Answered step by step

Verified Expert Solution

Question

1 Approved Answer

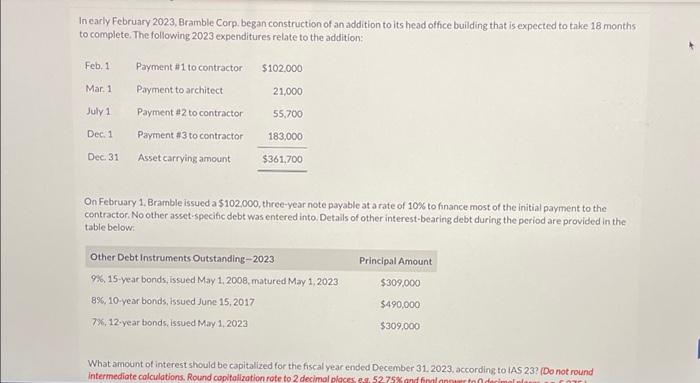

In early February 2023, Bramble Corp. began construction of an addition to its head office building that is expected to take 18 months to complete.

In early February 2023, Bramble Corp. began construction of an addition to its head office building that is expected to take 18 months to complete. The following 2023 expenditures relate to the addition: Feb. 1 Mar. 1 July 1 Dec. 1 Dec. 31 Payment #1 to contractor Payment to architect Payment #2 to contractor Payment #3 to contractor Asset carrying amount $102,000 21,000 55,700 183,000 $361,700 On February 1, Bramble issued a $102,000, three-year note payable at a rate of 10% to finance most of the initial payment to the contractor. No other asset-specific debt was entered into. Details of other interest-bearing debt during the period are provided in the table below: Other Debt Instruments Outstanding-2023 9%, 15-year bonds, issued May 1, 2008, matured May 1, 2023 8%, 10-year bonds, issued June 15, 2017 7%, 12-year bonds, issued May 1, 2023 Principal Amount $309,000 $490,000 $309,000 What amount of interest should be capitalized for the fiscal year ended December 31, 2023, according to IAS 23? (Do not round intermediate calculations. Round capitalization rate to 2 decimal places, e.g., 52.75% and final answer to decimal plac 50751

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started