Question

In early January, 2020, William Wyler, CPA, a senior manager at Myers Norris Penny LLP in Regina, Saskatchewan, was assigned the task of reviewing the

In early January, 2020, William Wyler, CPA, a senior manager at Myers Norris Penny LLP in Regina, Saskatchewan, was assigned the task of reviewing the financial performance of Power Green Industries (PGI) Ltd., a Canadian-based manufacturer of alternative electrical generating equipment. Before proceeding with the introduction of a revolutionary new product, PGI’s board of director thought it prudent to retain an independent consultant to review the company’s performance. Despite its rapid sales growth, the board was worried about PGI’s financial ability to execute this expansion.

Having taken two years of engineering before changing to accounting at university, Wyler feels he has the technical knowledge to understand the company’s products, which will aid him in analyzing its financial performance. If this review goes smoothly, Wyler believes he will finally make partner after 10 years at the firm.

Company Formation

PGI was formed in 2008 by Dr. Maggie McGruder, P.Eng. who had taken a buyout from Natural Resources Canada, a department of the federal government of Canada, after becoming frustrated with the slow rate of implementation of her many ideas. McGruder completed her PhD in electrical engineering in 1997 at the University of Manitoba where her dissertation dealt with home and farm-based energy alternatives such as wind turbines, water turbines, solar panels, geothermal, and biogas. In the new start-up, she decided to focus on wind and water turbines and solar panels because of her background in electrical engineering. Also, in her opinion, the geothermal and bio gas segments of the alternative energy industry were not cost effective in the long term.

McGruder’s knowledge of manufacturing and marketing was limited so she recruited two partners, Matthew Wiggins, P.Eng. and Nancy Cranston, CSP. Wiggins had over 30 years of experience supervising manufacturing facilities for companies such as Caterpillar, General Electric, and Nortel while Cranston had been a vice-president of marketing and sales for a number of equipment producers with her most recent position being with Stanley Tools. Each contributed $200,000 for a 25 percent share of the company and the remainder of the seed capital was provided by Wilson McIvor, a retired Fortune 500 CEO, who had been an “angel” to a number of other tech start-ups in Canada. After three rounds of funding from CanDo Venture Capital, each of the three founders’ holdings had been reduced to 15 percent. In 2014, the angel and venture capitalists took PGI public in an initial public offering in order to exit the investment. The partners bought enough of the shares to maintain control.

Company Expansion

The period from 2008 to 2010 was a troublesome one for PGI. Products took much longer than planned to develop and production processes where difficult to master. Venture capital financing was also difficult to acquire and the owners had to relinquish a much larger portion of the business than hoped to secure the needed funding. By 2011, the products and manufacturing facilities were in place. Despite initial hesitancy, a number of key distributors were recruited. In Canada, both Canadian Tire and Home Hardware agreed to carry PGI’s products. Canadian Tire also featured them in one of their advertising campaigns where they stressed their new focus on environmentally-friendly products. The Co-op, a farmer cooperative organization and major agricultural supply chain, agreed to sell the products and allowed PGI to promote them at all their membership meetings. In the U.S., Eagle Hardware and a number of regional farmer cooperatives also signed distribution agreements.

Sales of PGI’s products increased dramatically from 2012 to 2019. Farmers welcomed them as a way to reduce costs in a competitive industry and to avoid frequent power outages that can be problematic especially for dairy and poultry producers. People living in remote areas found them to be a cheaper alternative to burning fossil fuels, while environmentally conscious consumers felt they greatly reduced their ecological footprint.

New Product Introduction

To expand its product line further, PGI is currently developing an advanced power management system. This includes high-capacity batteries that store electricity to balance differences in generation and consumption as well as a monitoring system that automatically resells power to the local grid when user’s needs are met and prices offered by the local public utility are at their highest. The monitoring system also detects faulty storage batteries so they can be quickly replaced. PGI will produce its own batteries using technology licensed from a well-known research firm, but the remainder of this new system is being developed in-house and is considered “leading-edge” by the industry.

Operations

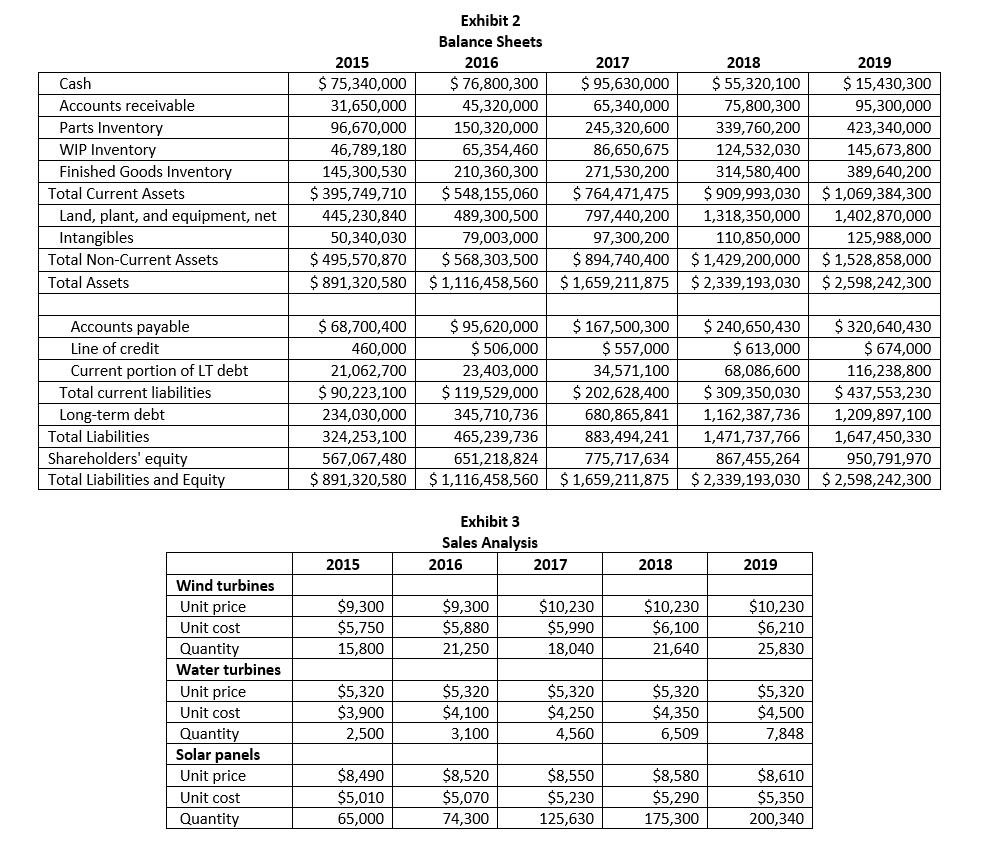

In order to expand sales, PGI has kept its prices constant over the last five years for water turbines. Wind turbine prices were only increased in 2017, and only solar turbines had annual price increases. However, competitors have increased prices annually. It also offers its distributors terms of 2/10, net 30, which vary from the industry standard of net 30. Most distributors took advantage of these terms over the past five years.

PGI designs and assembles its products in Canada but sources its components globally. As a precautionary measure, to guard against supply interruptions caused by strikes, material shortages, and transportation delays, it stockpiles many of its key parts. Its accounts payable relate primarily to inventory purchases. Industry standard credit terms are 3/15, net 60 and most suppliers charge interest of 10 percent per annum on any overdue accounts.

In order to remain competitive with low-wage countries, PGI invested heavily in factory automation, but has had difficulties with many of the complex systems. Breakdowns and software “bugs” are common place as most of the equipment was bought from a low-cost supplier, which has since gone bankrupt. Low educational standards also made training difficult and lowered production efficiency. It was thought automation would allow the company to reduce finished goods inventory though just-in-time production, but the frequent breakdowns made it necessary to carry more stock.

To accommodate company growth, PGI built a new corporate headquarters, R&D facility and distribution centre in 2017. A number of existing buildings were considered, but a new facility in an expensive area of Toronto was constructed to increase the profile of the company.

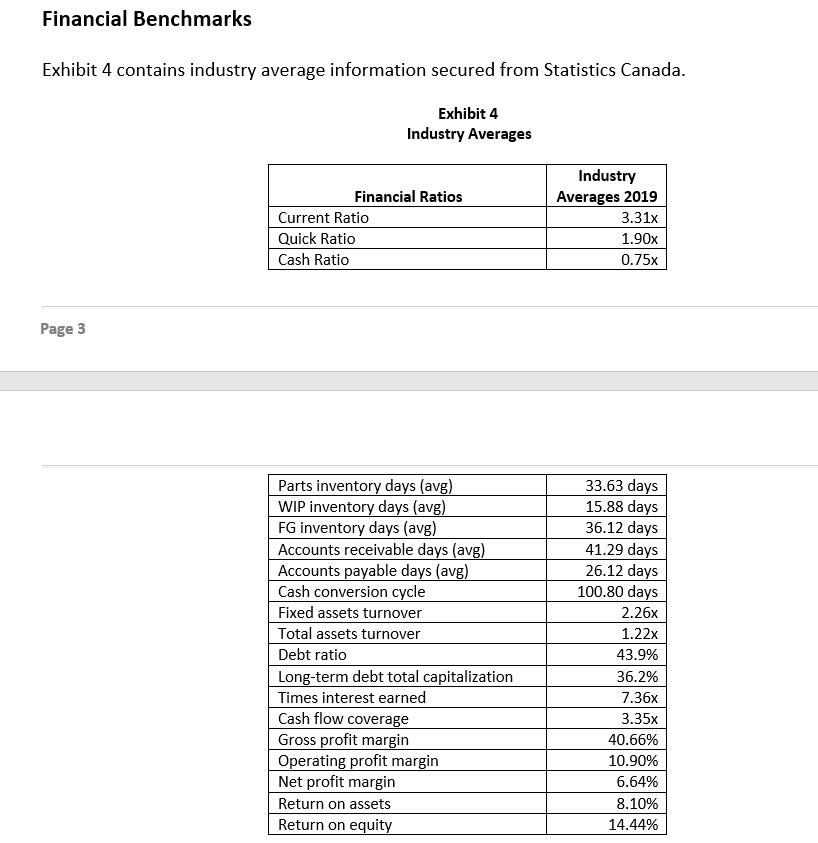

Retained earnings were insufficient to fund PGI’s rapid growth, so large amounts of capital had to be raised externa lly – the company has yet to pay a dividend. Terms loans and mortgages were negotiated with five different banks to diversify its funding sources. PGI is listed on the Toronto and New York Stock Exchanges and has gone to the market in each of the past five years to sell equity. To avoid losing control, the three founding shareholders agreed to issue only non-voting common shares, but is appears the market has lost its appetite for this type of security. PGI maintains a $1,500,000 line of credit with Western Canadian Bank to finance seasonal variations in net working capital. The loan must be 200 percent secured by inventory and accounts receivable. Also, to comply with the different loan agreements, the current ratio must be kept above 2.5, the long-term debt to total capitalization below 50 percent, and the cash flow coverage ratio above 2.0.

Prepare the following financial exhibits for 2015 through 2019:

Ratio table

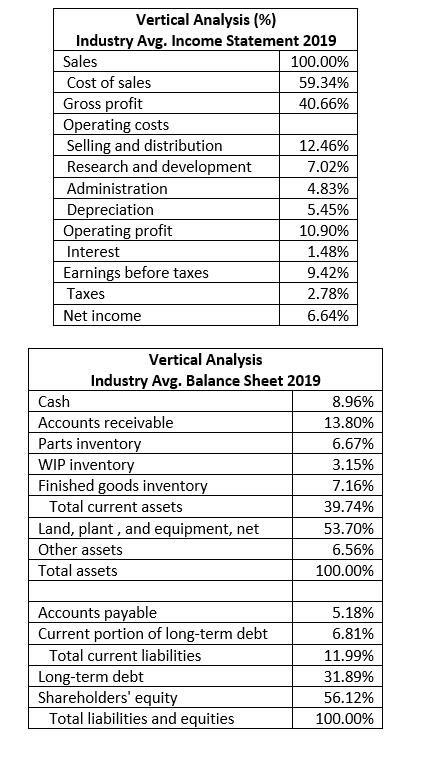

Vertical analysis of income statements and balance sheets

Horizontal analysis (index numbers) of income statements and balance sheets

Cash flow statements

5-part analysis of ROE

Assuming the role of William Wyler, CPA, prepare a memorandum that analyzes the financial condition of PGI and makes recommendations relating to the company’s financial performance and proposed new product introduction. The memo should be divided into sections describing liquidity, asset management, long-term debt paying ability, profitability, and recommendations.

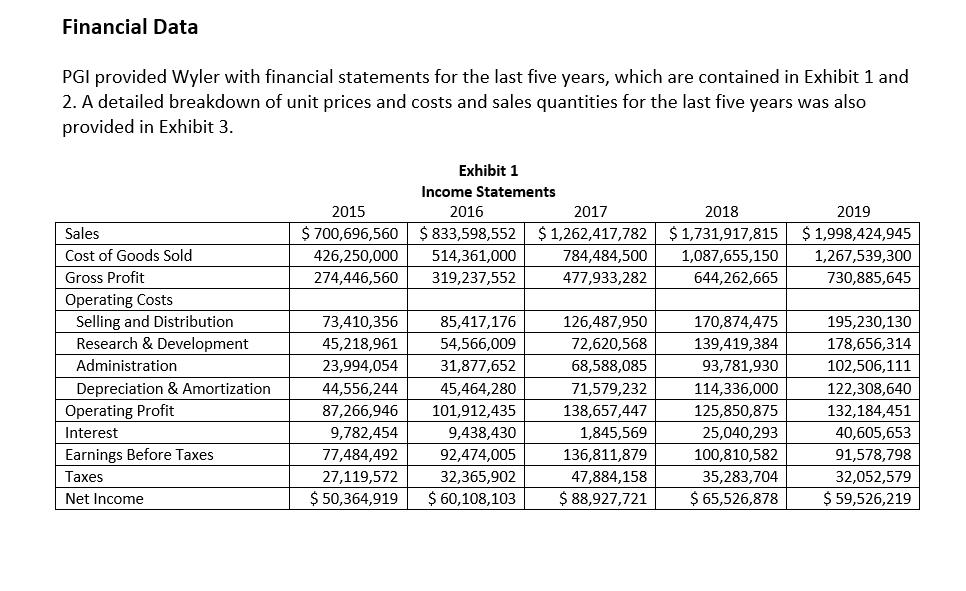

Financial Data PGI provided Wyler with financial statements for the last five years, which are contained in Exhibit 1 and 2. A detailed breakdown of unit prices and costs and sales quantities for the last five years was also provided in Exhibit 3. Sales Cost Goods Sold Gross Profit Operating Costs Selling and Distribution Research & Development Administration Depreciation & Amortization Operating Profit Interest Earnings Before Taxes Taxes Net Income 2015 $ 700,696,560 426,250,000 274,446,560 Exhibit 1 Income Statements 2016 2017 $ 833,598,552 $ 1,262,417,782 514,361,000 784,484,500 319,237,552 477,933,282 73,410,356 85,417,176 45,218,961 54,566,009 23,994,054 31,877,652 44,556,244 45,464,280 87,266,946 101,912,435 9,782,454 77,484,492 27,119,572 $ 50,364,919 9,438,430 92,474,005 32,365,902 $ 60,108,103 126,487,950 72,620,568 68,588,085 71,579,232 138,657,447 1,845,569 136,811,879 47,884,158 $ 88,927,721 2018 $ 1,731,917,815 1,087,655,150 644,262,665 170,874,475 139,419,384 93,781,930 114,336,000 125,850,875 25,040,293 100,810,582 35,283,704 $ 65,526,878 2019 $ 1,998,424,945 1,267,539,300 730,885,645 195,230,130 178,656,314 102,506,111 122,308,640 132,184,451 40,605,653 91,578,798 32,052,579 $ 59,526,219

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Ratio Table Ratio 2015 2016 2017 2018 2019 Current ratio 273 291 314 338 362 Quick ratio 182 185 207 229 251 Accounts receivable turnover 616 592 568 544 520 Inventory turnover 457 413 380 347 314 Fix...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started