Answered step by step

Verified Expert Solution

Question

1 Approved Answer

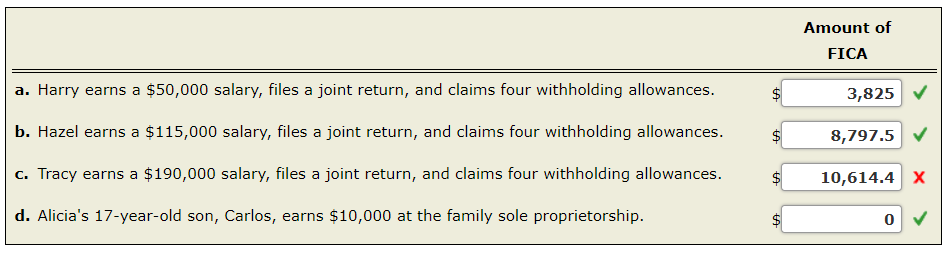

In each of the following independent situations, calculate the amount of FICA withholding from the employee's 2017 salary by the employer. If required, round your

In each of the following independent situations, calculate the amount of FICA withholding from the employee's 2017 salary by the employer.

If required, round your answers to two decimal places. If an amount is zero, enter "0".

The only one I am not understanding is Part C.

Amount of FICA a. Harry earns a $50,000 salary, files a joint return, and claims four withholding allowances. b. Hazel earns a $115,000 salary, files a joint return, and claims four withholding allowances c. Tracy earns a $190,000 salary, files a joint return, and claims four withholding allowances. d. Alicia's 17-year-old son, Carlos, earns $10,000 at the family sole proprietorship. 3,825 8,797.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started