In excel create and screen shot three tabs, for equity, initial value, and partial equity methods.

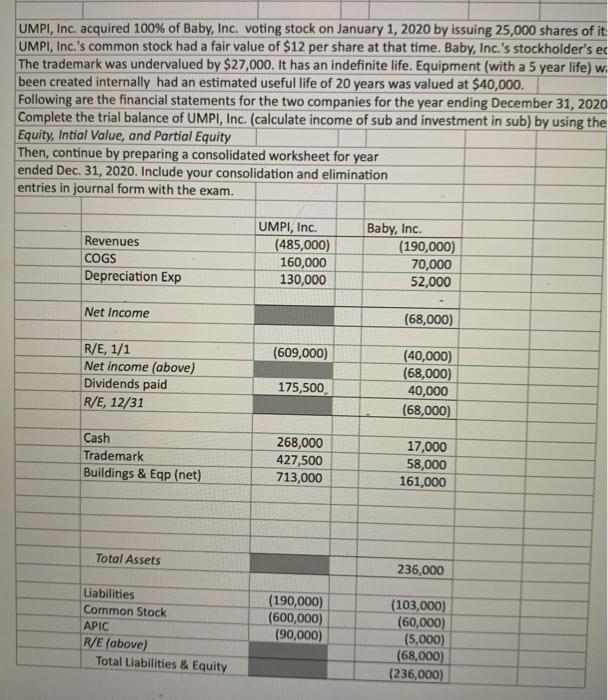

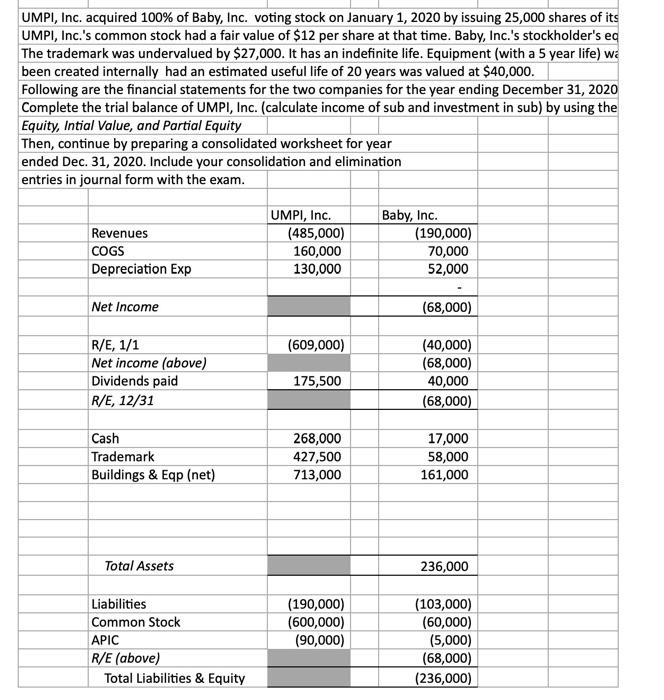

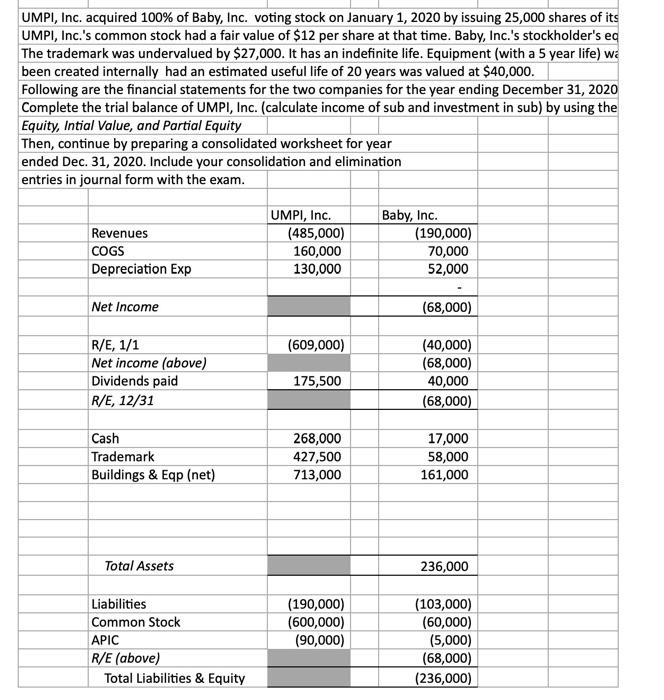

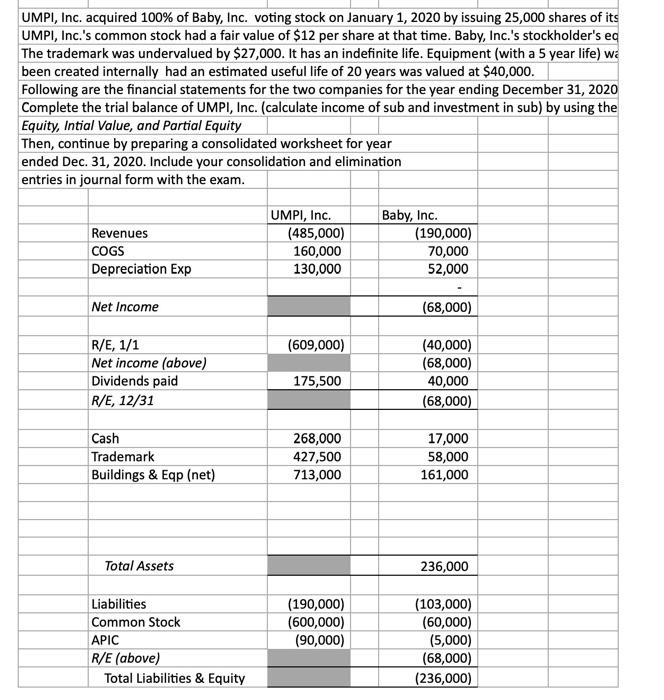

UMPI, Inc. acquired 100% of Baby, Inc. voting stock on January 1, 2020 by issuing 25,000 shares of it UMPI, Inc.'s common stock had a fair value of $12 per share at that time. Baby, Inc.'s stockholder's ec The trademark was undervalued by $27,000. It has an indefinite life. Equipment (with a 5 year life) w. been created internally had an estimated useful life of 20 years was valued at $40,000. Following are the financial statements for the two companies for the year ending December 31, 2020 Complete the trial balance of UMPI, Inc. (calculate income of sub and investment in sub) by using the Equity, Intial Value, and Partial Equity Then, continue by preparing a consolidated worksheet for year ended Dec 31, 2020. Include your consolidation and elimination entries in journal form with the exam. Revenues COGS Depreciation Exp UMPI, Inc. (485,000) 160,000 130,000 Baby, Inc. (190,000) 70,000 52,000 Net Income (68,000) (609,000) R/E, 1/1 Net income (above) Dividends paid R/E, 12/31 175,500 (40,000) (68,000) 40,000 (68,000) Cash Trademark Buildings & Eqp (net) 268,000 427,500 713,000 17,000 58,000 161,000 Total Assets 236,000 Liabilities Common Stock APIC R/E (above) Total Liabilities & Equity (190,000) (600,000) (90,000) (103,000) (60,000) (5,000) (68,000) (236,000) UMPI, Inc. acquired 100% of Baby, Inc. voting stock on January 1, 2020 by issuing 25,000 shares of its UMPI, Inc.'s common stock had a fair value of $12 per share at that time. Baby, Inc.'s stockholder's eq The trademark was undervalued by $27,000. It has an indefinite life. Equipment (with a 5 year life) wa been created internally had an estimated useful life of 20 years was valued at $40,000. Following are the financial statements for the two companies for the year ending December 31, 2020 Complete the trial balance of UMPI, Inc. (calculate income of sub and investment in sub) by using the Equity, Intial Value, and Partial Equity Then, continue by preparing a consolidated worksheet for year ended Dec. 31, 2020. Include your consolidation and elimination entries in journal form with the exam. Revenues COGS Depreciation Exp UMPI, Inc. (485,000) 160,000 130,000 Baby, Inc. (190,000) 70,000 52,000 Net Income (68,000) (609,000) R/E, 1/1 Net income (above) Dividends paid R/E, 12/31 175,500 (40,000) (68,000) 40,000 (68,000) Cash Trademark Buildings & Eqp (net) 268,000 427,500 713,000 17,000 58,000 161,000 Total Assets 236,000 Liabilities Common Stock APIC R/E (above) Total Liabilities & Equity (190,000) (600,000) (90,000) (103,000) (60,000) (5,000) (68,000) (236,000) UMPI, Inc. acquired 100% of Baby, Inc. voting stock on January 1, 2020 by issuing 25,000 shares of it UMPI, Inc.'s common stock had a fair value of $12 per share at that time. Baby, Inc.'s stockholder's ec The trademark was undervalued by $27,000. It has an indefinite life. Equipment (with a 5 year life) w. been created internally had an estimated useful life of 20 years was valued at $40,000. Following are the financial statements for the two companies for the year ending December 31, 2020 Complete the trial balance of UMPI, Inc. (calculate income of sub and investment in sub) by using the Equity, Intial Value, and Partial Equity Then, continue by preparing a consolidated worksheet for year ended Dec 31, 2020. Include your consolidation and elimination entries in journal form with the exam. Revenues COGS Depreciation Exp UMPI, Inc. (485,000) 160,000 130,000 Baby, Inc. (190,000) 70,000 52,000 Net Income (68,000) (609,000) R/E, 1/1 Net income (above) Dividends paid R/E, 12/31 175,500 (40,000) (68,000) 40,000 (68,000) Cash Trademark Buildings & Eqp (net) 268,000 427,500 713,000 17,000 58,000 161,000 Total Assets 236,000 Liabilities Common Stock APIC R/E (above) Total Liabilities & Equity (190,000) (600,000) (90,000) (103,000) (60,000) (5,000) (68,000) (236,000) UMPI, Inc. acquired 100% of Baby, Inc. voting stock on January 1, 2020 by issuing 25,000 shares of its UMPI, Inc.'s common stock had a fair value of $12 per share at that time. Baby, Inc.'s stockholder's eq The trademark was undervalued by $27,000. It has an indefinite life. Equipment (with a 5 year life) wa been created internally had an estimated useful life of 20 years was valued at $40,000. Following are the financial statements for the two companies for the year ending December 31, 2020 Complete the trial balance of UMPI, Inc. (calculate income of sub and investment in sub) by using the Equity, Intial Value, and Partial Equity Then, continue by preparing a consolidated worksheet for year ended Dec. 31, 2020. Include your consolidation and elimination entries in journal form with the exam. Revenues COGS Depreciation Exp UMPI, Inc. (485,000) 160,000 130,000 Baby, Inc. (190,000) 70,000 52,000 Net Income (68,000) (609,000) R/E, 1/1 Net income (above) Dividends paid R/E, 12/31 175,500 (40,000) (68,000) 40,000 (68,000) Cash Trademark Buildings & Eqp (net) 268,000 427,500 713,000 17,000 58,000 161,000 Total Assets 236,000 Liabilities Common Stock APIC R/E (above) Total Liabilities & Equity (190,000) (600,000) (90,000) (103,000) (60,000) (5,000) (68,000) (236,000)