Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In detail show and explain all steps (10 points) The Boggs Machine Tool Company needs a pressing machine for three years One alternative is to

In detail show and explain all steps

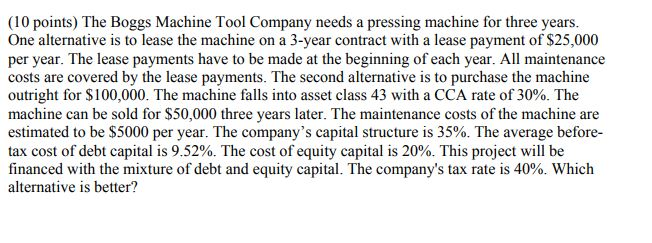

(10 points) The Boggs Machine Tool Company needs a pressing machine for three years One alternative is to lease the machine on a 3-year contract with a lease payment of $25,000 per year. The lease payments have to be made at the beginning of each year. All maintenance costs are covered by the lease payments. The second alternative is to purchase the machine outright for $100,000. The machine falls into asset class 43 with a CCA rate of 30%. The machine can be sold for $50,000 three years later. The maintenance costs of the machine are estimated to be $5000 per year. The company's capital structure is 35%. The average before- tax cost of debt capital is 9.52%. The cost of equity capital is 20%. This project will be financed with the mixture of debt and equity capital. The company's tax rate is 40%. Which alternative is betterStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started