Answered step by step

Verified Expert Solution

Question

1 Approved Answer

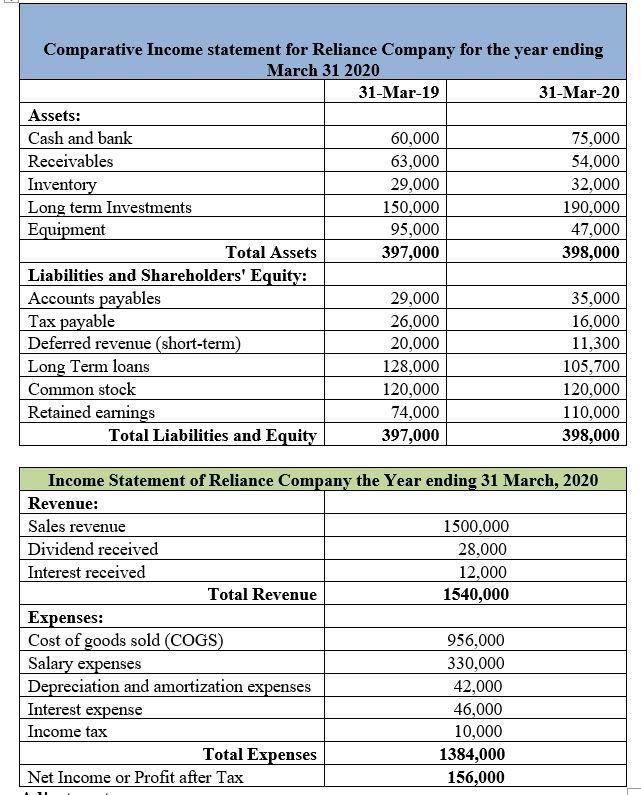

In direct method cash flow statement With the help of the following comparative balance sheet, income statement and additional information of Reliance Company, you are

In direct method cash flow statement With the help of the following comparative balance sheet, income statement and additional information of Reliance Company, you are required to prepare In Direct method Cash flow statement of Reliance company for the year ended March 31st 2020.

Adjustments:

During the year 2019-20, long-term investments worth of Rs 40,000 are purchased by paying cash.

During the year 2019-20, equipment with a net book value of Rs 6,000 is sold at cost.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started