Answered step by step

Verified Expert Solution

Question

1 Approved Answer

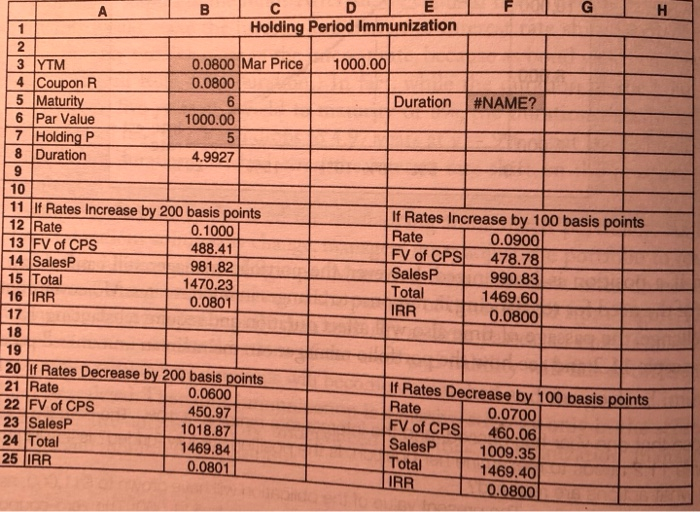

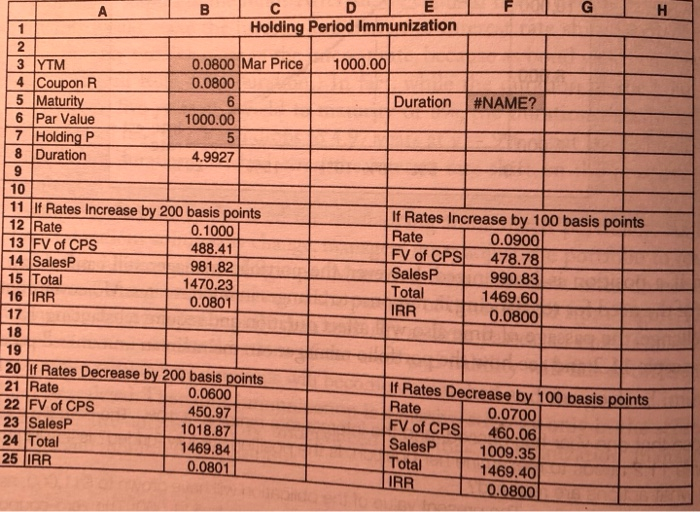

In excel, copy this table. Then, show what the total effect in the bond's portfolio is if rates decrease to 4%, and then if rates

In excel, copy this table. Then, show what the total effect in the bond's portfolio is if rates decrease to 4%, and then if rates increase to 12%.

plug in the new rates and calculate the new values, showing the change.

This is a finance question, not computer science. I'm not sure why this is under computer science?

Holding Period Immunization 1000.00 0.0800 Mar Price 0.0800 3 YTM 4 Coupon R 5 Maturity 6 Par Value 7 Holding P 8 Duration Duration #NAME? 1000.00 4.9927 10 11 If Rates Increase by 200 basis points 12 Rate 0.1000 13 FV of CPS 488.41 | 14 SalesP 981.82 15 Total 1470.23 16 IRR 0.0801 If Rates Increase by 100 basis points Rate 0.0900 FV of CPS 478.78 SalesP 990.83 Total 1469.60 IRR 0.0800 17 18 19 Rate 20 If Rates Decrease by 200 basis points 21 Rate 0.0600 22 FV of CPS 450.97 23 Sales 1018.87 24 Total 1469.84 25 IRR 0.0801 If Rates Decrease by 100 basis points 0.07001 FV of CPS 460.06 SalesPL 1009.35 1469.40 URR 0.0800 Total Holding Period Immunization 1000.00 0.0800 Mar Price 0.0800 3 YTM 4 Coupon R 5 Maturity 6 Par Value 7 Holding P 8 Duration Duration #NAME? 1000.00 4.9927 10 11 If Rates Increase by 200 basis points 12 Rate 0.1000 13 FV of CPS 488.41 | 14 SalesP 981.82 15 Total 1470.23 16 IRR 0.0801 If Rates Increase by 100 basis points Rate 0.0900 FV of CPS 478.78 SalesP 990.83 Total 1469.60 IRR 0.0800 17 18 19 Rate 20 If Rates Decrease by 200 basis points 21 Rate 0.0600 22 FV of CPS 450.97 23 Sales 1018.87 24 Total 1469.84 25 IRR 0.0801 If Rates Decrease by 100 basis points 0.07001 FV of CPS 460.06 SalesPL 1009.35 1469.40 URR 0.0800 Total Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started