Question

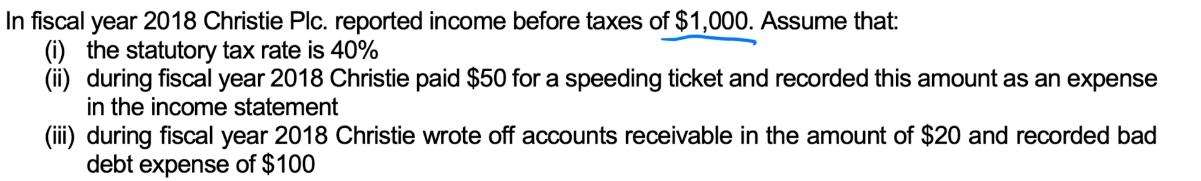

In fiscal year 2018 Christie Plc. reported income before taxes of $1,000. Assume that: (i) the statutory tax rate is 40% (ii) during fiscal

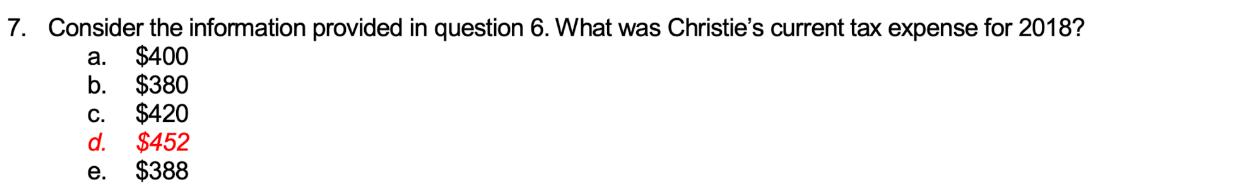

In fiscal year 2018 Christie Plc. reported income before taxes of $1,000. Assume that: (i) the statutory tax rate is 40% (ii) during fiscal year 2018 Christie paid $50 for a speeding ticket and recorded this amount as an expense in the income statement (iii) during fiscal year 2018 Christie wrote off accounts receivable in the amount of $20 and recorded bad debt expense of $100 7. Consider the information provided in question 6. What was Christie's current tax expense for 2018? a. $400 b. $380 C. $420 d. $452 e. $388

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Christie Plcs current tax expense for the fiscal year 2018 we need to consider the info...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Financial Accounting

Authors: Theodore E. Christensen, David M. Cottrell, Richard E. Baker

10th edition

78025621, 978-0078025624

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App