Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In each of the following independent cases, determine if the amount is included or excluded from gross income: a . Unemployment compensation received. b .

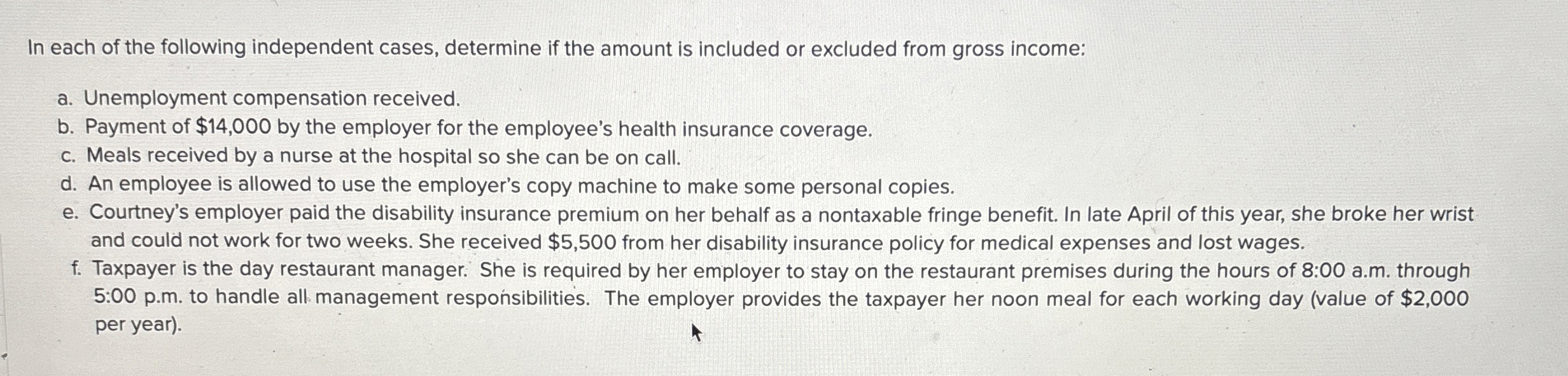

In each of the following independent cases, determine if the amount is included or excluded from gross income:

a Unemployment compensation received.

b Payment of $ by the employer for the employee's health insurance coverage.

c Meals received by a nurse at the hospital so she can be on call.

d An employee is allowed to use the employer's copy machine to make some personal copies.

e Courtney's employer paid the disability insurance premium on her behalf as a nontaxable fringe benefit. In late April of this year, she broke her wrist and could not work for two weeks. She received $ from her disability insurance policy for medical expenses and lost wages.

f Taxpayer is the day restaurant manager. She is required by her employer to stay on the restaurant premises during the hours of : am through : pm to handle all management responsibilities. The employer provides the taxpayer her noon meal for each working day value of $ per year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started