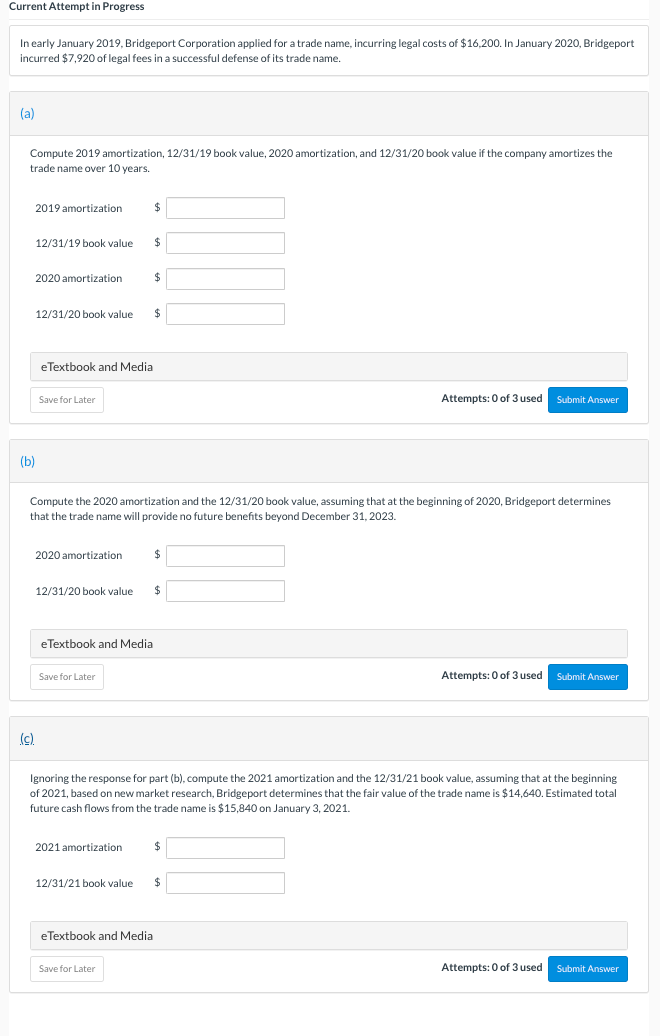

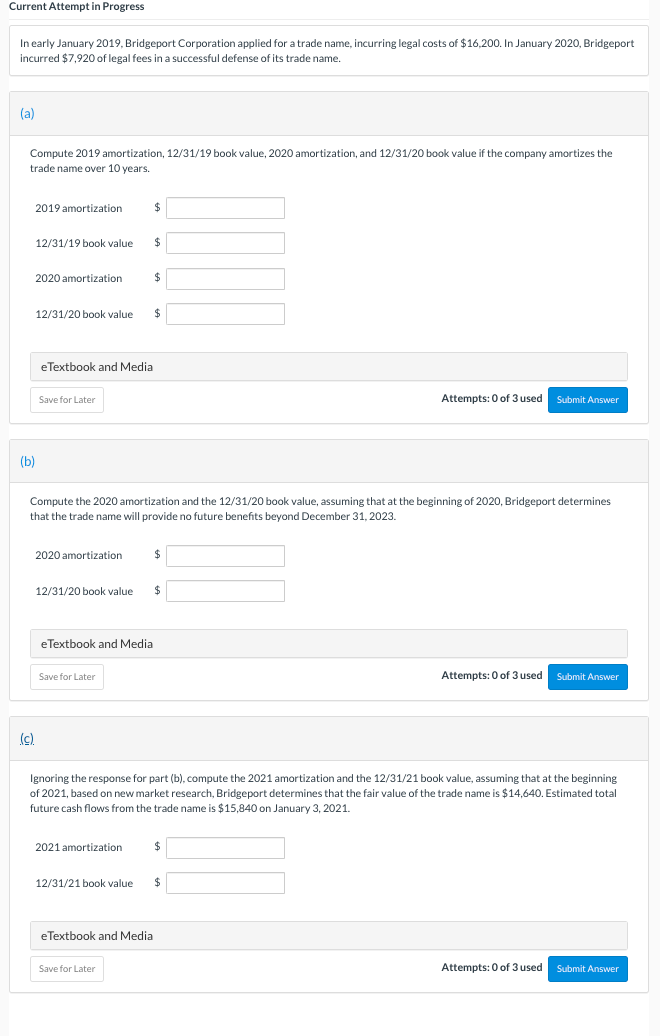

In early January 2019, Bridgeport Corporation applied for a trade name, incurring legal costs of $16,200. In January 2020, Bridgeport incurred $7,920 of legal fees in a successful defense of its trade name. (a) Compute 2019 amortization, 12/31/19 book value, 2020 amortization, and 12/31/20 book value if the company amortizes the trade name over 10 years. 2019 amortization \$ 12/31/19 book value $ 2020 amortization $ 12/31/20 bookvalue $ eTextbook and Media (b) Compute the 2020 amortization and the 12/31/20 book value, assuming that at the beginning of 2020 , Bridgeport determines that the trade name will provide no future benefits beyond December 31,2023. 2020 amortization \$ 12/31/20 bookvalue $ eTextbook and Media Attempts: 0 of 3 used (c). Ignoring the response for part (b), compute the 2021 amortization and the 12/31/21 book value, assuming that at the beginning of 2021 , based on new market research, Bridgeport determines that the fair value of the trade name is $14,640. Estimated total future cash flows from the trade name is $15,840 on January 3,2021. 2021 amortization \$ 12/31/21 bookvalue $ eTextbook and Media In early January 2019, Bridgeport Corporation applied for a trade name, incurring legal costs of $16,200. In January 2020, Bridgeport incurred $7,920 of legal fees in a successful defense of its trade name. (a) Compute 2019 amortization, 12/31/19 book value, 2020 amortization, and 12/31/20 book value if the company amortizes the trade name over 10 years. 2019 amortization \$ 12/31/19 book value $ 2020 amortization $ 12/31/20 bookvalue $ eTextbook and Media (b) Compute the 2020 amortization and the 12/31/20 book value, assuming that at the beginning of 2020 , Bridgeport determines that the trade name will provide no future benefits beyond December 31,2023. 2020 amortization \$ 12/31/20 bookvalue $ eTextbook and Media Attempts: 0 of 3 used (c). Ignoring the response for part (b), compute the 2021 amortization and the 12/31/21 book value, assuming that at the beginning of 2021 , based on new market research, Bridgeport determines that the fair value of the trade name is $14,640. Estimated total future cash flows from the trade name is $15,840 on January 3,2021. 2021 amortization \$ 12/31/21 bookvalue $ eTextbook and Media