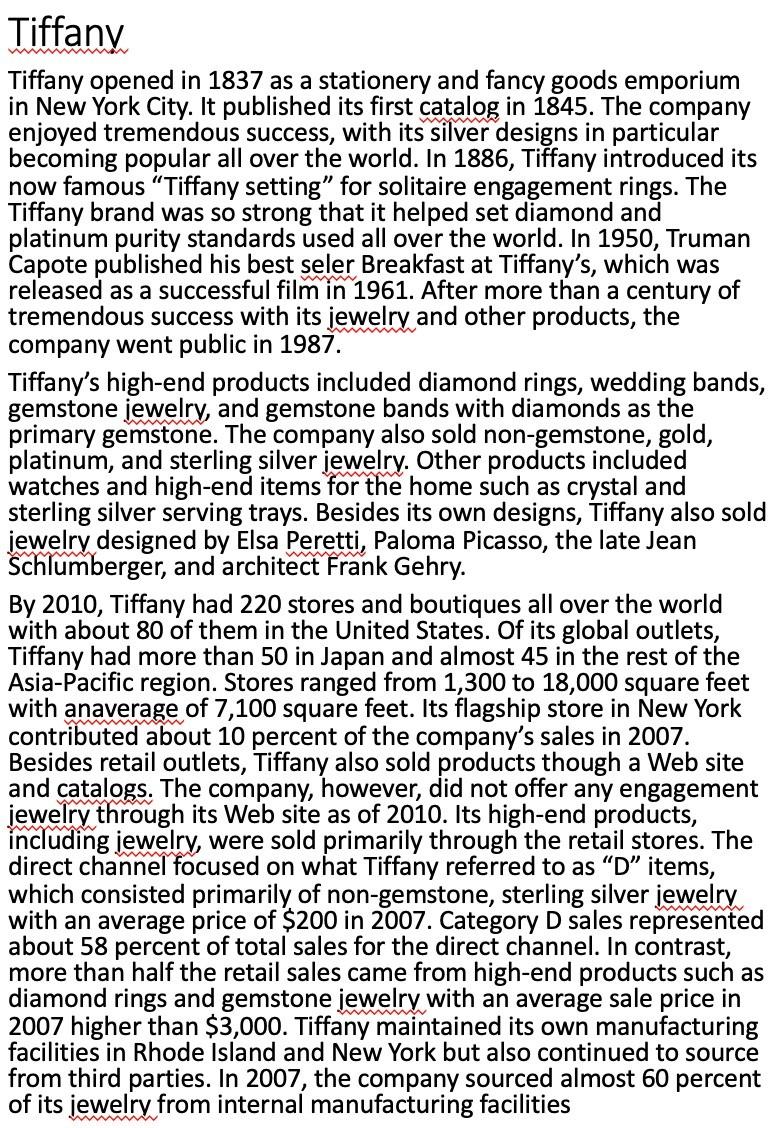

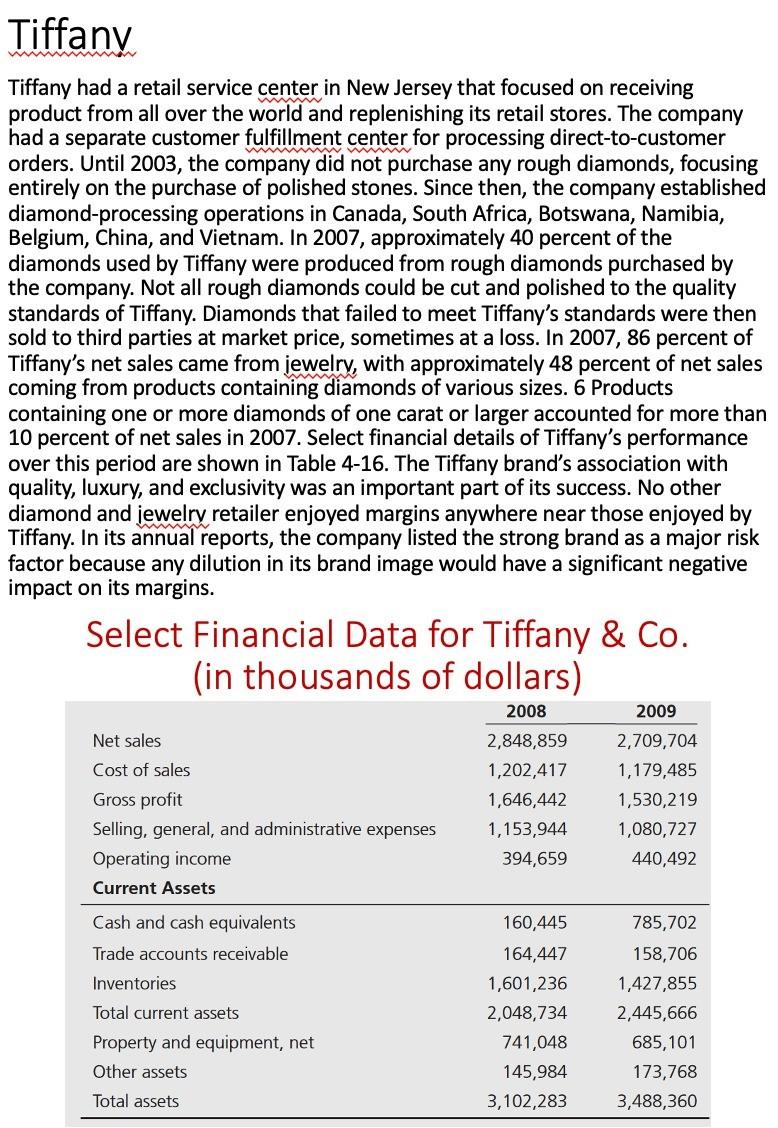

In December 1998, Mark Vadon, a young consultant, was shopping for an engagement ring and stumbled across a company called Internet Diamonds, run by Seattle jeweler Doug Williams. Vadon not only bought a ring but also went into businss with Williams in early 1999 . The company changed its name to Blue Nile by the end of 1999 because the new name "sounded elegant and upscale," according to Vadon. On its Web site, Blue Nile articulated its philosophy as follows: "Offerr high-quality diamonds and fine jewelry at outstanding prices. When you visit our Web site, you'll find extraordnary jewelrv, useful guidance, and easy-to-understand jewelrv education that's perfect for your occasion." Many customers (especially men) liked the lowpressure selling tactics that focused on education. Besides explaining the four Cs-cut, color, clarity, and carat-Blue Nile allowed customers to "build your own ring.' Starting with the cut they preferred, customers could determine ranges along each of the four C and price. Blue Nile then displayed all stones in inventory that fit the customer's desired profile. Customers selected the stone of their choice, followed by the setting they liked best. Blue Nile also allowed customers to have their questions resolved on the phone by sales reps who did not work on commission. This low-pressure selling approach had great appeal to a segment of the population. In a BusinessWeek article 3 in 2008, Web entrepreneur Jason Calacanis was quoted as saying that shopping for his engagement ring (for which he spent "tens of thousands of dollars") on Blue Nile "was the best shopping. experience he never had." The company focused on providing good value to its customers. Whereas retail jewelers routinely marked up diamonds by up to 50 percent, Blue Nile kept a lower markup of 20 to 30 percent. Blue Nile believed that it could afford the lower markup because of lower inventory and warehousing expense. Unlike jewelry retailers who maintained stores in highpriced areas, Blue Nile had a single warehouse in the United States where it stocked its entire inventory. The company strategy was not without hurdles because some customers did not care as much about under-pricing the competition. For example, some customers preferred "a piece of fine jewelry in a robin's egg blue box with Tiffany on it" 4 to getting a price discount. Also, it was not entirely clear that customers would be willing to spend thousands of dollars on an item they had not seen or touched. To counter this issue, Blue Nile offered a 30-day money back guarantee on items in original condition. In 2007, the company launched Web sites in Canada and the United Kingdom and opened an office in Dublin with local customer service and fulfillment operations. The Dublin office offered free shipping to several countries 'in Western Europe. The U.S. facility handled international shipping to some countries in the Asia-Pacific region. International sales had increased from \$17 million in 2007 to more than $33 million in 2009 despite poor economic conditions. By 2007, Blue Nile had sold more than 70,000 rings larger than a carat with 25 orders totaling more than $100,000. In June 2007, the company sold a single diamond for \$1.5 million. Forbes called it perhaps "the largest consumer purchase in Web history-and also the most unlikely." The stone, larger than 10 carats, had a diameter roughly the size of a penny. CASE STUDY. Blue Nile and Diamond Retailing A customer walks into your jewelry store with printouts of diamond selections from Blue Nile, a company that is the largest retailer of diamonds online. The list price for the customer's desired diamond is only $100 above your total cost for a stone of the same characteristics. Do you let the customer walk or come down in price to compete? This is a dilemma that has faced many jewelers. Some argue that jewelers should lower prices on Stones to keep the customer. Future sales and add-on sales such as custom designs, mountings, and repairs can then be used to make additional margins. Others argue that cutting prices to compete sends a negative signal to loyal customers from the past who may be upset by the fact that they were not given the best price. As the economy tightened during the holiday season of 2007, the differences in performance between Blue Nile and bricks-andmortar retailers were startling. In January 2008, Blue Nile reported a 24 percent jump in sales during its fourth quarter. For the same quarter, Tiffany posted a 2 percent drop in domestic same-store sales, and Zales reported a 9 percent drop. The chief operating officer of Blue Nile, Diane Irvine,' stated, "This business is all about taking market share. We look at this type of environment as one of opportunity." The Diamond Retailing Industry in 2008 For both wholesalers and retailers in the diamond industry, 2008 was turning into a very difficult year. It was so bad at the supply end that the dealers' trade association, the World Federation of Diamond Bourses, issued an appeal for the diamond producers to reduce the supply of new gems entering the market in an effort to reduce supply. However, the world's largest producer, De Beers, appeared unmoved, refusing to give any commitment to curtail production. The company had recently opened the Voorspoed mine in South Africa, which, when fully operational, could add 800,000 carts a year into an already oversupplied market. Historically, De Beers had exerted tremendous control over the supply of diamonds, going so far as to purchase large quantities of rough diamonds from other producers. In 2005, the European Commission forced De Beers to phase out its agreement to buy diamonds from ALROSA, the world's second largest diamond producer, which accounted for most of the diamond production in Russia. Russia was the second largest producer of diamonds in the world after Botswana. While discount retailers such as Wal-Mart and Costco continued to thrive, the situation was difficult for traditional jewelry retailers. Friedman's filed bankruptcy protection in January 2008, followed by Chicago-based Whitehall in June. When it filed for bankruptcy, Friedman was the third largest jewelry chain in North America with 455 stores, while Whitehall ranked fifth with 375 stores in April 2008. In February 2008, Zales announced a plan to close more than 100 stores in 2008. This shakeup offered an opportunity for other players to move in and try to gain market share. With the weakening economy, the third and fourth quarters of 2008 were particularly hard on diamond retailers. Even historically successful players like Blue Nile, Tiffany, and Zales saw a decline in sales and a significant drop in their share price. As customers tightened their belts and cut back on discretionary spending, high-cost purchases such as diamond jewelry were often the first to be postponed. The situation worsened as competition for the shrinking number of customers became fiercer. In such a difficult environment, it was hard to judge which factors could best help different jewelry retailers succeed. Blue Nile Blue Nile did not have the stone in inventory, but its network of suppliers quickly located one on a plane en route from a dealer in New York to a retailer in Italy. The stone was rerouted to Blue Nile headquarters in Seattle and transported in a Brinks armored carrier to the buyer. The whole process took only three days! In November 2008, Blue Nile offered more than 75,000 diamonds on its site. Of these diamonds, more than 30,000 were one carat or larger with prices up to \$1.9 million. Almost 43,000 diamonds on the Blue Nile Web site were priced higher than $2,500. In 2010 , the company CEO Diane Irvine was quoted saying "We're not positioned as a discounter. We are selling a very high-end product but selling it for much less." In 2007, the company had sales of almost $320 million with a net income of more than $22 million. By November 17, 2008, however, its stock had fallen from a high of more than $100 in October 2007 to less than $23. In the third quarter of 2008 , the company saw its first decline in sales with its reported sales of $65.4 million being 2.9 percent less than the same quarter in 2007. In an upbeat announcement, the company stated, "Blue Nile is well positioned to generate profitability and cash flow even in difficult market conditions. We remain confident in our ability to continue to gain market share and to emerge from this economic downturn in an even stronger competitive position"; however, 2008 turned out to be a challenging year with net sales dropping by just under 10 percent and operating income falling by more than 25 percent. In 2009 , however, both sales and income had improved for Blue Nile (see next table). Select Financial Data for Blue Nile, Inc. (in thousands of dollars) The first Zales Jewelers was established by Morris (M. B.) Zale, William Zale, and Ben Lipshy in 1924. Their marketing strategy was to offer a credit pln of "a penny down and a dollar a week." Their success allowed them to grow to 12 stores in Oklahoma and Texas by 1941. Over the next four decades, the company grew to hundreds of stores by buying up other stores and smaller chains. In 1986, the company was purchased in a leveraged buyout by Peoples Jewelers of Canada and Swarovski International. In 1992, its debt pushed Zales bankruptcy for a year. It became a public company again in that decade and operated nearly 2,400 stores by 2005. The company's divisions included Piercing Pagoda, which ran mall-based kiosks selling jewelry to teenagers; Zales Jewelers, which sold diamond jewelry for working-class mall shoppers; and the upscale Gordon's. Bailey Banks \& Biddle Fine Jewelers, which offered even pricier products out of fancier malls, was sold by Zale in November 2007. Three years of declining market share, lost mostly to discounters such as Wal-Mart and Costco, put pressure on Zales to decide on a makeover by 2005 . Zales dumped the lower value 10karat gold jewelry and modest quality diamonds. The goal was to make the jeweler more upscale and fashion conscious, moving away from its promotion-driven, lower end reputation. Unfortunately, the move was a disaster. There were delays in bringing in new merchandise, and same-store sales dropped. The company lost many of its traditional customers without winning the new ones it desired. It was soon passed by Akron, Ohio-based Sterling (a subsidiary of the Signet Group) as the largest jeweler in the United States. The chief executive officer of Zale Corporation was forced to resign by early 2006. In August 2006, under a new CEO, Zales started a transition to return to its role as a promotional retailer focused on diamond fashion jewelry and diamond rings. The transition involved selling nearly $50 million in discontinued inventory from its upscale strategy and an expenditure of $120 million on new inventory. As a result of the inventory write-downs, Zales lost \$26.4 million in its quarter ending July 31, 2006. Zales The company had some success with its new strategy but was hurt by the rise in fuel prices and falling home prices in 2007 that made its middle-class customers feel less secure. Its core customers hesitated to buy jewelry as they battled higher prices for food and fuel. Zales reported a profit of $1.5 million in the quarter ending July 31, 2007, but same-store sales fell by 0.5 percent. In February 2008, the company announced a plan to close approximately 105 stores, reduce inventory by $100 million, and reduce staff in company headquarters by about 20 percent. The goal of this plan was to enhance the company's profitability and improve its overall effectiveness. However, the company lost more than \$200 million in 2008 (next table). Select Financial Data for Zale Corporation (in thousands of dollars) Tiffany Tiffany opened in 1837 as a stationery and fancy goods emporium in New York City. It published its first catalog in 1845 . The company enjoyed tremendous success, with its silver designs in particular becoming popular all over the world. In 1886, Tiffany introduced its now famous "Tiffany setting" for solitaire engagement rings. The Tiffany brand was so strong that it helped set diamond and platinum purity standards used all over the world. In 1950, Truman Capote published his best seler Breakfast at Tiffany's, which was released as a successful film in 1961. After more than a century of tremendous success with its jewelrv and other products, the company went public in 1987. Tiffany's high-end products included diamond rings, wedding bands, gemstone jewelry, and gemstone bands with diamonds as the primary gemstone. The company also sold non-gemstone, gold, platinum, and sterling silver jewelry. Other products included watches and high-end items for the home such as crystal and sterling silver serving trays. Besides its own designs, Tiffany also sold jewelry designed by Elsa Peretti, Paloma Picasso, the late Jean Schlumberger, and architect Frank Gehry. By 2010, Tiffany had 220 stores and boutiques all over the world with about 80 of them in the United States. Of its global outlets, Tiffany had more than 50 in Japan and almost 45 in the rest of the Asia-Pacific region. Stores ranged from 1,300 to 18,000 square feet with anaverage of 7,100 square feet. Its flagship store in New York contributed about 10 percent of the company's sales in 2007. Besides retail outlets, Tiffany also sold products though a Web site and catalogs. The company, however, did not offer any engagement iewelry through its Web site as of 2010 . Its high-end products, including jewelry, were sold primarily through the retail stores. The direct channel focused on what Tiffany referred to as " D " items, which consisted primarily of non-gemstone, sterling silver jewelrv with an average price of $200 in 2007 . Category D sales represented about 58 percent of total sales for the direct channel. In contrast, more than half the retail sales came from high-end products such as diamond rings and gemstone jewelry with an average sale price in 2007 higher than $3,000. Tiffany maintained its own manufacturing facilities in Rhode Island and New York but also continued to source from third parties. In 2007, the company sourced almost 60 percent of its jewelrv from internal manufacturing facilities Tiftany Tiffany had a retail service center in New Jersey that focused on receiving product from all over the world and replenishing its retail stores. The company had a separate customer fulfillment center for processing direct-to-customer orders. Until 2003, the company did not purchase any rough diamonds, focusing entirely on the purchase of polished stones. Since then, the company established diamond-processing operations in Canada, South Africa, Botswana, Namibia, Belgium, China, and Vietnam. In 2007, approximately 40 percent of the diamonds used by Tiffany were produced from rough diamonds purchased by the company. Not all rough diamonds could be cut and polished to the quality standards of Tiffany. Diamonds that failed to meet Tiffany's standards were then sold to third parties at market price, sometimes at a loss. In 2007, 86 percent of Tiffany's net sales came from jewelrv, with approximately 48 percent of net sales coming from products containing diamonds of various sizes. 6 Products containing one or more diamonds of one carat or larger accounted for more than 10 percent of net sales in 2007. Select financial details of Tiffany's performance over this period are shown in Table 4-16. The Tiffany brand's association with quality, luxury, and exclusivity was an important part of its success. No other diamond and jewelry retailer enjoyed margins anywhere near those enjoyed by Tiffany. In its annual reports, the company listed the strong brand as a major risk factor because any dilution in its brand image would have a significant negative impact on its margins. Select Financial Data for Tiffany \& Co. (in thousands of dollars) Study Questions 1. What are some key success factors in diamond retailing? How do Blue Nile, Zales, and Tiffany compare on those dimensions? 2. What do you think of the fact that Blue Nile carries more than 30,000 stones priced at $2,500 or higher while almost 60 percent of the products sold from the Tiffany Web site are priced at around $200 ? Which of the two product categories is better suited to the strengths of the online channel? 3. What do you think of Tiffany's decision to not sell diamonds online? 4. Given that Tiffany stores have thrived with their focus on selling high-end jewelry, what do you think caused the failure of Zales with its upscale strategy in 2006 ? 5. Which of the three companies do you think is best structured to deal with weak economic times? 6. What advice would you give to each of the three companies regarding its strategy and structure

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started