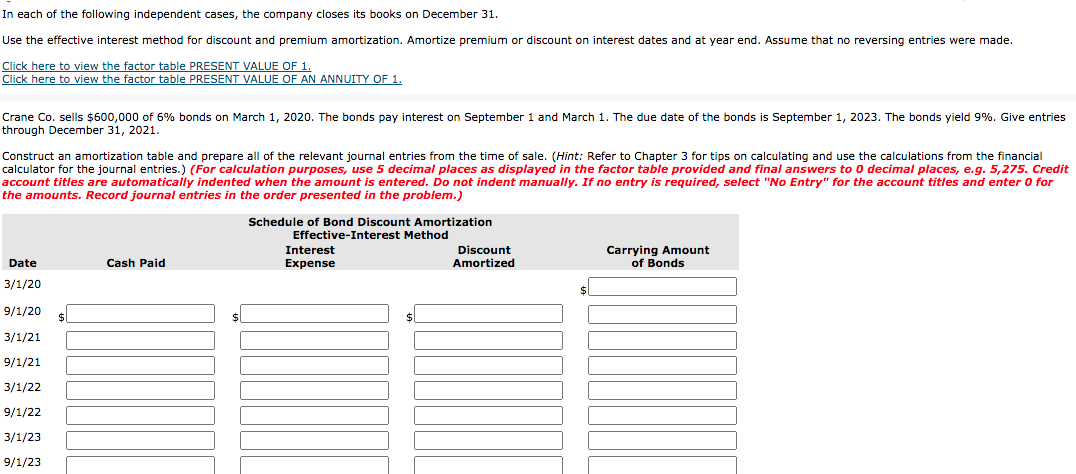

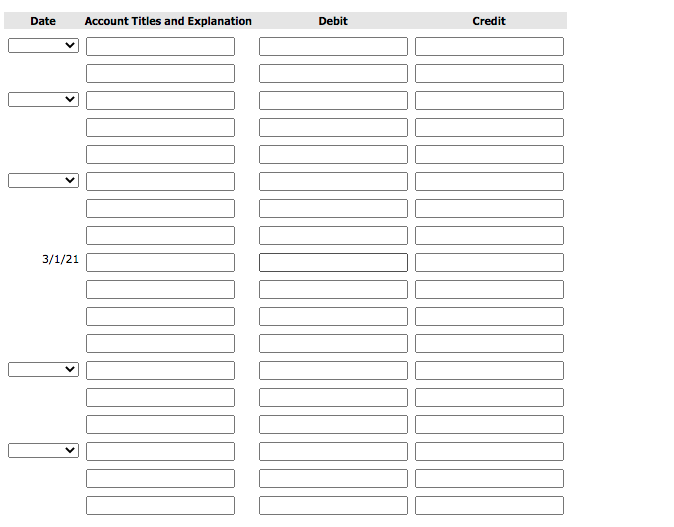

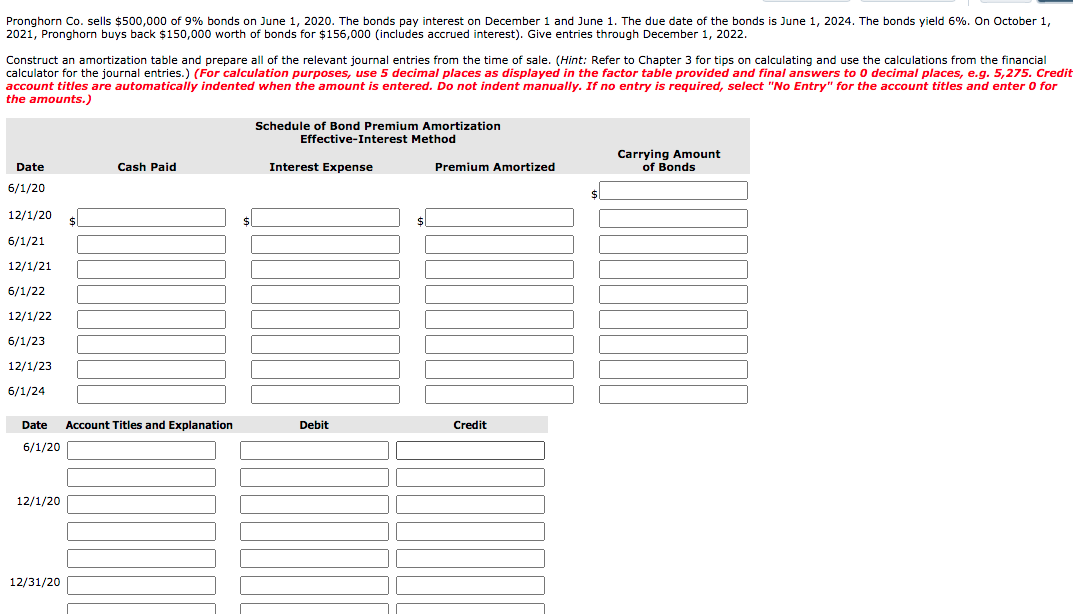

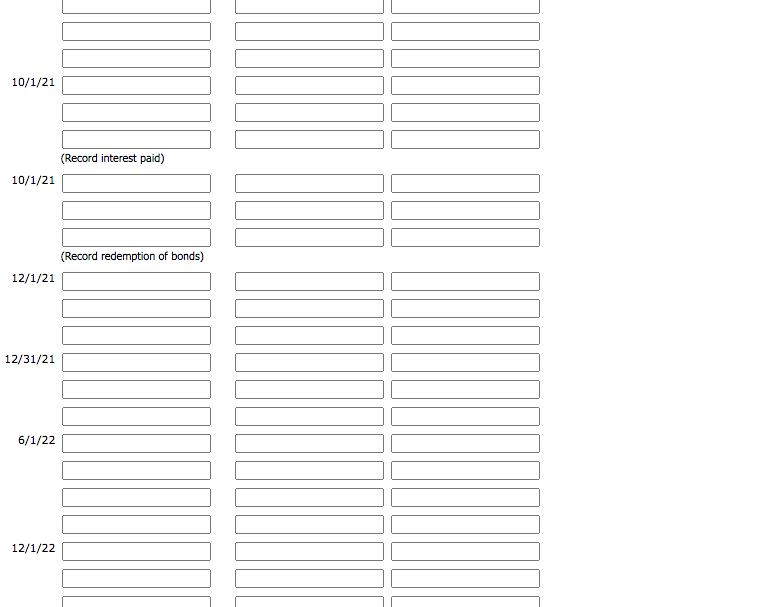

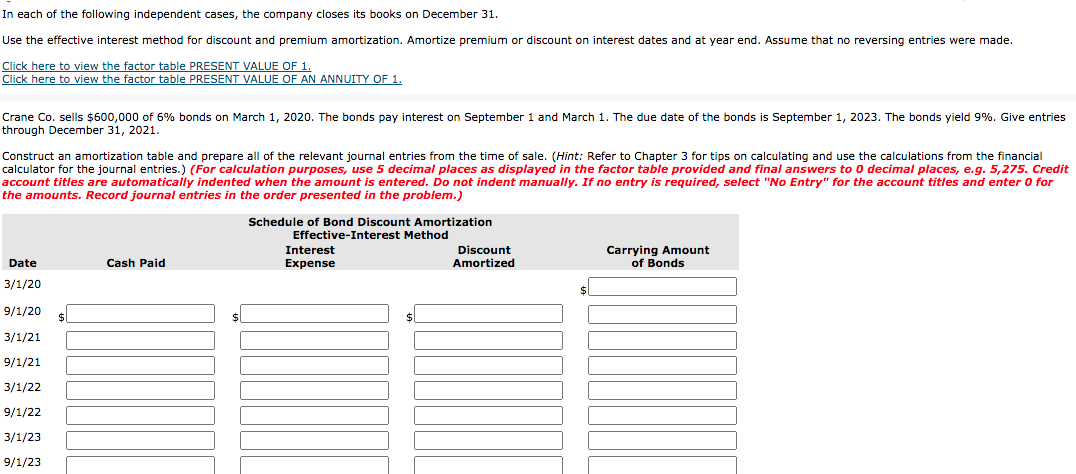

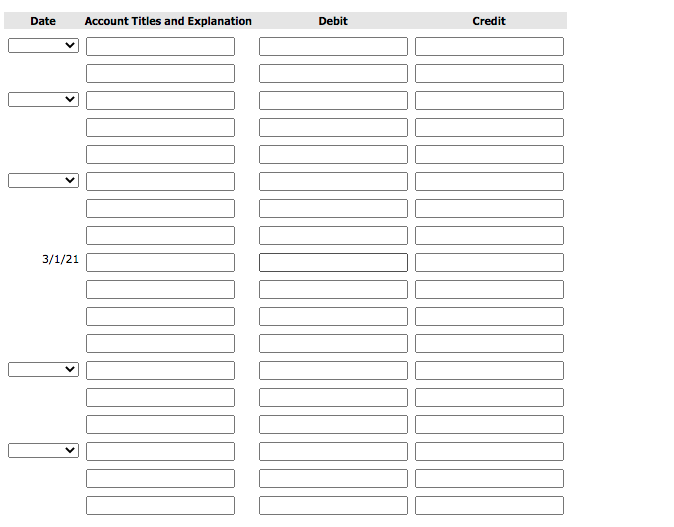

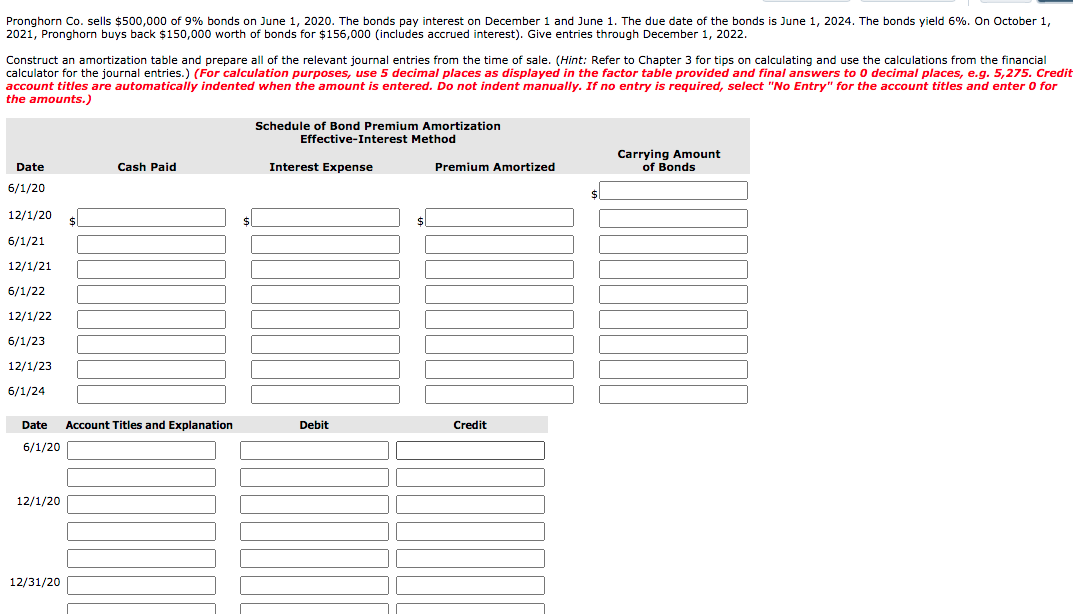

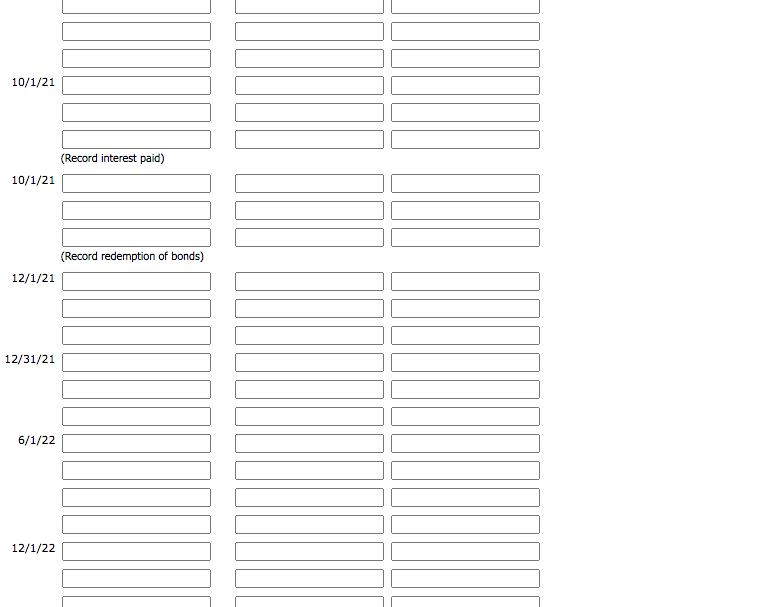

In each of the following independent cases, the company closes its books on December 31. Use the effective interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year end. Assume that no reversing entries were made. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Crane Co. sells $600,000 of 6% bonds on March 1, 2020. The bonds pay interest on September 1 and March 1. The due date of the bonds is September 1, 2023. The bonds yield 9%. Give entries through December 31, 2021. Construct an amortization table and prepare all of the relevant journal entries from the time of sale. (Hint: Refer to Chapter 3 for tips on calculating and use the calculations from the financial calculator for the journal entries.) (For calculation purposes, use 5 decimal places as displayed in the factor table provided and final answers to O decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Record journal entries in the order presented in the problem.) Schedule of Bond Discount Amortization Effective-Interest Method Interest Discount Expense Amortized Date Cash Paid Carrying Amount of Bonds 3/1/20 9/1/20 $ $ 3/1/21 9/1/21 3/1/22 9/1/22 3/1/23 9/1/23 Date Account Titles and Explanation Debit Credit 3/1/21 Pronghorn Co. sells $500,000 of 9% bonds on June 1, 2020. The bonds pay interest on December 1 and June 1. The due date of the bonds 2021, Pronghorn buys back $150,000 worth of bonds for $156,000 (includes accrued interest). Give entries through December 1, 2022. June 1, 2024. The bonds yield 6%. On October 1, Construct an amortization table and prepare all of the relevant journal entries from the time of sale. (Hint: Refer to Chapter 3 for tips on calculating and use the calculations from the financial calculator for the journal entries.) (For calculation purposes, use 5 decimal places as displayed in the factor table provided and final answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Schedule of Bond Premium Amortization Effective-Interest Method Carrying Amount of Bonds Date Cash Paid Interest Expense Premium Amortized 6/1/20 12/1/20 $ 6/1/21 12/1/21 6/1/22 12/1/22 6/1/23 12/1/23 6/1/24 Date Account Titles and Explanation Debit Credit 6/1/20 12/1/20 12/31/20 10/1/21 (Record interest paid) 10/1/21 (Record redemption of bonds) 12/1/21 12/31/21 6/1/22 12/1/22