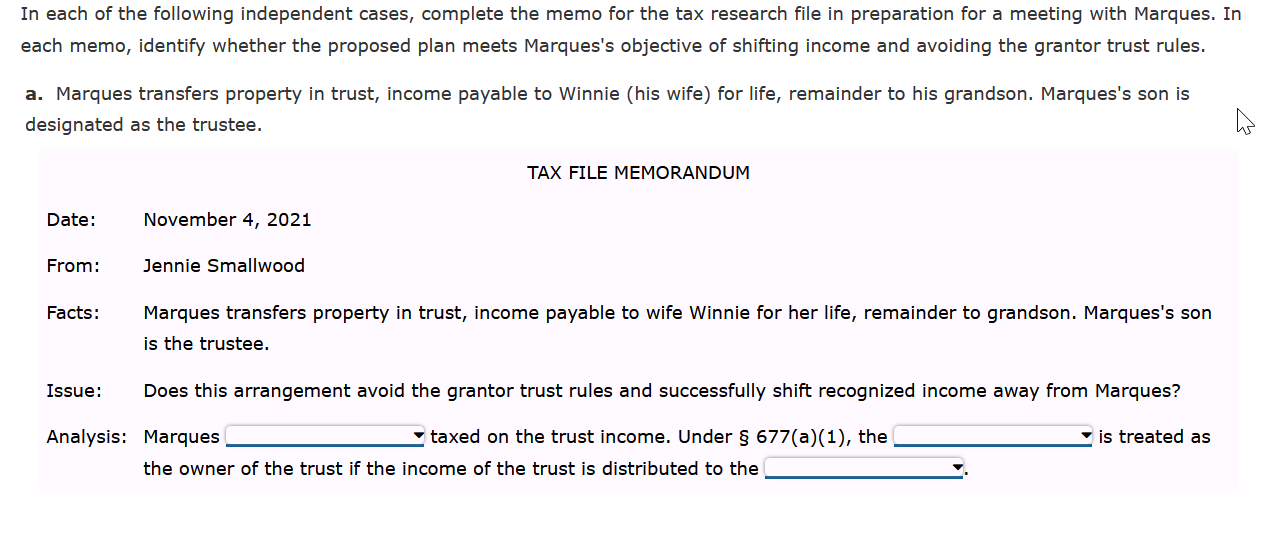

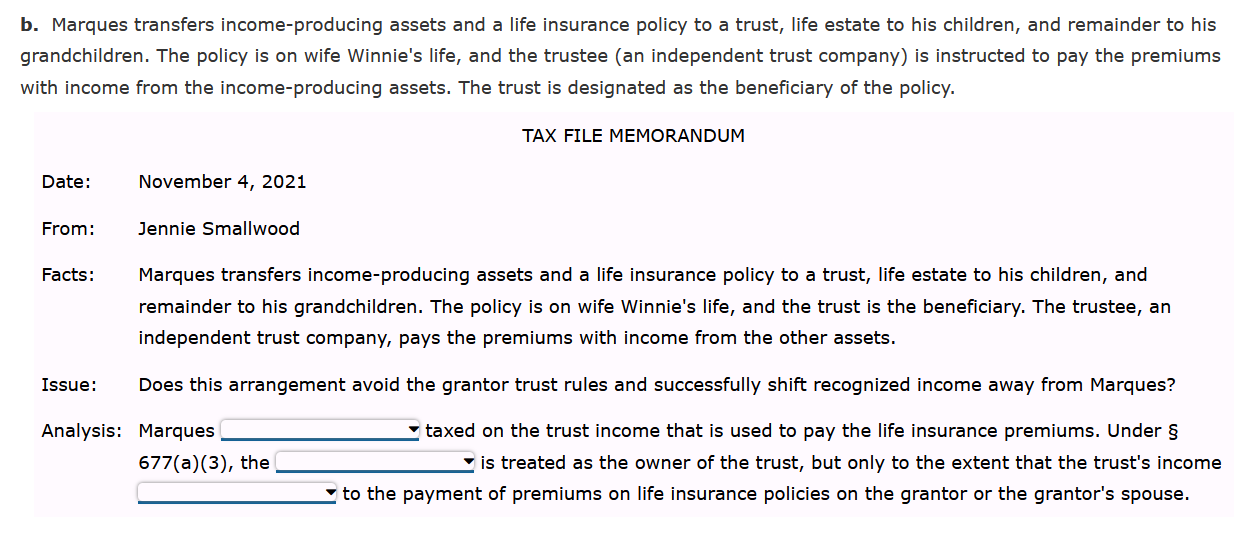

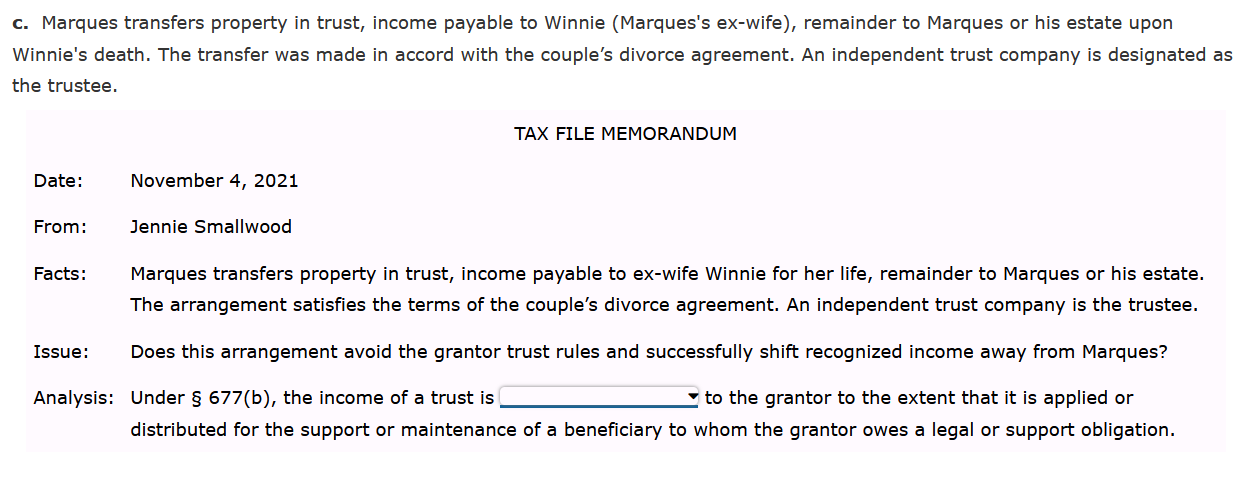

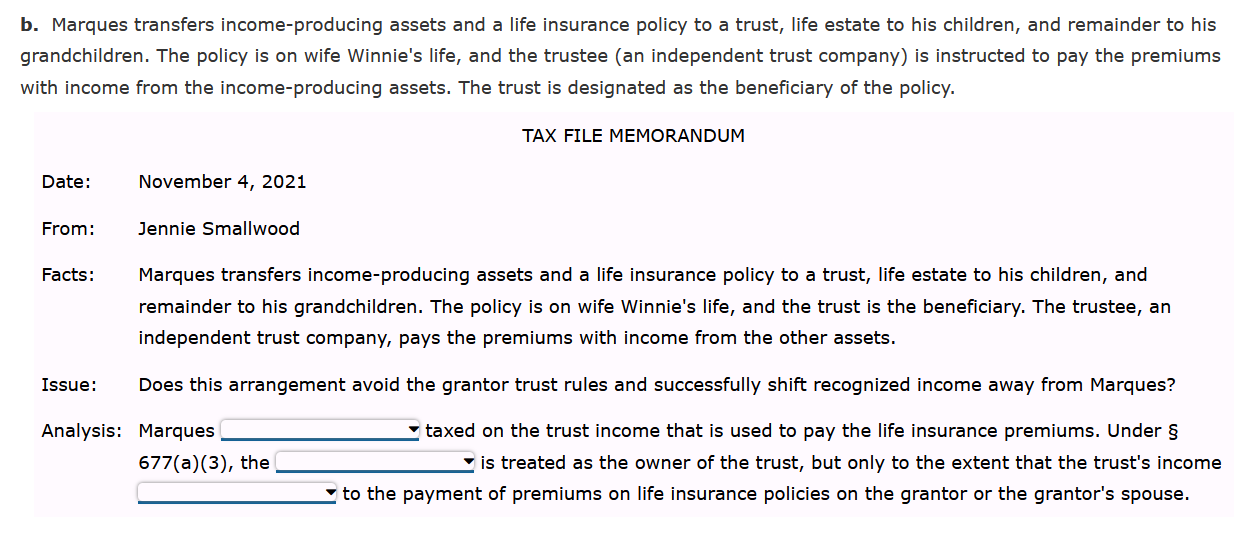

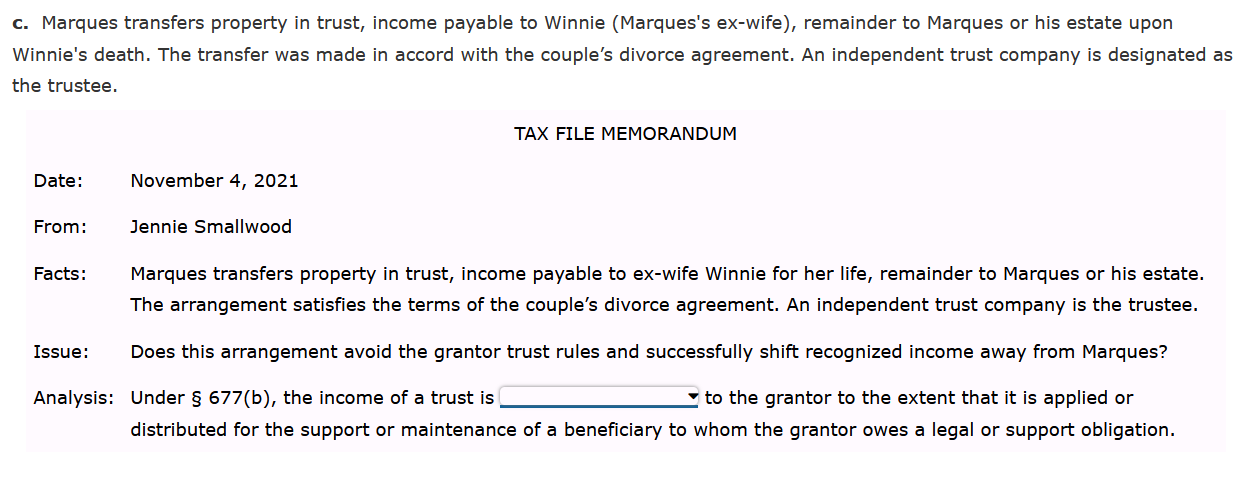

In each of the following independent cases, complete the memo for the tax research file in preparation for a meeting with Marques. In each memo, identify whether the proposed plan meets Marques's objective of shifting income and avoiding the grantor trust rules. a. Marques transfers property in trust, income payable to Winnie (his wife) for life, remainder to his grandson. Marques's son is designated as the trustee. TAX FILE MEMORANDUM Date: November 4,2021 From: Jennie Smallwood Facts: Marques transfers property in trust, income payable to wife Winnie for her life, remainder to grandson. Marques's son is the trustee. Issue: Does this arrangement avoid the grantor trust rules and successfully shift recognized income away from Marques? Analysis: Marques taxed on the trust income. Under 677(a)(1), the is treated as the owner of the trust if the income of the trust is distributed to the b. Marques transfers income-producing assets and a life insurance policy to a trust, life estate to his children, and remainder to his grandchildren. The policy is on wife Winnie's life, and the trustee (an independent trust company) is instructed to pay the premiums with income from the income-producing assets. The trust is designated as the beneficiary of the policy. TAX FILE MEMORANDUM Date: November 4, 2021 From: Jennie Smallwood Facts: Marques transfers income-producing assets and a life insurance policy to a trust, life estate to his children, and remainder to his grandchildren. The policy is on wife Winnie's life, and the trust is the beneficiary. The trustee, an independent trust company, pays the premiums with income from the other assets. Issue: Does this arrangement avoid the grantor trust rules and successfully shift recognized income away from Marques? Analysis: Marques taxed on the trust income that is used to pay the life insurance premiums. Under 677(a)(3), the is treated as the owner of the trust, but only to the extent that the trust's income to the payment of premiums on life insurance policies on the grantor or the grantor's spouse. c. Marques transfers property in trust, income payable to Winnie (Marques's ex-wife), remainder to Marques or his estate upon Winnie's death. The transfer was made in accord with the couple's divorce agreement. An independent trust company is designated as the trustee. TAX FILE MEMORANDUM Date: November 4,2021 From: Jennie Smallwood Facts: Marques transfers property in trust, income payable to ex-wife Winnie for her life, remainder to Marques or his estate. The arrangement satisfies the terms of the couple's divorce agreement. An independent trust company is the trustee. Issue: Does this arrangement avoid the grantor trust rules and successfully shift recognized income away from Marques? Analysis: Under 677(b), the income of a trust is to grantor to the extent that is applied or distributed for the support or maintenance of a beneficiary to whom the grantor owes a legalion