Answered step by step

Verified Expert Solution

Question

1 Approved Answer

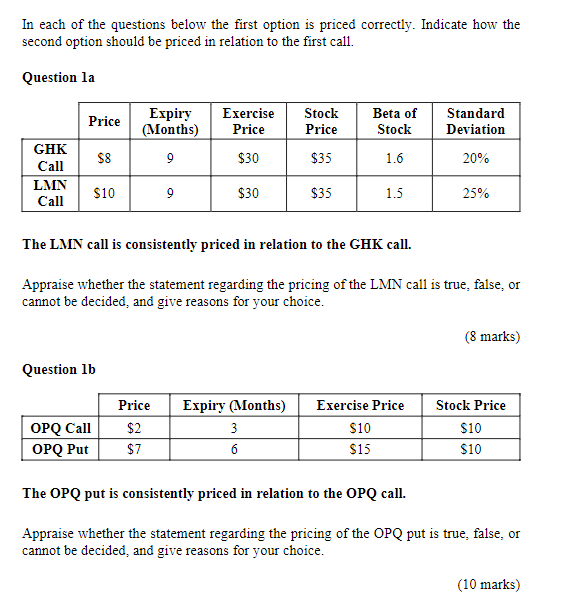

In each of the questions below the first option is priced correctly. Indicate how the second option should be priced in relation to the

In each of the questions below the first option is priced correctly. Indicate how the second option should be priced in relation to the first call. Question la Price Expiry Exercise Stock Beta of Standard (Months) Price Price Stock Deviation GHK $8 9 Call $30 $35 1.6 20% LMN $10 9 $30 Call $35 1.5 25% The LMN call is consistently priced in relation to the GHK call. Appraise whether the statement regarding the pricing of the LMN call is true, false, or cannot be decided, and give reasons for your choice. (8 marks) Question 1b Price Expiry (Months) Exercise Price Stock Price OPQ Call $2 3 $10 $10 OPQ Put $7 6 $15 $10 The OPQ put is consistently priced in relation to the OPQ call. Appraise whether the statement regarding the pricing of the OPQ put is true, false, or cannot be decided, and give reasons for your choice. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started