Answered step by step

Verified Expert Solution

Question

1 Approved Answer

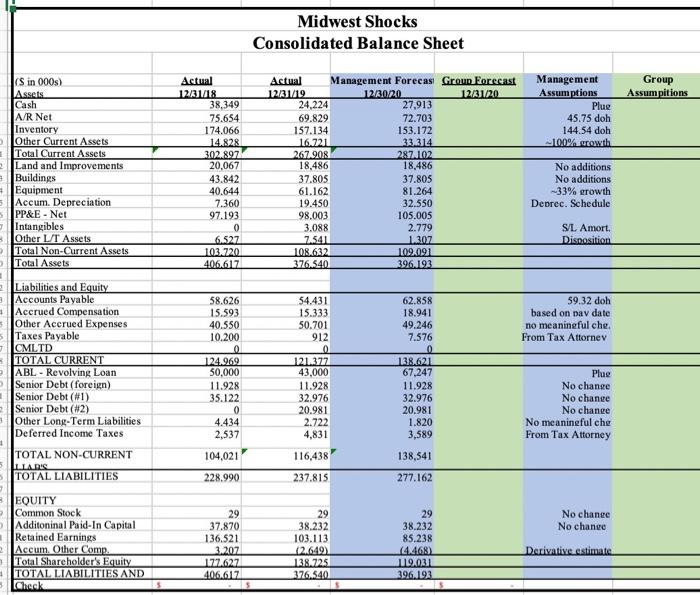

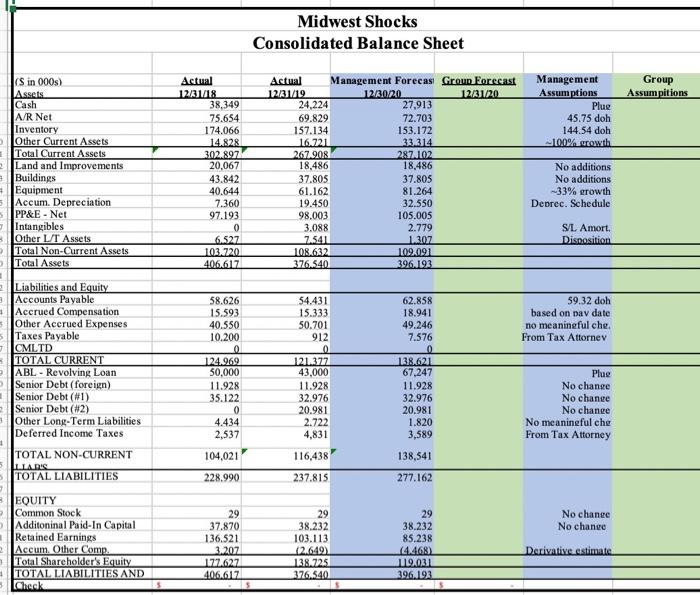

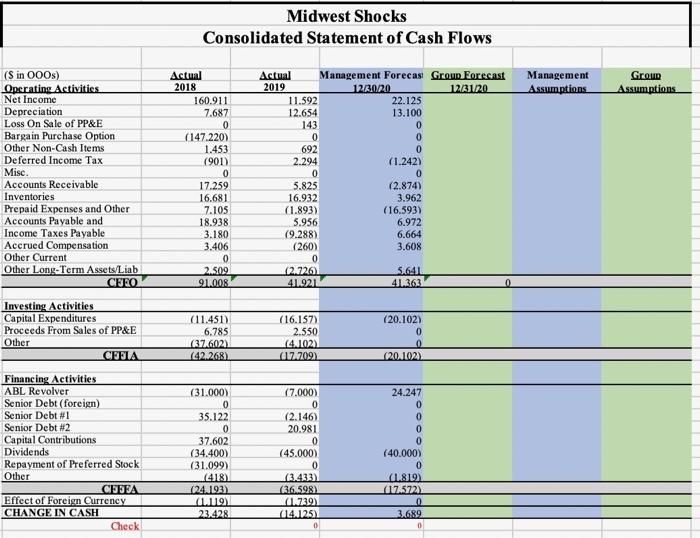

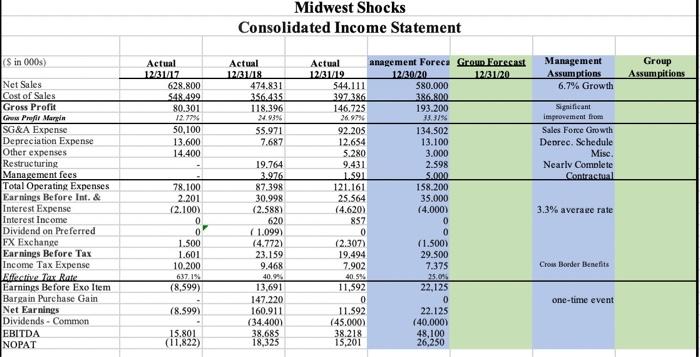

in each of the 5 focused areas provide your views/thought/analysis of Midwest Shocks historical performances Midwest Shocks Consolidated Balance Sheet Group Assumpitions Management Assumptions Plug

in each of the 5 focused areas provide your views/thought/analysis of Midwest Shocks historical performances

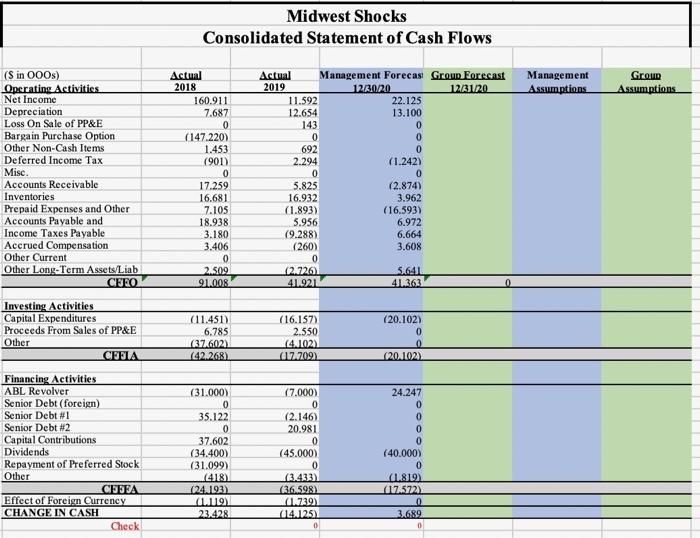

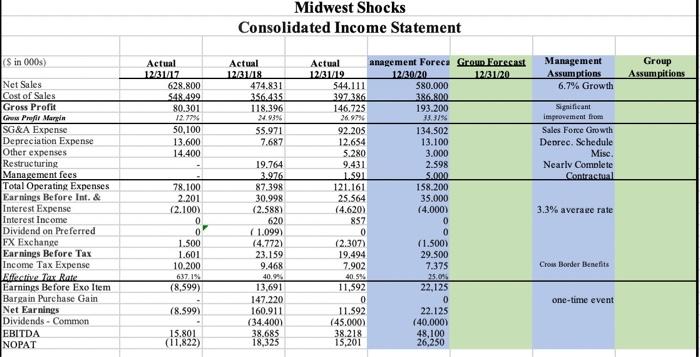

Midwest Shocks Consolidated Balance Sheet Group Assumpitions Management Assumptions Plug 45.75 doh 144.54 doh -100% growth (S in 000s) Assets Cash A/R Net Inventory Other Current Assets Total Current Assets Land and Improvements Buildings + Equipment 5 Accum. Depreciation 5 PP&E - Net Intangibles Other LIT Assets Total Non-Current Assets Total Assets Actual 121118 38,349 75.654 174.066 14.828 302.897 20,067 43.842 40.644 7.360 97.193 0 6.527 103.720 406.617 Actual Management Forecas Group Forecast 120119 122020 12/01/20 24,224 27,913 69.829 72.703 157.134 153.172 16.721 33 314 267.908 287102 18,486 18.486 37.805 37.805 61.162 81.264 19.450 32.550 98.003 105.005 3.088 2.779 7.541 1.3.07 108.632 109,091 376.540 396.193 No additions No additions -33% growth Deprec. Schedule S/L Amort. Disposition 59.32 doh based on nav date no meaningful che. From Tax Attorney Liabilities and Equity Accounts Payable Accrued Compensation Other Accrued Expenses Taxes Payable JCMLTD TOTAL CURRENT ABL - Revolving Loan Senior Debt (foreign) Senior Debt (#1) Senior Debt (#2) Other Long-Term Liabilities Deferred Income Taxes TOTAL NON-CURRENT ILLARIS TOTAL LIABILITIES 58.626 15.593 40.550 10.200 0 124.969 50,000 11.928 35.122 0 4.434 2,537 104,021 54.431 15.333 50.701 912 0 121.372 43,000 11.928 32.976 20.981 2.722 4,831 62.858 18.941 49.246 7.576 0 13.8.621 67,247 11.928 32.976 20.981 1.820 3,589 Plug No change No change No change No meaningful che From Tax Attorney 116,438 138,541 228.990 237.815 277.162 No change No change 2 EQUITY Common Stock Additoninal Paid-In Capital Retained Earnings Accum. Other Comp. Total Shareholder's Equity TOTAL LIABILITIES AND Cheel 29 37.870 136,521 3.202 177.627 406.617 15 29 38.232 103.113 (2.649) 138.725 376.540 29 38.232 85.238 144468) 119.021 396,192 Derivative estimate Midwest Shocks Consolidated Statement of Cash Flows Management Assumptions Group Assumptions (S in 000s) Operating Activities Net Income Depreciation Loss On Sale of PP&E Bargain Purchase Option Other Non-Cash Items Deferred Income Tax Misc. Accounts Receivable Inventories Prepaid Expenses and Other Accounts Payable and Income Taxes Payable Accrued Compensation Other Current Other Long-Term Assets/Liab CERO Actual 2018 160.911 7.687 0 (147.220) 1.453 (901) 0 17.259 16.681 7.105 18.938 3.180 3.406 0 2.509 91.008 Actual Management Forecas Group Forecast 2019 12/30/20 12/31/20 11.592 22.125 12.654 13.100 143 0 0 0 692 0 2.294 (1.242) 0 0 5.825 (2.874) 16.932 3.962 (1.893) (16.593) 5.956 6.972 (9.288) 6.664 (260) 3.608 0 (2.726 5.641 41.921 41363 (11.451) 6.785 (37.6021 (42.268) (16.157) 2.550 (4.102) (17.709 (20.102) 0 0 (12011024) (7.000) Investing Activities Capital Expenditures Proceeds From Sales of PP&E Other CELIA Financing Activities ABL Revolver Senior Debt (foreign) Senior Debt #1 Senior Debt #2 Capital Contributions Dividends Repayment of Preferred Stock Other CEBEA Effect of Foreign Currency CHANGE IN CASH Check (31.000) 0 35.122 0 37.602 (34.400) (31.099) 418) (24.192) (1.119 23.428 (2.146) 20.981 0 (45.000) 0 (3.433) (36.598) (1739 14.125) 0 24.247 0 0 0 0 (40.000) 0 (1819) (17.572) O 3.689 0 Midwest Shocks Consolidated Balance Sheet Group Assumpitions Management Assumptions Plug 45.75 doh 144.54 doh -100% growth (S in 000s) Assets Cash A/R Net Inventory Other Current Assets Total Current Assets Land and Improvements Buildings + Equipment 5 Accum. Depreciation 5 PP&E - Net Intangibles Other LIT Assets Total Non-Current Assets Total Assets Actual 121118 38,349 75.654 174.066 14.828 302.897 20,067 43.842 40.644 7.360 97.193 0 6.527 103.720 406.617 Actual Management Forecas Group Forecast 120119 122020 12/01/20 24,224 27,913 69.829 72.703 157.134 153.172 16.721 33 314 267.908 287102 18,486 18.486 37.805 37.805 61.162 81.264 19.450 32.550 98.003 105.005 3.088 2.779 7.541 1.3.07 108.632 109,091 376.540 396.193 No additions No additions -33% growth Deprec. Schedule S/L Amort. Disposition 59.32 doh based on nav date no meaningful che. From Tax Attorney Liabilities and Equity Accounts Payable Accrued Compensation Other Accrued Expenses Taxes Payable JCMLTD TOTAL CURRENT ABL - Revolving Loan Senior Debt (foreign) Senior Debt (#1) Senior Debt (#2) Other Long-Term Liabilities Deferred Income Taxes TOTAL NON-CURRENT ILLARIS TOTAL LIABILITIES 58.626 15.593 40.550 10.200 0 124.969 50,000 11.928 35.122 0 4.434 2,537 104,021 54.431 15.333 50.701 912 0 121.372 43,000 11.928 32.976 20.981 2.722 4,831 62.858 18.941 49.246 7.576 0 13.8.621 67,247 11.928 32.976 20.981 1.820 3,589 Plug No change No change No change No meaningful che From Tax Attorney 116,438 138,541 228.990 237.815 277.162 No change No change 2 EQUITY Common Stock Additoninal Paid-In Capital Retained Earnings Accum. Other Comp. Total Shareholder's Equity TOTAL LIABILITIES AND Cheel 29 37.870 136,521 3.202 177.627 406.617 15 29 38.232 103.113 (2.649) 138.725 376.540 29 38.232 85.238 144468) 119.021 396,192 Derivative estimate Midwest Shocks Consolidated Statement of Cash Flows Management Assumptions Group Assumptions (S in 000s) Operating Activities Net Income Depreciation Loss On Sale of PP&E Bargain Purchase Option Other Non-Cash Items Deferred Income Tax Misc. Accounts Receivable Inventories Prepaid Expenses and Other Accounts Payable and Income Taxes Payable Accrued Compensation Other Current Other Long-Term Assets/Liab CERO Actual 2018 160.911 7.687 0 (147.220) 1.453 (901) 0 17.259 16.681 7.105 18.938 3.180 3.406 0 2.509 91.008 Actual Management Forecas Group Forecast 2019 12/30/20 12/31/20 11.592 22.125 12.654 13.100 143 0 0 0 692 0 2.294 (1.242) 0 0 5.825 (2.874) 16.932 3.962 (1.893) (16.593) 5.956 6.972 (9.288) 6.664 (260) 3.608 0 (2.726 5.641 41.921 41363 (11.451) 6.785 (37.6021 (42.268) (16.157) 2.550 (4.102) (17.709 (20.102) 0 0 (12011024) (7.000) Investing Activities Capital Expenditures Proceeds From Sales of PP&E Other CELIA Financing Activities ABL Revolver Senior Debt (foreign) Senior Debt #1 Senior Debt #2 Capital Contributions Dividends Repayment of Preferred Stock Other CEBEA Effect of Foreign Currency CHANGE IN CASH Check (31.000) 0 35.122 0 37.602 (34.400) (31.099) 418) (24.192) (1.119 23.428 (2.146) 20.981 0 (45.000) 0 (3.433) (36.598) (1739 14.125) 0 24.247 0 0 0 0 (40.000) 0 (1819) (17.572) O 3.689 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started