Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In general, a practitioner must, at the request of a client, promptly return any and all records of the client that are necessary for the

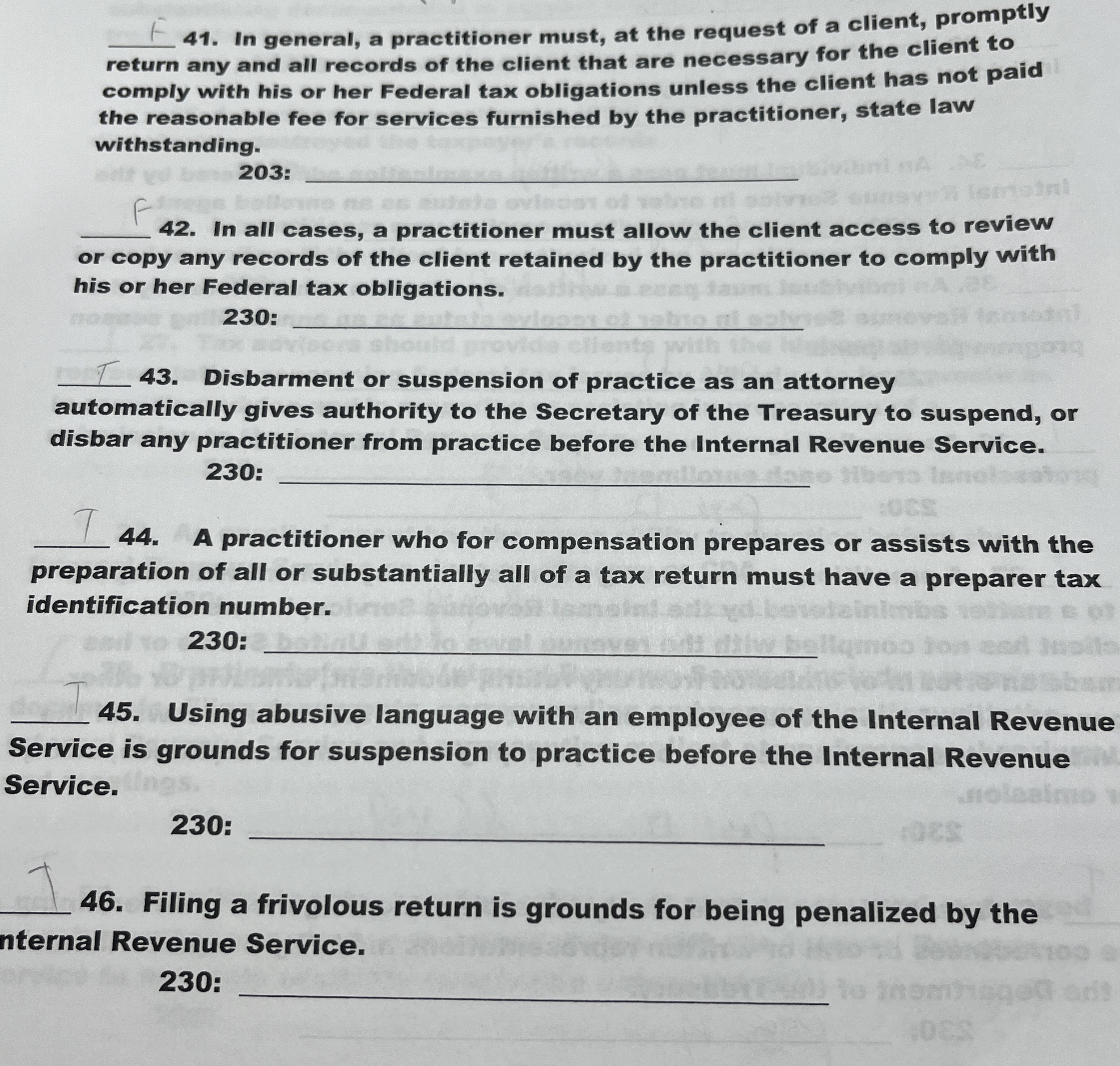

In general, a practitioner must, at the request of a client, promptly

return any and all records of the client that are necessary for the client to

comply with his or her Federal tax obligations unless the client has not paid

the reasonable fee for services furnished by the practitioner, state law

withstanding.

:

F

In all cases, a practitioner must allow the client access to review

or copy any records of the client retained by the practitioner to comply with

his or her Federal tax obligations.

:

Disbarment or suspension of practice as an attorney

automatically gives authority to the Secretary of the Treasury to suspend, or

disbar any practitioner from practice before the Internal Revenue Service.

:

A practitioner who for compensation prepares or assists with the

preparation of all or substantially all of a tax return must have a preparer tax

identification number.

:

Using abusive language with an employee of the Internal Revenue

Service is grounds for suspension to practice before the Internal Revenue

Service.

Filing a frivolous return is grounds for being penalized by the

nternal Revenue Service.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started