Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In doing a five-year analysis of future dividends, the Dawson Corporation is considering the following two plans. The values represent dividends per share. Use

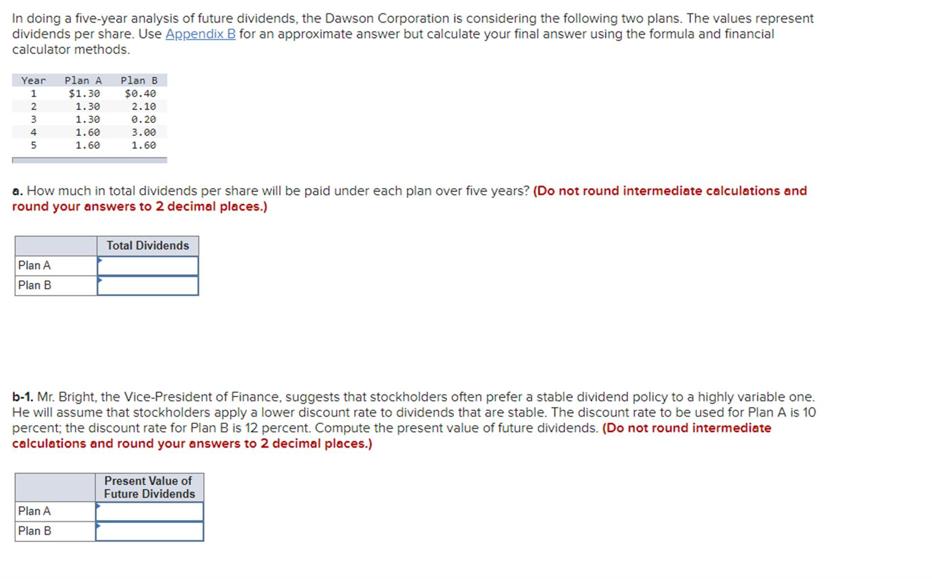

In doing a five-year analysis of future dividends, the Dawson Corporation is considering the following two plans. The values represent dividends per share. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. Year Plan A Plan B 1 $1.30 $0.40 1.30 2.10 1.30 0.20 1.60 3.00 1.60 1.60 2 3 4 a. How much in total dividends per share will be paid under each plan over five years? (Do not round intermediate calculations and round your answers to 2 decimal places.) Plan A Plan B Total Dividends b-1. Mr. Bright, the Vice-President of Finance, suggests that stockholders often prefer a stable dividend policy to a highly variable one. He will assume that stockholders apply a lower discount rate to dividends that are stable. The discount rate to be used for Plan A is 10 percent; the discount rate for Plan B is 12 percent. Compute the present value of future dividends. (Do not round intermediate calculations and round your answers to 2 decimal places.) Plan A Plan B Present Value of Future Dividends

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the total dividends per share over five years for each plan we simply need to sum up th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started