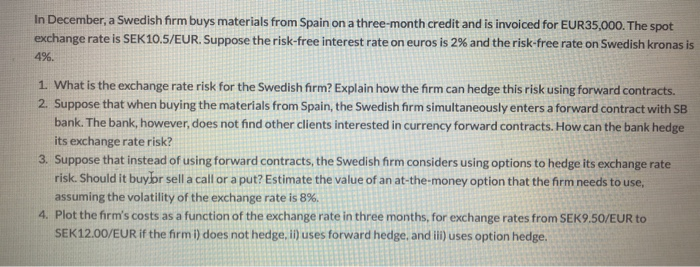

In December, a Swedish firm buys materials from Spain on a three-month credit and is invoiced for EUR35,000. The spot exchange rate is SEK10.5/EUR. Suppose the risk-free interest rate on euros is 2% and the risk-free rate on Swedish kronas is 4%. 1. What is the exchange rate risk for the Swedish firm? Explain how the firm can hedge this risk using forward contracts. 2. Suppose that when buying the materials from Spain, the Swedish firm simultaneously enters a forward contract with SB bank. The bank, however, does not find other clients interested in currency forward contracts. How can the bank hedge its exchange rate risk? 3. Suppose that instead of using forward contracts, the Swedish firm considers using options to hedge its exchange rate risk. Should it buy br sell a call or a put? Estimate the value of an at-the-money option that the firm needs to use, assuming the volatility of the exchange rate is 8%. 4. Plot the firm's costs as a function of the exchange rate in three months, for exchange rates from SEK9.50/EUR to SEK12.00/EUR if the firm 1) does not hedge, ii) uses forward hedge, and ill) uses option hedge. In December, a Swedish firm buys materials from Spain on a three-month credit and is invoiced for EUR35,000. The spot exchange rate is SEK10.5/EUR. Suppose the risk-free interest rate on euros is 2% and the risk-free rate on Swedish kronas is 4%. 1. What is the exchange rate risk for the Swedish firm? Explain how the firm can hedge this risk using forward contracts. 2. Suppose that when buying the materials from Spain, the Swedish firm simultaneously enters a forward contract with SB bank. The bank, however, does not find other clients interested in currency forward contracts. How can the bank hedge its exchange rate risk? 3. Suppose that instead of using forward contracts, the Swedish firm considers using options to hedge its exchange rate risk. Should it buy br sell a call or a put? Estimate the value of an at-the-money option that the firm needs to use, assuming the volatility of the exchange rate is 8%. 4. Plot the firm's costs as a function of the exchange rate in three months, for exchange rates from SEK9.50/EUR to SEK12.00/EUR if the firm 1) does not hedge, ii) uses forward hedge, and ill) uses option hedge