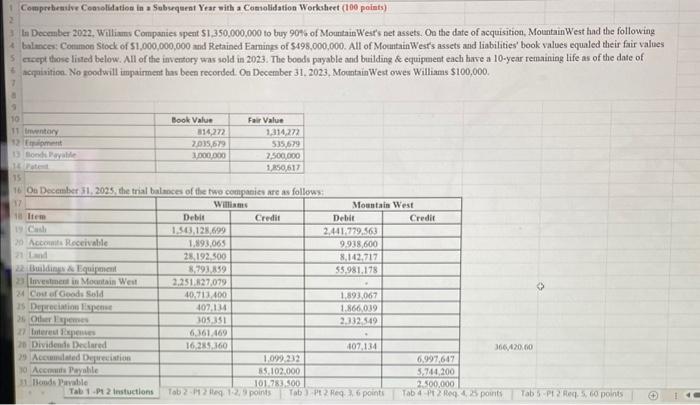

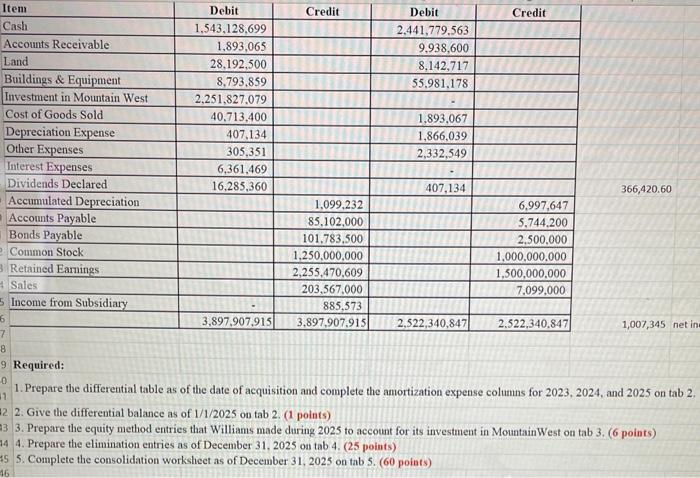

In December 2022. Williams Companies spent 51,350,000,000 to buy 907 of MountainWear's net assets. On the date of acquisition, Mountain West had the following balmee: Comamon Stock of 51,000,000,000 and Retained Eamines of 5498,000,000. All of MocutainWest's assets and liabilities' book values equaled their fair values ereept thase lined below. All of the inventory was sold in 2023 . The boods payable and buildinz \&e equiprnent each have a 10 -year remaining life as of the date of acrainition. No ropdwill impairment has been recorded On December 31. 2023. MountainWeat owes Williams $100,000. 1. Prepare the differential table as of the date of acquisition and complete the amortization expense columns for 2023, 2024, and 2025 on tab 2 . 2. Give the differential balance as of 1/1/2025 on tab 2. (1 points) 3. Prepare the equity method entries that Williams made during 2025 to account for its investment in MountainWest on tab 3. (6 points) 4. Prepare the elimination entries as of December 31,2025 on tab 4. (25 points) 5. Complete the consolidation worksheet as of December 31, 2025 on tab 5. ( 60 points) In December 2022. Williams Companies spent 51,350,000,000 to buy 907 of MountainWear's net assets. On the date of acquisition, Mountain West had the following balmee: Comamon Stock of 51,000,000,000 and Retained Eamines of 5498,000,000. All of MocutainWest's assets and liabilities' book values equaled their fair values ereept thase lined below. All of the inventory was sold in 2023 . The boods payable and buildinz \&e equiprnent each have a 10 -year remaining life as of the date of acrainition. No ropdwill impairment has been recorded On December 31. 2023. MountainWeat owes Williams $100,000. 1. Prepare the differential table as of the date of acquisition and complete the amortization expense columns for 2023, 2024, and 2025 on tab 2 . 2. Give the differential balance as of 1/1/2025 on tab 2. (1 points) 3. Prepare the equity method entries that Williams made during 2025 to account for its investment in MountainWest on tab 3. (6 points) 4. Prepare the elimination entries as of December 31,2025 on tab 4. (25 points) 5. Complete the consolidation worksheet as of December 31, 2025 on tab 5. ( 60 points)