Answered step by step

Verified Expert Solution

Question

1 Approved Answer

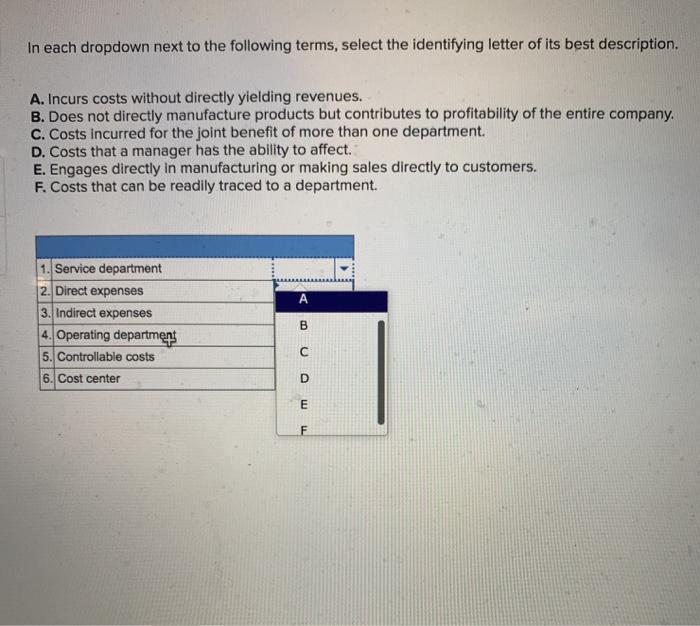

In each dropdown next to the following terms, select the identifying letter of its best description. A. Incurs costs without directly yielding revenues. B.

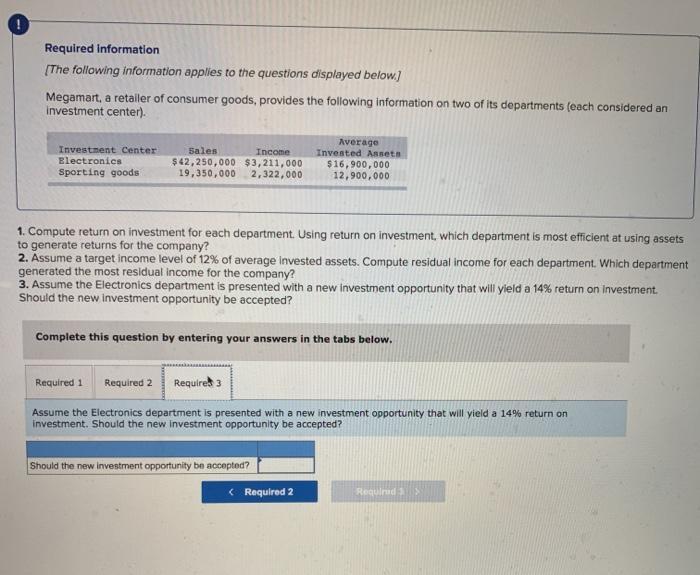

In each dropdown next to the following terms, select the identifying letter of its best description. A. Incurs costs without directly yielding revenues. B. Does not directly manufacture products but contributes to profitability of the entire company. C. Costs incurred for the joint benefit of more than one department. D. Costs that a manager has the ability to affect. E. Engages directly in manufacturing or making sales directly to customers. F. Costs that can be readily traced to a department. 1. Service department 2. Direct expenses 3. Indirect expenses 4. Operating department 5. Controllable costs 6. Cost center A B C D E F Required Information [The following information applies to the questions displayed below] Megamart, a retailer of consumer goods, provides the following information on two of its departments (each considered an investment center). Investment Center Electronics Sporting goods Sales $42,250,000 Income $3,211,000 19,350,000 2,322,000 1. Compute return on investment for each department. Using return on investment, which department is most efficient at using assets to generate returns for the company? 2. Assume a target income level of 12% of average invested assets. Compute residual income for each dep tment. Which department generated the most residual income for the company? 3. Assume the Electronics department is presented with a new investment opportunity that will yield a 14% return on investment. Should the new investment opportunity be accepted? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute return on investment for each department. Using return on investment, which department is most efficient at using assets to generate returns for the company? Choose Numerator Average Invested Assets $16,900,000 12,900,000 Return on investment / Choose Denominator Electronics Sporting Goods Which department is most efficient at using assets to generate returns for the company? Required 1 Return on Investment Return on Investment Required 2 > Required information [The following information applies to the questions displayed below.) Megamart, a retailer of consumer goods, provides the following information on two of its departments (each considered an investment center). Investment Center. Electronics Sporting goods Sales $42,250,000 19,350,000 Income $3,211,000. 2,322,000 1. Compute return on investment for each department. Using return on investment, which department is most efficient at using assets to generate returns for the company? 2. Assume a target income level of 12% of average invested assets. Compute residual income for each department. Which department generated the most residual Income for the company? 3. Assume the Electronics department is presented with a new investment opportunity that will yield a 14% return on investment. Should the new investment opportunity be accepted? Net income Target net income Residual income Complete this question by entering your answers in the tabs below. Average Invested Assets) $16,900,000 12,900,000 Required 1 Required 2 Required 3 Assume a target income level of 12% of average invested assets. Compute residual income for each department. Which department generated the most residual income for the company? Investment Center Electronics Sporting Goods Which department is most efficient at using assets to generate returns for the company? < Required 1 Required 3 > Required information [The following information applies to the questions displayed below] Megamart, a retailer of consumer goods, provides the following information on two of its departments (each considered an investment center). Investment Center Electronics Sporting goods Income Sales $42,250,000 $3,211,000 19,350,000 2,322,000 Average 1. Compute return on investment for each department. Using return on investment, which department is most efficient at using assets to generate returns for the company? 2. Assume a target income level of 12% of average invested assets. Compute residual income for each department. Which department generated the most residual income for the company? Invested Assets $16,900,000 12,900,000 3. Assume the Electronics department is presented with a new investment opportunity that will yield a 14% return on investment. Should the new investment opportunity be accepted? Complete this question by entering your answers in the tabs below. Should the new investment opportunity be accepted? Required 1 Required 2 Requires 3 Assume the Electronics department is presented with a new investment opportunity that will yield a 14% return on investment. Should the new investment opportunity be accepted? < Required 2 Required S

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started