Question

In general, the longer that your money is invested, the longer it is subject to risk. This is known as time horizon, business failure, market,

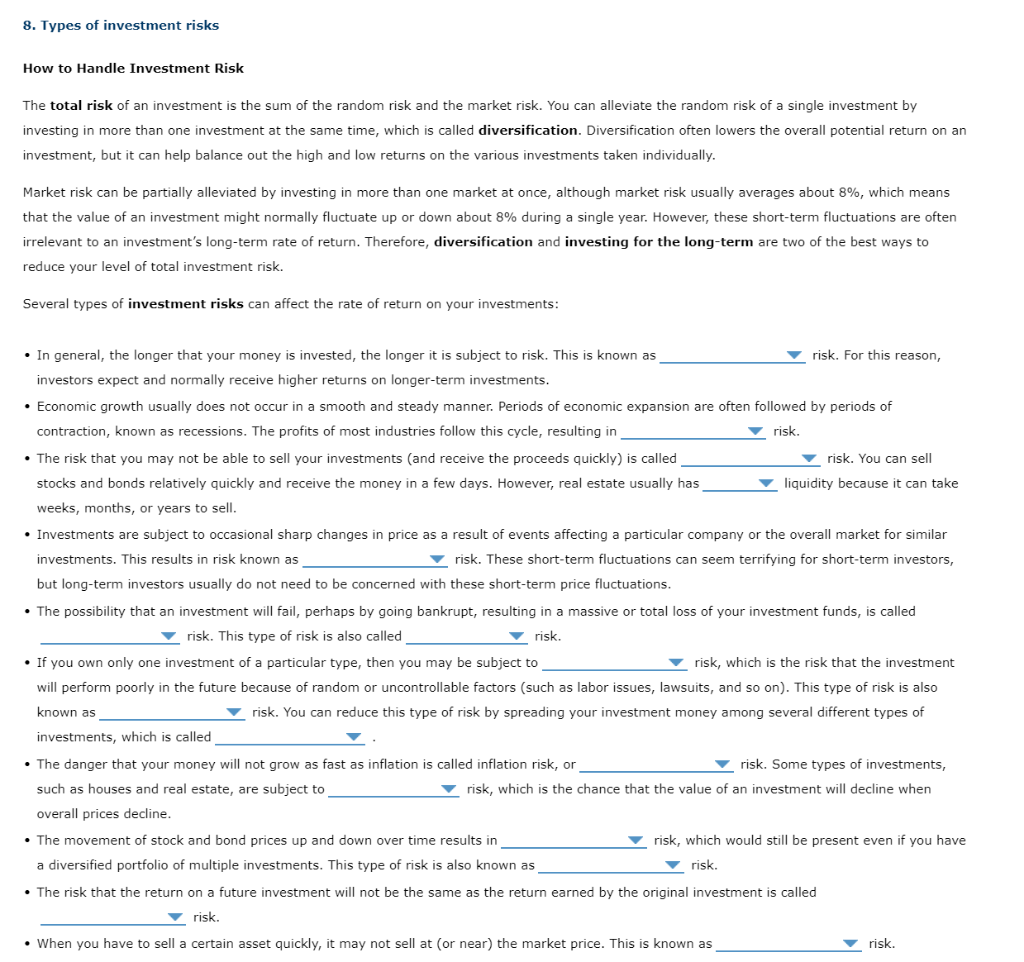

In general, the longer that your money is invested, the longer it is subject to risk. This is known as time horizon, business failure, market, business-cycle, market-volatility, marketability risk. For this reason, investors expect and normally receive higher returns on longer-term investments.

Economic growth usually does not occur in a smooth and steady manner. Periods of economic expansion are often followed by periods of contraction, known as recessions. The profits of most industries follow this cycle, resulting in market volatility, inflation, business cycle, random, business failure, liquidity risk.

The risk that you may not be able to sell your investments (and receive the proceeds quickly) is called liquidity, business failure, business cycle, time horizon, marketability, reinvestment risk. You can sell stocks and bonds relatively quickly and receive the money in a few days. However, real estate usually has lower or higher liquidity because it can take weeks, months, or years to sell.

Investments are subject to occasional sharp changes in price as a result of events affecting a particular company or the overall market for similar investments. This results in risk known as time horizon, merket, liquidity, market-volatility, inflation, reinvestment risk. These short-term fluctuations can seem terrifying for short-term investors, but long-term investors usually do not need to be concerned with these short-term price fluctuations.

The possibility that an investment will fail, perhaps by going bankrupt, resulting in a massive or total loss of your investment funds, is called business failure, random, marketability, inflation, time horizon, liquidity risk. This type of risk is also called financial, liquidity, random, marketability, time horizon, inflation risk.

If you own only one investment of a particular type, then you may be subject to marketability, business cycle, market, liquidity, business failure, market volatility, inflation, reinvestment, time horizon, random risk, which is the risk that the investment will perform poorly in the future because of random or uncontrollable factors (such as labor issues, lawsuits, and so on). This type of risk is also known as marketability, business cycle, market, liquidity, business failure, market volatility, inflation, reinvestment, time horizon, unsystematic risk. You can reduce this type of risk by spreading your investment money among several different types of investments, which is called passive investing, leverage, diversification, market efficiency, active investing.

The danger that your money will not grow as fast as inflation is called inflation risk, or purchasing power, reinvestment, market, random, business cycle, time horizon risk. Some types of investments, such as houses and real estate, are subject to reinvestment, market, random, business cycle, time horizon deflation risk, which is the chance that the value of an investment will decline when overall prices decline.

The movement of stock and bond prices up and down over time results in business failure, reinvestment, market, marketability, market volatility, inflation risk, which would still be present even if you have a diversified portfolio of multiple investments. This type of risk is also known as inflation, marketability, systematic, reinvestment, market volatility, business failure risk.

The risk that the return on a future investment will not be the same as the return earned by the original investment is called business cycle, marketability, reinvestment, market volatility, inflation, random risk.

When you have to sell a certain asset quickly, it may not sell at (or near) the market price. This is known as marketability, time horizon, liquidity, market volatility, market, random risk.

How to Handle Investment Risk The total risk of an investment is the sum of the random risk and the market risk. You can alleviate the random risk of a single investment by investing in more than one investment at the same time, which is called diversification. Diversification often lowers the overall potential return on an investment, but it can help balance out the high and low returns on the various investments taken individually. Market risk can be partially alleviated by investing in more than one market at once, although market risk usually averages about 8%, which means that the value of an investment might normally fluctuate up or down about 8% during a single year. However, these short-term fluctuations are often irrelevant to an investment's long-term rate of return. Therefore, diversification and investing for the long-term are two of the best ways to reduce your level of total investment risk. Several types of investment risks can affect the rate of return on your investments: - In general, the longer that your money is invested, the longer it is subject to risk. This is known as risk. For this reason, investors expect and normally receive higher returns on longer-term investments. - Economic growth usually does not occur in a smooth and steady manner. Periods of economic expansion are often followed by periods of contraction, known as recessions. The profits of most industries follow this cycle, resulting in risk. - The risk that you may not be able to sell your investments (and receive the proceeds quickly) is called risk. You can sell stocks and bonds relatively quickly and receive the money in a few days. However, real estate usually has liquidity because it can take weeks, months, or years to sell. - Investments are subject to occasional sharp changes in price as a result of events affecting a particular company or the overall market for similar investments. This results in risk known as risk. These short-term fluctuations can seem terrifying for short-term investors, but long-term investors usually do not need to be concerned with these short-term price fluctuations. - The possibility that an investment will fail, perhaps by going bankrupt, resulting in a massive or total loss of your investment funds, is called risk. This type of risk is also called risk. - If you own only one investment of a particular type, then you may be subject to risk, which is the risk that the investment will perform poorly in the future because of random or uncontrollable factors (such as labor issues, lawsuits, and so on). This type of risk is also known as risk. You can reduce this type of risk by spreading your investment money among several different types of investments, which is called - The danger that your money will not grow as fast as inflation is called inflation risk, or risk. Some types of investments, such as houses and real estate, are subject to risk, which is the chance that the value of an investment will decline when overall prices decline. - The movement of stock and bond prices up and down over time results in risk, which would still be present even if you have a diversified portfolio of multiple investments. This type of risk is also known as risk. - The risk that the return on a future investment will not be the same as the return earned by the original investment is called risk. - When you have to sell a certain asset quickly, it may not sell at (or near) the market price. This is known as risk. How to Handle Investment Risk The total risk of an investment is the sum of the random risk and the market risk. You can alleviate the random risk of a single investment by investing in more than one investment at the same time, which is called diversification. Diversification often lowers the overall potential return on an investment, but it can help balance out the high and low returns on the various investments taken individually. Market risk can be partially alleviated by investing in more than one market at once, although market risk usually averages about 8%, which means that the value of an investment might normally fluctuate up or down about 8% during a single year. However, these short-term fluctuations are often irrelevant to an investment's long-term rate of return. Therefore, diversification and investing for the long-term are two of the best ways to reduce your level of total investment risk. Several types of investment risks can affect the rate of return on your investments: - In general, the longer that your money is invested, the longer it is subject to risk. This is known as risk. For this reason, investors expect and normally receive higher returns on longer-term investments. - Economic growth usually does not occur in a smooth and steady manner. Periods of economic expansion are often followed by periods of contraction, known as recessions. The profits of most industries follow this cycle, resulting in risk. - The risk that you may not be able to sell your investments (and receive the proceeds quickly) is called risk. You can sell stocks and bonds relatively quickly and receive the money in a few days. However, real estate usually has liquidity because it can take weeks, months, or years to sell. - Investments are subject to occasional sharp changes in price as a result of events affecting a particular company or the overall market for similar investments. This results in risk known as risk. These short-term fluctuations can seem terrifying for short-term investors, but long-term investors usually do not need to be concerned with these short-term price fluctuations. - The possibility that an investment will fail, perhaps by going bankrupt, resulting in a massive or total loss of your investment funds, is called risk. This type of risk is also called risk. - If you own only one investment of a particular type, then you may be subject to risk, which is the risk that the investment will perform poorly in the future because of random or uncontrollable factors (such as labor issues, lawsuits, and so on). This type of risk is also known as risk. You can reduce this type of risk by spreading your investment money among several different types of investments, which is called - The danger that your money will not grow as fast as inflation is called inflation risk, or risk. Some types of investments, such as houses and real estate, are subject to risk, which is the chance that the value of an investment will decline when overall prices decline. - The movement of stock and bond prices up and down over time results in risk, which would still be present even if you have a diversified portfolio of multiple investments. This type of risk is also known as risk. - The risk that the return on a future investment will not be the same as the return earned by the original investment is called risk. - When you have to sell a certain asset quickly, it may not sell at (or near) the market price. This is known as risk

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started