Answered step by step

Verified Expert Solution

Question

1 Approved Answer

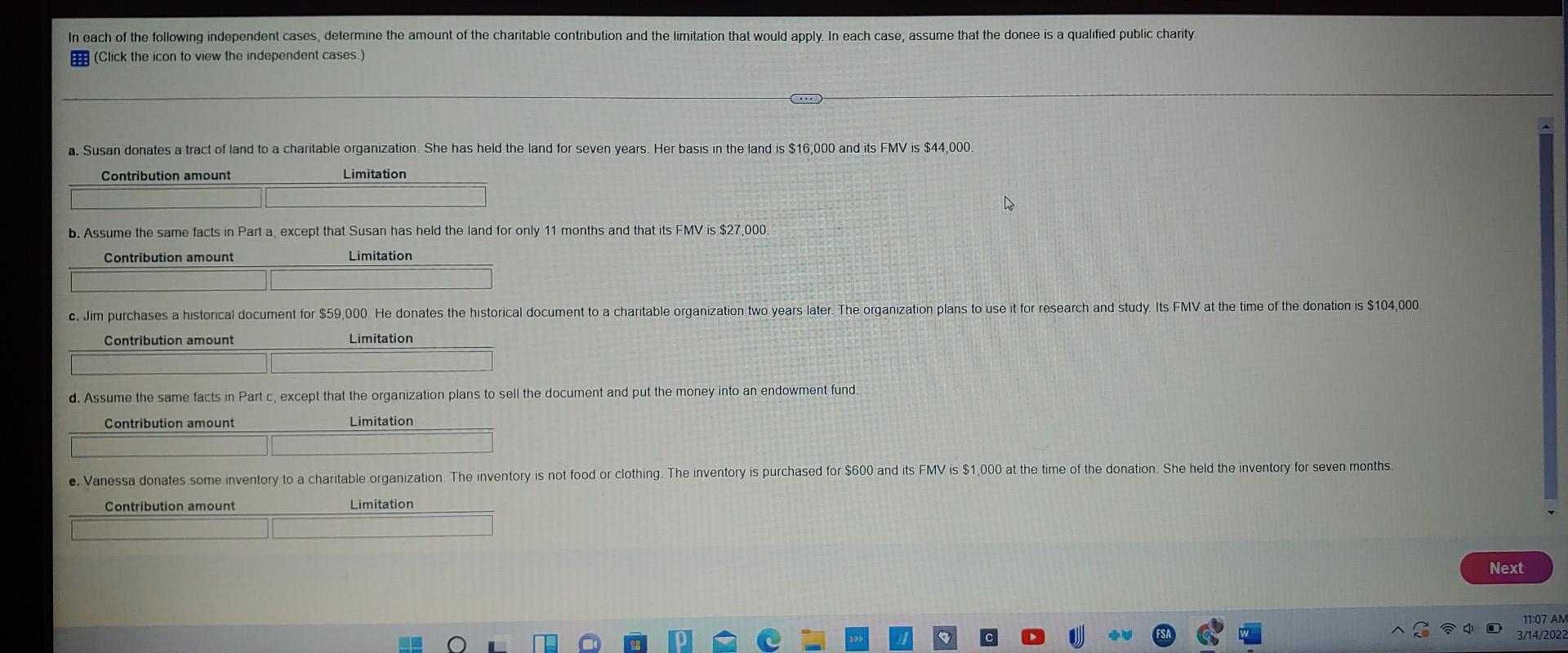

In each of the following independent cases, determine the amount of the charitable contribution and the limitation that would apply In each case, assume that

In each of the following independent cases, determine the amount of the charitable contribution and the limitation that would apply In each case, assume that the donee is a qualified public charity (Click the icon to view the independent cases) .. a. Susan donates a tract of land to a charitable organization. She has held the land for seven years. Her basis in the land is $16,000 and its FMV is $44,000 Contribution amount Limitation b. Assume the same facts in Parta, except that Susan has held the land for only 11 months and that its FMV is $27,000 Contribution amount Limitation c. Jim purchases a historical document for $59,000. He donates the historical document to a charitable organization two years later. The organization plans to use it for research and study. Its FMV at the time of the donation is $104,000 Contribution amount Limitation d. Assume the same facts in Part , except that the organization plans to sell the document and put the money into an endowment fund Contribution amount Limitation e. Vanessa donates some inventory to a charitable organization. The inventory is not food or clothing. The inventory is purchased for $600 and its FMV is $1,000 at the time of the donation. She held the inventory for seven months Contribution amount Limitation Next 11:07 AM 3/14/2022 c FSA c o W > 0 In each of the following independent cases, determine the amount of the charitable contribution and the limitation that would apply In each case, assume that the donee is a qualified public charity (Click the icon to view the independent cases) .. a. Susan donates a tract of land to a charitable organization. She has held the land for seven years. Her basis in the land is $16,000 and its FMV is $44,000 Contribution amount Limitation b. Assume the same facts in Parta, except that Susan has held the land for only 11 months and that its FMV is $27,000 Contribution amount Limitation c. Jim purchases a historical document for $59,000. He donates the historical document to a charitable organization two years later. The organization plans to use it for research and study. Its FMV at the time of the donation is $104,000 Contribution amount Limitation d. Assume the same facts in Part , except that the organization plans to sell the document and put the money into an endowment fund Contribution amount Limitation e. Vanessa donates some inventory to a charitable organization. The inventory is not food or clothing. The inventory is purchased for $600 and its FMV is $1,000 at the time of the donation. She held the inventory for seven months Contribution amount Limitation Next 11:07 AM 3/14/2022 c FSA c o W > 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started