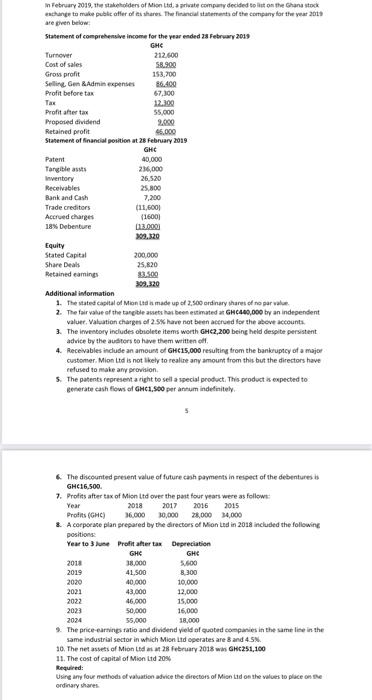

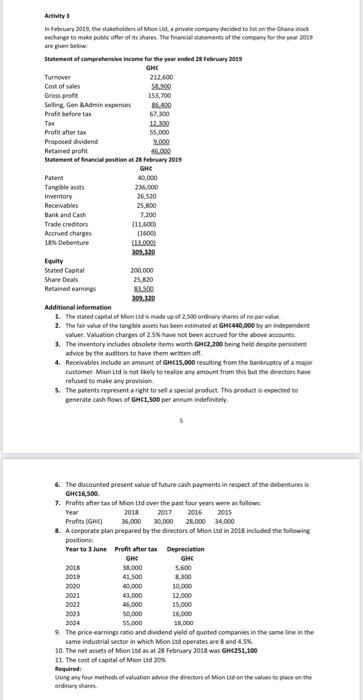

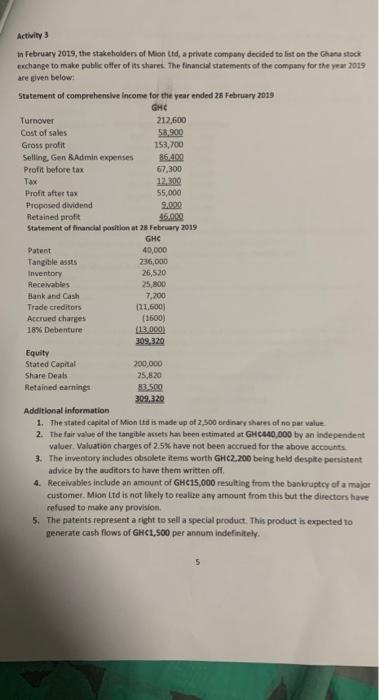

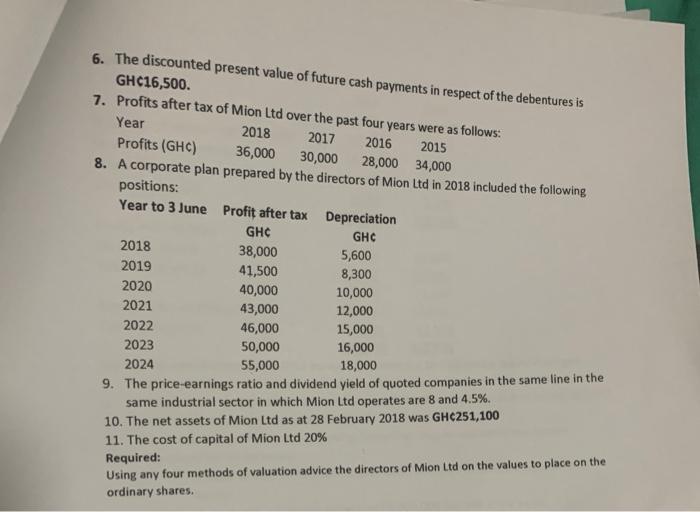

In February 2019, the sholders of Mion Ltda prate company decided to the Ghana stock changes to make puble offer of shares. The Financial statements of the company for the year 2013 are given below Selline Gen & Adminexpenses Statement of comprehensive income for the year ended 28 February 2013 GHE Turnover 212.500 Cost of sales 58.900 Gross profit 153,700 16.400 Profit before tax 67.100 Tax Profit after tax 55.000 Proposed dividend 9.000 Retained profit 45.000 Statement of financial position at 28 February 2019 GHC Patent 40.000 Tangible assts 236.000 Inventory 26.520 Receivables 25,800 Bank and Cash 7,200 Trade creditors (11.600 Accred charges (16001 18% Debenture 113.000) 399.520 Equity Stated Capital 200.000 Share Deals 25,820 Retained earnings 32.500 Additional information 1. The stated capital of Min Lid made up of 2.500 ordinary shares of no par value 2. The fair value of the tangible assets has been estimated at GHC440,000 by an independent valuer. Valuation charge of 2.5% have not been accrued for the above accounts 3. The inventory includes obsolete items worth GHC2,200 being held despite persistent advice by the auditors to have them written off 4. Receivables indude an amount of GHC15,000 resulting from the bankruptcy of a major customer. Mion Ltd is not likely to realize any amount from this but the directors have refused to make any provision 5. The patents represent a right to sell a special product. This product as expected to generate cash flows of GHC1,500 per annum indefinitely The discounted present value of future cash payments in respect of the debentures GHC16,500 7. Profits after tax of Mion Ltd over the past four years were as follows: Year 2018 2017 2016 2015 Profits (GHC) 36.000 30,000 28,000 4,000 & A corporate plan prepared by the directors of Mion Ltd in 2018 included the following positions: Year to 3 lune Profit after tax Depreciation GHE GHE 2011 38.000 5.600 2019 41.500 8.300 2020 40,000 10.000 2022 43,000 12,000 2022 46.000 15,000 2023 50,000 16,000 2024 55.000 18,000 The price-earningstatio and dividend yield of quoted companies in the same line in the same industrial sector in which Mion Ltd operates are 3 and 4.5 10. The net assets of Minds 28 February 2018 win GHC251,100 11. The cost of capital of Mion Ltd 20% Required: Using any foue methods of valuation advice the directors of Min tid on the values to place on the ordinary shares Activity February 2018, the stakeholder of Minota private company decided to let the hand exchange to make publicotter of its shares. The financial statements of the common for the 2019 are below Statement at comprehensive Income for the year ended 28 February 2013 Turnover 212.000 Cost of sales S1.900 Grow pro 153,700 Selling en Adminexpenses 86.420 Profit before an 67.100 Tas 12.100 Profit after tax 55,000 Proposed dividend 9.000 Retailed profit 46.000 Statement of financial position at 28 February 2018 GHC Patent 40,000 Tangibles 276.000 Inventory 26.520 Receivables 25,800 Bank and Cash 7,200 Trade creditors 111.600) Accrued charges 18 Debenture 13.000 30.120 Equity Stated Capital 200.000 Share Deals 25,820 Retained earnings 23.500 03.120 Additional information 1. The stated capital of Montes made up of 2.500 ordinary rares of ne per value 2. The fair value of the table with bestimated GHC640.000 by an independent valuer. Valuation charges of 25 have not been accrued for the above accounts 1. The inventory Indudes obtolete item worth GMC2,200 being held despite print advice by the auditors to have them written off 4. Receivables indude an amount of GHC15,000 resulting from the bankruptcy of a major customer Mind is not likely to realize any amount from this but the directors have refused to make any provision 5. The patents representa right to set a special product. This products expected to generate cash flows of GHC 1.500 per annum indefinitely 5.500 6. The discounted present value of future cash payments in respect of she debertures da GHC16.500 7. Profits after tax of Mion Ltd over the past four years were as follow Yew 2018 2017 2016 2015 Profits (GHC) 36.000 30.000 28.000 34.000 8. A corporate plan prepared by the directors of Mind in 2018 included the following position Year to June Profit after tax Depreciation GHE GHC 2015 38.000 2019 41,500 2000 40,000 10,000 43.000 12.000 2022 $5,000 25.000 2003 50,000 16.000 2004 55,000 1.000 The price-earings ratio and dividend yield of quoted companies in the same line in the same industrial sector in which Mion Ltd operates are 8 and 4.5% 10. The net sets of Min Lids at 28 February 2018 was GHC251.100 11. The cost of capital of Mion itd 20% Required Using four methods of valuation advice the directors of Moon Ltd on the west on the ordinary shares 2001 Activity 3 tn February 2019, the stakeholders of Mion Ltd, a private company decided to list on the Ghana stock exchange to make publicotter of its shares. The financial statements of the company for the year 2018 are given below: Statement of comprehensive Income for the year ended 28 February 2013 GHC Turnover 212,600 Cost of sales 58.900 Gross profit 153,700 Selling. Gen Admin expenses 86,400 Profit before tax 67,300 Tax 12,300 Profit after tax 55,000 Proposed dividend 9.000 Retained profit 46.00 Statement of financial position at 28 February 2019 GHC Patent 40,000 Tangible assts 236,000 Inventory 26,520 Receivables 25,800 Bank and Cash 7,200 Trade creditors 01.600) Accrued charges (1600) 18% Debenture (13.000) 309,320 Equity Stated Capital 200,000 Share Deals 25.8.20 Retained earnings 83.500 309,320 Additional information 1. The stated capital of Mion Ltd is made up of 2.500 ordinary shares of no pat value 2. The fair value of the tangible assets has been estimated at GHC440,000 by an independent valuer. Valuation charges of 2.5% have not been accrued for the above accounts 3. The inventory includes obsolete items worth GHC2.200 being held despite persistent advice by the auditors to have them written off 4. Receivables include an amount of GHC15,000 resulting from the bankruptcy of a major customer. Mion Ltd is not likely to realize any amount from this but the directors have refused to make any provision 5. The patents represent a right to sell a special product. This product is expected to generate cash flows of GHC1,500 per annum indefinitely 6. The discounted present value of future cash payments in respect of the debentures is GHC16,500. 7. Profits after tax of Mion Ltd over the past four years were as follows: Year 2018 2017 2016 Profits (GHC) 2015 36,000 30,000 28,000 34,000 8. A corporate plan prepared by the directors of Mion Ltd in 2018 included the following positions: Year to 3 June Profit after tax Depreciation GHC GHC 2018 38,000 5,600 2019 41,500 8,300 2020 40,000 10,000 2021 43,000 12,000 2022 46,000 15,000 2023 50,000 16,000 2024 55,000 18,000 9. The price-earnings ratio and dividend yield of quoted companies in the same line in the same industrial sector in which Mion Ltd operates are 8 and 4.5%. 10. The net assets of Mion Ltd as at 28 February 2018 was GHC251,100 11. The cost of capital of Mion Ltd 20% Required: Using any four methods of valuation advice the directors of Mion Ltd on the values to place on the ordinary shares. In February 2019, the sholders of Mion Ltda prate company decided to the Ghana stock changes to make puble offer of shares. The Financial statements of the company for the year 2013 are given below Selline Gen & Adminexpenses Statement of comprehensive income for the year ended 28 February 2013 GHE Turnover 212.500 Cost of sales 58.900 Gross profit 153,700 16.400 Profit before tax 67.100 Tax Profit after tax 55.000 Proposed dividend 9.000 Retained profit 45.000 Statement of financial position at 28 February 2019 GHC Patent 40.000 Tangible assts 236.000 Inventory 26.520 Receivables 25,800 Bank and Cash 7,200 Trade creditors (11.600 Accred charges (16001 18% Debenture 113.000) 399.520 Equity Stated Capital 200.000 Share Deals 25,820 Retained earnings 32.500 Additional information 1. The stated capital of Min Lid made up of 2.500 ordinary shares of no par value 2. The fair value of the tangible assets has been estimated at GHC440,000 by an independent valuer. Valuation charge of 2.5% have not been accrued for the above accounts 3. The inventory includes obsolete items worth GHC2,200 being held despite persistent advice by the auditors to have them written off 4. Receivables indude an amount of GHC15,000 resulting from the bankruptcy of a major customer. Mion Ltd is not likely to realize any amount from this but the directors have refused to make any provision 5. The patents represent a right to sell a special product. This product as expected to generate cash flows of GHC1,500 per annum indefinitely The discounted present value of future cash payments in respect of the debentures GHC16,500 7. Profits after tax of Mion Ltd over the past four years were as follows: Year 2018 2017 2016 2015 Profits (GHC) 36.000 30,000 28,000 4,000 & A corporate plan prepared by the directors of Mion Ltd in 2018 included the following positions: Year to 3 lune Profit after tax Depreciation GHE GHE 2011 38.000 5.600 2019 41.500 8.300 2020 40,000 10.000 2022 43,000 12,000 2022 46.000 15,000 2023 50,000 16,000 2024 55.000 18,000 The price-earningstatio and dividend yield of quoted companies in the same line in the same industrial sector in which Mion Ltd operates are 3 and 4.5 10. The net assets of Minds 28 February 2018 win GHC251,100 11. The cost of capital of Mion Ltd 20% Required: Using any foue methods of valuation advice the directors of Min tid on the values to place on the ordinary shares Activity February 2018, the stakeholder of Minota private company decided to let the hand exchange to make publicotter of its shares. The financial statements of the common for the 2019 are below Statement at comprehensive Income for the year ended 28 February 2013 Turnover 212.000 Cost of sales S1.900 Grow pro 153,700 Selling en Adminexpenses 86.420 Profit before an 67.100 Tas 12.100 Profit after tax 55,000 Proposed dividend 9.000 Retailed profit 46.000 Statement of financial position at 28 February 2018 GHC Patent 40,000 Tangibles 276.000 Inventory 26.520 Receivables 25,800 Bank and Cash 7,200 Trade creditors 111.600) Accrued charges 18 Debenture 13.000 30.120 Equity Stated Capital 200.000 Share Deals 25,820 Retained earnings 23.500 03.120 Additional information 1. The stated capital of Montes made up of 2.500 ordinary rares of ne per value 2. The fair value of the table with bestimated GHC640.000 by an independent valuer. Valuation charges of 25 have not been accrued for the above accounts 1. The inventory Indudes obtolete item worth GMC2,200 being held despite print advice by the auditors to have them written off 4. Receivables indude an amount of GHC15,000 resulting from the bankruptcy of a major customer Mind is not likely to realize any amount from this but the directors have refused to make any provision 5. The patents representa right to set a special product. This products expected to generate cash flows of GHC 1.500 per annum indefinitely 5.500 6. The discounted present value of future cash payments in respect of she debertures da GHC16.500 7. Profits after tax of Mion Ltd over the past four years were as follow Yew 2018 2017 2016 2015 Profits (GHC) 36.000 30.000 28.000 34.000 8. A corporate plan prepared by the directors of Mind in 2018 included the following position Year to June Profit after tax Depreciation GHE GHC 2015 38.000 2019 41,500 2000 40,000 10,000 43.000 12.000 2022 $5,000 25.000 2003 50,000 16.000 2004 55,000 1.000 The price-earings ratio and dividend yield of quoted companies in the same line in the same industrial sector in which Mion Ltd operates are 8 and 4.5% 10. The net sets of Min Lids at 28 February 2018 was GHC251.100 11. The cost of capital of Mion itd 20% Required Using four methods of valuation advice the directors of Moon Ltd on the west on the ordinary shares 2001 Activity 3 tn February 2019, the stakeholders of Mion Ltd, a private company decided to list on the Ghana stock exchange to make publicotter of its shares. The financial statements of the company for the year 2018 are given below: Statement of comprehensive Income for the year ended 28 February 2013 GHC Turnover 212,600 Cost of sales 58.900 Gross profit 153,700 Selling. Gen Admin expenses 86,400 Profit before tax 67,300 Tax 12,300 Profit after tax 55,000 Proposed dividend 9.000 Retained profit 46.00 Statement of financial position at 28 February 2019 GHC Patent 40,000 Tangible assts 236,000 Inventory 26,520 Receivables 25,800 Bank and Cash 7,200 Trade creditors 01.600) Accrued charges (1600) 18% Debenture (13.000) 309,320 Equity Stated Capital 200,000 Share Deals 25.8.20 Retained earnings 83.500 309,320 Additional information 1. The stated capital of Mion Ltd is made up of 2.500 ordinary shares of no pat value 2. The fair value of the tangible assets has been estimated at GHC440,000 by an independent valuer. Valuation charges of 2.5% have not been accrued for the above accounts 3. The inventory includes obsolete items worth GHC2.200 being held despite persistent advice by the auditors to have them written off 4. Receivables include an amount of GHC15,000 resulting from the bankruptcy of a major customer. Mion Ltd is not likely to realize any amount from this but the directors have refused to make any provision 5. The patents represent a right to sell a special product. This product is expected to generate cash flows of GHC1,500 per annum indefinitely 6. The discounted present value of future cash payments in respect of the debentures is GHC16,500. 7. Profits after tax of Mion Ltd over the past four years were as follows: Year 2018 2017 2016 Profits (GHC) 2015 36,000 30,000 28,000 34,000 8. A corporate plan prepared by the directors of Mion Ltd in 2018 included the following positions: Year to 3 June Profit after tax Depreciation GHC GHC 2018 38,000 5,600 2019 41,500 8,300 2020 40,000 10,000 2021 43,000 12,000 2022 46,000 15,000 2023 50,000 16,000 2024 55,000 18,000 9. The price-earnings ratio and dividend yield of quoted companies in the same line in the same industrial sector in which Mion Ltd operates are 8 and 4.5%. 10. The net assets of Mion Ltd as at 28 February 2018 was GHC251,100 11. The cost of capital of Mion Ltd 20% Required: Using any four methods of valuation advice the directors of Mion Ltd on the values to place on the ordinary shares