Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In each of February 2005, 2006 and 2007, Lyle made an annual contribution of $6,750 into a spousal RRSP. He did not make any

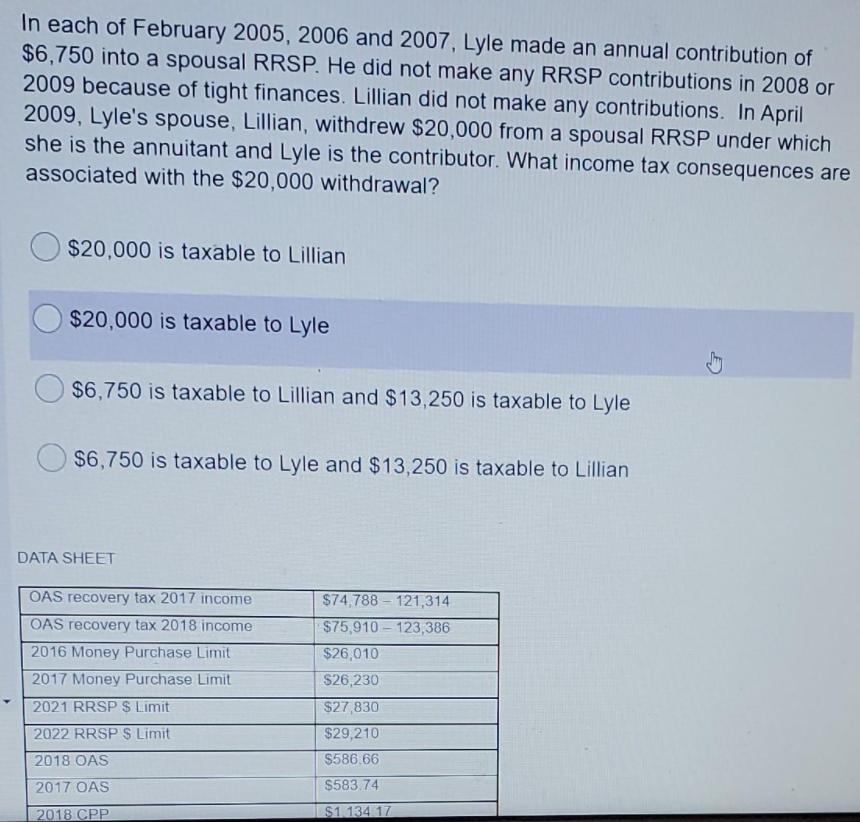

In each of February 2005, 2006 and 2007, Lyle made an annual contribution of $6,750 into a spousal RRSP. He did not make any RRSP contributions in 2008 or 2009 because of tight finances. Lillian did not make any contributions. In April 2009, Lyle's spouse, Lillian, withdrew $20,000 from a spousal RRSP under which she is the annuitant and Lyle is the contributor. What income tax consequences are associated with the $20,000 withdrawal? $20,000 is taxable to Lillian $20,000 is taxable to Lyle $6,750 is taxable to Lillian and $13,250 is taxable to Lyle $6,750 is taxable to Lyle and $13,250 is taxable to Lillian DATA SHEET OAS recovery tax 2017 income $74,788 - 121,314 OAS recovery tax 2018 income $75,910 - 123,386 2016 Money Purchase Limit $26,010 2017 Money Purchase Limit S26,230 2021 RRSP$ Limit $27,830 2022 RRSP $ Limit $29,210 2018 OAS $586.66 2017 OAS $583 74 2018 CPP $1.134 17

Step by Step Solution

★★★★★

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Answer The term revenue enhancement refers to a kind of tax t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started