Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In December 2018, you joined as the Managing Partner in taxation for Wilson & Partners, CPA, a local CPA firm which offers audit and

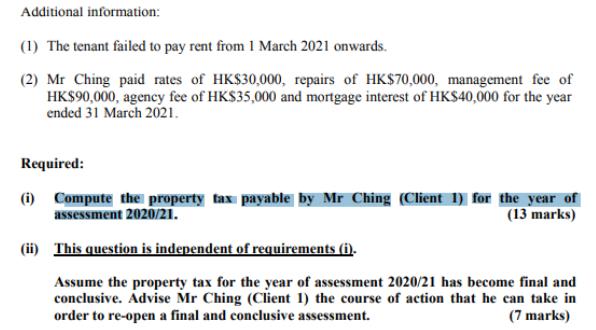

In December 2018, you joined as the Managing Partner in taxation for Wilson & Partners, CPA, a local CPA firm which offers audit and taxation services for clients in Hong Kong. The following clients came to seek your advice on tax this week. Client 1 - Mr Ching Mr Ching, a Hong Kong permanent resident, has been retired since 2018. He owns a block of village house in Yuen Long which is leased to a tenant on a fully furnished basis under the following terms: Lease term: Monthly rental: Rental deposit: Service charge: 1 April 2020 to 31 March 2022 $70,000, payable in advance $140,000 paid on 1 April 2020. The rental deposit is returnable to the tenant after deduction of any loss of revenue as a result of default by the tenant. $50,000 per annum for the use of the furniture as per the lease agreement, paid on 1 April 2020. Management fee: $7,500 per month, payable by landlord Additional information: (1) The tenant failed to pay rent from 1 March 2021 onwards. (2) Mr Ching paid rates of HK$30,000, repairs of HK$70,000, management fee of HK$90,000, agency fee of HK$35,000 and mortgage interest of HK$40,000 for the year ended 31 March 2021. Required: (i) Compute the property tax payable by Mr Ching (Client 1) for the year of assessment 2020/21. (13 marks) (ii) This question is independent of requirements (i). Assume the property tax for the year of assessment 2020/21 has become final and conclusive. Advise Mr Ching (Client 1) the course of action that he can take in order to re-open a final and conclusive assessment. (7 marks)

Step by Step Solution

★★★★★

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

i Property Tax Payable by Mr Ching Client 1 for the Year of Assessment 202021 Property Tax Computati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started